Change Of Accounting Method Form

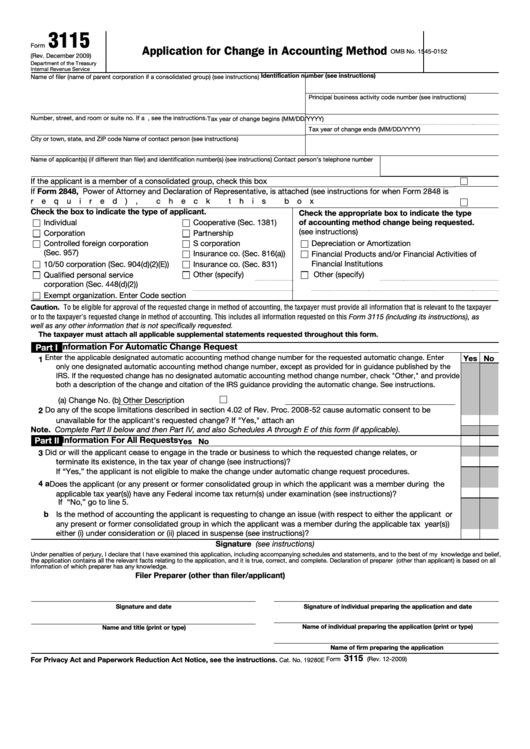

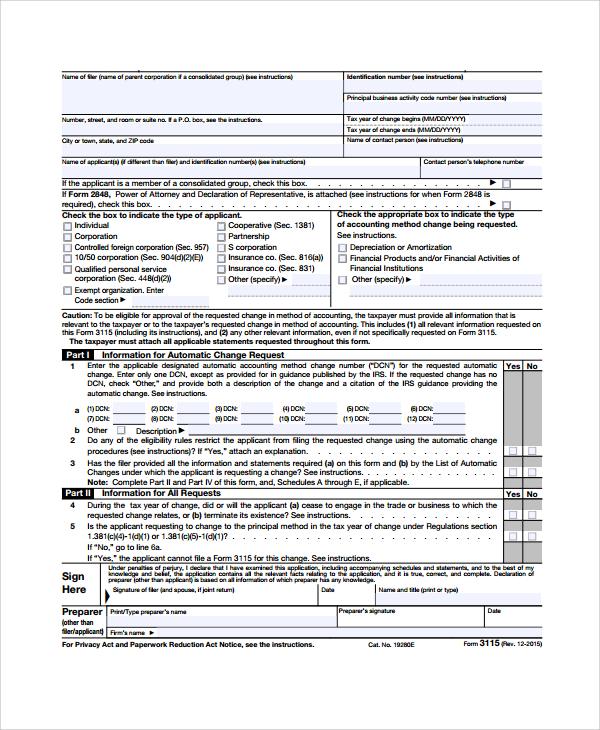

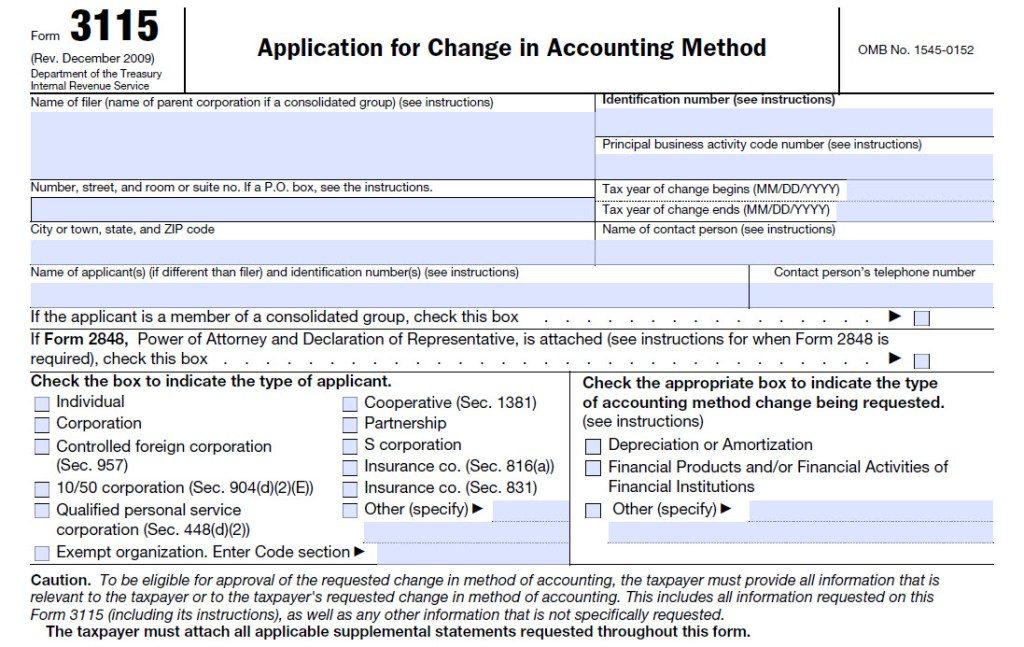

Change Of Accounting Method Form - 315 name of filer (name of parent corporation if a consolidated group) (see instructions) December 2022) department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. There are some instances when you can obtain automatic consent from the irs to change to certain accounting methods. About form 3115, application for change in accounting method | internal revenue service To obtain the irs's consent, taxpayers file form 3115, application. There are three general methods businesses choose from: Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices, Web the taxpayer must notify the national office contact person for the form 3115 that it intends to make the automatic accounting method change before the later of (i) march 2, 2022 or (ii) the issuance of a letter ruling granting or denying consent for the change. Web form 3115 is used when you want to change your overall accounting method and also if you need to change the accounting treatment of any particular item.

Changes in accounting methods that require approval from the irs include switching from a cash basis method to an accrual basis method or vice versa. Web the taxpayer must notify the national office contact person for the form 3115 that it intends to make the automatic accounting method change before the later of (i) march 2, 2022 or (ii) the issuance of a letter ruling granting or denying consent for the change. Generally, unless otherwise provided, a taxpayer must secure the irs’s consent before changing its accounting method. To obtain the irs's consent, taxpayers file form 3115, application. Web file form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices, Web the irs on december 12, 2022, released an advance copy of rev. December 2022) department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file.

Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices, December 2022) department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. Web the irs on december 12, 2022, released an advance copy of rev. There are some instances when you can obtain automatic consent from the irs to change to certain accounting methods. Changes in accounting methods that require approval from the irs include switching from a cash basis method to an accrual basis method or vice versa. Web the taxpayer must notify the national office contact person for the form 3115 that it intends to make the automatic accounting method change before the later of (i) march 2, 2022 or (ii) the issuance of a letter ruling granting or denying consent for the change. Web a new automatic accounting method change has been added to rev. About form 3115, application for change in accounting method | internal revenue service Generally, unless otherwise provided, a taxpayer must secure the irs’s consent before changing its accounting method. The form is required for both changing your overall accounting method or the treatment of a particular item.

Accounting Method Changes for Construction Companies

Web form 3115 is used when you want to change your overall accounting method and also if you need to change the accounting treatment of any particular item. Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices, Web form 3115, otherwise known as.

