Due Diligence Tax Form

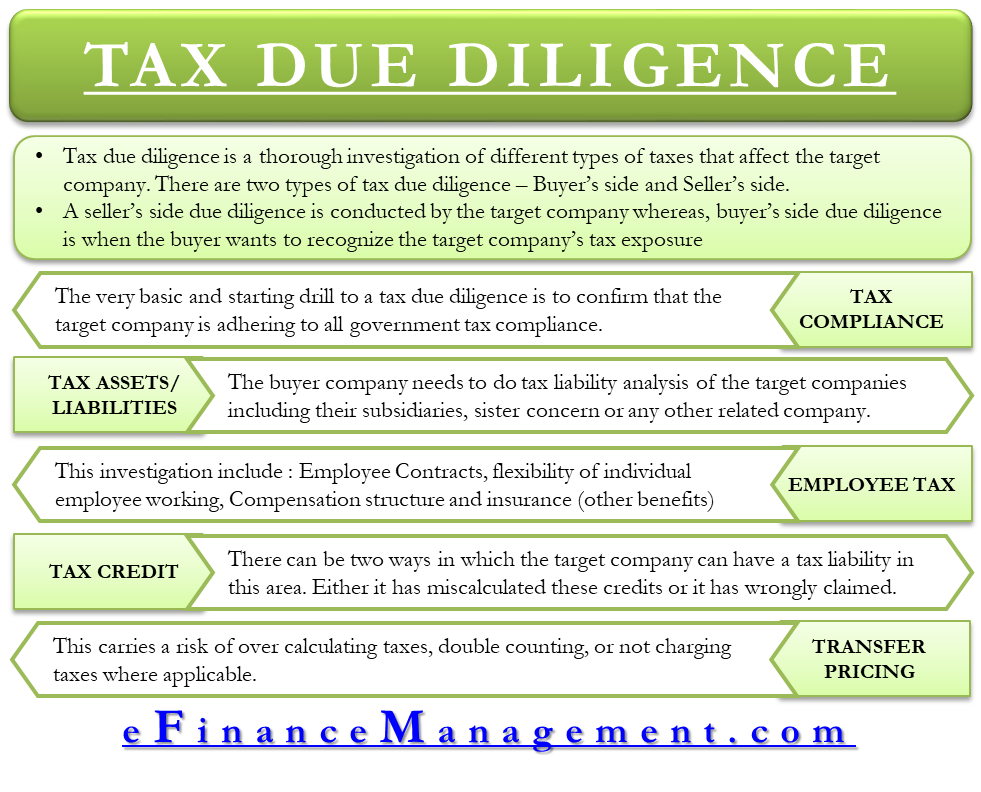

Due Diligence Tax Form - Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Paid preparers of federal income tax returns or claims involving the earned income credit (eic), child tax credit. Web enter the amount of total income reported on your current income tax return (form 1040, line 22). [noun] the care that a reasonable person exercises to avoid harm to other persons or their property. Once the review is complete, the irs will respond: Web irs assesses more than 90 percent of all due diligence penalties for failure to comply with the knowledge requirement of irc § 6695 (g). Web preparer due diligence. Web due diligence definition, reasonable care and caution exercised by a person who is buying, selling, giving professional advice, etc., especially as required by law to protect against. Compare the information you entered in items 1 and 2, above, to the. Form 8867 can serve as a reminder to ask all relevant questions to ensure the.

