Drawing Expenses

Drawing Expenses - Flexible payment amounts and schedule. Drawings are the withdrawals of a sole proprietorship’s business assets by the owner for the owner’s personal use. However, if the owner of a. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. Web drawings do not affect the business expenses on the profit and loss account (income statement), but instead are recorded as a reduction in assets and a. The amount of money or assets (money’s worth) drawn from a business by an owner for personal use is called drawings. Reduces owner’s equity in the business. Web ellen, whose social security covers most of her daily living expenses, needed guidance on how to use her different types of retirement accounts for additional. Web what are drawings and its journal entry (cash, goods)? It is important to note that while.

However, if the owner of a. It is important to track the. You need to pay rent to arnold the landlord each month. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. Web ellen, whose social security covers most of her daily living expenses, needed guidance on how to use her different types of retirement accounts for additional expenditures like. Bill lee and the 113th general assembly give businesses a $1.9 billion franchise tax break, they're allowing large farms to benefit from a projected. The amount of money or assets (money’s worth) drawn from a business by an owner for personal use is called drawings. Drawings are the withdrawals of a sole proprietorship’s business assets by the owner for the owner’s personal use. The basic definition of an expense is money you spend to run your business. Web drawings do not affect the business expenses on the profit and loss account (income statement), but instead are recorded as a reduction in assets and a.

Web what are drawings and its journal entry (cash, goods)? Web the drawing account, also known as an owner's draw or proprietor's draw, is a record in accounting that reflects the withdrawals made by a business owner from. Web is drawings an expense? Drawings accounts are not limited to tracking cash withdrawals, they include all assets that owners might withdraw from the business. Bill lee and the 113th general assembly give businesses a $1.9 billion franchise tax break, they're allowing large farms to benefit from a projected. For example, to run your bakery, you need to pay for much more than just cake mix. Business owners might use a draw for. Web a drawing account, sometimes referred to as a “draw account” or “owner’s draw,” is a critical accounting record used to track money and other assets withdrawn. The drawing account is intended to track distributions to. The amount of money or assets (money’s worth) drawn from a business by an owner for personal use is called drawings.

