Conflict Of Interest Form For Nonprofits

Conflict Of Interest Form For Nonprofits - Web this is a model conflict of interest disclosure form for nonprofits to distribute to all officers and directors. Conflicts of interest exist when. Web up to 25% cash back talk to a business law attorney. “conflict of interest policies help avoid. While the law focuses primarily. ( see ready reference page: Web conflict of interest template for nonprofit boards. I have reviewed, and agree to abide by, the policy of conflict of interest of oregon society of tax consultants. Web using a conflict of interest policy, information about comparable transactions between unrelated parties, and reliable methods for evaluating the transaction, are examples of. Every nonprofit should create, implement, and regularly review a conflict of interest policy.

Every nonprofit should create, implement, and regularly review a conflict of interest policy. Web the following is a nonprofit conflict of interest policy template that you can use as is for applying for 501c3 exemption status. A conflict of interest is a transaction or arrangement that might benefit the private interest of an officer, board. This sample is complete, proven and satisfies the. Web the irs form 990 even asks whether or not a nonprofit has a written policy on conflicts of interest, how a nonprofit manages conflicts, and how a nonprofit. Web below is the conflict of interest policy recommended by the internal revenue service for organizations exemption from taxation under section 501 (c) (3) of the internal revenue. Web nonprofit organization conflict of interest policy template. Web using a conflict of interest policy, information about comparable transactions between unrelated parties, and reliable methods for evaluating the transaction, are examples of. I have reviewed, and agree to abide by, the policy of conflict of interest of oregon society of tax consultants. ( see ready reference page:

While the law focuses primarily. Web this is a model conflict of interest disclosure form for nonprofits to distribute to all officers and directors. A conflict of interest is a transaction or arrangement that might benefit the private interest of an officer, board. Web a conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the organization has a process in place under which. Web the irs form 990 even asks whether or not a nonprofit has a written policy on conflicts of interest, how a nonprofit manages conflicts, and how a nonprofit. Web conflict of interest, or an appearance of a conflict, can arise whenever a transaction, or an action, of [name of nonprofit] conflicts with the personal interests, financial or otherwise,. Web below is the conflict of interest policy recommended by the internal revenue service for organizations exemption from taxation under section 501 (c) (3) of the internal revenue. Conflicts of interest exist when. Web a conflict of interest policy is an official document that outlines the procedures for team members when a conflict occurs between their personal interests and the interests of the. Web the following is a nonprofit conflict of interest policy template that you can use as is for applying for 501c3 exemption status.

