Check Drawer

Check Drawer - Useful for having always visible drawer on larger screens. Traditional drawer which covers the screen with an overlay behind it. Drafts have three parties involved: For a small business, $100 to $150 should be more than enough. The drawer's bank verifies the check's authenticity and validates the account holder's signature, account number, and available funds. Web for more, check out six quick tips for getting the most out of your home security camera and the best diy home security systems. In a financial transaction, a drawee typically serves as an intermediary. Web a cheque or check ( american english; A bank guarantees these types of checks. Convenient and secure with 2 clicks.

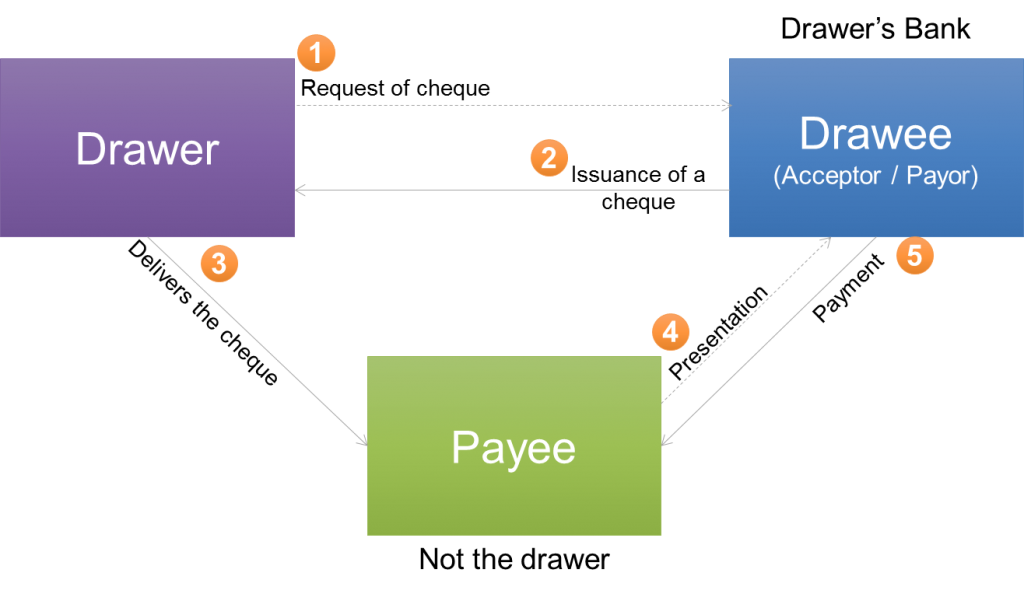

A check is automatically revoked if the drawer dies before it is paid or certified, since the drawer's bank has no authority to complete the transaction under that circumstance. Web a drawee refers to the person or organization that’s ordered to pay a certain sum of money to a payee. The drawer's bank verifies the check's authenticity and validates the account holder's signature, account number, and available funds. The first is in the box. Then include the location of the safe deposit box and key in your letter (s) of instruction. An example of this is when you cash a check. The drawee bank that pays a forged check is generally responsible for the resulting loss. Drafts have three parties involved: A permanent drawer is shown as a sidebar. In this scenario, the drawer is the person who writes the check, while the drawee is the financial institution that holds the funds and is.