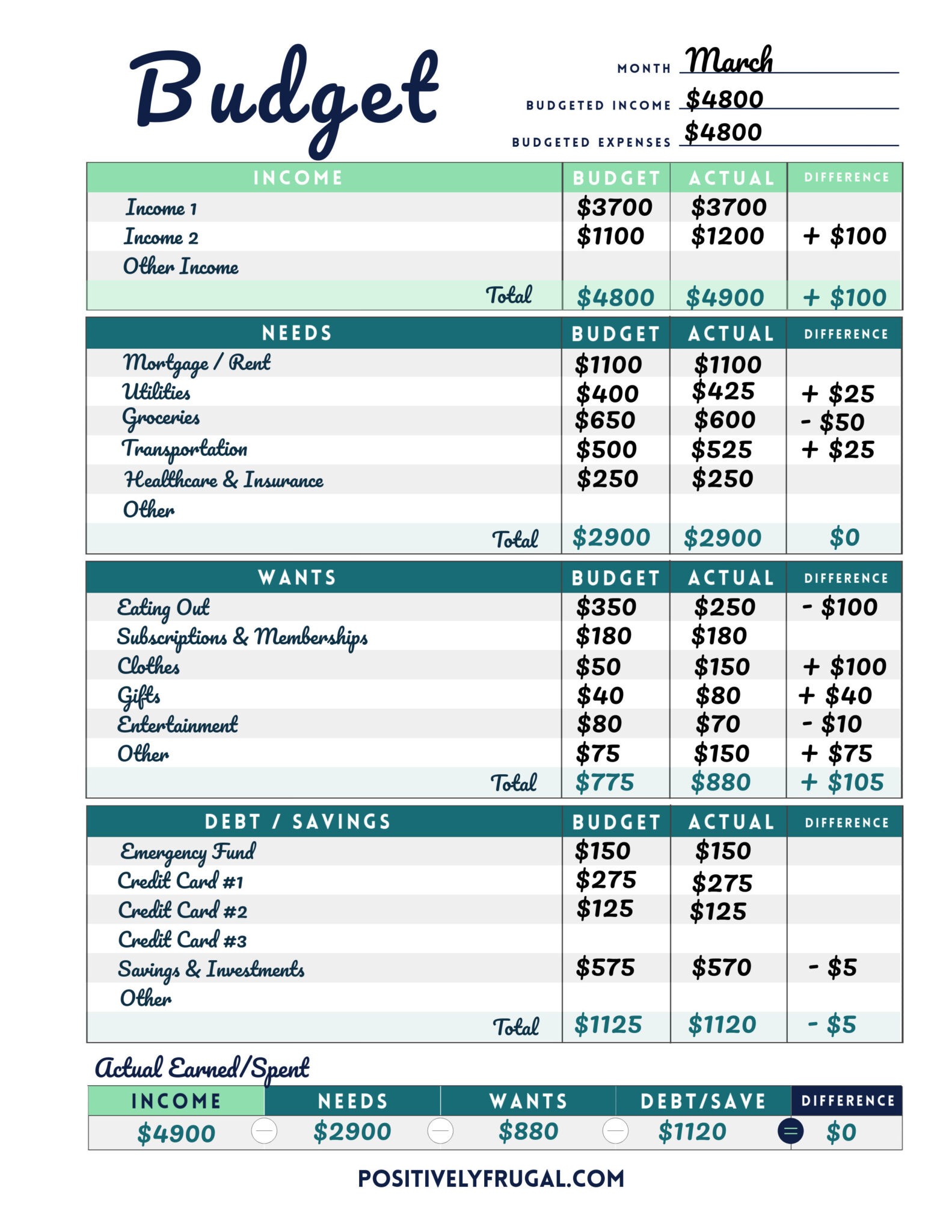

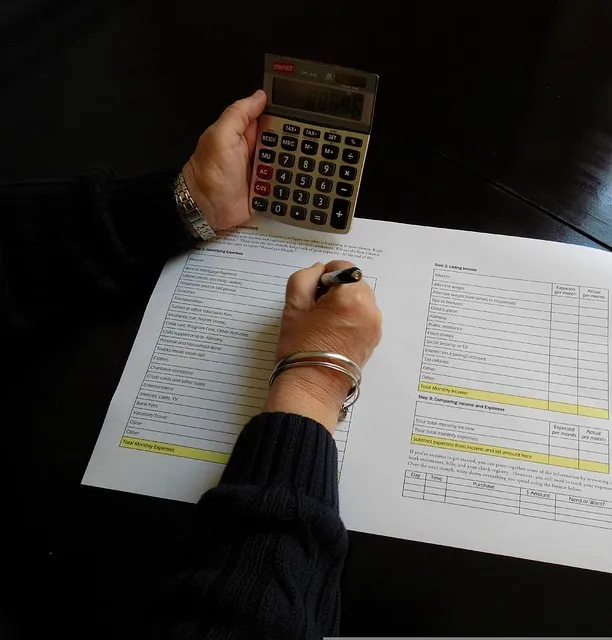

How to draw up a budget City Press

The basic definition of an expense is money you spend to run your business. However, if the owner of a. Web although drawings are outflow of resources from entity’s perspective yet they are not expense because such outflow is not permitted with an intention generate higher cash. Web an owner’s draw, also called a draw, is when a business owner.

Personal Finance Expenses Balance Cartoon in Black and White Stock

It is important to note that while. Bill lee and the 113th general assembly give businesses a $1.9 billion franchise tax break, they're allowing large farms to benefit from a projected. It is important to track the. Web is drawings an expense? Web ellen, whose social security covers most of her daily living expenses, needed guidance on how to use.