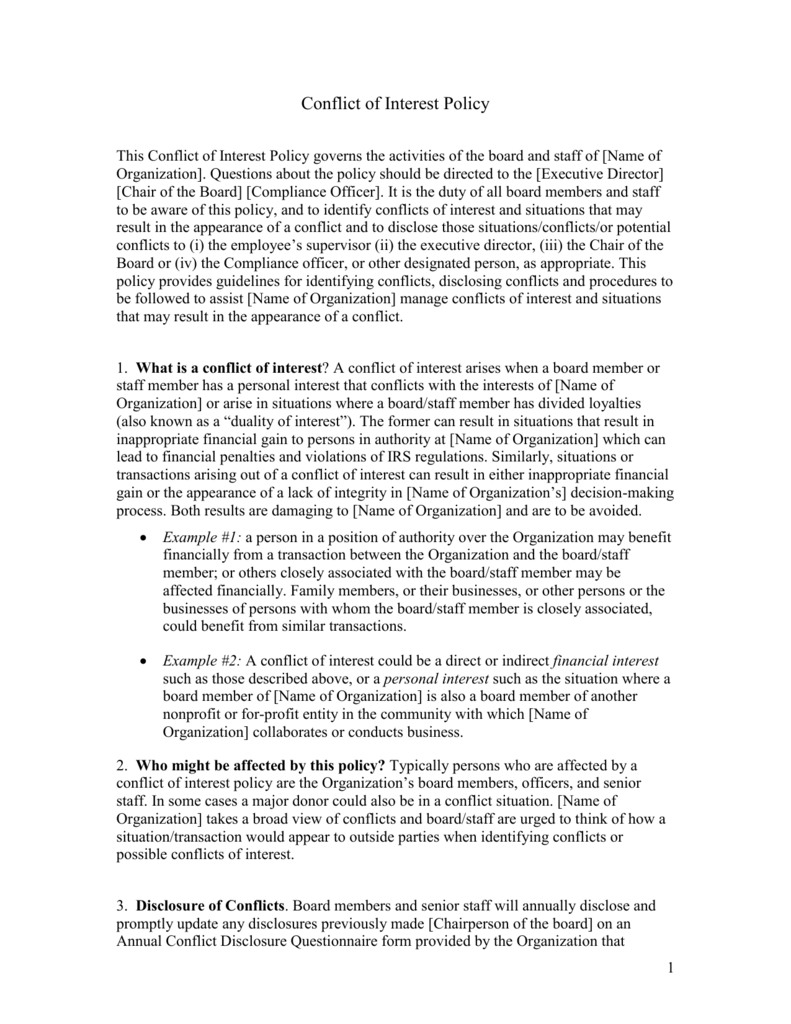

Non Profit Sample Conflict of Interest Policy Conflict Of Interest

Web doing business with or serving nonprofit organization name unless it has been determined by the board, on the basis of full disclosure of facts, that such interest does not give rise. Web i think it is fair to say that a board that fails to do so is simply asking for trouble. Web nonprofit organization conflict of interest policy.

Sample Conflict of Interest Policy

Every nonprofit should create, implement, and regularly review a conflict of interest policy. Conflicts of interest exist when. Web up to 25% cash back talk to a business law attorney. Web in the united states, a conflict of interest typically is defined by regulatory authorities (e.g., the federal internal revenue service [irs], and many states’ attorneys. Web conflict of interest,.

