Change Of Business Ownership Form

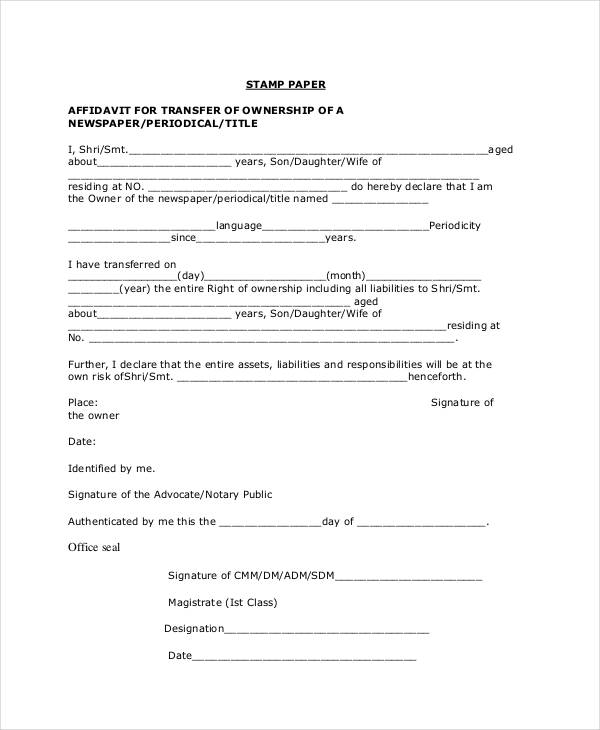

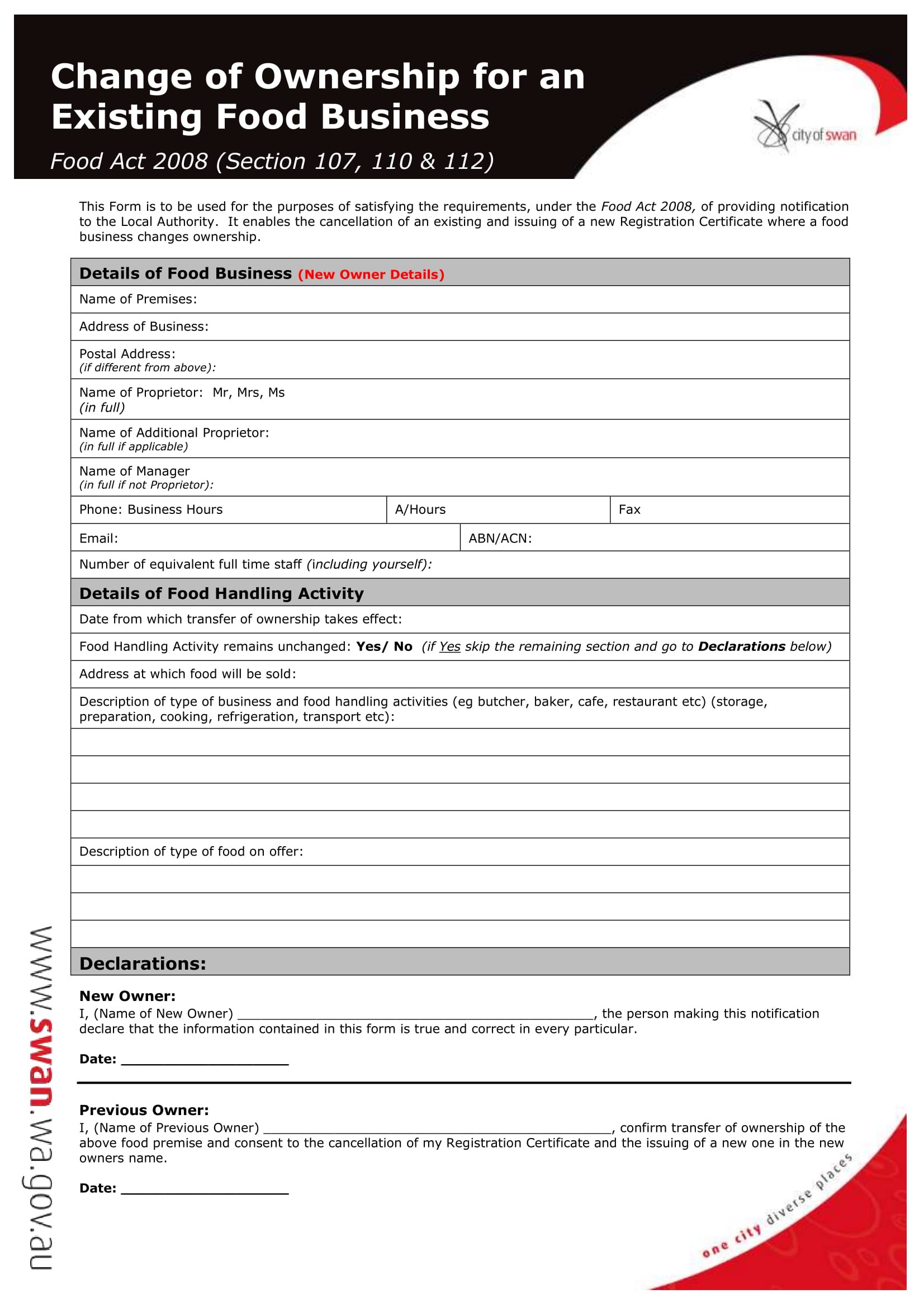

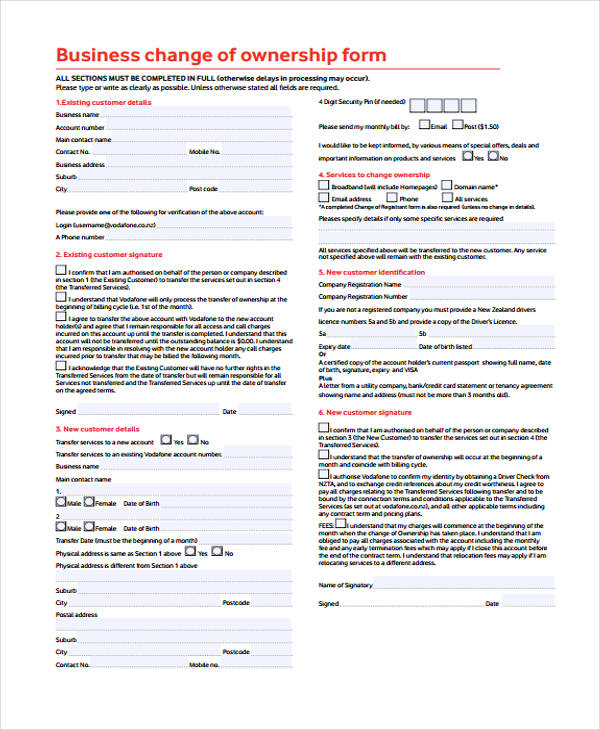

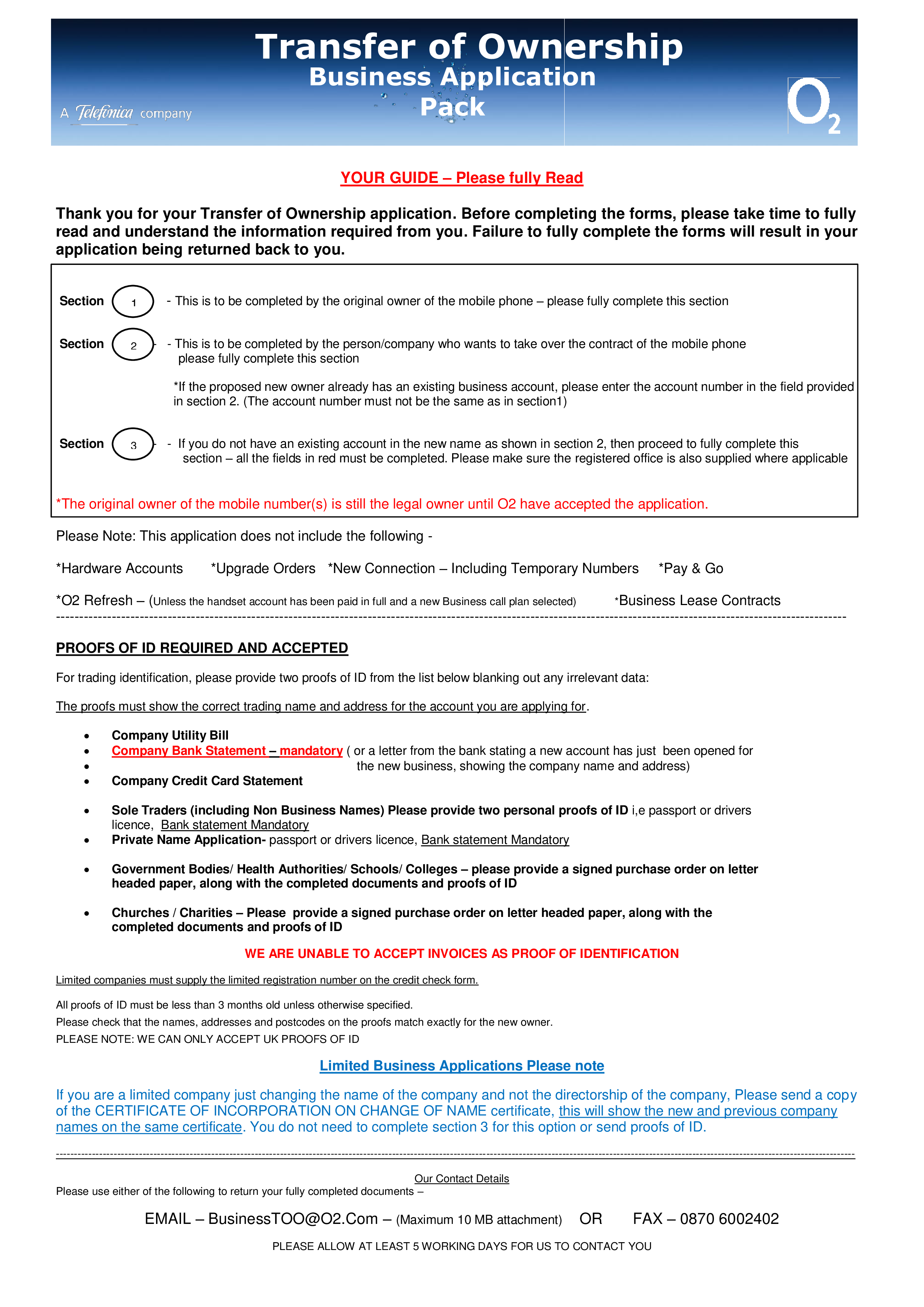

Change Of Business Ownership Form - A new corporation is created after a statutory merger. When beginning a business, you must decide what form of business entity to establish. Web change the ownership of your business, vehicle, pets, and other belongings. Web up to $40 cash back the purpose of transferring business ownership is to allow a business to continue to operate and grow by transferring ownership to another person or group of people. Sell the business selling your business is the most common way to transfer ownership. Start by modifying this form to suit your specific agreement. To change ownership structure, e.g., sole owner to corporation, or to assume an existing business, visit dor.wa.gov/changeownership. Depending on the business, there can be multiple steps and required forms. By definition, a sole proprietorship has just one owner. The specific action required may vary depending on the type of.

Only business name (new) is needed. Reinstate a revoked or voided. Of course, you will need an attorney to help with some of the legal documents. Thus, a business owner can’t really. Secretary of state (sos) form/register a business entity in california. Use your preferred form fields with. Web change the ownership of your business, vehicle, pets, and other belongings. Web how your business's structure affects transfers of ownership. Depending on the business, there can be multiple steps and required forms. Start by modifying this form to suit your specific agreement.

