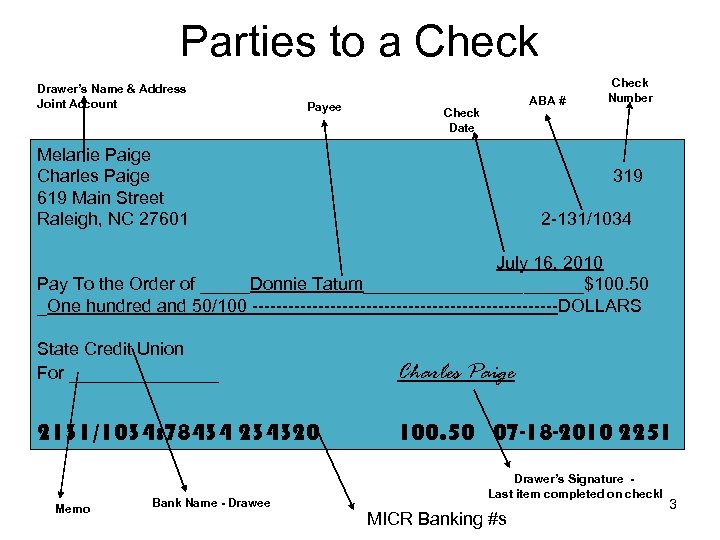

Drawer On A Cheque

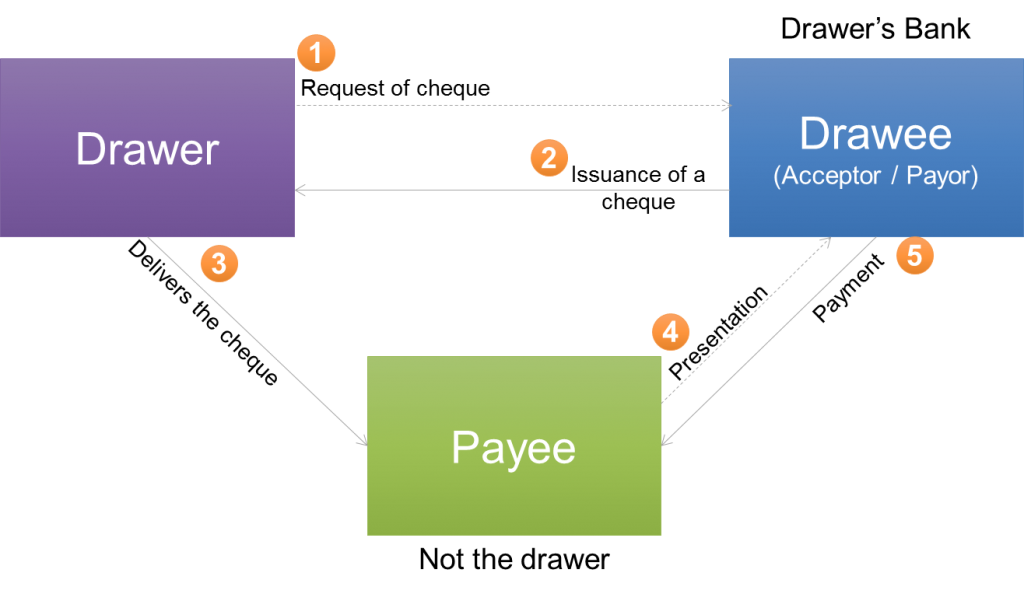

Drawer On A Cheque - What happens when a drawee receives a bill of exchange? They act as a drawee each time you deposit a check or receive a bill of exchange. Web as a negotiable instrument, a cheque represents a promise of payment by the drawer to the payee. Then he signs it and hands it to the payee. Web the drawer bank, also known as the payer's bank, is the financial institution where the individual, company, or organization who writes the check holds their account. The date on which the cheque is written. The person or entity to whom the cheque is addressed, indicating who will receive the payment. The primary role of a drawee is to redirect funds from the payor’s account to the payee’s account. Checks instruct a financial institution to transfer funds from the payor’s account. Web a drawee refers to the person or organization that’s ordered to pay a certain sum of money to a payee.