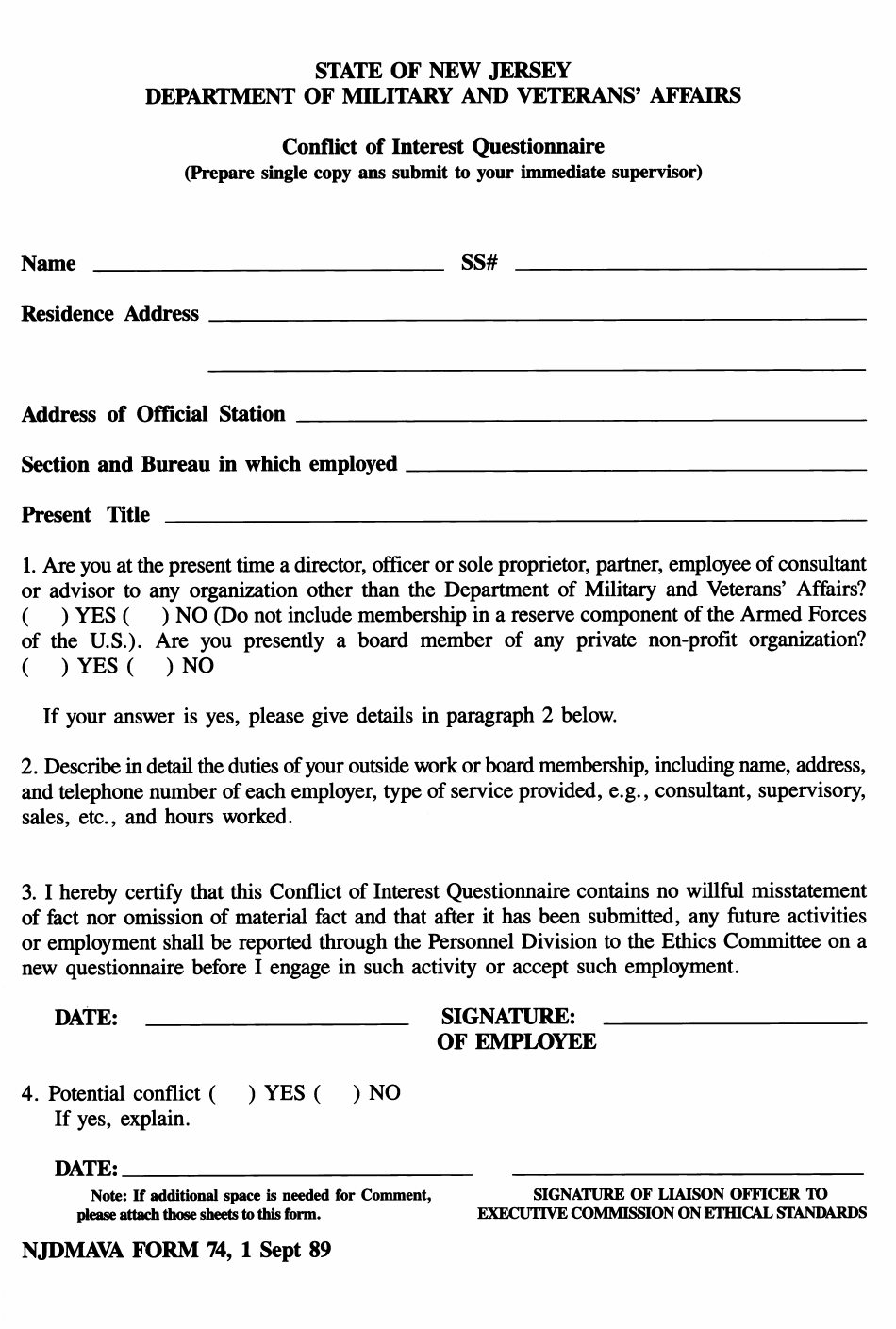

NJDMAVA Form 74 Download Fillable PDF or Fill Online Conflict of

Conflicts of interest exist when. Web a conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the organization has a process in place under which. Web a conflict of interest policy is an official document that outlines the procedures for team members when a conflict occurs between their personal interests and.

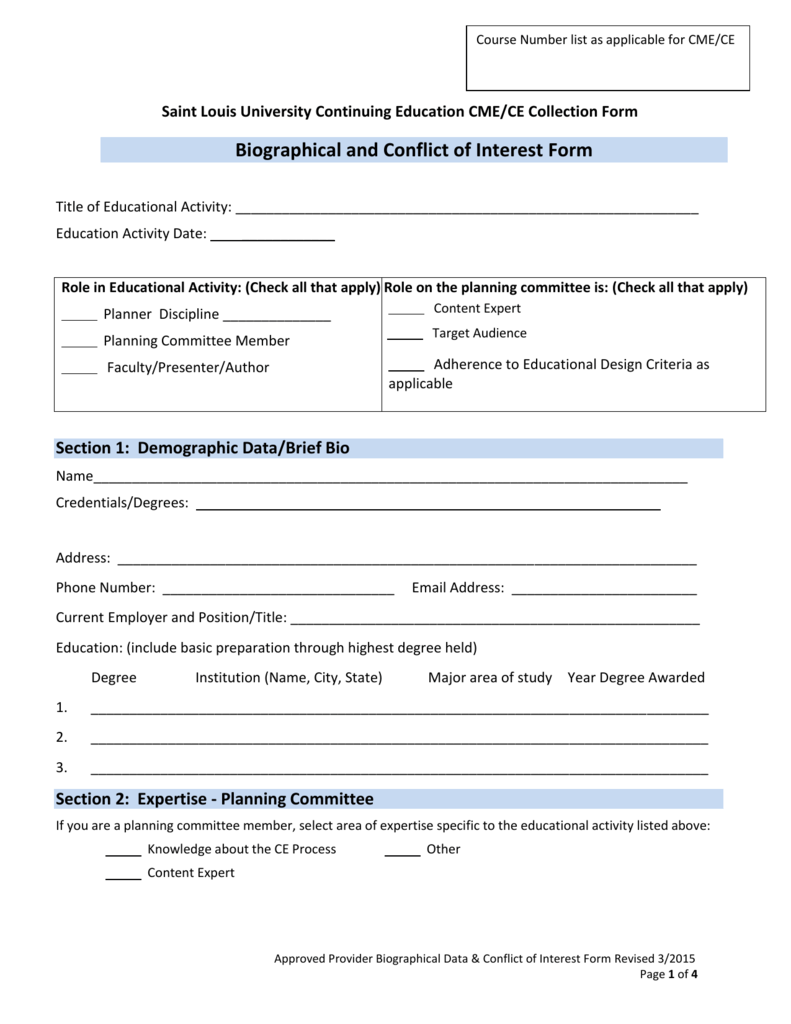

Combined Biographical and Conflict of Interest Form

Web the following is a nonprofit conflict of interest policy template that you can use as is for applying for 501c3 exemption status. A conflict of interest is a transaction or arrangement that might benefit the private interest of an officer, board. Every nonprofit should create, implement, and regularly review a conflict of interest policy. Web nonprofit organization conflict of.