Web business owners and other authorized individuals can submit a name change for their business. Your form of business determines which income tax. Web how your business's structure affects transfers of ownership. You can do this in two ways: Secretary of state (sos) form/register a business entity in california. Start by modifying this form to suit your specific agreement. Only business name (new) is needed. Fill, sign and download transfer of business ownership form online on handypdf.com. The specific action required may vary depending on the type of. Web ready to transfer the ownership of your llc?

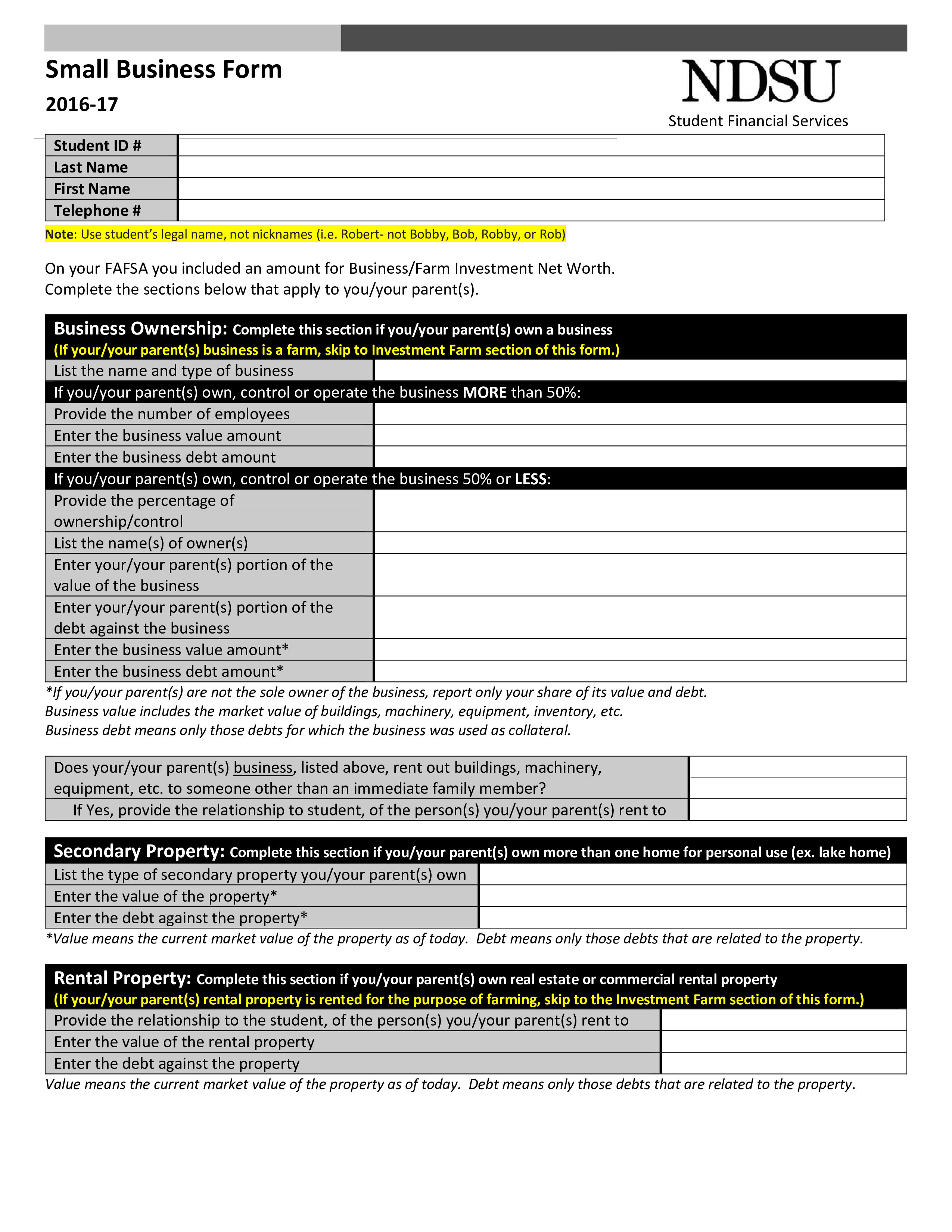

Small Business Investment Ownership Form Templates at

Web you change to a partnership or a sole proprietorship. Web form id (cab 105) this document is to consent to a change of ownership between the parties listed below all changes will be completed within 10 business days from the. Your form of business determines which income tax. Of course, you will need an attorney to help with some.

