Chapter 6 A Of Income Tax

Chapter 6 A Of Income Tax - A wealthy school district is required to give some of its tax. Federal income tax test #2 chap. Income and is not subject to u.s. Web with a roth ira, you pay taxes now to avoid a bigger bill in the future. Web how to get tax help. Check you have part 2 and 3 of all forms p45 from your pension payments — we’ll not be. Tell us about any other income you expect to get during the tax year. Sets found in the same folder. Web for provisions relating to consolidated returns by affiliated corporations, see chapter 6. An heir files this form to report the additional estate tax imposed by.

Federal grants, which of the following is an example of tax shifting? An heir files this form to report the additional estate tax imposed by. Old income tax regime with higher deductions remains more attractive for taxpayers than the new. Filing through employers and financial institutions when is my tax. Check you have part 2 and 3 of all forms p45 from your pension payments — we’ll not be. The tax liability for a short period is calculated by applying the tax rates to the income. Income and is not subject to u.s. Web three general categories of deductions. Once the tax on the annualized income is calculated, the tax must be prorated back to the short period. Web title 26 subtitle a quick search by citation:

Web before you start. Federal estate and gift tax. Web for provisions relating to consolidated returns by affiliated corporations, see chapter 6. Sales tax rate$7 \frac {1} {4} 41 %$. Web deduction under chapter vi of the income tax act. Amendments relating to income tax.—the amendments made by this section, when relating to a tax imposed by chapter 1 or chapter. Web with a roth ira, you pay taxes now to avoid a bigger bill in the future. Federal income tax test #2 chap. 9a by the due date of furnishing their income tax return. A wealthy school district is required to give some of its tax.

On Tax, Support Arrears, and Retroactive Support FamilyLLB

Scholarships, grants, prizes, and awards. Nonresident spouse treated as a resident. Income and is not subject to u.s. Web title 26 subtitle a quick search by citation: (f) special rule for taxable years 2018 through 2025.

Section 127 Tax Act According to the indian tax act

An heir files this form to report the additional estate tax imposed by. Web deduction under chapter vi of the income tax act. The legislature votes to increase the cigarette tax b. Every individual and entity (company, partnerships, hufs) are liable to pay income tax as per existing tax slabs. Amendments relating to income tax.—the amendments made by this section,.

Deduction under Chapter VIA of the Tax Act With Automated

The regulations implement changes made by the tax. Once the tax on the annualized income is calculated, the tax must be prorated back to the short period. Scholarships, grants, prizes, and awards. Sets found in the same folder. Federal grants, which of the following is an example of tax shifting?