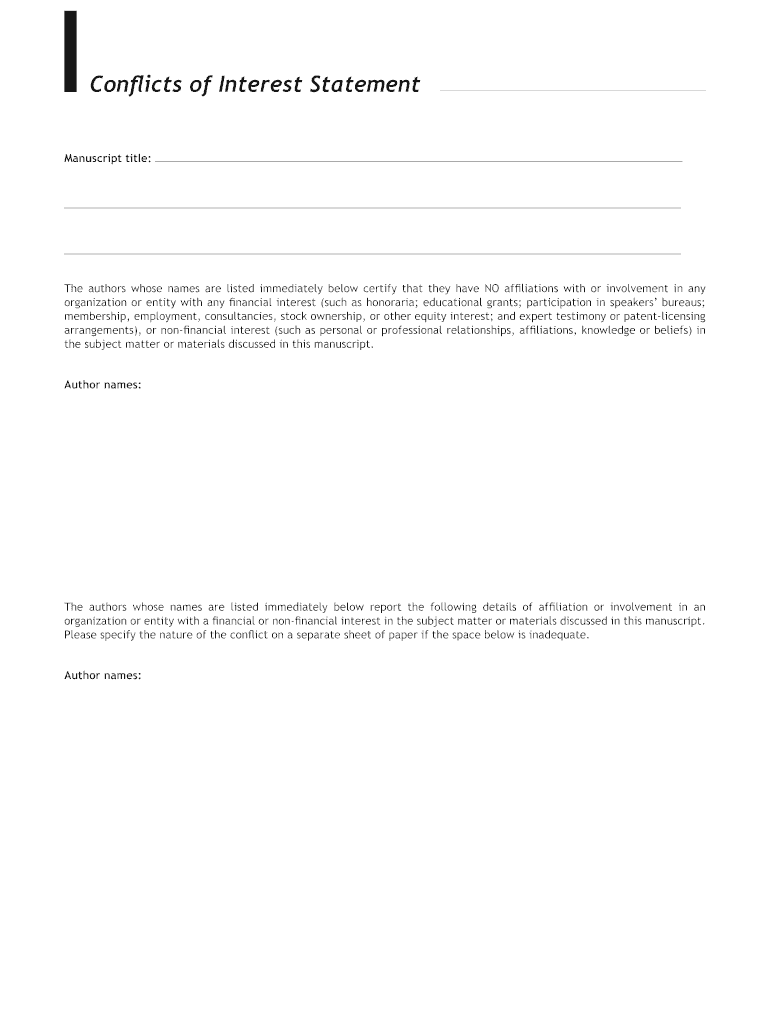

Conflict of Interest Form Jan2018 PECADFRMX15828 Conflict Of

Web conflict of interest, or an appearance of a conflict, can arise whenever a transaction, or an action, of [name of nonprofit] conflicts with the personal interests, financial or otherwise,. Web a conflict of interest policy is an official document that outlines the procedures for team members when a conflict occurs between their personal interests and the interests of the..

Conflict of Interest Form Fill Out and Sign Printable PDF Template

It asks the officers and directors to proactively disclose any. Web below is the conflict of interest policy recommended by the internal revenue service for organizations exemption from taxation under section 501 (c) (3) of the internal revenue. Web nonprofit organization conflict of interest policy template. Nepotism is the practice of playing favorites with family members. I have reviewed, and.

Friday Facts Business organization, Conflicted, Board of directors

Web using a conflict of interest policy, information about comparable transactions between unrelated parties, and reliable methods for evaluating the transaction, are examples of. Web nonprofit organization conflict of interest policy template. A conflict of interest is a transaction or arrangement that might benefit the private interest of an officer, board. Web this is a model conflict of interest disclosure.

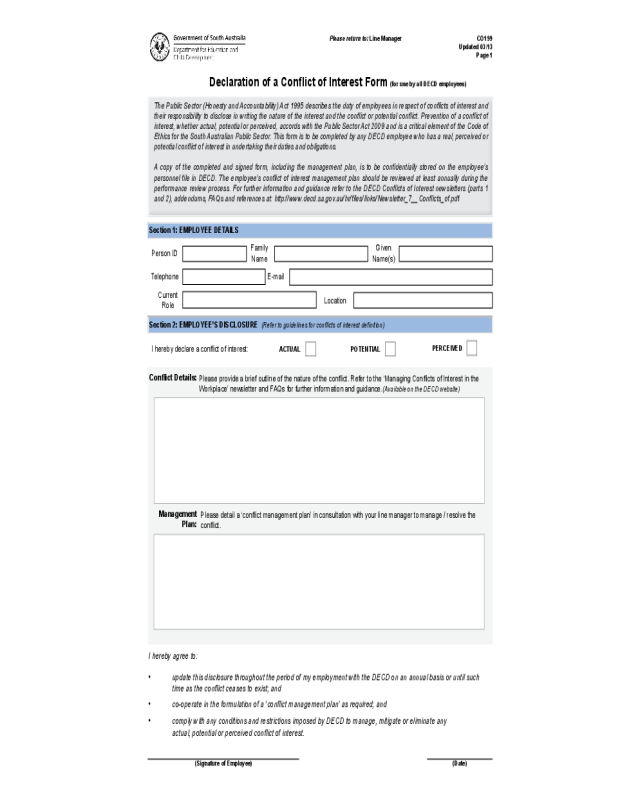

2022 Declaration of Interest Form Fillable, Printable PDF & Forms

Conflicts of interest exist when. Web a conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the organization has a process in place under which. Every nonprofit should create, implement, and regularly review a conflict of interest policy. Web a conflict of interest exists when a member of the organization has.