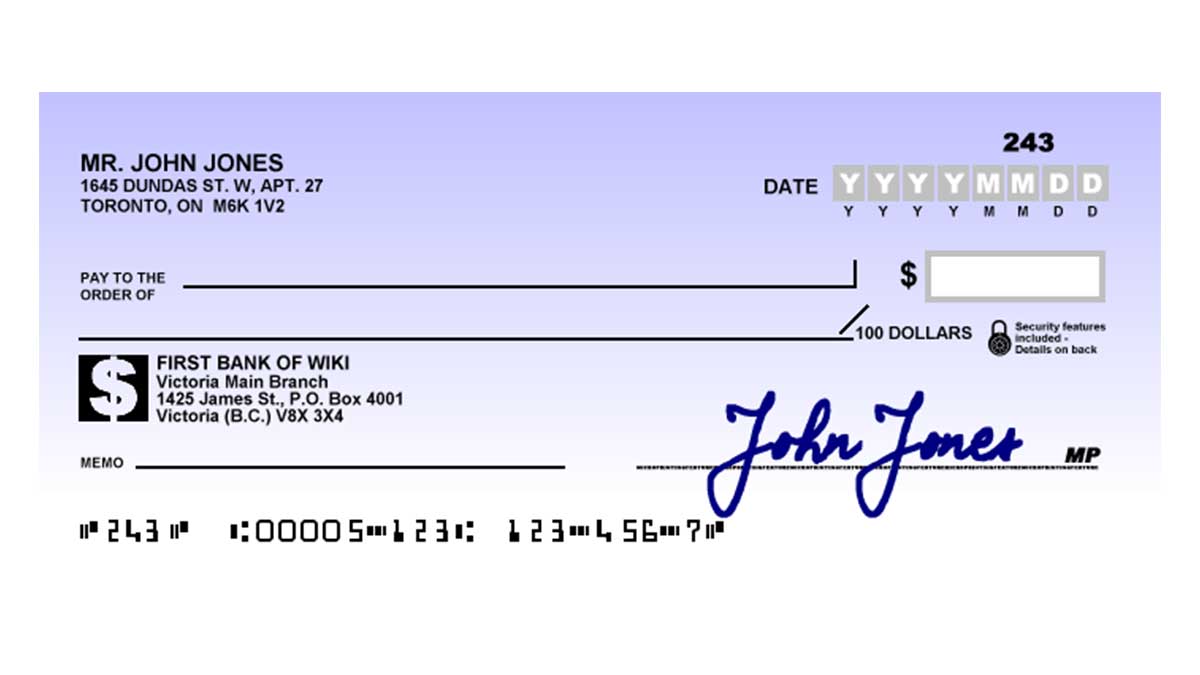

Web the drawer writes the cheque in the name of the beneficiary, requesting the bank to transfer the mentioned amount to the beneficiary from their account. Web drawer is the person who writes and issues the cheque. Web the term “drawer” refers to the party who initiates a negotiable instrument, such as a check or a bill of exchange. Furthermore, there can also be a holder who is generally the original payee. Web a cheque is a bill of exchange, drawn on a specified banker and it includes ‘the electronic image of truncated cheque’ and ‘a cheque in electronic form’. The person or entity to whom the funds are to be paid. The date on which the cheque is written. Web basically, there are three parties to a cheque: The primary role of a drawee is to redirect funds from the payor’s account to the payee’s account. The bank on which the cheque is drawn or who is directed to pay the specified sum written on the cheque.

The person thereby directed to pay is called the “drawee”. How to reactivate an inactive or dormant savings account? Web the drawer of a cheque has significant responsibilities and liabilities, especially in the event of a dishonor. 2 characteristics of a cheque. Web the payor, or drawer, is the individual with the funds who issues a check. When the payee deposits the cheque, the bank will withdraw the specified amount from the drawer’s account and transfer it to the payee’s account. The date on which the cheque is written. It is the party to whom the money specified in the cheque is payable. The most common example of a drawee is a bank. The bank on which the cheque is drawn or who is directed to pay the specified sum written on the cheque.

