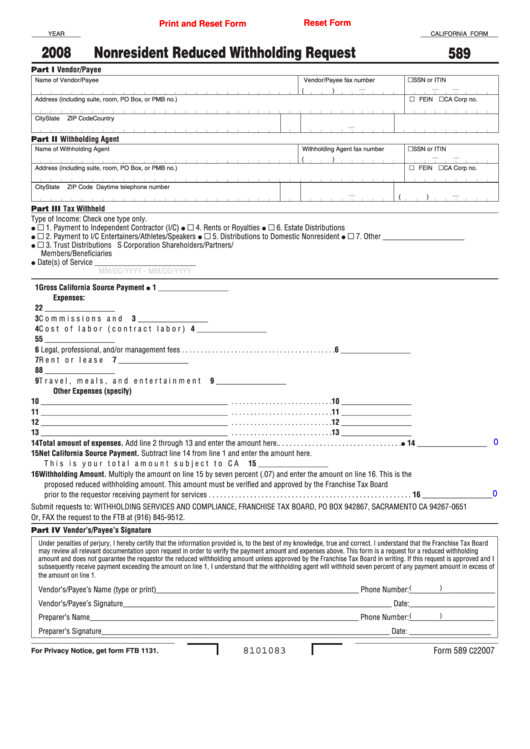

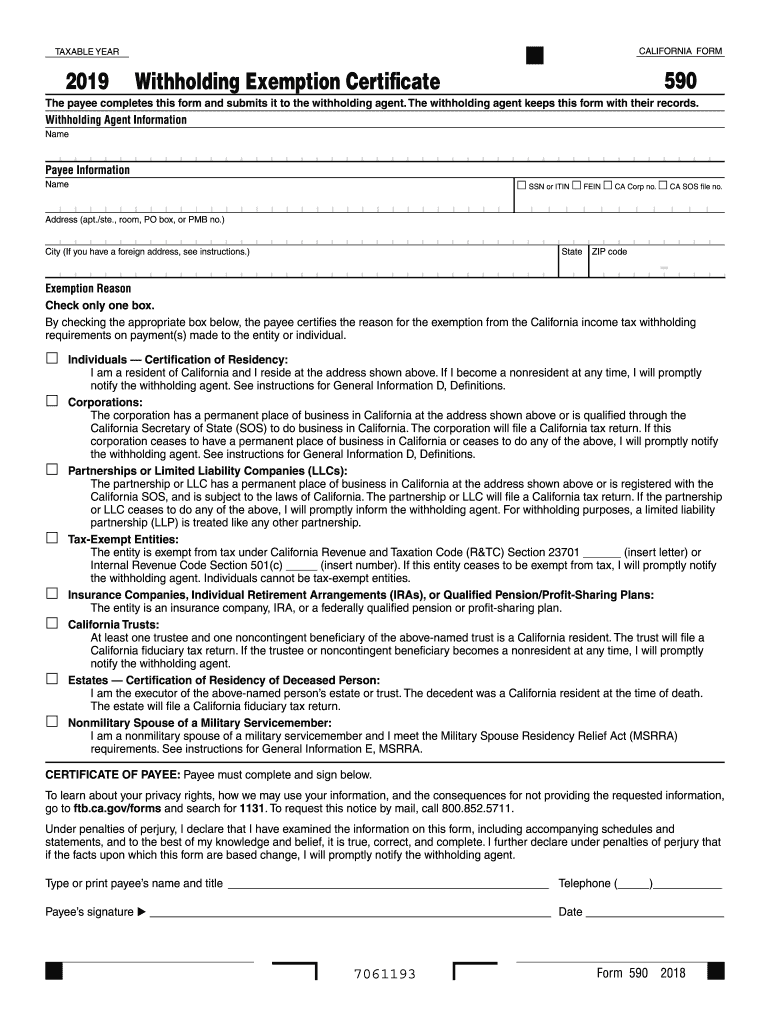

California Form 589

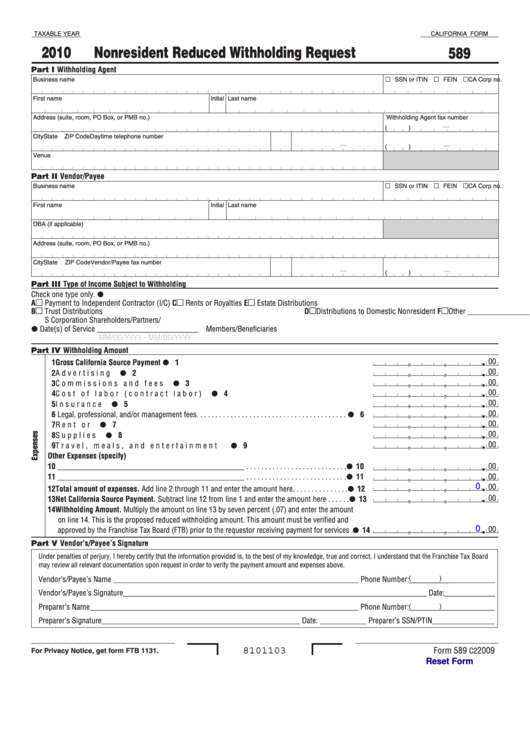

California Form 589 - Web we last updated california form 589 in february 2023 from the california franchise tax board. Easily fill out pdf blank, edit, and sign them. Subtract line 12 from line 1. Web 2021 california form 589 nonresident reduced withholding request author: Type text, add images, blackout confidential details,. Multiply the amount on line 13 by 7%. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income subject to. Nonresident payee can use form 589 to itemize expenses against the california source income. Web analyzing whether foreign owners consent to participate in the california. Complete, sign, print and send your tax documents easily with us legal forms.

Edit your form 589 online. This form is for income earned in tax year 2022, with tax returns due in april. 2021, california form 589, nonresident reduced. Do not use form 589. You can also download it, export it or print it out. Complete, sign, print and send your tax documents easily with us legal forms. To request this notice by mail, call 800.852.5711. Get ready for tax season deadlines by completing any required tax forms today. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income subject to. If zero or less, enter 0.

