Call Calendar Spread

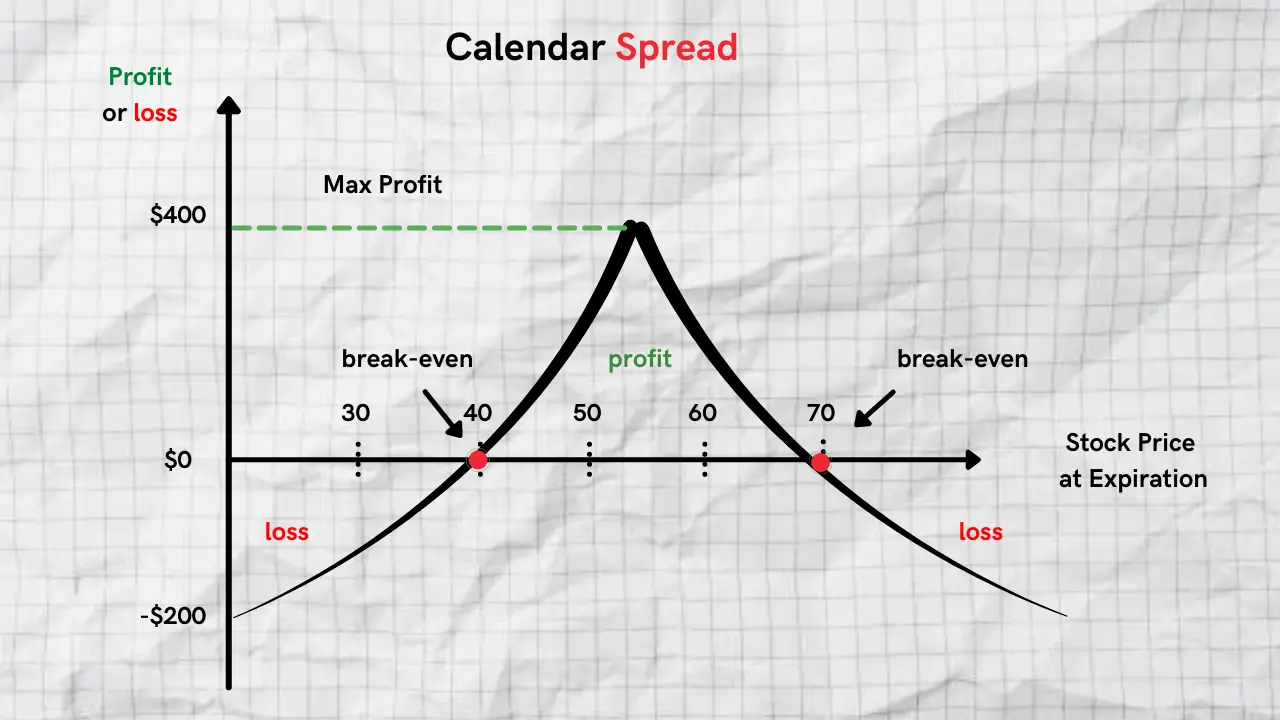

Call Calendar Spread - Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike. The strategy most commonly involves calls with. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. You make money when the stock. Select option contracts to view profit estimates. Web short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. Use the optionscout profit calculator to visualize your trading idea for the long call calendar. Web calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies.

Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike. Use the optionscout profit calculator to visualize your trading idea for the long call calendar. Select option contracts to view profit estimates. You make money when the stock. Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. Web short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. Web what is a calendar spread?

Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. The strategy most commonly involves calls with. Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Web what is a calendar spread? A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. Select option contracts to view profit estimates. Use the optionscout profit calculator to visualize your trading idea for the long call calendar. You make money when the stock.

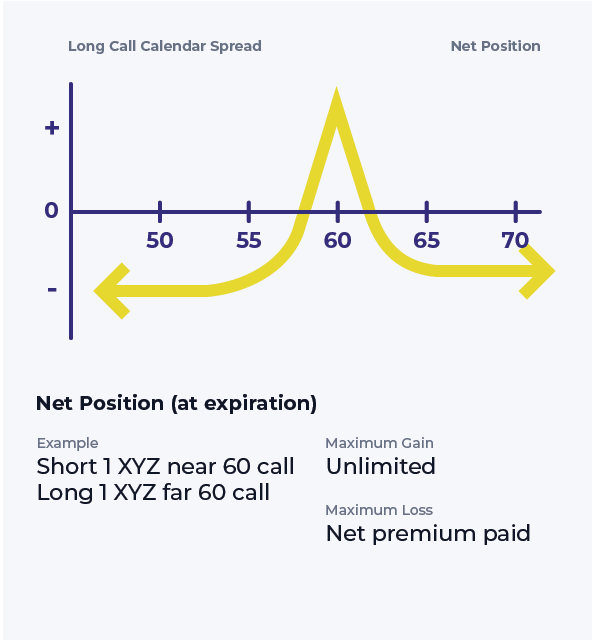

Long Call Calendar Spread Options Strategy

Use the optionscout profit calculator to visualize your trading idea for the long call calendar. Web short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. Select option contracts to view profit estimates. Web calculate potential profit, max loss, chance of profit, and more for calendar.

