Chase Ira Distribution Form

Chase Ira Distribution Form - Please complete sections 1 through 7 and send to j.p. Web request a distribution, rollover or removal of excess contribution from your ira. This form will not work in. Web payment distribution forms (provided by j.p. Please complete, sign and return this form to j.p. Use this form to • recharacterize a traditional ira contribution to a roth ira contribution. Web you must take minimum distributions from your ira (other than a roth ira). Web a distribution to a chase account (except for return of excess contribution) must be completed online on chase.com using the pay & transfer tab. Web sign in to access your forms. If you don’t, you’re subject to a 50% excise tax on the amount that should’ve been distributed.

Morgan securities estate settlements) individual retirement accounts (ira) or transfer on death (tod) copy of death. Web this form should be used for required minimum distributions from your traditional and sep iras at rmd age. Box 2145 minneapolis, mn 55402 contact us: Web a distribution to a chase account (except for return of excess contribution) must be completed online on chase.com using the pay & transfer tab. Ira to ira transfer (please complete ira transfer form). Web sign in to access your forms. This form will not work in. Effective january 1, 2015, this new limit. The fund(s) and the allocation(s) specified on the. Web contingent beneficiary percentage of distribution 2.

Web sign in to access your forms. Effective january 1, 2015, this new limit. Web a chase funds ira account application must be completed to process this transfer if a new account is being established. The fund(s) and the allocation(s) specified on the. Web you must take minimum distributions from your ira (other than a roth ira). Web a distribution to a chase account (except for return of excess contribution) must be completed online on chase.com using the pay & transfer tab. Web request a distribution, rollover or removal of excess contribution from your ira. Web contingent beneficiary percentage of distribution 2. Designation of beneficiary (continued) form can be faxed to: Web chase funds ira application for traditional, roth, sep, and simple iras.

chase roth ira calculator Choosing Your Gold IRA

Web this form should be used for required minimum distributions from your traditional and sep iras at rmd age. Web you must take minimum distributions from your ira (other than a roth ira). There is no need to show a hardship to take a distribution. Please complete, sign and return this form to j.p. Web chase funds ira application for.

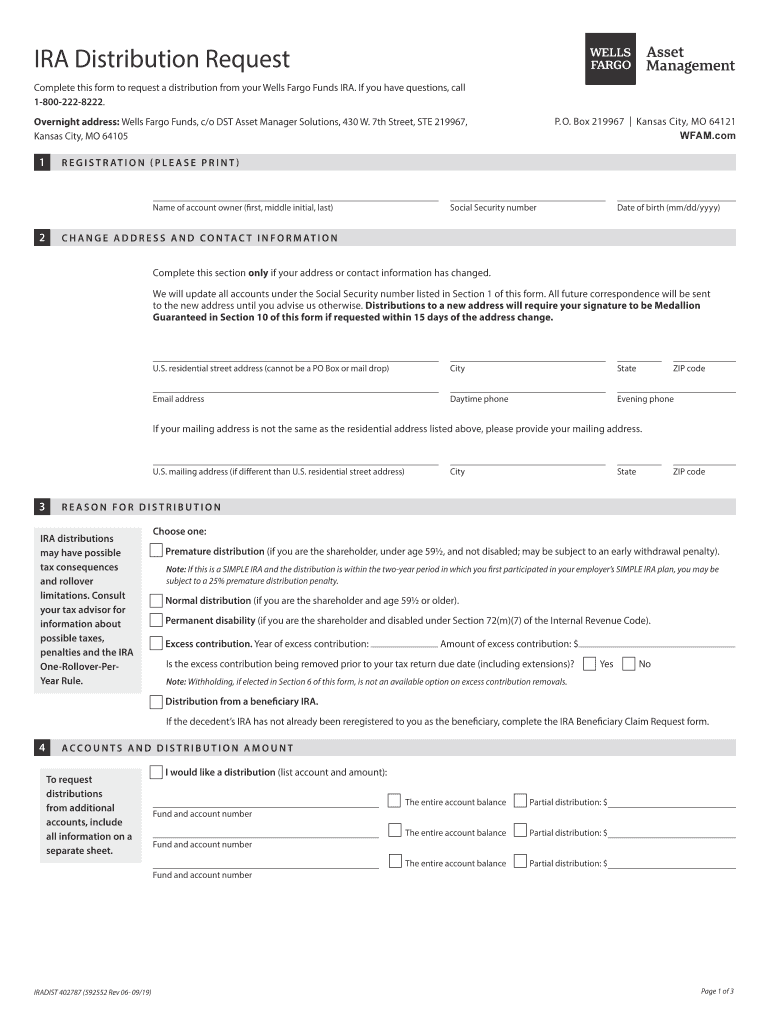

Wells Fargo Ira Distribution Form Fill Out and Sign Printable PDF

Web contingent beneficiary percentage of distribution 2. Please complete, sign and return this form to j.p. Web chase funds ira application for traditional, roth, sep, and simple iras. Web a chase funds ira account application must be completed to process this transfer if a new account is being established. • recharacterize a roth ira contribution to a traditional ira.