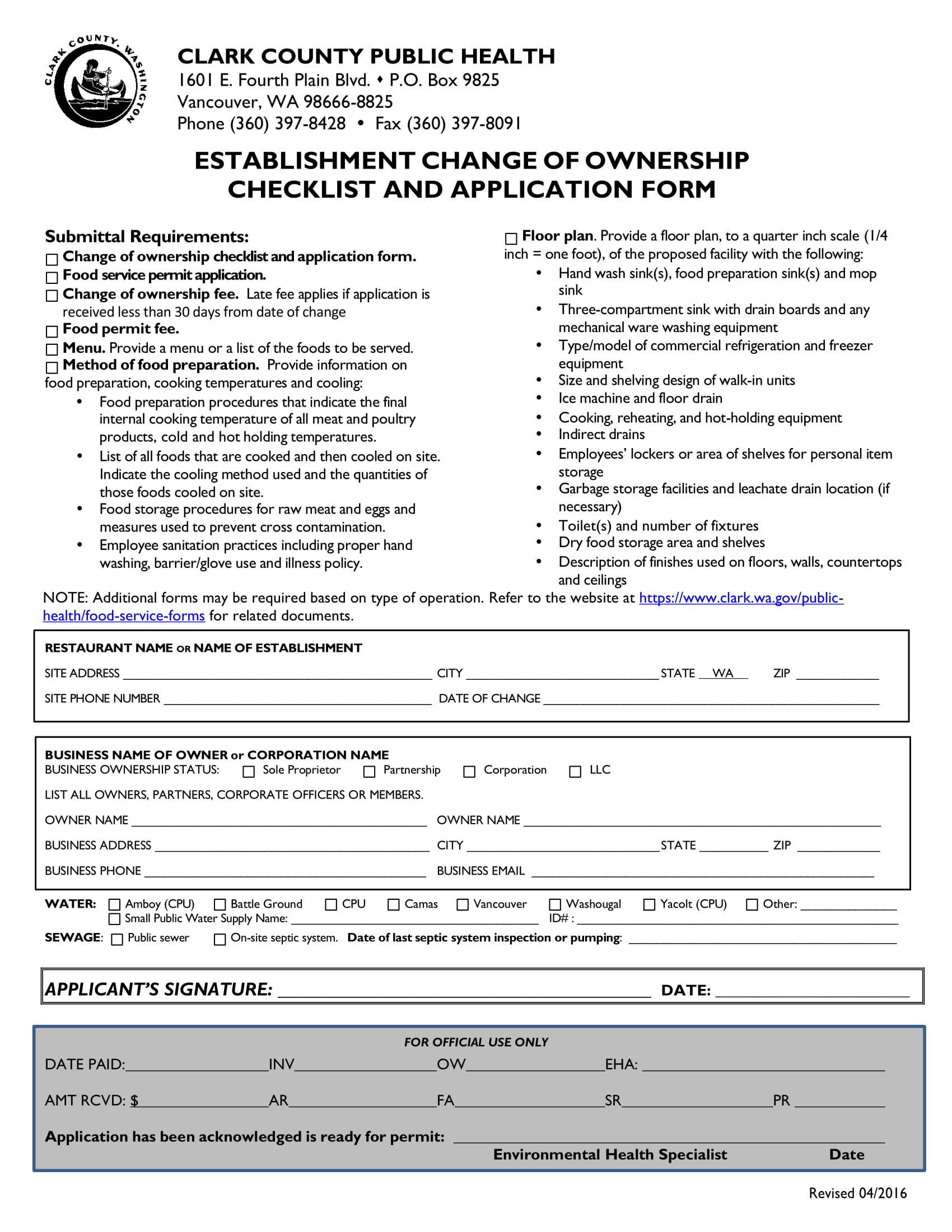

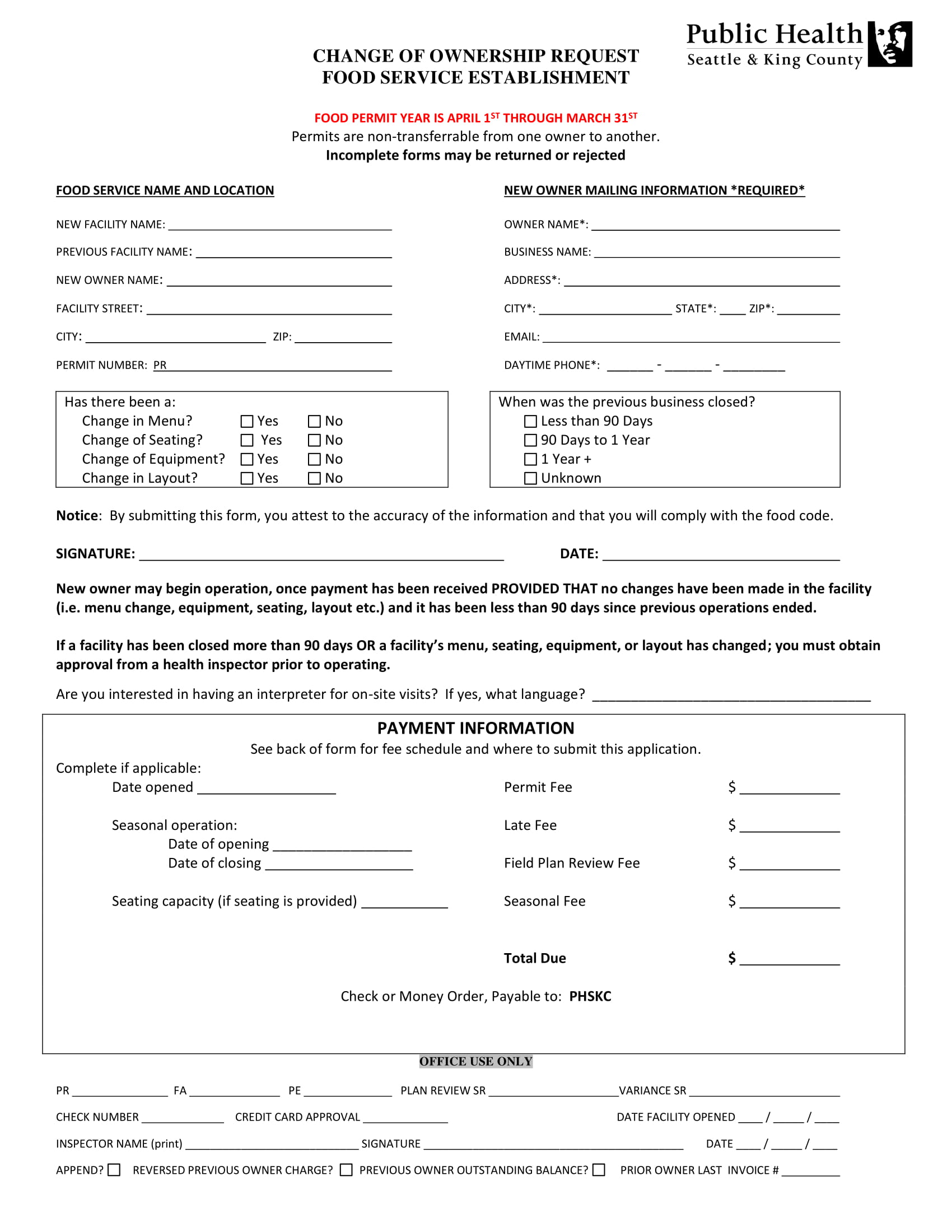

FREE 4+ Restaurant Transfer of Ownership Forms in PDF MS Word

You can do this in two ways: As of the closing date, all of these tasks will need to be completed, except for the final dissolution of your old business. If you are a representative signing for the. Web up to $40 cash back the purpose of transferring business ownership is to allow a business to continue to operate and.

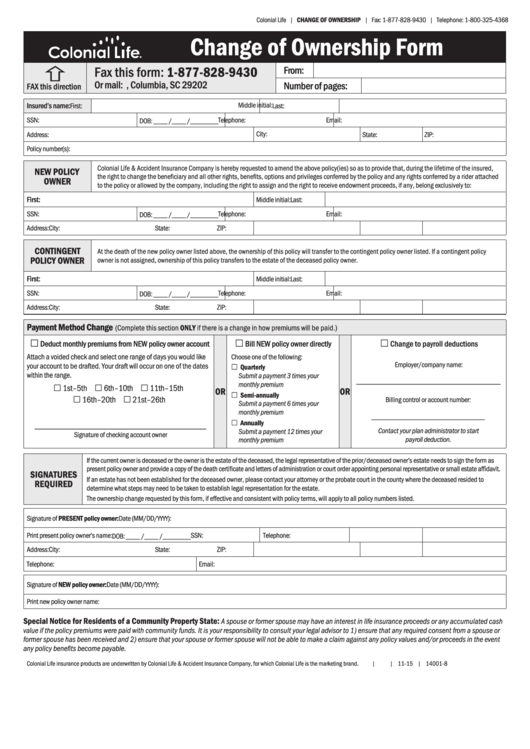

Fillable Change Of Ownership Form Colonial Life printable pdf download

A new corporation is created after a statutory merger. The specific action required may vary depending on the type of. Sell the business selling your business is the most common way to transfer ownership. Account address (if more than one location, please complete a form for each location) current customer. Web business owners and other authorized individuals can submit a.

Ownership Transfer Letter Format How to write an ownership Transfer

