California S Corp Extension Form

California S Corp Extension Form - Form 7004 is used to request an automatic extension to file the certain returns. Is the s corporation deferring any income from the disposition of assets? Be received before the extended period ends. Dissolved surrendered (withdrawn) merged/reorganized irc section 338 sale qsub election enter date (mm/dd/yyyy). Web helpful forms and publications what is an s corporation? 16, 2023, to file and pay taxes. View our emergency tax relief page for more information. Contain the reason why the filing or payment could not be filed on time. All of california’s tax extensions are paperless, meaning there are no forms or applications to file. The edd will notify you if the extension is granted.

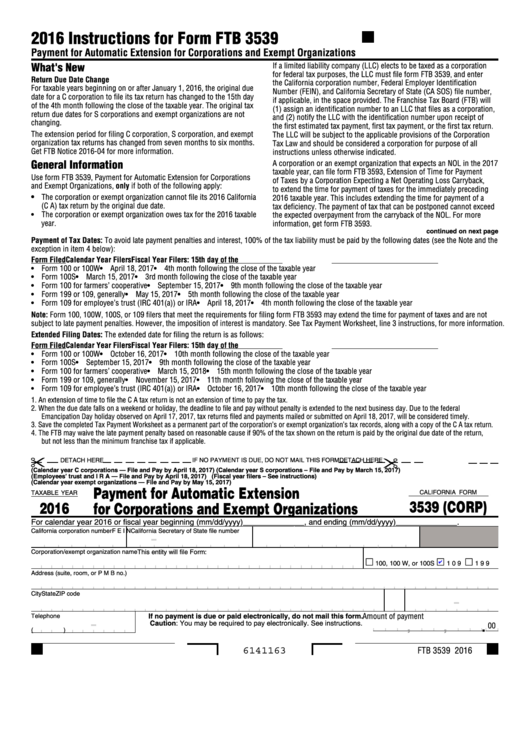

Be received before the extended period ends. All of california’s tax extensions are paperless, meaning there are no forms or applications to file. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Web use form ftb 3539, payment for automatic extension for corporations and exempt organizations, only if both of the following apply: Web form 100s a 1. Web helpful forms and publications what is an s corporation? The original due date for this return is the 15th day of the third month of the s corporation's taxable year, which is generally march 15 for calendar year taxpayers. Web now only $34.95 file your tax extension now! C corporations is the 15th day of the 10th month following the close of the taxable year. Web this is a reminder that the extended due date to file form 100s, california s corporation franchise or income tax return, is september 15, 2021.

Securing a california business tax extension depends on the type of business you’re filing for. Web use form ftb 3539, payment for automatic extension for corporations and exempt organizations, only if both of the following apply: Contain the reason why the filing or payment could not be filed on time. View our emergency tax relief page for more information. The edd will notify you if the extension is granted. Web form 100s a 1. All of california’s tax extensions are paperless, meaning there are no forms or applications to file. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. 16, 2023, to file and pay taxes. C corporations is the 15th day of the 10th month following the close of the taxable year.

Delaware S Corp Extension Form Best Reviews

Web form 100s a 1. Incorporated in california doing business in california registered to do business in california with the secretary of state (sos) receiving california source income The edd will notify you if the extension is granted. Web helpful forms and publications what is an s corporation? Web use form ftb 3539, payment for automatic extension for corporations and.

Creating an S Corporation in California A People's Choice

Web filing requirements you must file california s corporation franchise or income tax return (form 100s) if the corporation is: 16, 2023, to file and pay taxes. This extension of time to file is not an extension of time to pay. C corporations is the 15th day of the 10th month following the close of the taxable year. Form 7004.

How to Start an S Corp in California California S Corp TRUiC

Dissolved surrendered (withdrawn) merged/reorganized irc section 338 sale qsub election enter date (mm/dd/yyyy). The corporation or exempt organization cannot file its 2020 california(c a) tax return by the original due date. Form 7004 is used to request an automatic extension to file the certain returns. Be received before the extended period ends. The edd will notify you if the extension.

Corporation return due date is March 16, 2015Cary NC CPA

C corporations is the 15th day of the 10th month following the close of the taxable year. Contain the reason why the filing or payment could not be filed on time. Incorporated in california doing business in california registered to do business in california with the secretary of state (sos) receiving california source income The corporation or exempt organization owes.