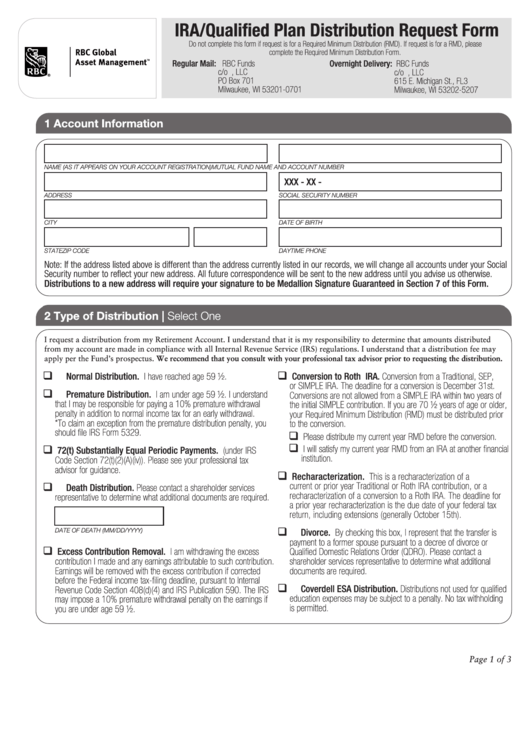

Ira/qualified Plan Distribution Request Form printable pdf download

Box 2145 minneapolis, mn 55402 contact us: Please complete sections 1 through 7 and send to j.p. Web chase funds ira application for traditional, roth, sep, and simple iras. So, let's say you earn $60,000 a. Web ira distribution request systematic distribution and partial or complete liquidation please write your account number in box provided.

Ach Payment Form Chase Universal Network

Morgan securities estate settlements) individual retirement accounts (ira) or transfer on death (tod) copy of death. Web a chase funds ira account application must be completed to process this transfer if a new account is being established. Web this form should be used for required minimum distributions from your traditional and sep iras at rmd age. The fund(s) and the.