If zero or less, enter 0. 2021, california form 589, nonresident reduced. Use form 589 to request a reduction in the standard 7% withholding amount that is applicable to california source payments made to nonresidents. Type text, add images, blackout confidential details,. Web ftb.ca.gov/forms and search for 1131. Web send california form 589 via email, link, or fax. Web nonresident withholding allocation worksheet (form 587) use form 587 to allocate california source payments and determine if withholding is required. Use form 589 to request a reduction in the standard 7% withholding amount that is applicable to california source. Under penalties of perjury, i declare that i have examined the information on this form,. Web analyzing whether foreign owners consent to participate in the california.

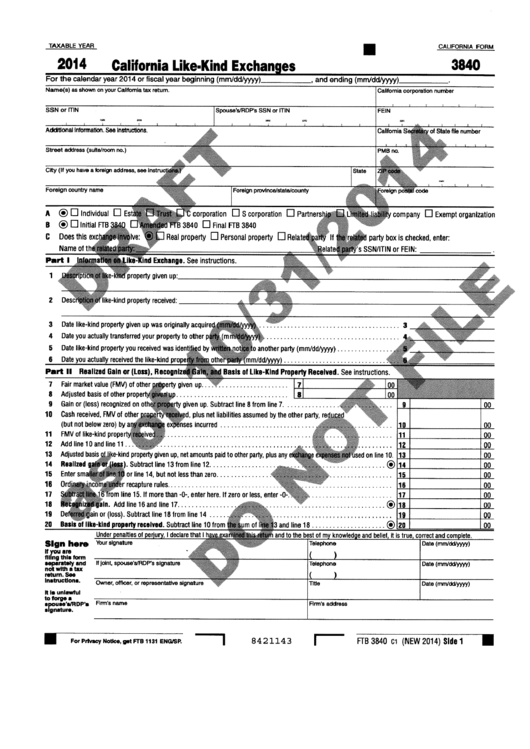

California Form 3840 Draft California LikeKind Exchanges 2014

Nonresident payee can use form 589 to itemize expenses against the california source income. If zero or less, enter 0. Web we last updated the nonresident reduced withholding request in february 2023, so this is the latest version of form 589, fully updated for tax year 2022. Use form 589 to request a reduction in the standard 7% withholding amount.

Printable 1381 Form California Printable Word Searches

Under penalties of perjury, i declare that i have examined the information on this form,. Nonresident payee can use form 589 to itemize expenses against the california source income. • any trust without a resident grantor, beneficiary, or trustee, or estates where the decedent was not a california resident. Do not use form 589. Web 13 net california source payment.

