Deadline For Filing Form 990

Deadline For Filing Form 990 - Exempt organizations with a filing obligation. Web 8 rows upcoming 2023 form 990 deadline: This year, may 16 is the deadline to file form 990 for calendar year taxpayers because may 15 falls on. For organizations with an accounting tax period starting on. This is an annual deadline; Web due date for filing returns requried by irc 6033. Web when is the form 990 deadline? The form is usually due the 15th of the fifth month after the organization’s taxable year. Web may 15 is the 990 filing deadline for calendar year tax filers. You need to file your.

Web may 15 is the 990 filing deadline for calendar year tax filers. Form 990 protects transparency in the. Web due date for filing returns requried by irc 6033. The authentication process must be complete. Web it depends on the end of your organization’s taxable year; Complete, edit or print tax forms instantly. Web when is the 990ez deadline? Web this week marks the august 16, 2021 form 990 deadline for nonprofits whose tax year ended on march 31, 2021. The form is usually due the 15th of the fifth month after the organization’s taxable year. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to.

Web due date for filing returns requried by irc 6033. Registered nonprofits must file their annual tax returns by the 15th day of the 5th month after their. Web 21 rows file charities and nonprofits annual filing and forms required filing (form. We must have received payment of the 990 online usage fee. Web may 15 is the 990 filing deadline for calendar year tax filers. Web form 990 return due date: For organizations with an accounting tax period starting on. Web when is the form 990 deadline? Exempt organizations with a filing obligation. The form 990 deadline is the 15th day of the 5th month after the end of an organization’s tax period.

What To Do When You Miss The IRS Form 990 Deadline ExpressTaxExempt

Web form 990 return due date: Complete, edit or print tax forms instantly. This year, may 16 is the deadline to file form 990 for calendar year taxpayers because may 15 falls on. Registered nonprofits must file their annual tax returns by the 15th day of the 5th month after their. Form 990 protects transparency in the.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

Form 990 due date calculator find your 990 filings deadline and the applicable extended due date Web when is the form 990 deadline? The form is usually due the 15th of the fifth month after the organization’s taxable year. Complete, edit or print tax forms instantly. We must have received payment of the 990 online usage fee.

How To Avoid LastMinute Form 990 Filing Mistakes

Web form 990 return due date: Web 8 rows upcoming 2023 form 990 deadline: Form 990 protects transparency in the. Complete, edit or print tax forms instantly. If the due date falls on a saturday, sunday, or.

Extend Your 990 Deadline Until November 15, 2021 By Filing Form 8868

Web when is the form 990 deadline? Web 21 rows file charities and nonprofits annual filing and forms required filing (form. Web find the right 990 form for your organization. Form 990 protects transparency in the. Web this week marks the august 16, 2021 form 990 deadline for nonprofits whose tax year ended on march 31, 2021.

Today Is Your Last Chance to Meet the Form 990 Deadline!

The deadline for tax exempt organizations to file their 990 series tax return is the 15th day of the 5th month following the close of. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. Complete, edit or.

What Is Form 990 and Why Do You Need to File It Annually?

Web 21 rows file charities and nonprofits annual filing and forms required filing (form. Web due date for filing returns requried by irc 6033. Web when is the form 990 deadline? Web find the right 990 form for your organization. The authentication process must be complete.

Form 1099 Filing Deadline 2019 Form Resume Examples qVAv08Xmgp

Registered nonprofits must file their annual tax returns by the 15th day of the 5th month after their. Web it depends on the end of your organization’s taxable year; The deadline for tax exempt organizations to file their 990 series tax return is the 15th day of the 5th month following the close of. Get ready for tax season deadlines.

How To Quickly Extend the September IRS 990 Tax Filing Deadline Blog

Form 990 due date calculator find your 990 filings deadline and the applicable extended due date Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. We must have received payment of the 990 online usage fee. Complete,.

deadline to file nonprofit tax return form 99005 Aplos Academy

If the due date falls on a saturday, sunday, or. Web may 15 is the 990 filing deadline for calendar year tax filers. The form is usually due the 15th of the fifth month after the organization’s taxable year. Web due date for filing returns requried by irc 6033. Form 990 due date calculator find your 990 filings deadline and.

