Draw Versus Commission

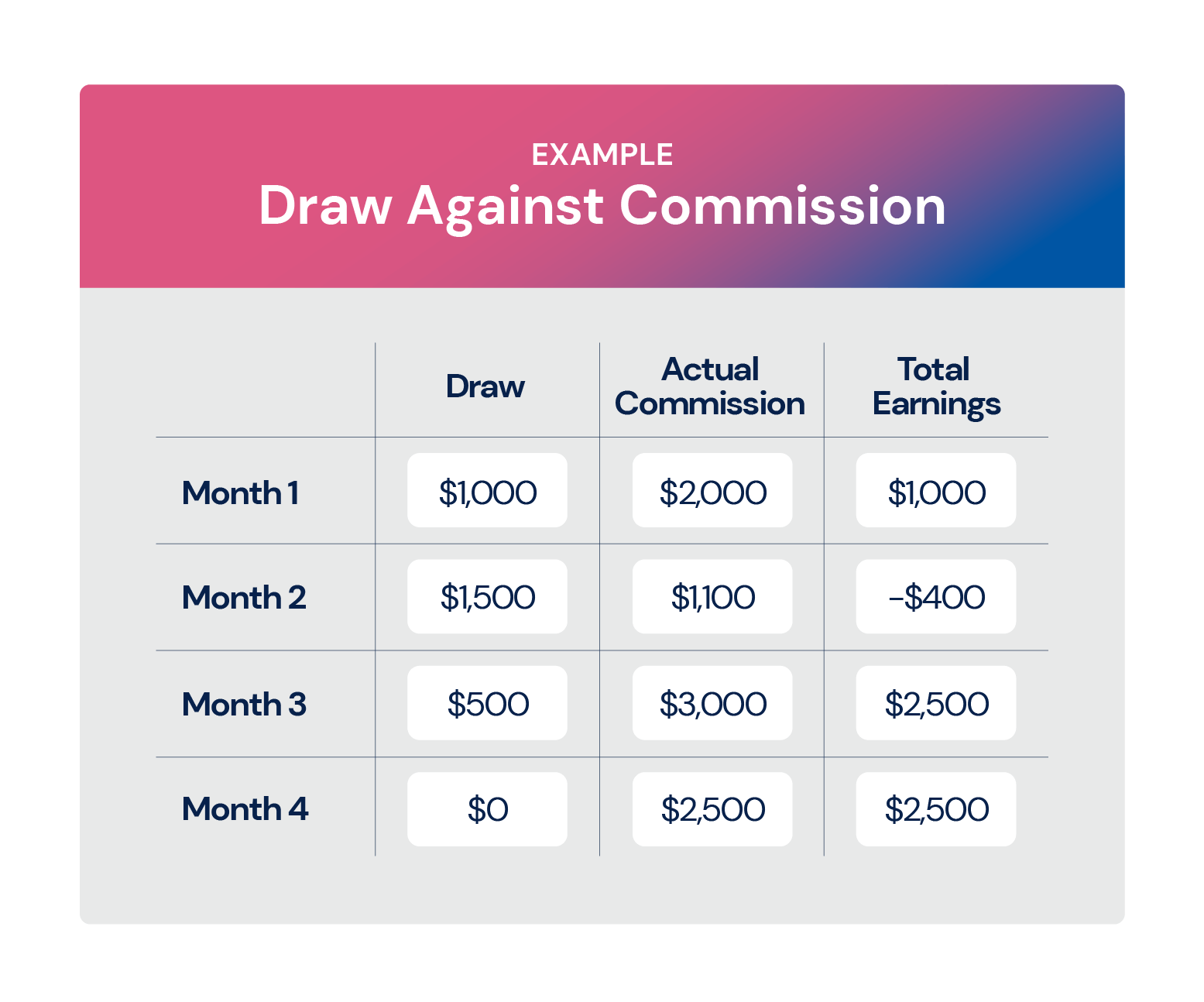

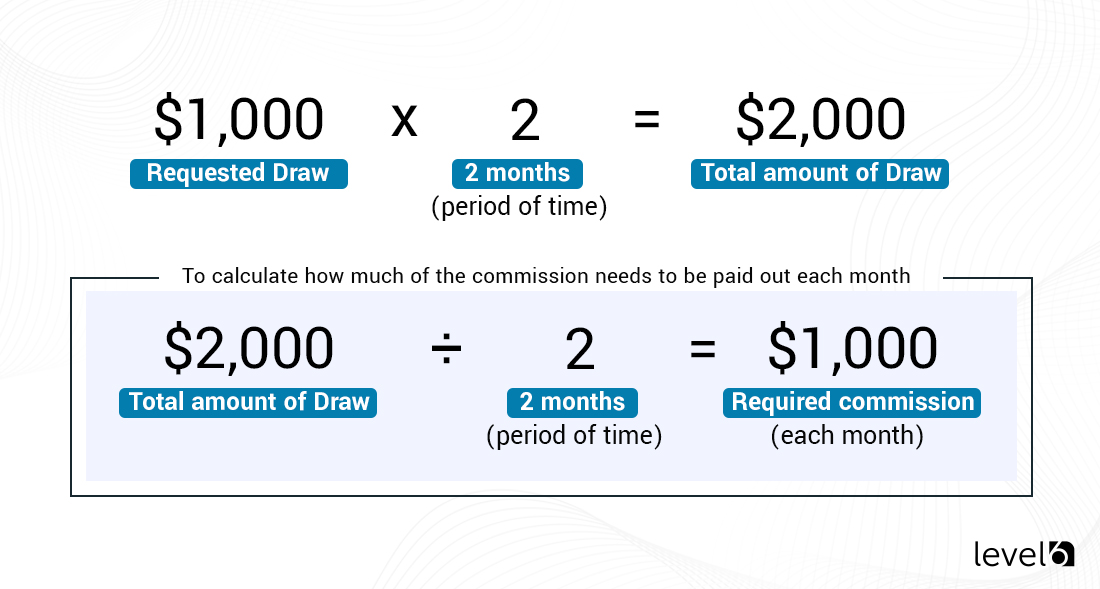

Draw Versus Commission - This draw is essentially an advance on the commission they're expected to earn. S stands for the sales amount. When reps receive a draw that must be paid back to their company it is considered a recoverable draw because the company is able to recover the funds they paid the rep in advance of earning their commission. Draws against commission guarantee that sales reps will be paid a certain amount in a given pay period. Web a draw against commission system is a professional payroll offering where you give commissioned employees a routine paycheck as an advance against future commissions. Associates in a commission pay plan may receive a portion or the majority of their compensation as commission pay. Web a draw against commission is a promise of a minimum payout. A payment to a commissioned sales employee as an advance or loan against future, unearned commissions. Draw versus commission is a form of pay structure in which an employee is paid a base salary (the draw) that is supplemented or replaced by commission when a specific sales goal is met. R is the commission rate in percentage.

For example, say you earned a $25,000 draw and an additional $50,000 in commission. In other terms, a draw is an option available to managers who design incentive plans to even out commission payouts. Web article • 11 min read. However, recoverable draws are more common and are deducted from any earned commission at the end of the pay cycle. If you have a sales jobs that is paid completely or mostly on commission, you may be paid an advance draw. If the commission is more than the initial draw, the rep gets the overage. It is understood that the draw is for the sales person to keep forever and ever. Web a draw against commission is a promise of a minimum payout. Learn how you can use a draw effectively in your sales incentive compensation plan to motivate reps and drive performance. Web a draw against commission system is a professional payroll offering where you give commissioned employees a routine paycheck as an advance against future commissions.

In other terms, a draw is an option available to managers who design incentive plans to even out commission payouts. It is essentially an advance that is subtracted from the employee’s commissions. By cristina maza, contributing writer. This draw is essentially an advance on the commission they're expected to earn. Web use our free draw against commission calculator to quickly figure out your sales goals and commission checks. Pick the right commission structure to keep sales agents motivated and improve your bottom line. In sales, a draw against commission (also known as a pay draw) is guaranteed pay a sales rep receives with every paycheck. When reps receive a draw that must be paid back to their company it is considered a recoverable draw because the company is able to recover the funds they paid the rep in advance of earning their commission. Dc represents the draw commission. Associates in a commission pay plan may receive a portion or the majority of their compensation as commission pay.