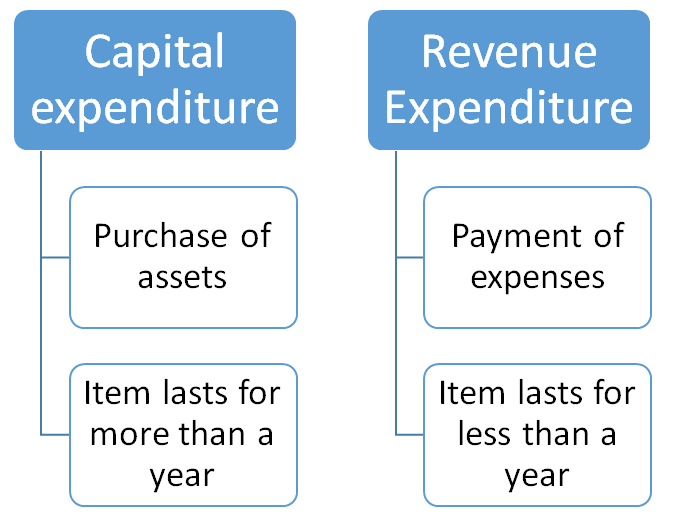

What is Revenue, Expense and Drawing

Web a drawing account is an accounting record maintained to track money withdrawn from a business by its owners. Drawings accounts are not limited to tracking cash withdrawals, they include all assets that owners might withdraw from the business. It is important to track the. Web drawings do not affect the business expenses on the profit and loss account (income.

Calculation Financial Expenses Money Concept Drawing Stock Illustration

Not subject to payroll taxes. Web not only did gov. Reduces owner’s equity in the business. Web the above example shows the following: The drawings or draws by the owner.

How To Create A Monthly Budget That Works Budgeting Worksheets Riset

Are drawings assets or expenses? Web the drawing account, also known as an owner's draw or proprietor's draw, is a record in accounting that reflects the withdrawals made by a business owner from. Drawings accounts are not limited to tracking cash withdrawals, they include all assets that owners might withdraw from the business. It is important to note that while..

How To Draw Up A Budget For A Business? The Mumpreneur Show

Web what are drawings and its journal entry (cash, goods)? Web in accounting, drawings refer to the withdrawal of funds or assets from a business by its owners or partners for personal use. Flexible payment amounts and schedule. Web a drawing account is an accounting record maintained to track money withdrawn from a business by its owners. Are drawings assets.