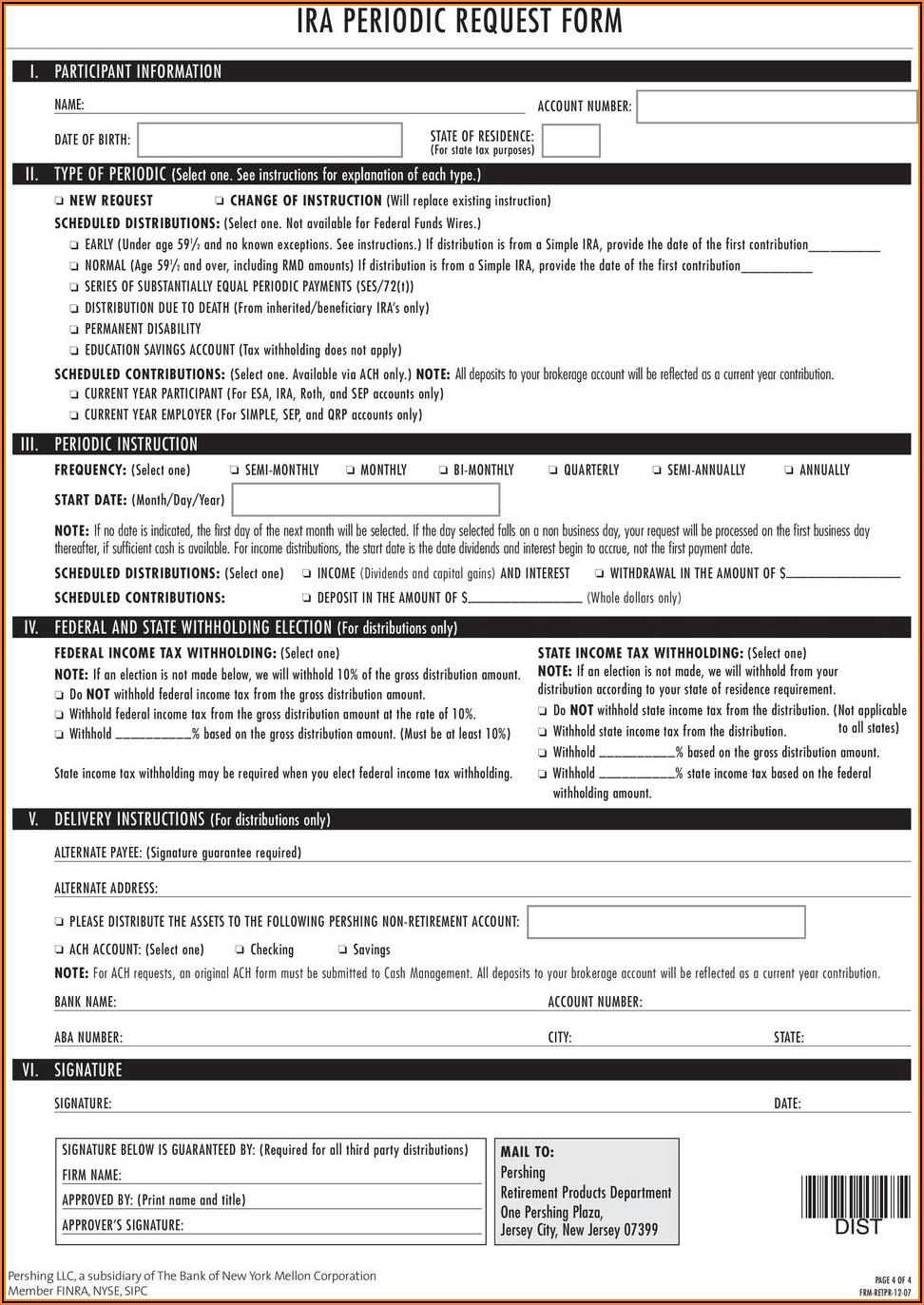

2013 IRA Distribution Request Form Fill Online, Printable, Fillable

So, let's say you earn $60,000 a. If you don’t, you’re subject to a 50% excise tax on the amount that should’ve been distributed. Morgan securities estate settlements) individual retirement accounts (ira) or transfer on death (tod) copy of death. Web this form should be used for required minimum distributions from your traditional and sep iras at rmd age. Morgan.

Who to Choose as a Beneficiary? Texas A&M Foundation

Morgan asset management is the brand. Web qualified distribution is any payment or distribution from your roth ira that meets the following requirements: Please complete, sign and return this form to j.p. Designation of beneficiary (continued) form can be faxed to: This form will not work in.

Citibank Ira Distribution Request Form Universal Network

Web payment distribution forms (provided by j.p. Designation of beneficiary (continued) form can be faxed to: Effective january 1, 2015, this new limit. Web ira beneficiary designation form download ira transfer b download indemnity statement download account maintenance request form download have. Web a distribution to a chase account (except for return of excess contribution) must be completed online on.

Raymond James Ira Distribution Form Form Resume Examples AjYdXQXEYl

Web ira distribution request systematic distribution and partial or complete liquidation please write your account number in box provided. Effective january 1, 2015, this new limit. Morgan asset management is the brand. Web a chase funds ira account application must be completed to process this transfer if a new account is being established. Web sign in to access your forms.

Chase Bank Checking Account Beneficiary Form

Web up to $40 cash back ira distribution form for traditional and roth iras tcf national bank p.o. Web this form should be used for required minimum distributions from your traditional and sep iras at rmd age. Web ira beneficiary designation form download ira transfer b download indemnity statement download account maintenance request form download have. This form will not.

Web Ira Distribution Request Systematic Distribution And Partial Or Complete Liquidation Please Write Your Account Number In Box Provided.

Please complete sections 1 through 7 and send to j.p. Web payment distribution forms (provided by j.p. Box 2145 minneapolis, mn 55402 contact us: This form will not work in.

Web Contingent Beneficiary Percentage Of Distribution 2.

Effective january 1, 2015, this new limit. Web request a distribution, rollover or removal of excess contribution from your ira. Web sign in to access your forms. So, let's say you earn $60,000 a.

Web Chase Funds Ira Application For Traditional, Roth, Sep, And Simple Iras.

Designation of beneficiary (continued) form can be faxed to: Web a chase funds ira account application must be completed to process this transfer if a new account is being established. Web you must take minimum distributions from your ira (other than a roth ira). Web this form should be used for required minimum distributions from your traditional and sep iras at rmd age.

• Recharacterize A Roth Ira Contribution To A Traditional Ira.

There is no need to show a hardship to take a distribution. Web a distribution to a chase account (except for return of excess contribution) must be completed online on chase.com using the pay & transfer tab. If you don’t, you’re subject to a 50% excise tax on the amount that should’ve been distributed. Morgan asset management is the brand.