Calendar Call Spread Options Edge

Select option contracts to view profit estimates. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike. Web.

Calendar Call Spread Option Strategy Heida Kristan

Web what is a calendar spread? Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike. Use the.

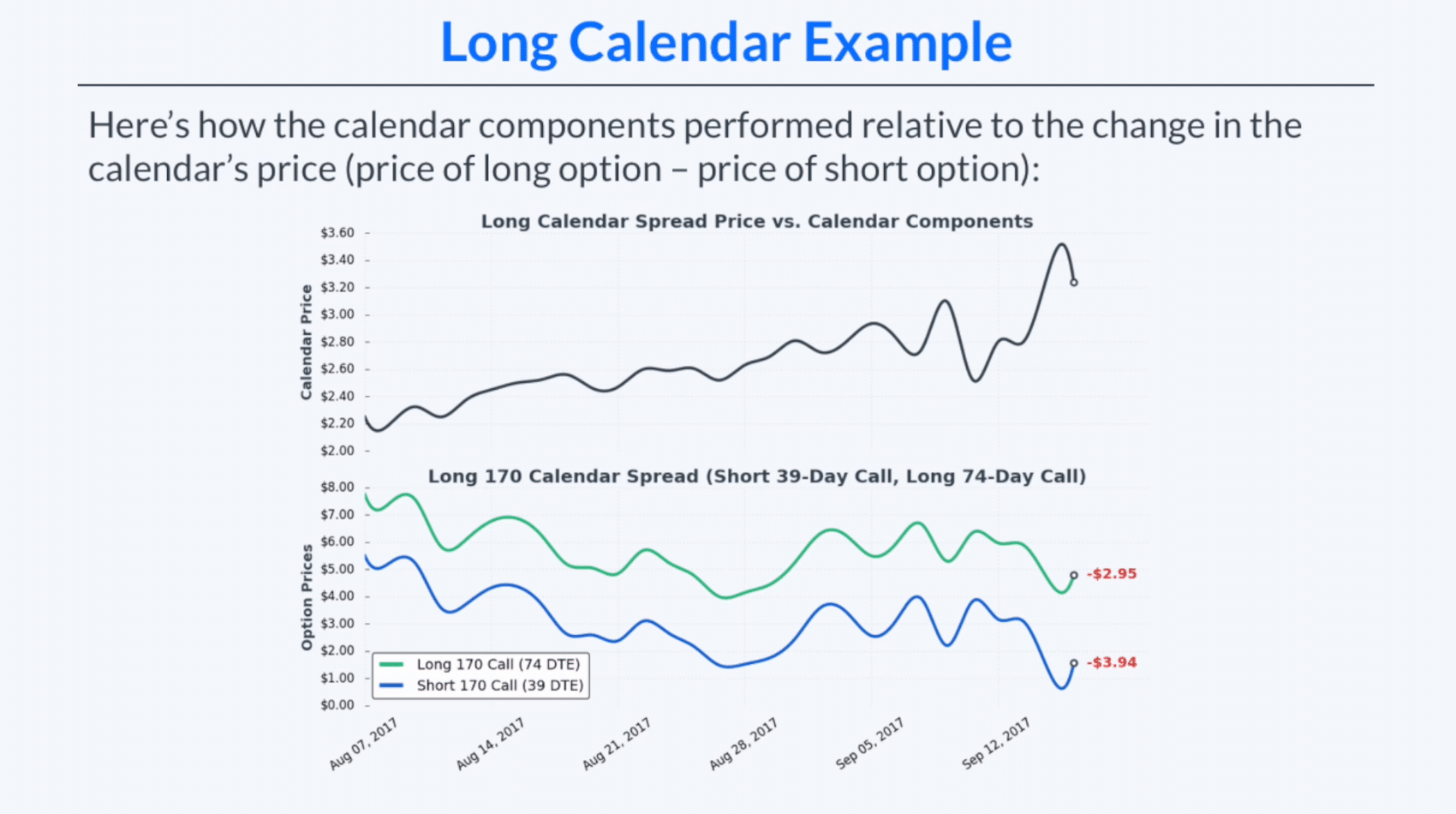

How to Trade Options Calendar Spreads (Visuals and Examples)

Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. The strategy most commonly involves calls with. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike. Use.