What is Draw against Commission in Sales? Everstage Blog

When reps receive a draw that must be paid back to their company it is considered a recoverable draw because the company is able to recover the funds they paid the rep in advance of earning their commission. A draw against commission is a paycheck made against future commission earnings. For example, say you earned a $25,000 draw and an.

6 Sales Commission Structures You Should Know [Free Calculator Inside]

Learning about this style of payment can help you decide if a commission draw salary works for you. Web last modified date: When a salesperson′s compensation is derived largely from commissions, a company can pay the salesperson a substantial sum of money even before the commissions are earned. However, recoverable draws are more common and are deducted from any earned.

11 Sales Compensation Plan Examples To Inspire Reps Mailshake

Web last modified date: It is understood that the draw is for the sales person to keep forever and ever. In other terms, a draw is an option available to managers who design incentive plans to even out commission payouts. A draw against commission is a paycheck made against future commission earnings. Discover the pros and cons of commission based.

A Small Business Guide to Building a Successful Sales Team Keap

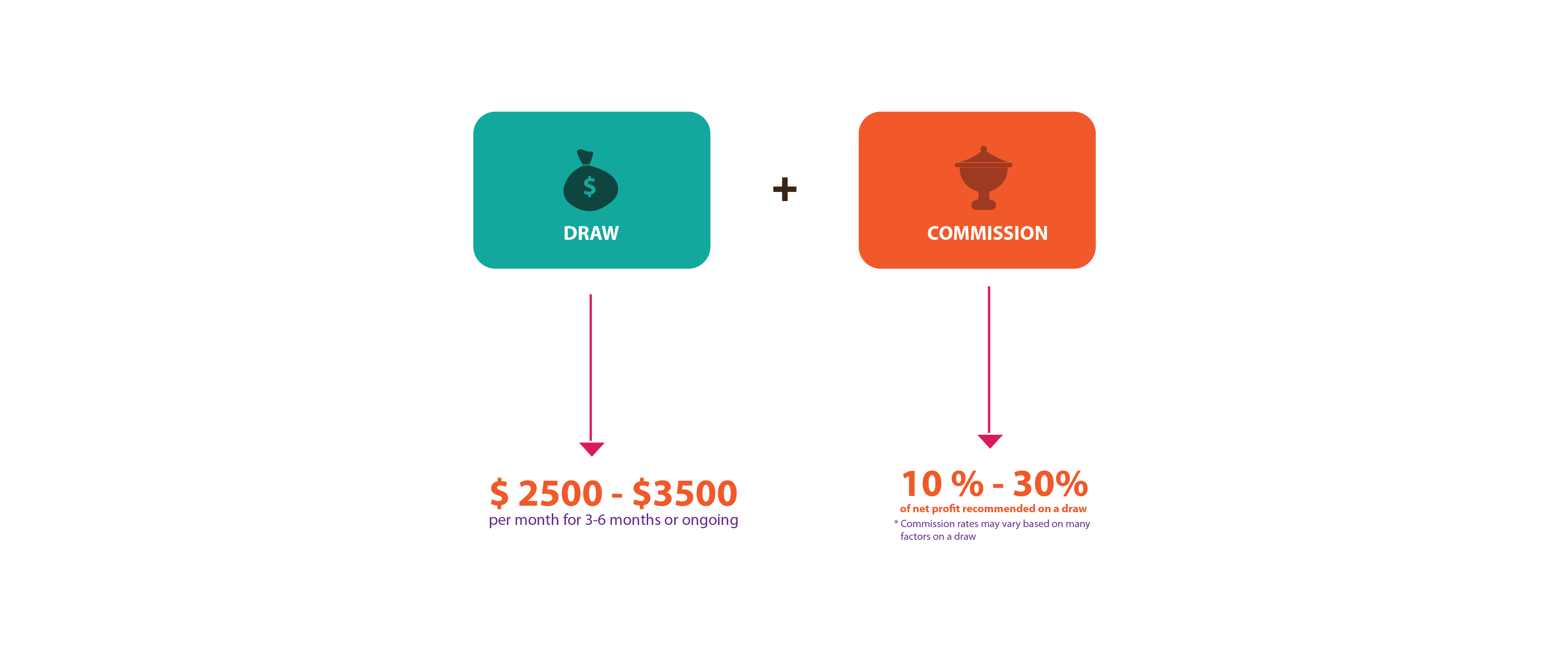

How commission pay plans work. Web the parties will then negotiate different commission percentages for sales made against the draw. Unleash your sales team’s full potential with data. By cristina maza, contributing writer. Web last modified date:

How to use a NonRecoverable Draw Against Commission in Sales

S stands for the sales amount. Web a recoverable draw (also known as a draw against commission) is a set amount of money paid to the sales representative by the company at regular intervals. If it’s less than the draw, the employee is guaranteed the original advance. R is the commission rate in percentage. The formula to calculate the draw.

What is a “Draw Against Commissions” in a Sales Rep Team?

When a salesperson′s compensation is derived largely from commissions, a company can pay the salesperson a substantial sum of money even before the commissions are earned. This form of payment is a slightly different tactic from one where an employee is. Draws against commission guarantee that sales reps will be paid a certain amount in a given pay period. It.

What is a “Draw Against Commissions” in a Sales Rep Team?

Web there are two main types of sales commission draws: Learn how you can use a draw effectively in your sales incentive compensation plan to motivate reps and drive performance. In sales, a draw against commission (also known as a pay draw) is guaranteed pay a sales rep receives with every paycheck. Draw versus commission is a form of pay.

Draw Against Commission Definition, Types, Pros & Cons