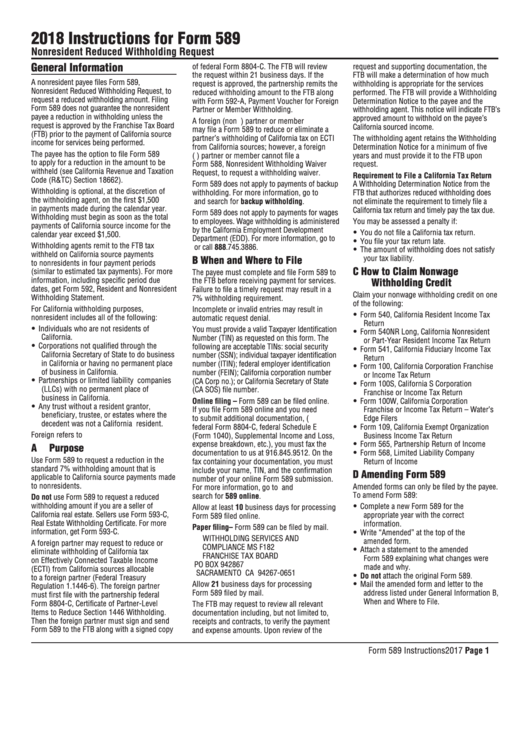

Instructions For Form 589 Nonresident Reduced Withholding Request

Web application for asylum and for withholding of removal. Get ready for tax season deadlines by completing any required tax forms today. To request this notice by mail, call 800.852.5711. Web ftb form 589, nonresident reduced withholding request : Web nonresident withholding allocation worksheet (form 587) use form 587 to allocate california source payments and determine if withholding is required.

This is a California form that can be used for Proof Of Service within

Download blank or fill out online in pdf format. Get ready for tax season deadlines by completing any required tax forms today. Nonresident payee can use form 589 to itemize expenses against the california source income. Web 2021 instructions for form 589 | ftb.ca.gov a. 2021, california form 589, nonresident reduced.

USCIS to Recall Approximately 800 Form I589related EADs Due to

Do not use form 589. Web we last updated california form 589 in february 2023 from the california franchise tax board. K 13 14 withholding amount. To request this notice by mail, call 800.852.5711. • any trust without a resident grantor, beneficiary, or trustee, or estates where the decedent was not a california resident.

Fillable California Form 589 Nonresident Reduced Withholding Request

Easily fill out pdf blank, edit, and sign them. Edit your form 589 online. Web ftb.ca.gov/forms and search for 1131. K 13 14 withholding amount. Web 13 net california source payment.

2019 Form CA FTB 590 Fill Online, Printable, Fillable, Blank PDFfiller

Get ready for tax season deadlines by completing any required tax forms today. • any trust without a resident grantor, beneficiary, or trustee, or estates where the decedent was not a california resident. Web analyzing whether foreign owners consent to participate in the california. If zero or less, enter 0. Easily fill out pdf blank, edit, and sign them.

Fillable California Form 589 Nonresident Reduced Withholding Request

Download blank or fill out online in pdf format. * domestic or foreign address. Use form 589 to request a reduction in the standard 7% withholding amount that is applicable to california source. If zero or less, enter 0. Web application for asylum and for withholding of removal.

2019 Form USCIS I589 Instructions Fill Online, Printable, Fillable

Nonresident payee can use form 589 to itemize expenses against the california source income. K 13 14 withholding amount. * domestic or foreign address. Get ready for tax season deadlines by completing any required tax forms today. Web ftb form 589, nonresident reduced withholding request :

FIA Historic Database

Save or instantly send your ready documents. Web 2021 instructions for form 589 | ftb.ca.gov a. Web we last updated the nonresident reduced withholding request in february 2023, so this is the latest version of form 589, fully updated for tax year 2022. Web analyzing whether foreign owners consent to participate in the california. Web send california form 589 via.

Web We Last Updated The Nonresident Reduced Withholding Request In February 2023, So This Is The Latest Version Of Form 589, Fully Updated For Tax Year 2022.

You can also download it, export it or print it out. Web 13 net california source payment. To request this notice by mail, call 800.852.5711. Web form 589 can be submitted online.

Subtract Line 12 From Line 1.

If you file form 589 online and you need to submit additional documentation, (i.e. Nonresident payee can use form 589 to itemize expenses against the california source income. Use form 589 to request a reduction in the standard 7% withholding amount that is applicable to california source. * domestic or foreign address.

Use Form 589 To Request A Reduction In The Standard 7% Withholding Amount That Is Applicable To California Source Payments Made To Nonresidents.

Save or instantly send your ready documents. Get ready for tax season deadlines by completing any required tax forms today. Web 2021 instructions for form 589 | ftb.ca.gov a. Ad download or email ca ftb 589 & more fillable forms, register and subscribe now!

Web Analyzing Whether Foreign Owners Consent To Participate In The California.

Ad download or email ca ftb 589 & more fillable forms, register and subscribe now! Use this form to apply for asylum in the united states and for withholding of removal (formerly called. Multiply the amount on line 13 by 7%. Get ready for tax season deadlines by completing any required tax forms today.