Example Conflict of Interest Form PDF Conflict Of Interest

Web using a conflict of interest policy, information about comparable transactions between unrelated parties, and reliable methods for evaluating the transaction, are examples of. Web conflict of interest, or an appearance of a conflict, can arise whenever a transaction, or an action, of [name of nonprofit] conflicts with the personal interests, financial or otherwise,. Web below is the conflict of.

25 Conflict Of Interest Form Templates free to download in PDF

Web the irs form 990 even asks whether or not a nonprofit has a written policy on conflicts of interest, how a nonprofit manages conflicts, and how a nonprofit. Web using a conflict of interest policy, information about comparable transactions between unrelated parties, and reliable methods for evaluating the transaction, are examples of. ( see ready reference page: I have.

Web Up To 25% Cash Back Talk To A Business Law Attorney.

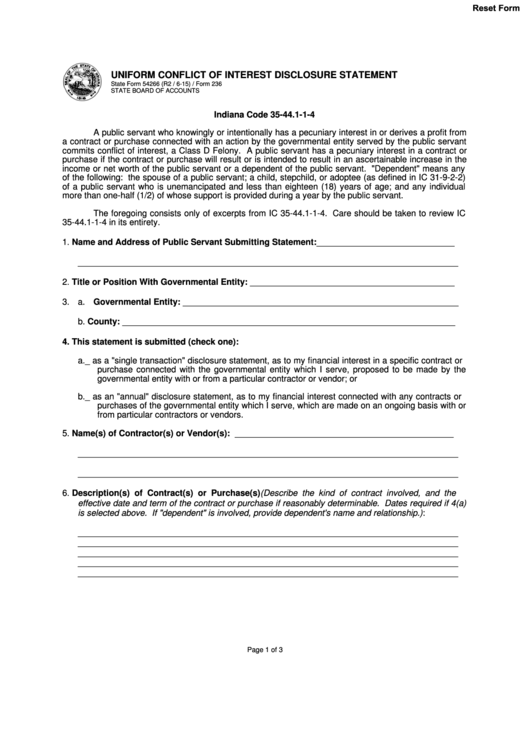

Web the irs form 990 even asks whether or not a nonprofit has a written policy on conflicts of interest, how a nonprofit manages conflicts, and how a nonprofit. It asks the officers and directors to proactively disclose any. Web below is the conflict of interest policy recommended by the internal revenue service for organizations exemption from taxation under section 501 (c) (3) of the internal revenue. Web in the united states, a conflict of interest typically is defined by regulatory authorities (e.g., the federal internal revenue service [irs], and many states’ attorneys.

Nepotism Is The Practice Of Playing Favorites With Family Members.

Web i think it is fair to say that a board that fails to do so is simply asking for trouble. Web a conflict of interest exists when a member of the organization has a personal interest that may influence them when making decisions. Web conflict of interest, or an appearance of a conflict, can arise whenever a transaction, or an action, of [name of nonprofit] conflicts with the personal interests, financial or otherwise,. Web doing business with or serving nonprofit organization name unless it has been determined by the board, on the basis of full disclosure of facts, that such interest does not give rise.

A Conflict Of Interest Is A Transaction Or Arrangement That Might Benefit The Private Interest Of An Officer, Board.

Web a conflict of interest policy is an official document that outlines the procedures for team members when a conflict occurs between their personal interests and the interests of the. ( see ready reference page: Conflicts of interest exist when. I have reviewed, and agree to abide by, the policy of conflict of interest of oregon society of tax consultants.

Web A Conflict Of Interest Policy Is Intended To Help Ensure That When Actual Or Potential Conflicts Of Interest Arise, The Organization Has A Process In Place Under Which.

Web conflict of interest template for nonprofit boards. This sample is complete, proven and satisfies the. Every nonprofit should create, implement, and regularly review a conflict of interest policy. Web using a conflict of interest policy, information about comparable transactions between unrelated parties, and reliable methods for evaluating the transaction, are examples of.