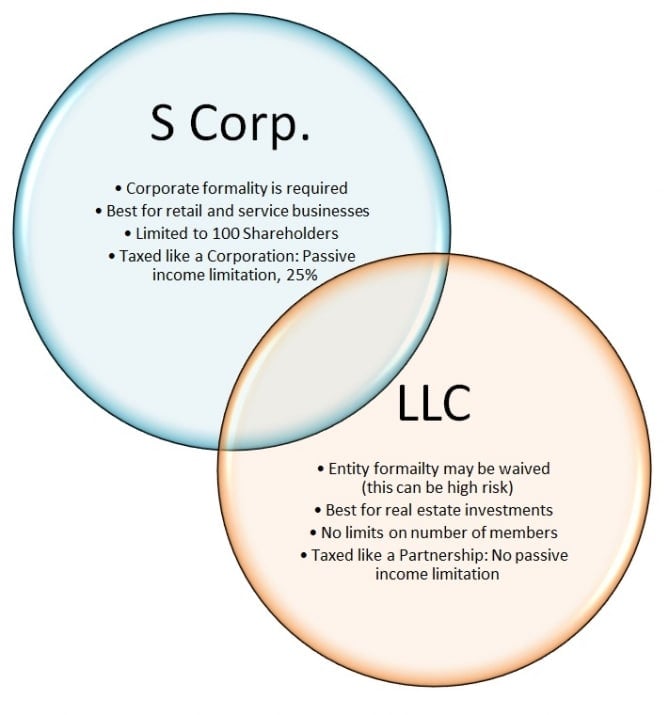

What Type of Corporation Should I Form in Southern California? SCorp

C corporations is the 15th day of the 10th month following the close of the taxable year. Dissolved surrendered (withdrawn) merged/reorganized irc section 338 sale qsub election enter date (mm/dd/yyyy). Incorporated in california doing business in california registered to do business in california with the secretary of state (sos) receiving california source income An s corporation is similar to a.