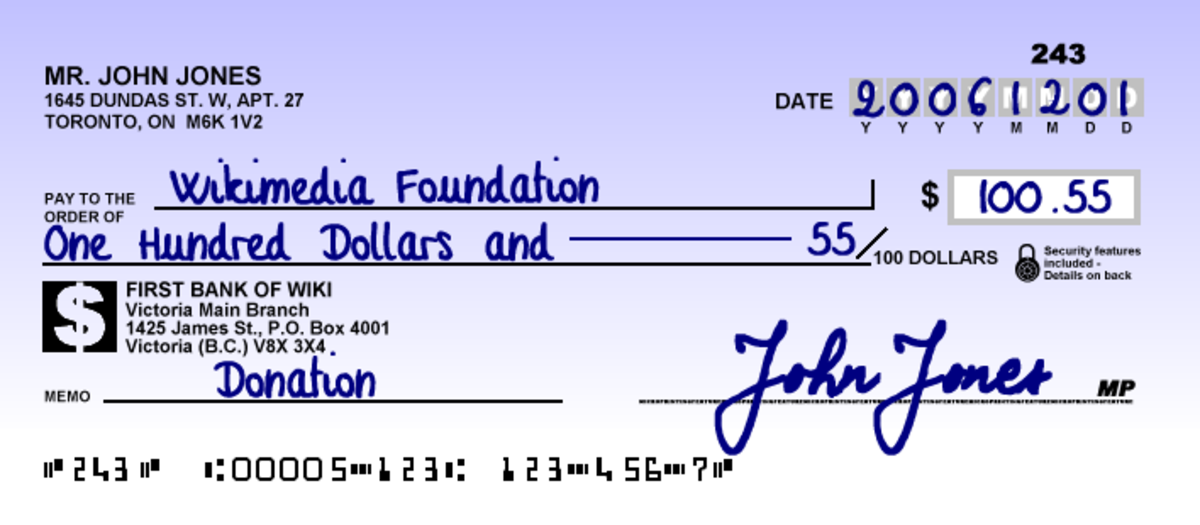

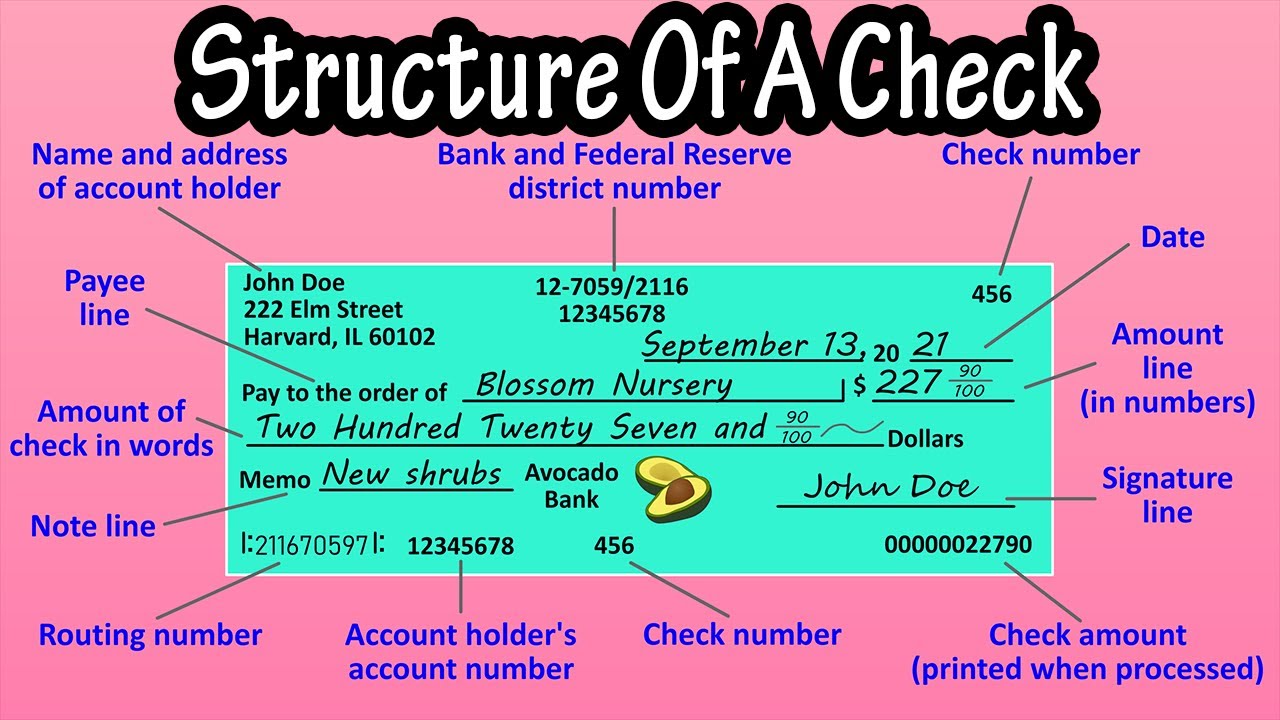

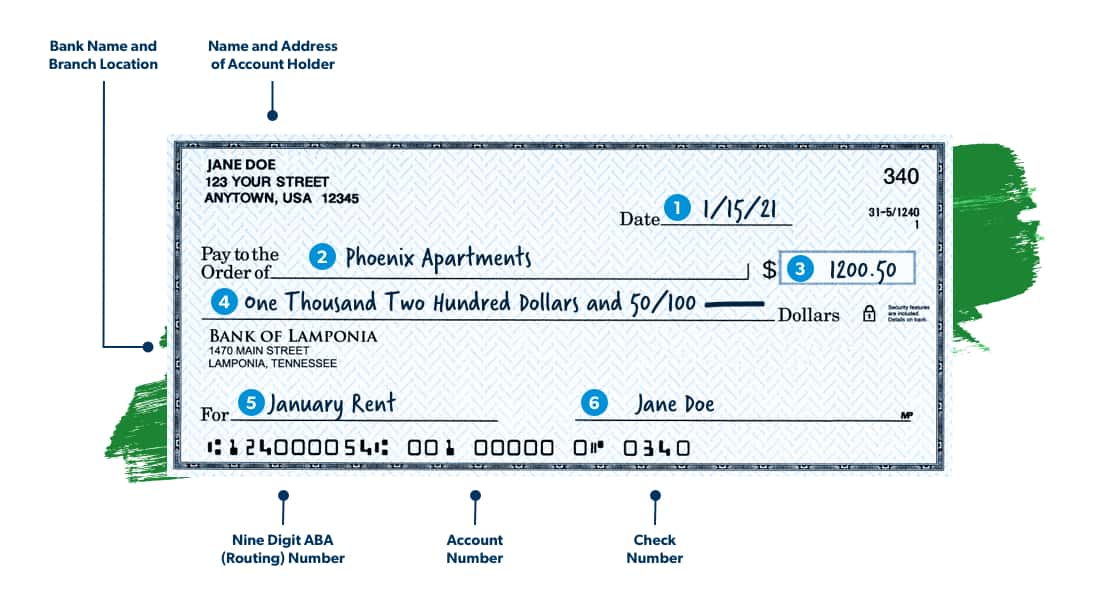

How to Write a Check Cheque Writing 101 HubPages

The date on which the cheque is written. Web the drawer bank, also known as the payer's bank, is the financial institution where the individual, company, or organization who writes the check holds their account. The person who draws the cheque, i.e. It is a written commitment to discharge a debt or meet a financial obligation. Essentially, the drawer bank.

10 Essential elements characteristics of cheque by Techy Khushi Medium

The person or entity whose transaction account is to be drawn. Signs and orders the bank to pay the sum. Then he signs it and hands it to the payee. Web a cheque is a bill of exchange, drawn on a specified banker and it includes ‘the electronic image of truncated cheque’ and ‘a cheque in electronic form’. The bank.