Reinstate a revoked or voided. Account address (if more than one location, please complete a form for each location) current customer. Web form id (cab 105) this document is to consent to a change of ownership between the parties listed below all changes will be completed within 10 business days from the. Web change owner’s legal name to: Depending on.

FREE 4+ Restaurant Transfer of Ownership Forms in PDF MS Word

Web business owners and other authorized individuals can submit a name change for their business. Web up to $40 cash back the purpose of transferring business ownership is to allow a business to continue to operate and grow by transferring ownership to another person or group of people. When beginning a business, you must decide what form of business entity.

Sample Gift Car Letter

All fields need to be completed. As of the closing date, all of these tasks will need to be completed, except for the final dissolution of your old business. Web you change to a partnership or a sole proprietorship. Web change owner’s legal name to: Web changing business information.

FREE 4+ Restaurant Transfer of Ownership Forms in PDF MS Word

Web fillable and printable transfer of business ownership form 2023. Only business name (new) is needed. All fields need to be completed. Fill, sign and download transfer of business ownership form online on handypdf.com. Web you change to a partnership or a sole proprietorship.

FREE 35+ Sample Change Forms in PDF MS Word Excel

All fields need to be completed. Start by modifying this form to suit your specific agreement. Web changing business information. Of course, you will need an attorney to help with some of the legal documents. Depending on the business, there can be multiple steps and required forms.

Business Account Ownership Transfer Letter Templates at

Web changing business information. Web change the ownership of your business, vehicle, pets, and other belongings. You can do this in two ways: The specific action required may vary depending on the type of. When beginning a business, you must decide what form of business entity to establish.