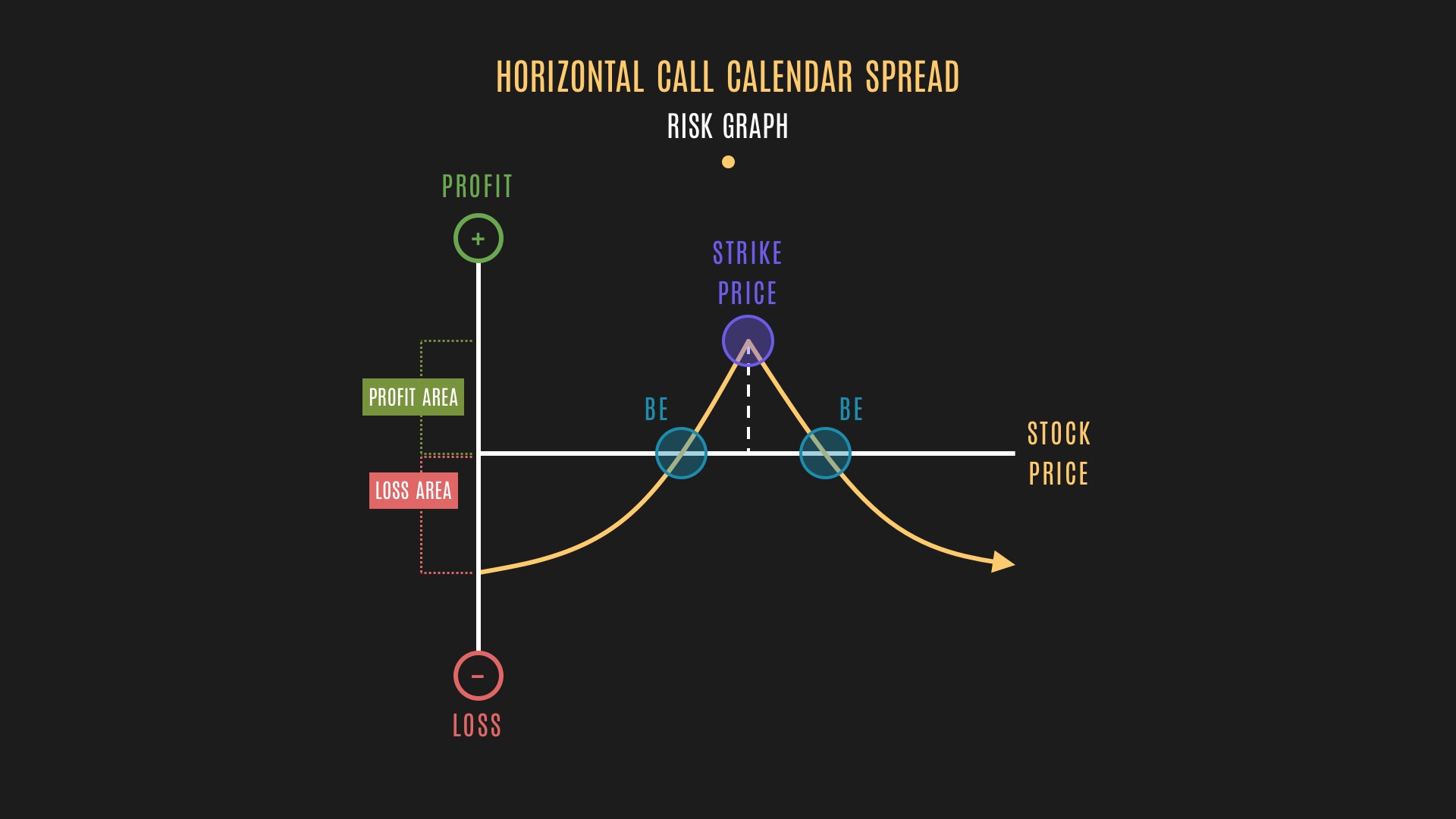

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike. Web calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. Web the calendar call spread is a neutral options trading strategy, which means you.

Calendar Call Spread Strategy

The strategy most commonly involves calls with. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

You make money when the stock. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike. Use the.

Trading Guide on Calendar Call Spread AALAP

Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. You make money when the stock. Web what is a calendar spread? The strategy most commonly involves calls with. Web short one call option and long a second call option with a more.

Long Call Calendar Spread Explained (Options Trading Strategies For

A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. Web a long call calendar spread involves buying.

Calendar Call Spread Strategy

Web calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. You make money when the.

Web Short One Call Option And Long A Second Call Option With A More Distant Expiration Is An Example Of A Long Call Calendar Spread.

Select option contracts to view profit estimates. Web what is a calendar spread? Web calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little.

A Calendar Spread Typically Involves Buying And Selling The Same Type Of Option (Calls Or Puts) For The Same Underlying Security At The Same Strike.

Use the optionscout profit calculator to visualize your trading idea for the long call calendar. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. The strategy most commonly involves calls with. You make money when the stock.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)