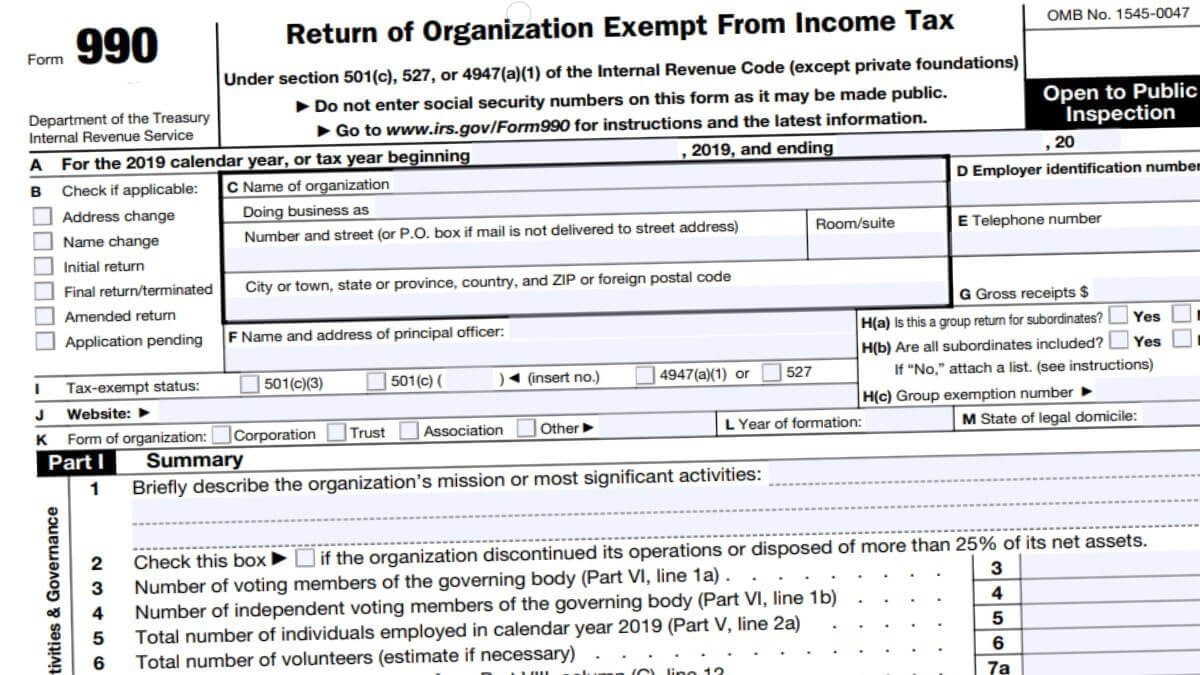

Due Date Form 990

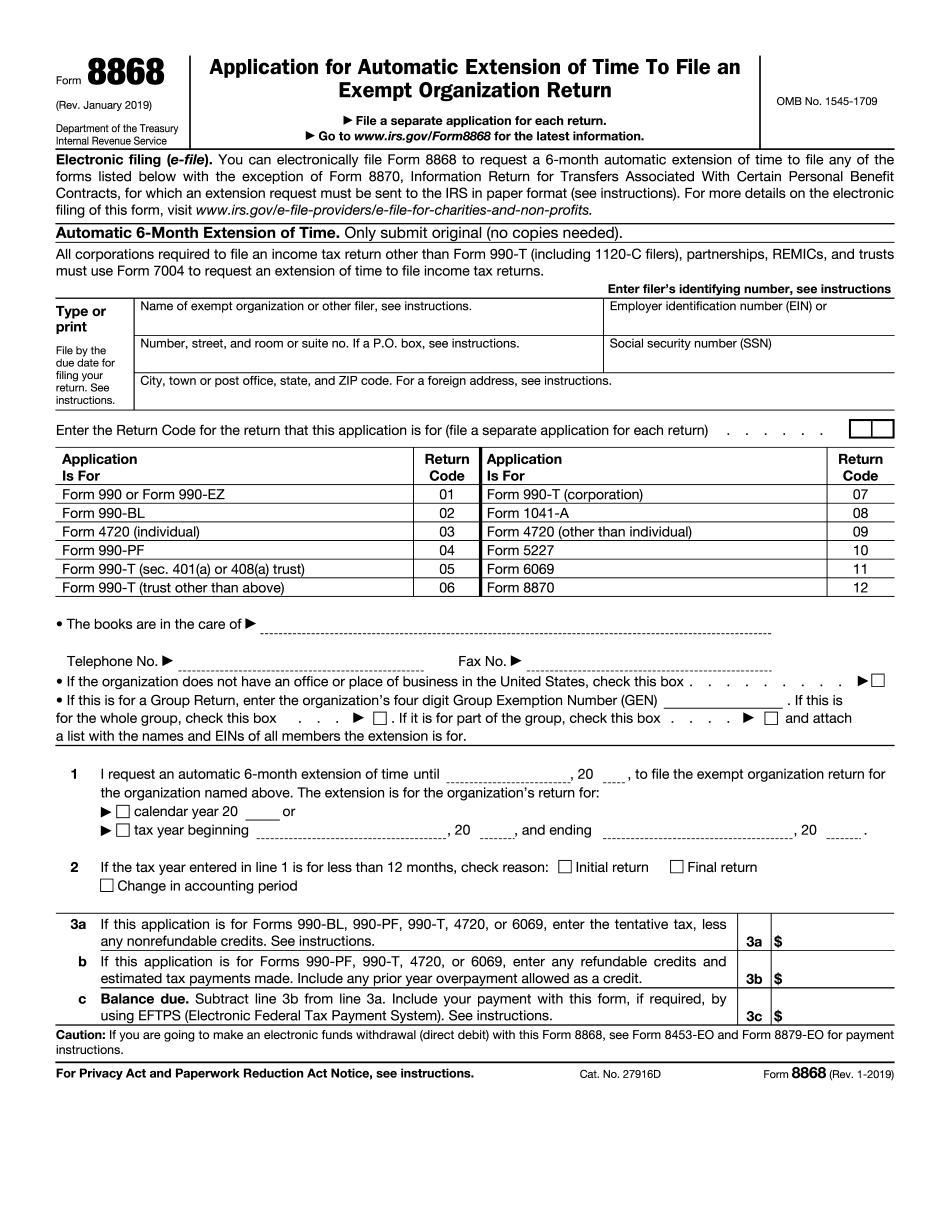

Due Date Form 990 - The due date will vary for each organization depending on the accounting period they follow. If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. If your organization filed an 8868 extension on february 15, 2023, then your form 990 extended deadline is august 15, 2023. For organizations on a calendar year, the form 990 is due on may 15th of the following year. What is the extended due date for form 990? Web due date for filing returns requried by irc 6033. If a due date falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day. Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends. If your organization follows a calendar tax period, form 990 is due by may 15, 2023.

To use the table, you must know when your organization’s tax year ends. For organizations on a calendar year, the form 990 is due on may 15th of the following year. On the other hand, if an exempt organization's fiscal tax year ends on january. Due to the large volume of returns we are receiving, we will accept returns for processing until 5:00 pm eastern standard time on monday, july 17, 2023. What is the extended due date for form 990? The table above does not reflect the. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Web form 990 is due on the 15th day of the 5th month following the end of the organization’s taxable year. The due date will vary for each organization depending on the accounting period they follow. If the due date falls on a saturday, sunday, or legal holiday, file on the next business day.