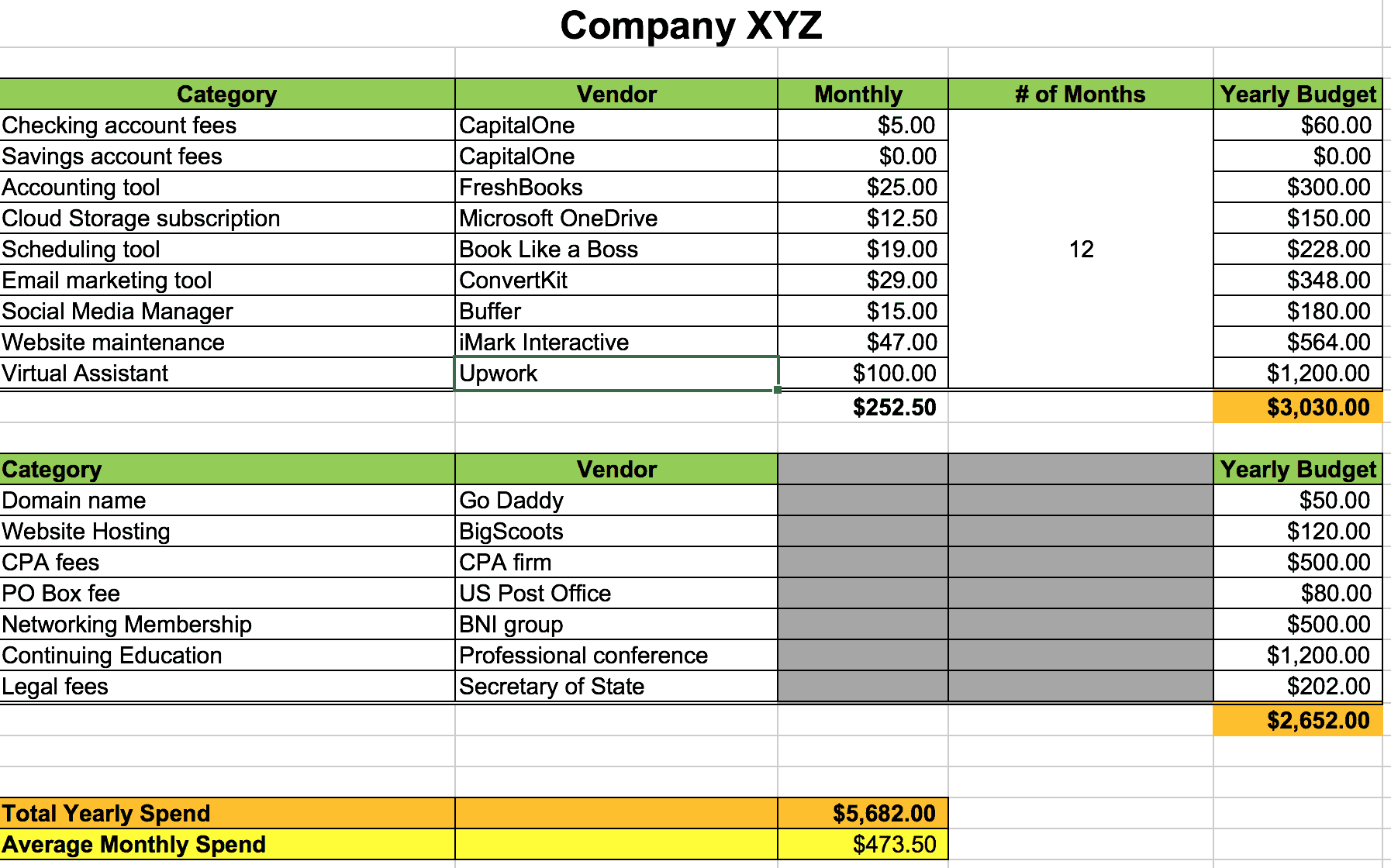

Drawing Expenses and expenditure plan is important

You need to pay for repairs to the delivery car every time you ding your bumper in the parking. The basic definition of an expense is money you spend to run your business. Drawings are the withdrawals of a sole proprietorship’s business assets by the owner for the owner’s personal use. Web a drawing account, sometimes referred to as a.

Free Vector Monthly expenses, costs and infographics template

Web not only did gov. The drawings or draws by the owner. However, if the owner of a. A drawing account is used primarily for. Web a drawing account is an accounting record maintained to track money withdrawn from a business by its owners.

Stealthy Wealth How To Draw Up A Budget

Shenzhen, once known for fake designer. For example, to run your bakery, you need to pay for much more than just cake mix. Web although drawings are outflow of resources from entity’s perspective yet they are not expense because such outflow is not permitted with an intention generate higher cash. Web a drawing account is a contra owner’s equity account.

Personal Expenses and Drawings Double Entry Bookkeeping

Web a drawing account is an accounting record maintained to track money withdrawn from a business by its owners. Web the drawing account, also known as an owner's draw or proprietor's draw, is a record in accounting that reflects the withdrawals made by a business owner from. Business owners might use a draw for. Flexible payment amounts and schedule. Drawings.

Drawings Are The Withdrawals Of A Sole Proprietorship’s Business Assets By The Owner For The Owner’s Personal Use.

Web not only did gov. Shenzhen, once known for fake designer. A drawing account is used primarily for. Bill lee and the 113th general assembly give businesses a $1.9 billion franchise tax break, they're allowing large farms to benefit from a projected.

In Accounting, Assets Such As Cash Or Goods Which Are Withdrawn From A Business By The Owner (S) For Their.

The drawing account is intended to track distributions to. Reduces owner’s equity in the business. Web what are drawings and its journal entry (cash, goods)? For example, to run your bakery, you need to pay for much more than just cake mix.

Are Drawings Assets Or Expenses?

It is important to note that while. Web as a result, the placement of drawings within the balance sheet depends on how it is categorised. Web a drawing account is a contra owner’s equity account used to record the withdrawals of cash or other assets made by an owner from the enterprise for its. Not subject to payroll taxes.

You Need To Pay For Repairs To The Delivery Car Every Time You Ding Your Bumper In The Parking.

Web some key aspects of the draw method are: The drawings or draws by the owner. Web drawing, in accounting, refers to the action of taking funds from an account or company holdings for individual use. Web a drawing account is an accounting record maintained to track money withdrawn from a business by its owners.