Web a draw against commission is a promise of a minimum payout. At the end of the pay period, the salesperson's commission is calculated based on their sales. Learning about this style of payment can help you decide if a commission draw salary works for you. Pick the right commission structure to keep sales agents motivated and improve your bottom.

What is Draw Against Commission in Sales? Xactly

Web a draw is an advance against future anticipated incentive compensation (commission) earnings. Discover the pros and cons of commission based jobs. What are the types of draw against commission arrangements? When a salesperson′s compensation is derived largely from commissions, a company can pay the salesperson a substantial sum of money even before the commissions are earned. For instance, you.

What Is a Draw Against Commission? Examples & More

Web a draw against commission system is a professional payroll offering where you give commissioned employees a routine paycheck as an advance against future commissions. Web use our free draw against commission calculator to quickly figure out your sales goals and commission checks. Learning about this style of payment can help you decide if a commission draw salary works for.

Web The Parties Will Then Negotiate Different Commission Percentages For Sales Made Against The Draw.

Web draws against commission can vary over time. Dc = (s * r) / 100. Pick the right commission structure to keep sales agents motivated and improve your bottom line. In other terms, a draw is an option available to managers who design incentive plans to even out commission payouts.

A Commission Draw Is One Type Of Pay That Advances Commission Payments To Salespeople Before The Sales Cycle Closes.

Web a draw against commission (or draw) is a sales compensation method that provides a sales representative with an advance payment from the company based on projected sales. It is essentially an advance that is subtracted from the employee’s commissions. Draws against commission guarantee that sales reps will be paid a certain amount in a given pay period. By cristina maza, contributing writer.

In This Arrangement There Is No Concern That The Salesperson Will Ever Be Expected To Pay Back Any Of The Monies Earned As A Draw.

Dc represents the draw commission. If there are any remaining commissions after a. With a recoverable draw, the sales rep eventually brings in enough commission to repay their advance. Web there are two main types of sales commission draws:

At The End Of The Pay Period, The Salesperson's Commission Is Calculated Based On Their Sales.

How does a draw work in sales? What are the types of draw against commission arrangements? Web a draw against commission guarantees sales representatives an income outside their earned commission. For instance, you may start out with an initial base draw and gradually add to it as you reach certain goals and gain experience.

![6 Sales Commission Structures You Should Know [Free Calculator Inside]](https://www.salesmate.io/blog/wp-content/uploads/2021/12/Commission-draw.jpg)