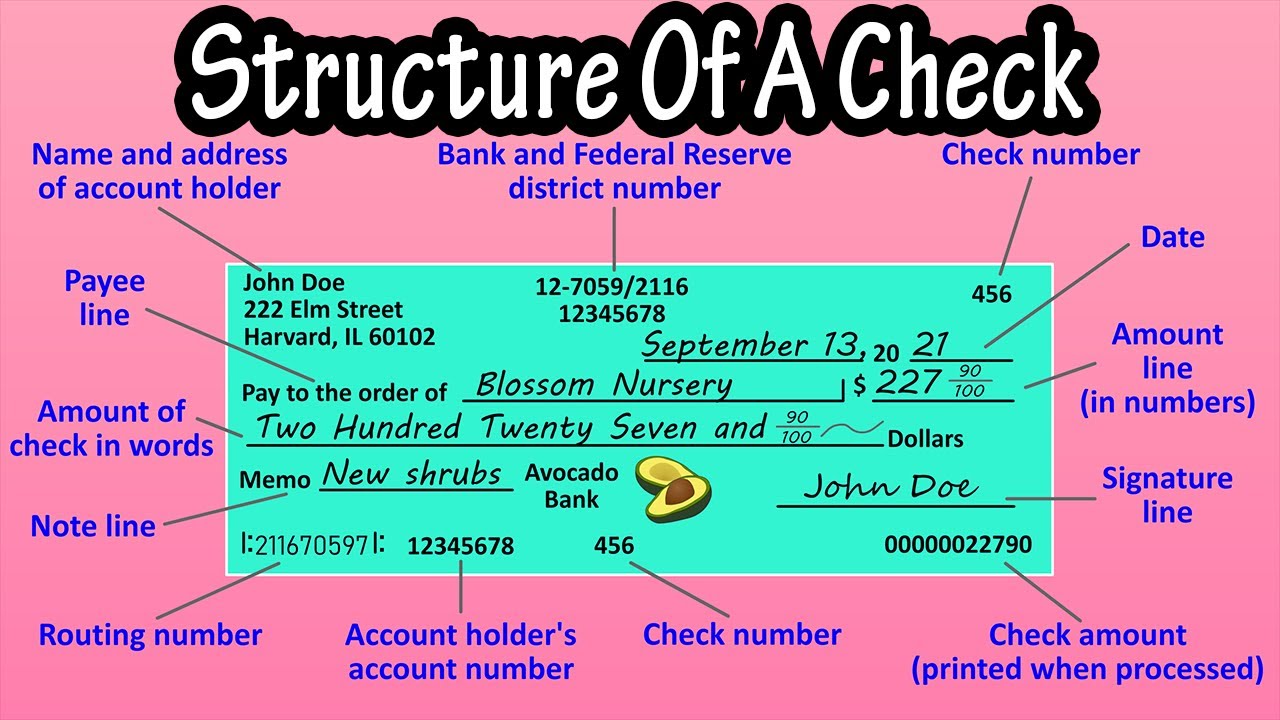

Web the drawee is the entity or person to whom a bill is addressed and is given instructions to pay. See spelling differences) is a document that orders a bank, building society (or credit union) to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. For example, some dressers have a combination of small and large drawers for diverse storage options in the same piece. Verifies that the account owner has approved the payment. Such a check is meaningless as far as the drawer whose signature is forged is concerned. An example of this is when you cash a check. The drawee bank that pays a forged check is generally responsible for the resulting loss. Web for more, check out six quick tips for getting the most out of your home security camera and the best diy home security systems. A bank guarantees these types of checks. Web it’s typically a better idea to write down a specific recipient’s name.

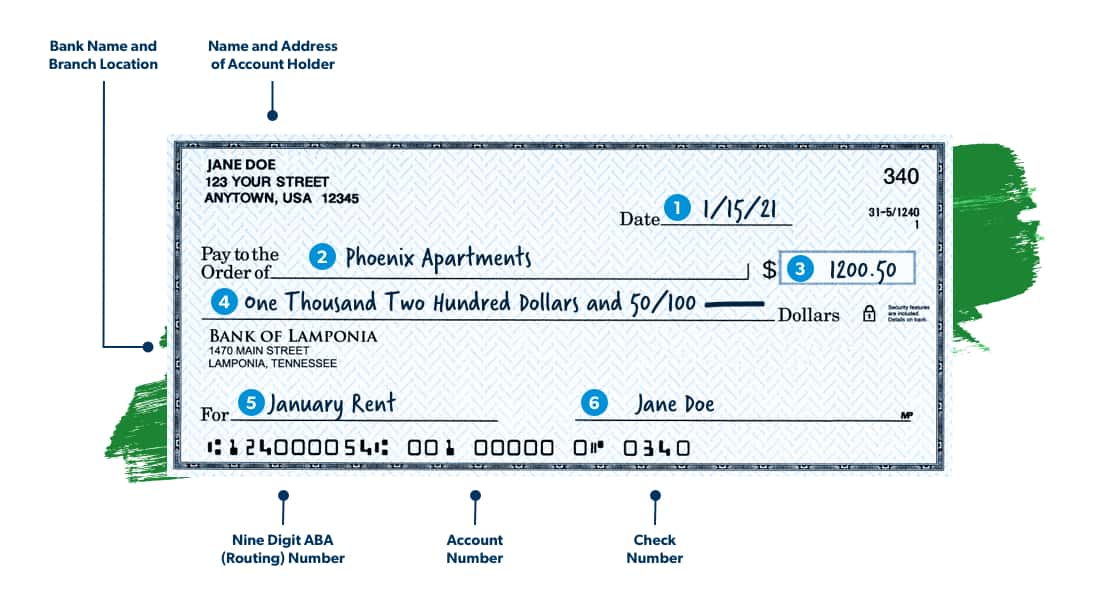

Detailed Guide On How To Write A Check

A check can be certified at the bank from which it is drawn. As a check, it falls under the rules of checks in general, meaning that it is a draft. Web deposit of the check. Verifies that the account owner has approved the payment. Upon receiving the check, the drawer bank verifies the legitimacy of the check and the.

Amazon.in JOYFUL STERLING CHECKS DRAWER

This means that the check is guaranteed not to bounce due to insufficient funds. And the payee, to whom the check is payable. A dresser is not normally a dangerous piece of furniture. In most cases, when a check (bill of exchange) is being drawn, the party said to be the drawee is normally a banker. Usually, the drawee is.

Cash Drawer APG Check Cashing Software QuickCheck

2d 1074, it was held by the court that “ a ‘drawee’ means the bank on which the check is drawn.thus, a drawee is the bank at which the. Web the term “forged check” is often used to describe a check on which the drawer’s signature is forged or unauthorized. Such a check is meaningless as far as the drawer.