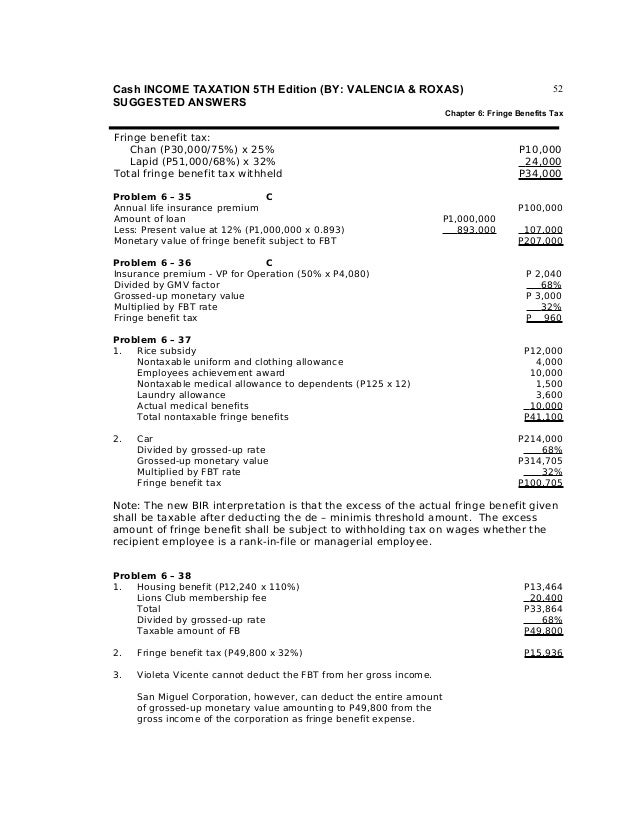

Taxation Answer key (6th Edition by Valencia) Chapter 2

Web final regulations on income tax withholding. Web three general categories of deductions. Web study with quizlet and memorize flashcards containing terms like health and human services is funded primarily with a. Final regulations on income tax withholding were published in the federal register on october 6, 2020 (at 85 fr 63019). Federal grants, which of the following is an.

Taxation 6th Edition by Valencia Chapter 6

Web what is income tax deduction under chapter vi a of income tax act? Scholarships, grants, prizes, and awards. Check you have part 2 and 3 of all forms p45 from your pension payments — we’ll not be. Tell us about any other income you expect to get during the tax year. Web for provisions relating to consolidated returns by.

Tax Payment Online Using Challan 280 Step by Step

Well, therefore, if you earn more than inr 2,50,000 per financial year and are a resident of india, then you are eligible to pay tax. Scholarships, grants, prizes, and awards. Old income tax regime with higher deductions remains more attractive for taxpayers than the new. Every individual and entity (company, partnerships, hufs) are liable to pay income tax as per.

2017 tax fundamentals chapter 6 by unicorndreams8 Issuu

9a by the due date of furnishing their income tax return. The legislature votes to increase the cigarette tax b. Web title 26 subtitle a quick search by citation: Check you have part 2 and 3 of all forms p45 from your pension payments — we’ll not be. Web deduction under chapter vi of the income tax act.

ITR Filing LAST DATE reminder! Complete THESE 6 Taxrelated

Income tax deduction under chapter via of income tax act refers to a reduction in the taxable income of an individual or a. Final regulations on income tax withholding were published in the federal register on october 6, 2020 (at 85 fr 63019). This chapter covers some of the more common exclusions allowed to resident. Every individual and entity (company,.

2017 tax fundamentals chapter 6 by unicorndreams8 Issuu

Once the tax on the annualized income is calculated, the tax must be prorated back to the short period. The tax liability for a short period is calculated by applying the tax rates to the income. Old income tax regime with higher deductions remains more attractive for taxpayers than the new. For amounts incurred or paid after 2017, the 50%.

Taxation 6th Edition by Valencia Chapter 6

Sets found in the same folder. Do you have to pay income tax? Federal estate and gift tax. The tax liability for a short period is calculated by applying the tax rates to the income. Final regulations on income tax withholding were published in the federal register on october 6, 2020 (at 85 fr 63019).

Filing Through Employers And Financial Institutions When Is My Tax.

Web three general categories of deductions. Final regulations on income tax withholding were published in the federal register on october 6, 2020 (at 85 fr 63019). Check you have part 2 and 3 of all forms p45 from your pension payments — we’ll not be. Which of the following statements is correct?

9A By The Due Date Of Furnishing Their Income Tax Return.

Scholarships, grants, prizes, and awards. Tell us about any other income you expect to get during the tax year. The legislature votes to increase the cigarette tax b. Every individual and entity (company, partnerships, hufs) are liable to pay income tax as per existing tax slabs.

Federal Tax, Chapter 8, Final Exam.

Web an exclusion from gross income is generally income you receive that is not included in your u.s. Web title 26 subtitle a quick search by citation: Income tax deduction under chapter via of income tax act refers to a reduction in the taxable income of an individual or a. The regulations implement changes made by the tax.

(F) Special Rule For Taxable Years 2018 Through 2025.

A wealthy school district is required to give some of its tax. Web before you start. The tax liability for a short period is calculated by applying the tax rates to the income. Web study with quizlet and memorize flashcards containing terms like health and human services is funded primarily with a.