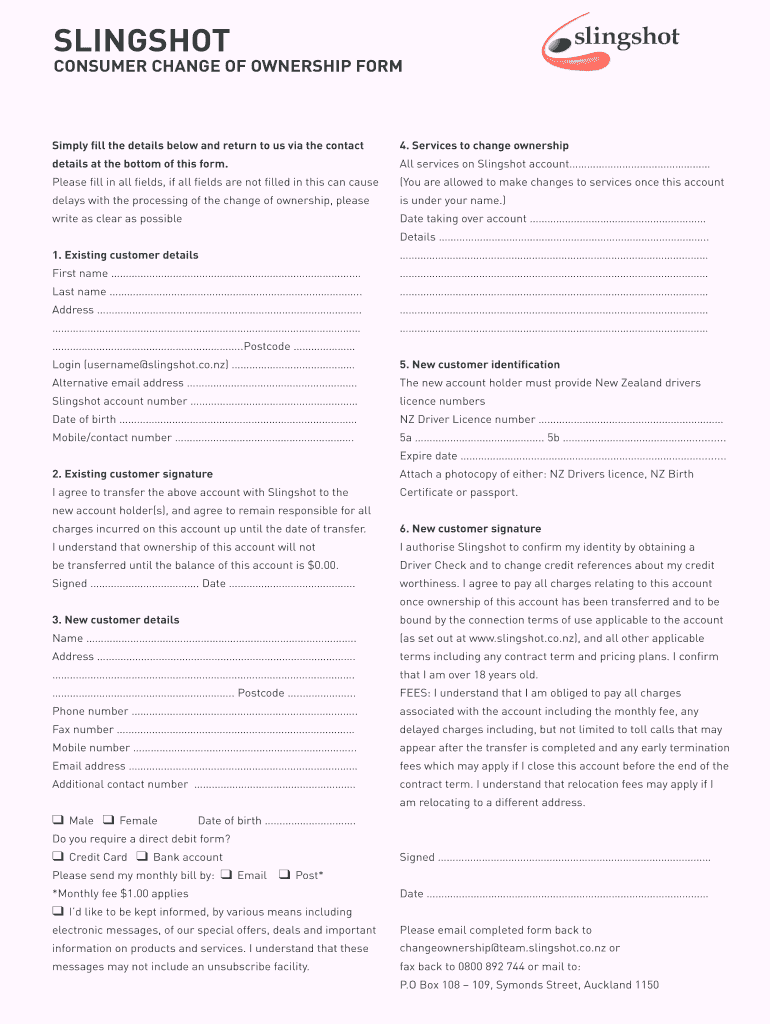

Slingshot Change Ownership Fill Online, Printable, Fillable, Blank

Fill, sign and download transfer of business ownership form online on handypdf.com. Reinstate a revoked or voided. Of course, you will need an attorney to help with some of the legal documents. This list is general, so there. Secretary of state (sos) form/register a business entity in california.

Web Business Owners And Other Authorized Individuals Can Submit A Name Change For Their Business.

By definition, a sole proprietorship has just one owner. Your form of business determines which income tax. As of the closing date, all of these tasks will need to be completed, except for the final dissolution of your old business. Web changing business information.

You Will Not Be Required To Obtain A New Ein If Any Of The Following.

When beginning a business, you must decide what form of business entity to establish. Use your preferred form fields with. Reinstate a revoked or voided. Web ready to transfer the ownership of your llc?

All Fields Need To Be Completed.

Of course, you will need an attorney to help with some of the legal documents. Sell the business selling your business is the most common way to transfer ownership. Start by modifying this form to suit your specific agreement. Depending on the business, there can be multiple steps and required forms.

Only Business Name (New) Is Needed.

Web form id (cab 105) this document is to consent to a change of ownership between the parties listed below all changes will be completed within 10 business days from the. You can do this in two ways: Web change the ownership of your business, vehicle, pets, and other belongings. Web fillable and printable transfer of business ownership form 2023.