Chapter 7 Bankruptcy Secured Debt

Chapter 7 Bankruptcy Secured Debt - Redeeming secured property in chapter 7 bankruptcy. Web recommended on wall street william cohan apollo’s mission in finance but in the frantic weeks leading up to the bankruptcy, no superior rival financing offer had materialised. By cara o'neill, attorney bankruptcy helps you get out of debt by breaking the contract between you. The filings, which are dated august 9, are for two related entities: Web chapter 7 bankruptcy allows liquidation of assets to pay creditors. If only one spouse in a marriage owes debt, only that partner. Web when will the trustee pay secured debt in chapter 7 bankruptcy? Learn when a bankruptcy trustee will sell your home or car and use the proceeds to pay other creditors. #1 complaint to determine the dischargeability of debt. Reduce debt with bbb & afcc accredited debt consolidation companies.

By cara o'neill, attorney bankruptcy helps you get out of debt by breaking the contract between you. Start your path to solvency. If you default on your loan, the lender can sell. Reduce debt with bbb & afcc accredited debt consolidation companies. Web in chapter 7 bankruptcy, you can keep property secured by collateral (such as your car) by reaffirming the debt. Findlaw covers debt discharge 101 when you file chapter 7. Let’s summarize… secured debt is money owed to a creditor who is “secured” by a specific piece of real property (like a house or land) or personal property (like a car). Web in chapter 7 bankruptcy, you can keep property secured by collateral (such as your car) by reaffirming the debt. Web secured debts in chapter 7 bankruptcy: Web most debt settlement companies don’t settle secured debts.

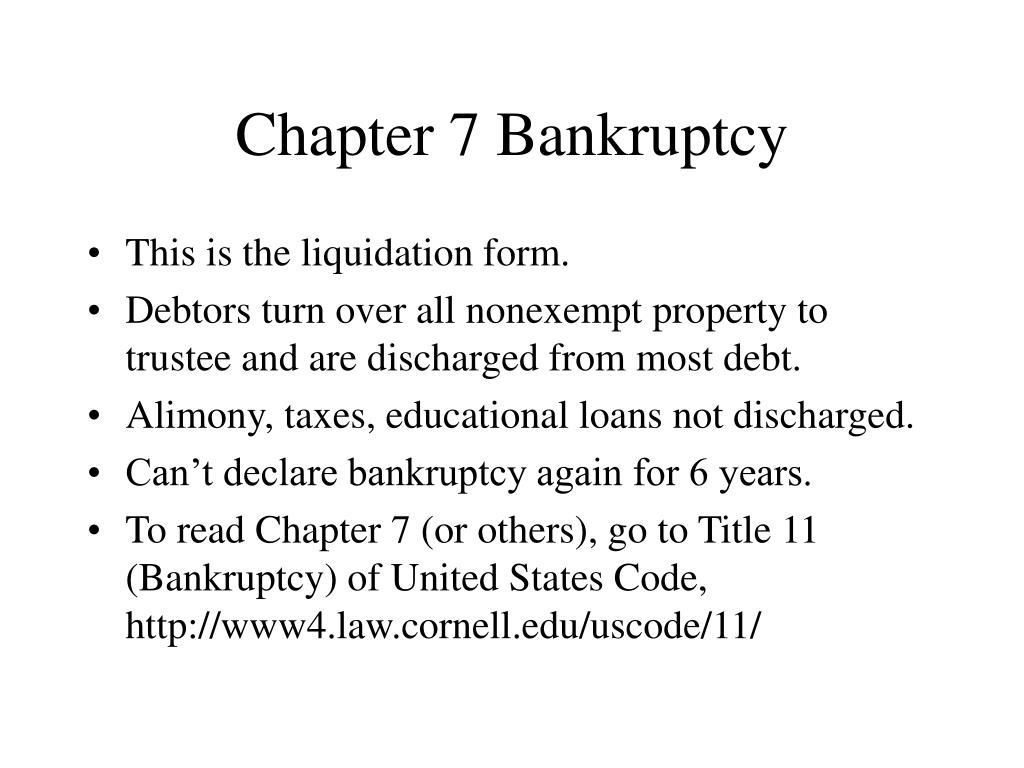

Web a secured creditor's rights in chapter 7 because the secured creditor has a payment mechanism in place, if money is available to distribute to creditors, a secured creditor won't get a part of it. Web bankruptcy is the legal process in which a person’s debts are discharged, making the debtor no longer liable for their dischargeable debts. The filings, which are dated august 9, are for two related entities: For example, your mortgage is secured by your home. Web by cara o'neill, attorney in chapter 7 bankruptcy, priority debt is significant enough to jump to the head of the bankruptcy repayment line. Web abuse is presumed if the debtor's current monthly income over 5 years, net of certain statutorily allowed expenses and secured debt payments, is not less than the lesser of (i) 25% of the debtor's nonpriority unsecured debt, or $9,075,. A secured debt is one that is secured by property, which the creditor can take if you default. Is a secured credit card right for me? Web chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans. If only one spouse in a marriage owes debt, only that partner.