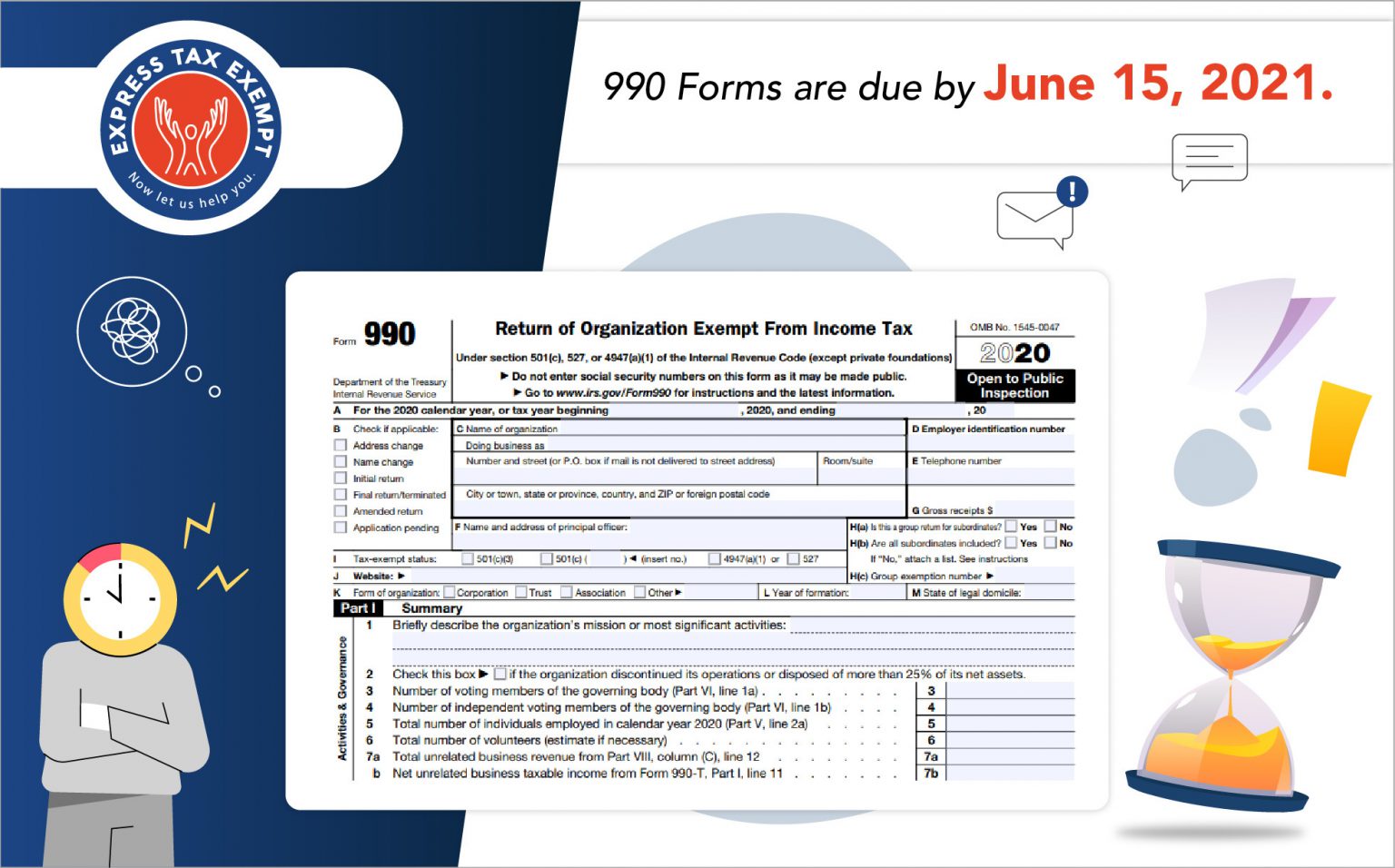

Is June 15, 2021 Your IRS Form 990 Deadline? What You Need to Know

Web who needs to file form 990 by june 15th? The short answer is may 15th. Form 990 due date calculator find your 990 filings deadline and the applicable extended due date Web find the right 990 form for your organization. For organizations with an accounting tax period starting on.

Form 990 Protects Transparency In The.

We must have received payment of the 990 online usage fee. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. Web this week marks the august 16, 2021 form 990 deadline for nonprofits whose tax year ended on march 31, 2021. The short answer is may 15th.

This Year, May 16 Is The Deadline To File Form 990 For Calendar Year Taxpayers Because May 15 Falls On.

The deadline for tax exempt organizations to file their 990 series tax return is the 15th day of the 5th month following the close of. Web 21 rows file charities and nonprofits annual filing and forms required filing (form. Complete, edit or print tax forms instantly. Web the deadline for filing form 990 is the 15th day of the 5th month after your organization's accounting period ends.

Web Find The Right 990 Form For Your Organization.

This is an annual deadline; Get ready for tax season deadlines by completing any required tax forms today. The form is usually due the 15th of the fifth month after the organization’s taxable year. Web when is the form 990 deadline?

Web Due Date For Filing Returns Requried By Irc 6033.

If the due date falls on a saturday, sunday, or. Web who needs to file form 990 by june 15th? Registered nonprofits must file their annual tax returns by the 15th day of the 5th month after their. Web it depends on the end of your organization’s taxable year;