For organizations on a calendar year, the form 990 is due on may 15th of the following year. If a due date falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day. If your organization follows a calendar tax period, form 990 is due by may 15, 2023. For example, exempt organizations that follow the calendar tax year must file their annual return by may 15, 2023. The due date will vary for each organization depending on the accounting period they follow. Web upcoming form 990 deadline: Web form 990 is due on the 15th day of the 5th month following the end of the organization’s taxable year. If your organization filed an 8868 extension on february 15, 2023, then your form 990 extended deadline is august 15, 2023. On the other hand, if an exempt organization's fiscal tax year ends on january. Web due date for filing returns requried by irc 6033.

Receptionist Self Evaluation Form Vincegray2014 / Various artists

Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. Web form 990 is due on the 15th day of the 5th month following the end of.

Form 990, 990EZ, 990PF (Sch B) Schedule of Contributors (2015) Free

For organizations on a calendar year, the form 990 is due on may 15th of the following year. The table above does not reflect the. Web upcoming form 990 deadline: The due date will vary for each organization depending on the accounting period they follow. If the due date falls on a saturday, sunday, or legal holiday, file on the.

990 Form 2021

Web form 990 is due on the 15th day of the 5th month following the end of the organization’s taxable year. Web calendar year organization filing deadline. For organizations on a calendar year, the form 990 is due on may 15th of the following year. If your organization follows a calendar tax period, form 990 is due by may 15,.

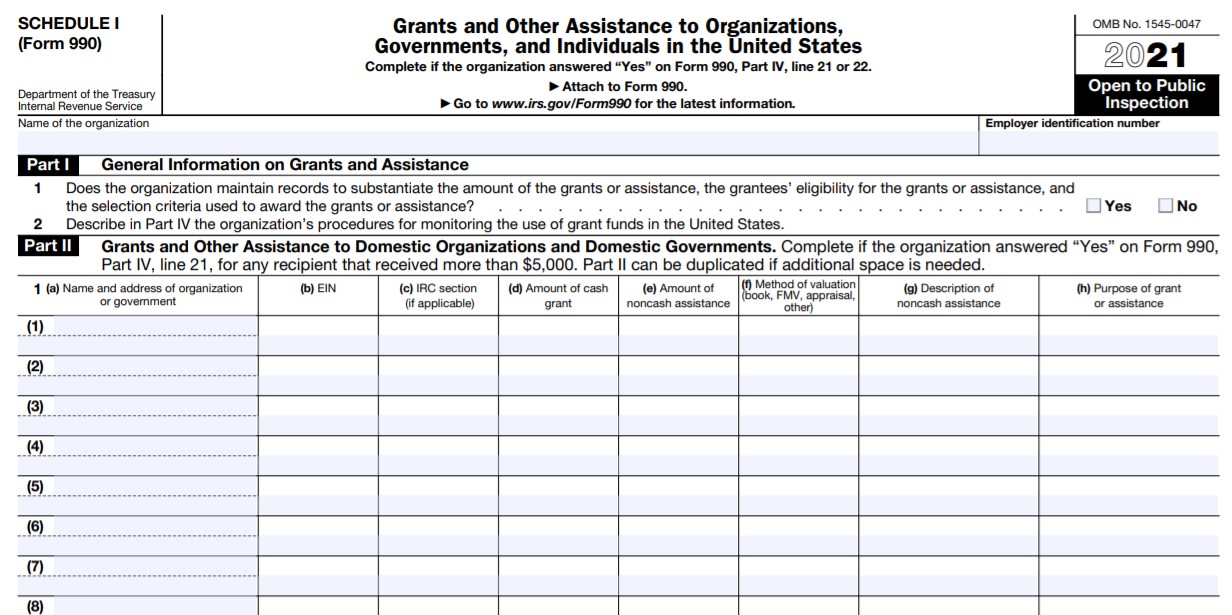

IRS Form 990 Schedule I Instructions Grants & Other Assistance

Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. The table above does not reflect the. A business day is any day that isn't a saturday, sunday, or legal holiday. Web upcoming form 990 deadline: What is the extended due date for form 990?