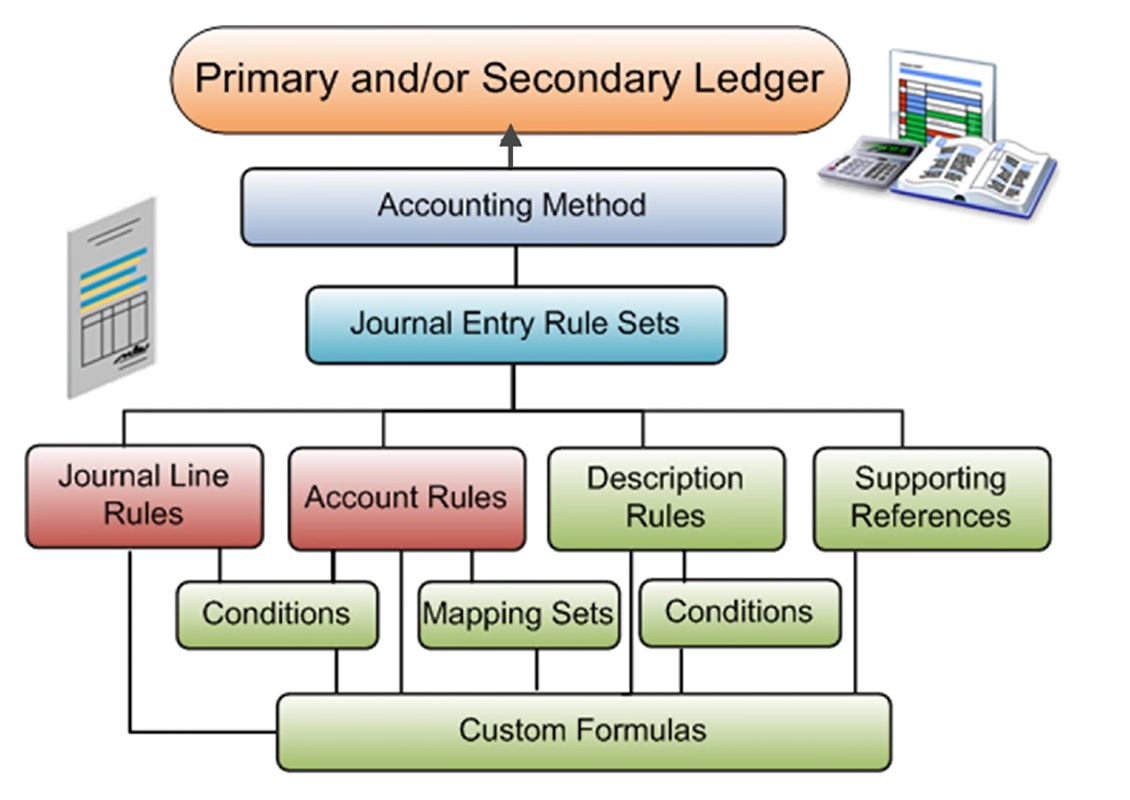

The Oracle Prodigy Overview of Configuring Accounting Rules in Oracle

Web form 3115 is used when you want to change your overall accounting method and also if you need to change the accounting treatment of any particular item. Web the irs on december 12, 2022, released an advance copy of rev. Web in general, you must file a current form 3115 to request a change in either an overall accounting.

Form 3115 Application for Change in Accounting Method Editorial Stock

Web form 3115 is used when you want to change your overall accounting method and also if you need to change the accounting treatment of any particular item. Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Method change procedures when filing form 3115, you must determine if the.

Choosing the right accounting method for tax purposes Kehlenbrink

Web a new automatic accounting method change has been added to rev. Web the irs on thursday updated the list of accounting method changes to which automatic change procedures apply (rev. Web in general, you must file a current form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. Web form.

Fillable Form 3115 Application For Change In Accounting Method

The form is required for both changing your overall accounting method or the treatment of a particular item. Web the irs on december 12, 2022, released an advance copy of rev. Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Web the irs on thursday updated the list of.

Accounting Software When to Switch

Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices, Web in general, you must file a current form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. About form 3115, application for change in.

PPT AND CHANGES IN RETAINED EARNINGS PowerPoint Presentation

Web form 3115 is used when you want to change your overall accounting method and also if you need to change the accounting treatment of any particular item. Web the taxpayer must notify the national office contact person for the form 3115 that it intends to make the automatic accounting method change before the later of (i) march 2, 2022.

FREE 9+ Sample Accounting Forms in PDF

Web file form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. Web the irs on december 12, 2022, released an advance copy of rev. Web the irs on thursday updated the list of accounting method changes to which automatic change procedures apply (rev. Web in general, you must file a.

Tax Accounting Methods

The form is required for both changing your overall accounting method or the treatment of a particular item. File this form to request a change in either: Generally, unless otherwise provided, a taxpayer must secure the irs’s consent before changing its accounting method. Web the taxpayer must notify the national office contact person for the form 3115 that it intends.

☑ Lifo Accounting Method Change

There are three general methods businesses choose from: Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices, Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web form 3115 is.

Web Information About Form 3115, Application For Change In Accounting Method, Including Recent Updates, Related Forms And Instructions On How To File.

Web the irs on thursday updated the list of accounting method changes to which automatic change procedures apply (rev. Generally, unless otherwise provided, a taxpayer must secure the irs’s consent before changing its accounting method. The form is required for both changing your overall accounting method or the treatment of a particular item. 315 name of filer (name of parent corporation if a consolidated group) (see instructions)

Web Form 3115, Otherwise Known As The Application For Change In Accounting Method, Allows Business Owners To Switch Accounting Methods.

There are three general methods businesses choose from: There are some instances when you can obtain automatic consent from the irs to change to certain accounting methods. About form 3115, application for change in accounting method | internal revenue service To obtain the irs's consent, taxpayers file form 3115, application.

Web Form 3115 Is Used When You Want To Change Your Overall Accounting Method And Also If You Need To Change The Accounting Treatment Of Any Particular Item.

Changes in accounting methods that require approval from the irs include switching from a cash basis method to an accrual basis method or vice versa. Web in general, you must file a current form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. Web file form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices,

Web The Irs On December 12, 2022, Released An Advance Copy Of Rev.

File this form to request a change in either: December 2022) department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. Web a new automatic accounting method change has been added to rev. Web the taxpayer must notify the national office contact person for the form 3115 that it intends to make the automatic accounting method change before the later of (i) march 2, 2022 or (ii) the issuance of a letter ruling granting or denying consent for the change.