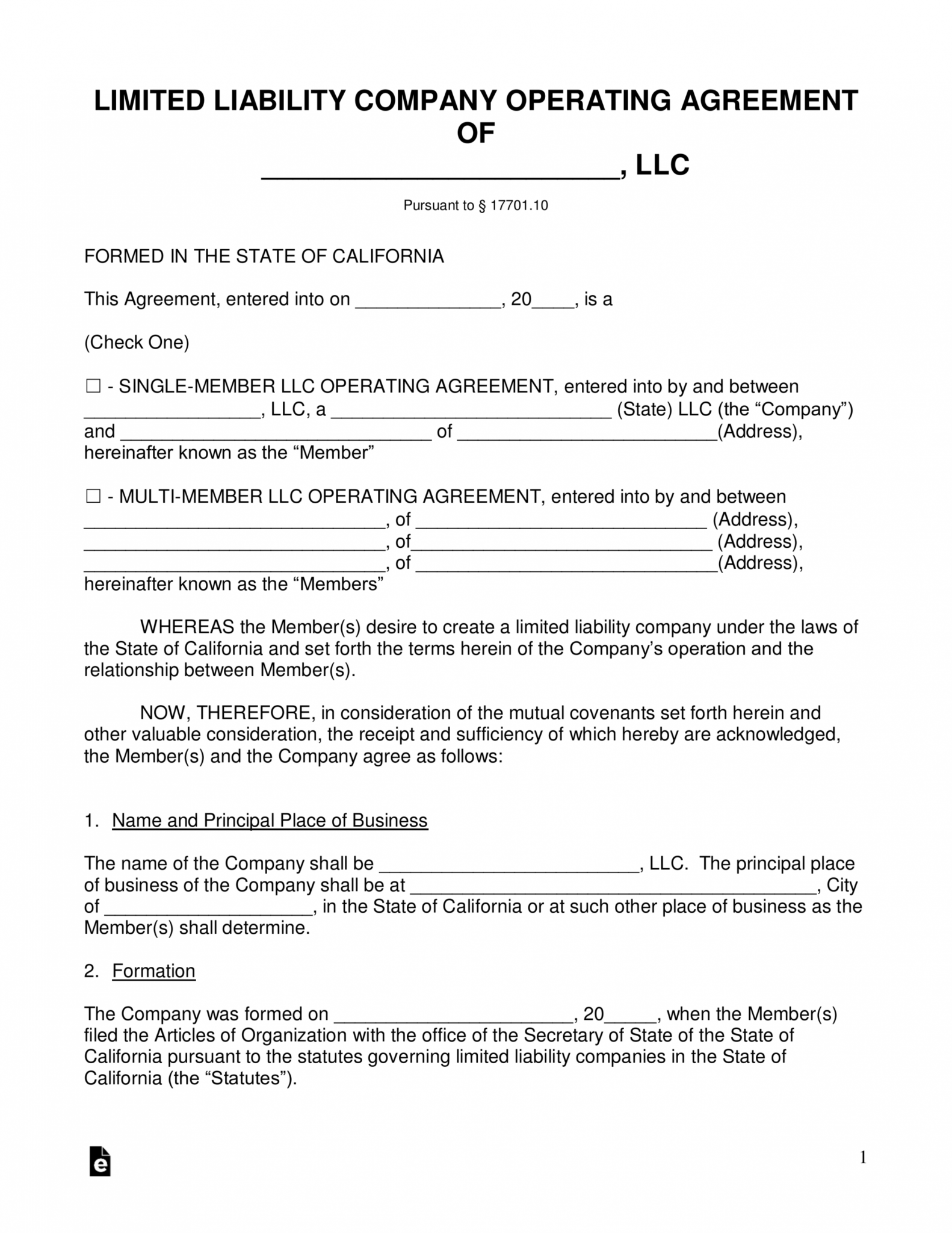

Free Free California Llc Operating Agreement Templates Pdf Corp To Corp

Web use form ftb 3539, payment for automatic extension for corporations and exempt organizations, only if both of the following apply: 16, 2023, to file and pay taxes. This extension of time to file is not an extension of time to pay. Contain the reason why the filing or payment could not be filed on time. Form 7004 is used.

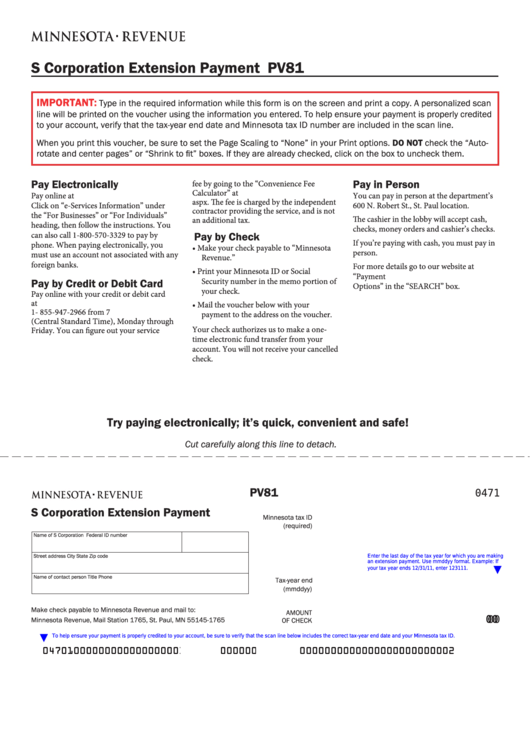

Fillable Form Pv81 S Corporation Extension Payment printable pdf download

C corporations is the 15th day of the 10th month following the close of the taxable year. Incorporated in california doing business in california registered to do business in california with the secretary of state (sos) receiving california source income Dissolved surrendered (withdrawn) merged/reorganized irc section 338 sale qsub election enter date (mm/dd/yyyy). Is the s corporation deferring any income.