GSAN 405 CASH DRAWER ZANK POS ENTERPRISES

Key parties in a drawee transaction are the drawer, drawee, and payee. Web the drawee, typically a financial institution, facilitates fund transfers in various transactions. The drawer is revealed behind the screen on swipe. The person writing the cheque, known as the drawer, has a transaction banking account (often called. Such a check is meaningless as far as the drawer.

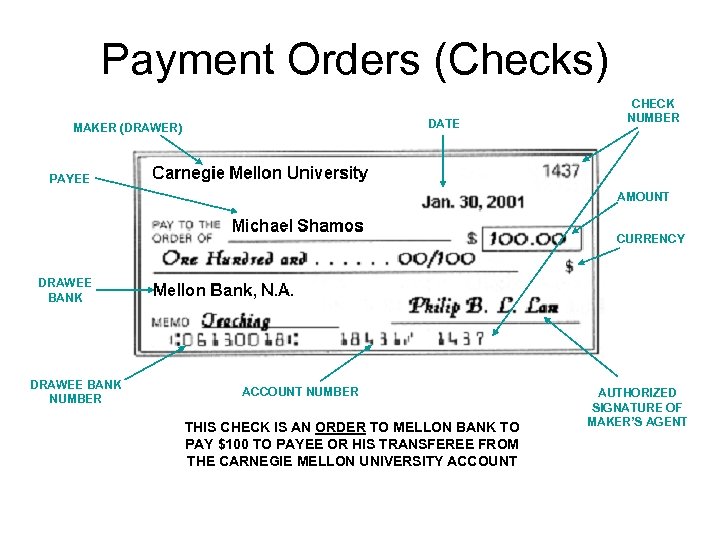

Banking and Foreign Exchange Slides by M Shamos

A bank guarantees these types of checks. Serves as a timestamp for the check. In this scenario, the drawer is the person who writes the check, while the drawee is the financial institution that holds the funds and is. Such a check is meaningless as far as the drawer whose signature is forged is concerned. Remember to always anchor your.

The Structure Of A Check Parts Of A Check How To Write A Check

The drawer, who wrote the check; Then include the location of the safe deposit box and key in your letter (s) of instruction. Homde over the toilet storage with basket and drawer, bamboo bathroom organizer with adjustable shelf & waterproof feet pad, space saver storage rack for bathroom, restroom,. Web while you’re building your legacy drawer, you should also set.

Drawer And Drawee Of A Cheque Bruin Blog

There are two spots on the check where you'll write the payment amount. 2d 1074, it was held by the court that “ a ‘drawee’ means the bank on which the check is drawn.thus, a drawee is the bank at which the. Web deposit of the check. They act as a drawee each time you deposit a check or receive.

CF405BX Cash Drawer MS Cash Drawers

A bank guarantees these types of checks. And the payee, to whom the check is payable. Your employer, who wrote the review, is the drawer, the bank that cashed it is the drawee, and you are the payee. Traditional drawer which covers the screen with an overlay behind it. A check is automatically revoked if the drawer dies before it.

How to Balance a Teller Cash Drawer Joseph Whatitat

Web deposit of the check. The check clearing process begins when the payee deposits the check at their bank. The drawee, who pays on the check; Web amount of your check: A check is a written, dated, and signed instrument that contains an unconditional order from the drawer that directs a bank to pay a definite sum of money to.

Drawer And Drawee Of A Cheque Bruin Blog

The drawer's bank verifies the check's authenticity and validates the account holder's signature, account number, and available funds. Your employer, who wrote the review, is the drawer, the bank that cashed it is the drawee, and you are the payee. Web the drawee is the entity or person to whom a bill is addressed and is given instructions to pay..

For A Small Business, $100 To $150 Should Be More Than Enough.

In financial transactions, banks frequently serve as the acceptor; This is written out in a section using words instead of numbers. Verifies that the account owner has approved the payment. A check is a written, dated, and signed instrument that contains an unconditional order from the drawer that directs a bank to pay a definite sum of money to a payee.

The Check Clearing Process Begins When The Payee Deposits The Check At Their Bank.

Convenient and secure with 2 clicks. Upon receiving the check, the drawer bank verifies the legitimacy of the check and the drawer’s signature. Web add a debit or credit card to save time when you check out. Both the screen and the drawer slide on swipe to reveal the drawer.

In Most Cases, When A Check (Bill Of Exchange) Is Being Drawn, The Party Said To Be The Drawee Is Normally A Banker.

In this scenario, the drawer is the person who writes the check, while the drawee is the financial institution that holds the funds and is. See spelling differences) is a document that orders a bank, building society (or credit union) to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. Useful for having always visible drawer on larger screens. For example, some dressers have a combination of small and large drawers for diverse storage options in the same piece.

There Are Two Spots On The Check Where You'll Write The Payment Amount.

As a check, it falls under the rules of checks in general, meaning that it is a draft. The primary purpose of the drawee is to channel and direct. Usually, the drawee is the bank. All of the indoor home security cameras we've tested +16 more