Parts Of A Cheque

Furthermore, there can also be a holder who is generally the original payee. The primary role of a drawee is to redirect funds from the payor’s account to the payee’s account. Web a drawee refers to the person or organization that’s ordered to pay a certain sum of money to a payee. Usually, the drawer's name and account is preprinted.

Detailed Guide On How To Write A Check

The sum of money to be paid. A cheque must contain all the characteristics of a bill of exchange. The person who draws the cheque, i.e. The bank where the drawer holds an account and from which the money will be withdrawn. 2 characteristics of a cheque.

Drawer And Drawee Of A Cheque Bruin Blog

They act as a drawee each time you deposit a check or receive a bill of exchange. Bearer cheque vs order cheque. The person who writes the cheque and has the account from which the funds are drawn. Drawee is the bank in which drawer holds and on which he draws his cheque. The person thereby directed to pay is.

Drawer Drawee & Payee Parties on Cheque Difference Between Drawer

Payee is the person in whose name the cheque is issued. It represents the bank that will make the payment. Web drawee is a legal and banking term used to describe the party that has been directed by a depositor to pay a certain sum of money to the person presenting a check or draft written by the. The date.

Drawer And Drawee Of A Cheque Bruin Blog

Web a check is a written, dated, and signed draft that directs a bank to pay a specific sum of money to the bearer. Web a cheque is a bill of exchange, drawn on a specified banker and it includes ‘the electronic image of truncated cheque’ and ‘a cheque in electronic form’. The cheque is always payable on demand. Web.

Drawer And Drawee Of A Cheque Bruin Blog

It is the party to whom the money specified in the cheque is payable. Web the person writing the cheque, known as the drawer, instructs the bank to transfer a certain amount of money to the payee, the person receiving the money. Web the person writing the cheque is known as drawer and has a bank account from where the.

Common Payment Services — EFT Electronic Funds Transfer

The person or entity who is to be paid the amount. The sum of money to be paid. Signs and orders the bank to pay the sum. The person or entity to whom the cheque is addressed, indicating who will receive the payment. Usually, the drawer's name and account is preprinted on the cheque, and the drawer is usually the.

Drawer And Drawee Of A Cheque Bruin Blog

Web basically, there are three parties to a cheque: A cheque must contain all the characteristics of a bill of exchange. The person who writes the cheque and has the account from which the funds are drawn. The person who writes the cheque, instructing the bank to make the payment. The person or entity whose transaction account is to be.

Web A Cheque Is A Bill Of Exchange, Drawn On A Specified Banker And It Includes ‘The Electronic Image Of Truncated Cheque’ And ‘A Cheque In Electronic Form’.

The cheque is always payable on demand. The primary role of a drawee is to redirect funds from the payor’s account to the payee’s account. The bank that is instructed to pay the funds. It represents the bank that will make the payment.

A Cheque Must Contain All The Characteristics Of A Bill Of Exchange.

How to reactivate an inactive or dormant savings account? The person or entity to whom the cheque is addressed, indicating who will receive the payment. In simpler terms, the drawer is the person or entity who creates and signs the document, thereby ordering the payment of a specified amount to a designated recipient, known as the payee. Web the payor, or drawer, is the individual with the funds who issues a check.

The Person Who Writes The Cheque And Has The Account From Which The Funds Are Drawn.

Checks instruct a financial institution to transfer funds from the payor’s account. The banks are the drawer in cheque payments. The date on which the cheque is written. Web the drawer is the individual who issues the cheque, instructing the bank (drawee) to pay the recipient (payee).

Web The Drawer Of A Cheque Has Significant Responsibilities And Liabilities, Especially In The Event Of A Dishonor.

Payee is the person in whose name the cheque is issued. What happens when a drawee receives a bill of exchange? The bank on which the cheque is drawn or who is directed to pay the specified sum written on the cheque. Web drawer is the person who writes and issues the cheque.