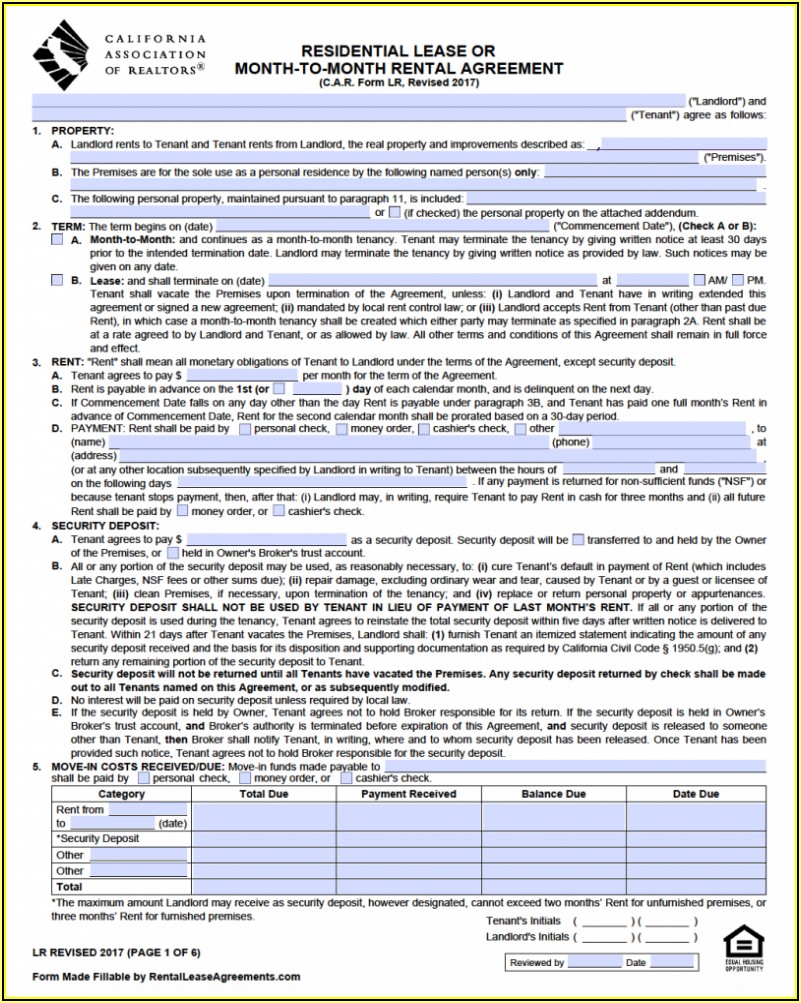

Free California Rental Lease Agreement Form Form Resume Examples

C corporations is the 15th day of the 10th month following the close of the taxable year. Web helpful forms and publications what is an s corporation? Dissolved surrendered (withdrawn) merged/reorganized irc section 338 sale qsub election enter date (mm/dd/yyyy). An s corporation is similar to a partnership, in that the taxable income or loss of the s corporation flows.

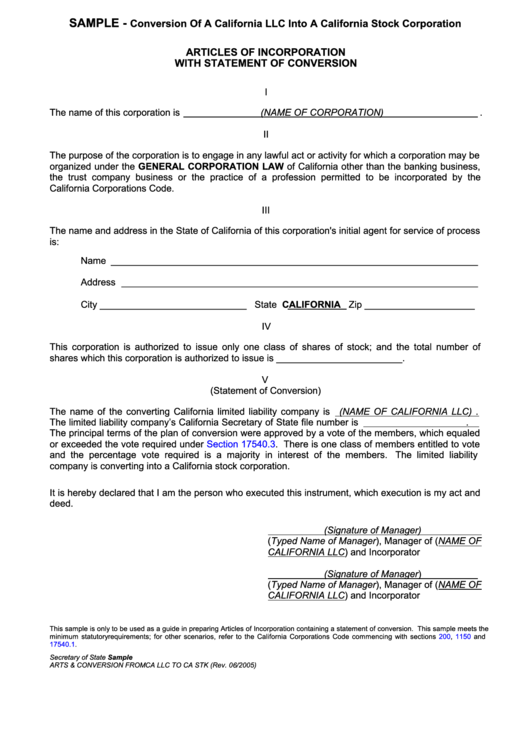

Sample Conversion Of A California Llc Into A California Stock

Web use form ftb 3539, payment for automatic extension for corporations and exempt organizations, only if both of the following apply: Incorporated in california doing business in california registered to do business in california with the secretary of state (sos) receiving california source income Contain the reason why the filing or payment could not be filed on time. All of.

Fillable California Form 3539 (Corp) Payment For Automatic Extension

Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Be signed by the employer or authorized agent. S corporations the extended due date is the 15th day of the 9th month following the close of the taxable.

Contain The Reason Why The Filing Or Payment Could Not Be Filed On Time.

Web helpful forms and publications what is an s corporation? An s corporation is similar to a partnership, in that the taxable income or loss of the s corporation flows through to the shareholders that report the income or loss on their own returns. All of california’s tax extensions are paperless, meaning there are no forms or applications to file. The edd will notify you if the extension is granted.

Web Information About Form 7004, Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns, Including Recent Updates, Related Forms, And Instructions On How To File.

View our emergency tax relief page for more information. Form 7004 is used to request an automatic extension to file the certain returns. Web use form ftb 3539, payment for automatic extension for corporations and exempt organizations, only if both of the following apply: C corporations is the 15th day of the 10th month following the close of the taxable year.

Web This Is A Reminder That The Extended Due Date To File Form 100S, California S Corporation Franchise Or Income Tax Return, Is September 15, 2021.

Is the s corporation deferring any income from the disposition of assets? Web filing requirements you must file california s corporation franchise or income tax return (form 100s) if the corporation is: Dissolved surrendered (withdrawn) merged/reorganized irc section 338 sale qsub election enter date (mm/dd/yyyy). Web now only $34.95 file your tax extension now!

Web Form 100S A 1.

The corporation or exempt organization cannot file its 2020 california(c a) tax return by the original due date. Incorporated in california doing business in california registered to do business in california with the secretary of state (sos) receiving california source income This extension of time to file is not an extension of time to pay. Be received before the extended period ends.