Form 990BL Information and Initial Excise Tax Return for Black Lung

Web upcoming form 990 deadline: If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. Web calendar year organization filing deadline. If your organization follows a calendar tax period, form 990 is due by may 15, 2023. The table above does not reflect the.

form 990 due date 2018 extension Fill Online, Printable, Fillable

On the other hand, if an exempt organization's fiscal tax year ends on january. If your organization follows a calendar tax period, form 990 is due by may 15, 2023. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Web form 990 is.

Calendar Year Tax Year? Your 990 Is Due Tony

On the other hand, if an exempt organization's fiscal tax year ends on january. Web due date for filing returns requried by irc 6033. Web calendar year organization filing deadline. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Due to the large.

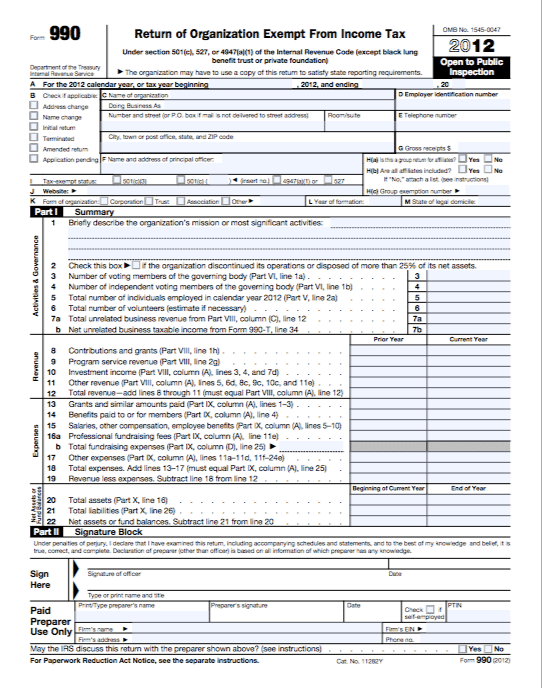

2012 Form 990

To use the table, you must know when your organization’s tax year ends. If a due date falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15,.

what is the extended due date for form 990 Fill Online, Printable

A business day is any day that isn't a saturday, sunday, or legal holiday. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. To use the table, you must know when your organization’s tax year ends. If your organization follows a calendar tax.

Form 990 Return of Organization Exempt from Tax (2014) Free

Web calendar year organization filing deadline. On the other hand, if an exempt organization's fiscal tax year ends on january. For example, exempt organizations that follow the calendar tax year must file their annual return by may 15, 2023. If your organization follows a calendar tax period, form 990 is due by may 15, 2023. Due to the large volume.

The Due Date Will Vary For Each Organization Depending On The Accounting Period They Follow.

A business day is any day that isn't a saturday, sunday, or legal holiday. If the due date falls on a saturday, sunday, or legal holiday, file on the next business day. Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023.

What Is The Extended Due Date For Form 990?

To use the table, you must know when your organization’s tax year ends. Due to the large volume of returns we are receiving, we will accept returns for processing until 5:00 pm eastern standard time on monday, july 17, 2023. Web due date for filing returns requried by irc 6033. If a due date falls on a saturday, sunday, or legal holiday, the due date is delayed until the next business day.

For Example, Exempt Organizations That Follow The Calendar Tax Year Must File Their Annual Return By May 15, 2023.

If your organization follows a calendar tax period, form 990 is due by may 15, 2023. The table above does not reflect the. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. Web upcoming form 990 deadline:

Web Calendar Year Organization Filing Deadline.

For organizations on a calendar year, the form 990 is due on may 15th of the following year. Web form 990 is due on the 15th day of the 5th month following the end of the organization’s taxable year. If your organization filed an 8868 extension on february 15, 2023, then your form 990 extended deadline is august 15, 2023. On the other hand, if an exempt organization's fiscal tax year ends on january.