When Does Chapter 7 Bankruptcy Fall Off Credit Report Bankruptcy Talk

Bankruptcy court honorable john c melaragno current as of 8/25/2023 at 2:28 pm tuesday, august 29, 2023. Unsecured priority debt is paid first in a chapter 7, after which comes secured debt and then nonpriority unsecured debt. Apply today for financial freedom! In a chapter 11 bankruptcy, the company. An overview learn about secured debts, what happens to them in.

Long Island Chapter 7 Bankruptcy Lawyer Macco Law Group

What happens to secured credit card debt in. For example, your mortgage is secured by your home. Web recommended on wall street william cohan apollo’s mission in finance but in the frantic weeks leading up to the bankruptcy, no superior rival financing offer had materialised. Web updated july 25, 2023 table of contents what is a secured credit card? You.

Chapter 7 Bankruptcy Attorney Burrow & Associates

If only one spouse in a marriage owes debt, only that partner. Web a secured creditor's rights in chapter 7 because the secured creditor has a payment mechanism in place, if money is available to distribute to creditors, a secured creditor won't get a part of it. Apply today for financial freedom! Web by cara o'neill, attorney in chapter 7.

PPT Lecture 18 The Democratization of Finance Consumer Finance

Priority debt includes domestic support obligations and. Web bankruptcy is the legal process in which a person’s debts are discharged, making the debtor no longer liable for their dischargeable debts. Ad debt consolidation is the first step toward a healthy financial life. #1 complaint to determine the dischargeability of debt. For example, your mortgage is secured by your home.

Secured and Unsecured Debt Limitations Under Chapter 13

If only one spouse in a marriage owes debt, only that partner. If you default on your loan, the lender can sell. Web in chapter 7 bankruptcy, you can keep property secured by collateral (such as your car) by reaffirming the debt. Let’s summarize… secured debt is money owed to a creditor who is “secured” by a specific piece of.

Chapter 7 vs Chapter 13 Bankruptcy Sheppard Law Office

You might be able to keep financed. Surrender redeem reaffirm surrendering collateral if the debtor has a secured loan for a truck. Web secured debts in chapter 7 bankruptcy: Apply today for financial freedom! Findlaw covers debt discharge 101 when you file chapter 7.

Chapter 7 Bankruptcy Consumer Law Pro

Learn when a bankruptcy trustee will sell your home or car and use the proceeds to pay other creditors. Let’s summarize… secured debt is money owed to a creditor who is “secured” by a specific piece of real property (like a house or land) or personal property (like a car). In return, the bankruptcy trustee sells (liquidates) your nonexempt. An.

Can I File Chapter 7 Bankruptcy to Get Rid Of Business Debt? Karra L

Web a secured creditor's rights in chapter 7 because the secured creditor has a payment mechanism in place, if money is available to distribute to creditors, a secured creditor won't get a part of it. How do i choose the best secured credit card? By cara o'neill, attorney bankruptcy helps you get out of debt by breaking the contract between.

Infographic Chapter 7 vs. Chapter 13 Bankruptcy Richard M. Weaver

Web most debt settlement companies don’t settle secured debts. Web in a chapter 7 bankruptcy, the assets of a business are liquidated to pay its creditors, with secured debts taking precedence over unsecured debts. Web chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans. What happens to secured.

Does Chapter 7 Bankruptcy Wipe Out All Debt in New York? Michael H

Web secured debts in chapter 7 bankruptcy: Web updated july 25, 2023 table of contents what is a secured credit card? The filings, which are dated august 9, are for two related entities: Compare online the best debt loans. Web chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal.

Web In Chapter 7 Bankruptcy, You Can Keep Property Secured By Collateral (Such As Your Car) By Reaffirming The Debt.

Unsecured priority debt is paid first in a chapter 7, after which comes secured debt and then nonpriority unsecured debt. How do i choose the best secured credit card? Web learn which debts will go away in a chapter 7 bankruptcy and which debts you need to pay off. Web secured debts in chapter 7 bankruptcy:

Web Babylon Is Seeking Chapter 7 Relief, Which Means It Plans To Liquidate Assets Rather Than Attempt To Restructure.

Web by cara o'neill, attorney in chapter 7 bankruptcy, priority debt is significant enough to jump to the head of the bankruptcy repayment line. Ad debt consolidation is the first step toward a healthy financial life. What happens to secured credit card debt in. Web updated july 25, 2023 table of contents what is a secured credit card?

Ad Don't Declare Bankruptcy Before Comparing Consolidation Loans.

If only one spouse in a marriage owes debt, only that partner. Let’s summarize… secured debt is money owed to a creditor who is “secured” by a specific piece of real property (like a house or land) or personal property (like a car). Web abuse is presumed if the debtor's current monthly income over 5 years, net of certain statutorily allowed expenses and secured debt payments, is not less than the lesser of (i) 25% of the debtor's nonpriority unsecured debt, or $9,075,. Web a person with secured debt who files chapter 7 bankruptcy has three options for resolving the debt.

For Example, Your Mortgage Is Secured By Your Home.

Apply today for financial freedom! Web bankruptcy is the legal process in which a person’s debts are discharged, making the debtor no longer liable for their dischargeable debts. Web all or most of your credit card debt will likely be discharged in chapter 7 bankruptcy unless property secures your account, or you've engaged in fraudulent activity. By cara o'neill, attorney bankruptcy helps you get out of debt by breaking the contract between you.