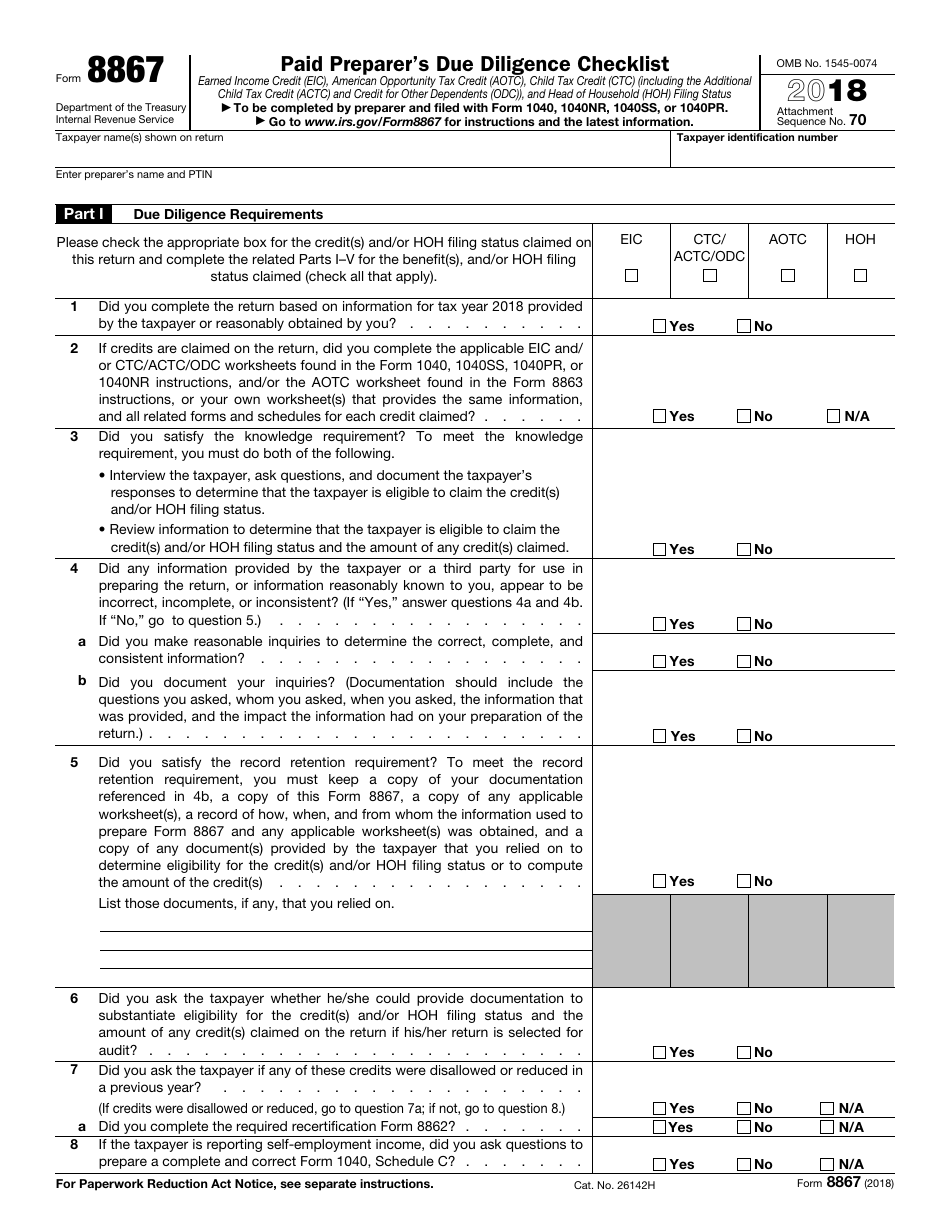

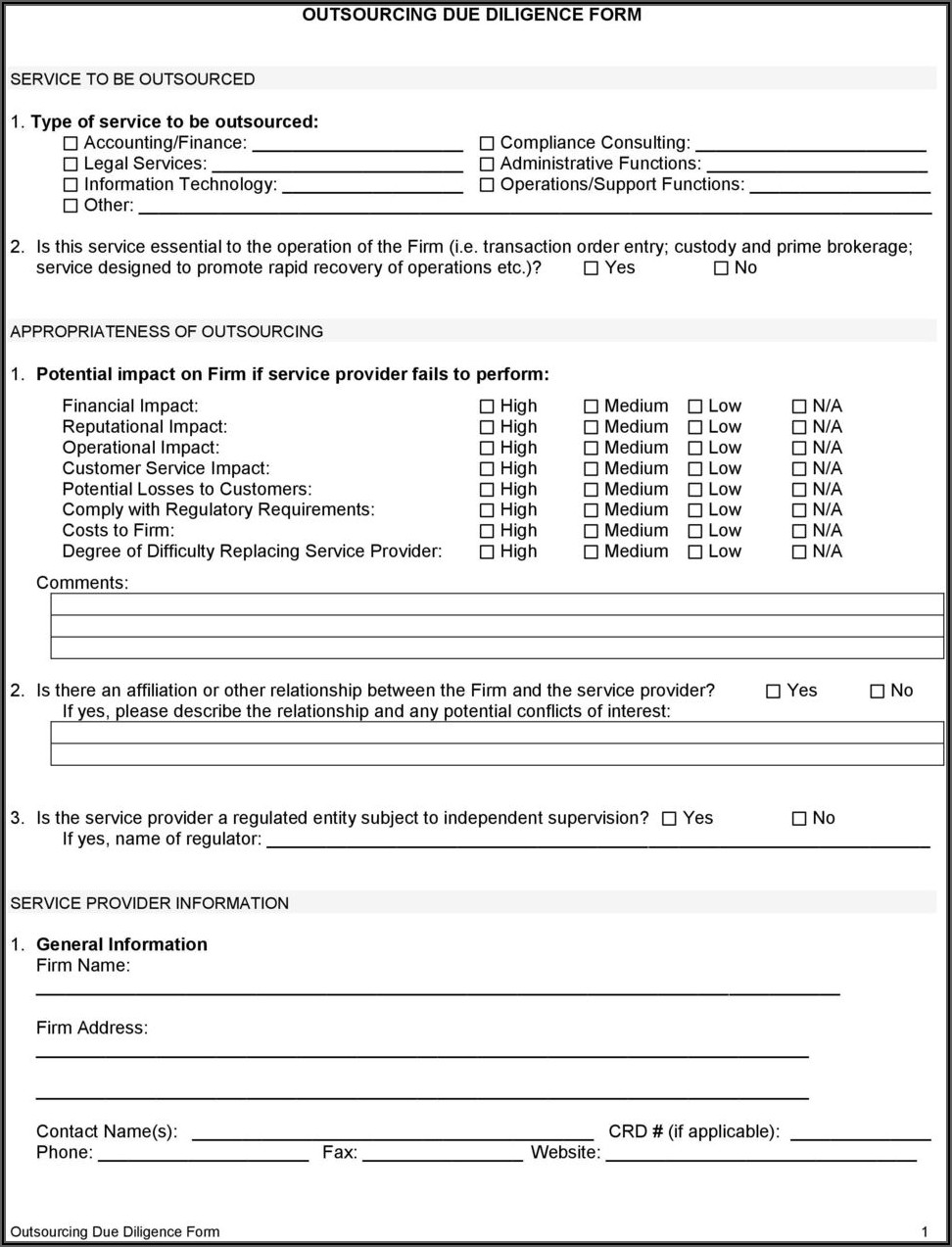

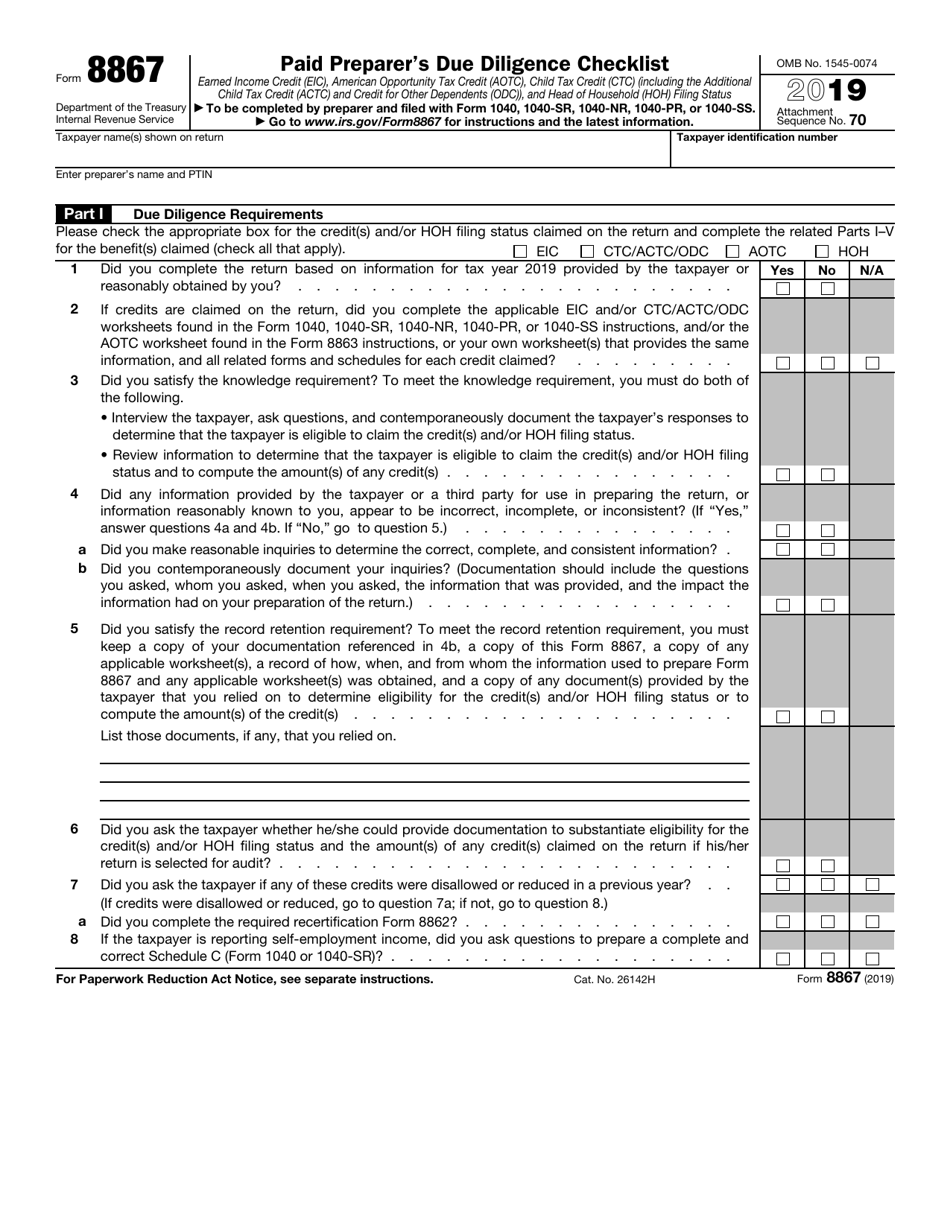

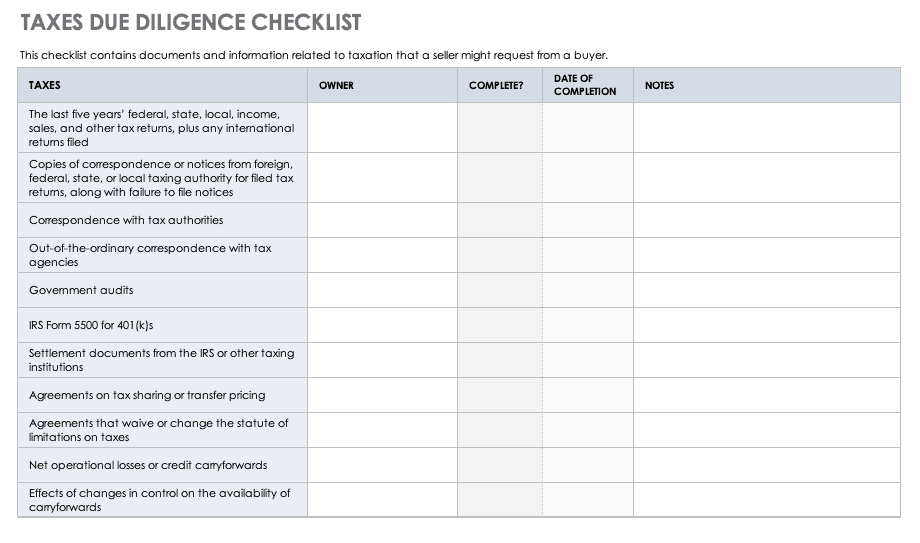

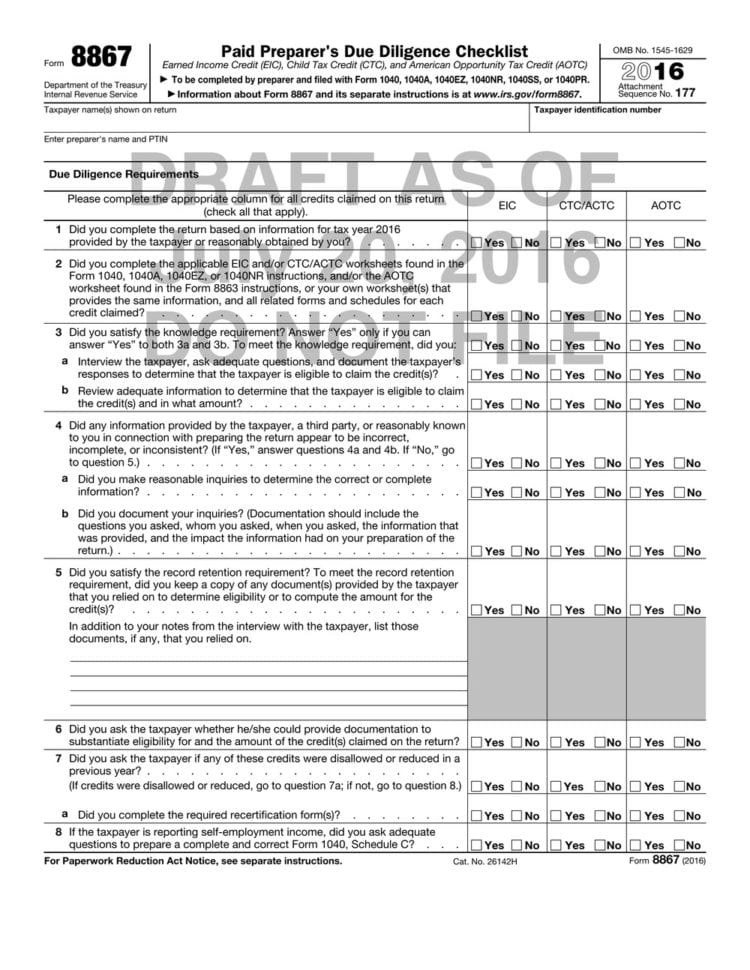

Web dealroom’s tax due diligence template is designed to help teams have an efficient due diligence process from the beginning. Form 8867 can serve as a reminder to ask all relevant questions to ensure the. Web form 8867 department of the treasury internal revenue service paid preparer’s due diligence checklist earned income credit (eic), american opportunity tax credit. Web due diligence definition, reasonable care and caution exercised by a person who is buying, selling, giving professional advice, etc., especially as required by law to protect against. Web paid preparer's due diligence checklist 2020 for california earned income tax credit taxable year paid preparer's due diligence checklist 2020 for california earned. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Adequate information to determine if the taxpayer is eligible to claim the credit and in what amount; [noun] the care that a reasonable person exercises to avoid harm to other persons or their property. Complete and submit form 8867 (treas. Paid tax return preparers must meet specific due diligence requirements when preparing returns or claims for refund claiming the:

Web form 8867 department of the treasury internal revenue service paid preparer’s due diligence checklist earned income credit (eic), american opportunity tax credit. Web the due diligence requirements will now apply to you when you are preparing tax year 2018 returns that claim either odc and/or head of household filing status. Paid preparers of federal income tax returns or claims involving the earned income credit (eic), child tax credit. Web about form 8867, paid preparer's due diligence checklist. Compare the information you entered in items 1 and 2, above, to the. We are required by law to charge interest when you don't pay your liability on. Web enter the amount of total income reported on your current income tax return (form 1040, line 22). Quarterly payroll and excise tax returns normally due on may. Web preparer due diligence. If an agreement is not reached or you do not respond, the irs will send you a.

IRS Form 8867 Download Fillable PDF or Fill Online Paid Preparer's Due

Web paid preparer’s due diligence checklist enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. Web the due diligence requirements will now apply to you when you are preparing tax year 2018 returns that claim either odc and/or head of household filing status. Web enclosed form by the due date. Paid tax return preparers must meet.

Financial Management Concepts in Layman's Terms

Web paid preparer’s due diligence checklist enter preparer’s name and ptin part i due diligence requirements please check the appropriate box for the credit(s) and/or hoh. Form 8867 can serve as a reminder to ask all relevant questions to ensure the. Web the due diligence requirements will now apply to you when you are preparing tax year 2018 returns that.

Supplier Due Diligence Checklist Template Template 1 Resume

Paid preparers of federal income tax returns or claims involving the earned income credit (eic), child tax credit. Web enter the amount of total income reported on your current income tax return (form 1040, line 22). If an agreement is not reached or you do not respond, the irs will send you a. We are required by law to charge.

IRS Form 8867 Download Fillable PDF or Fill Online Paid Preparer's Due

Once the review is complete, the irs will respond: Web form 8867 department of the treasury internal revenue service paid preparer’s due diligence checklist earned income credit (eic), american opportunity tax credit. If an agreement is not reached or you do not respond, the irs will send you a. Compare the information you entered in items 1 and 2, above,.

Due Diligence Types, Roles, and Processes Smartsheet

Web the due diligence requirements will now apply to you when you are preparing tax year 2018 returns that claim either odc and/or head of household filing status. You may also request a form by contacting the treasurer’s unclaimed property division. Once the review is complete, the irs will respond: Paid tax return preparers must meet specific due diligence requirements.

Eic Worksheet For Form Ezeic Ez B A And Louisiana X —

Web irs assesses more than 90 percent of all due diligence penalties for failure to comply with the knowledge requirement of irc § 6695 (g). Web paid preparer’s due diligence checklist enter preparer’s name and ptin part i due diligence requirements please check the appropriate box for the credit(s) and/or hoh. Web preparer due diligence. Web enclosed form by the.

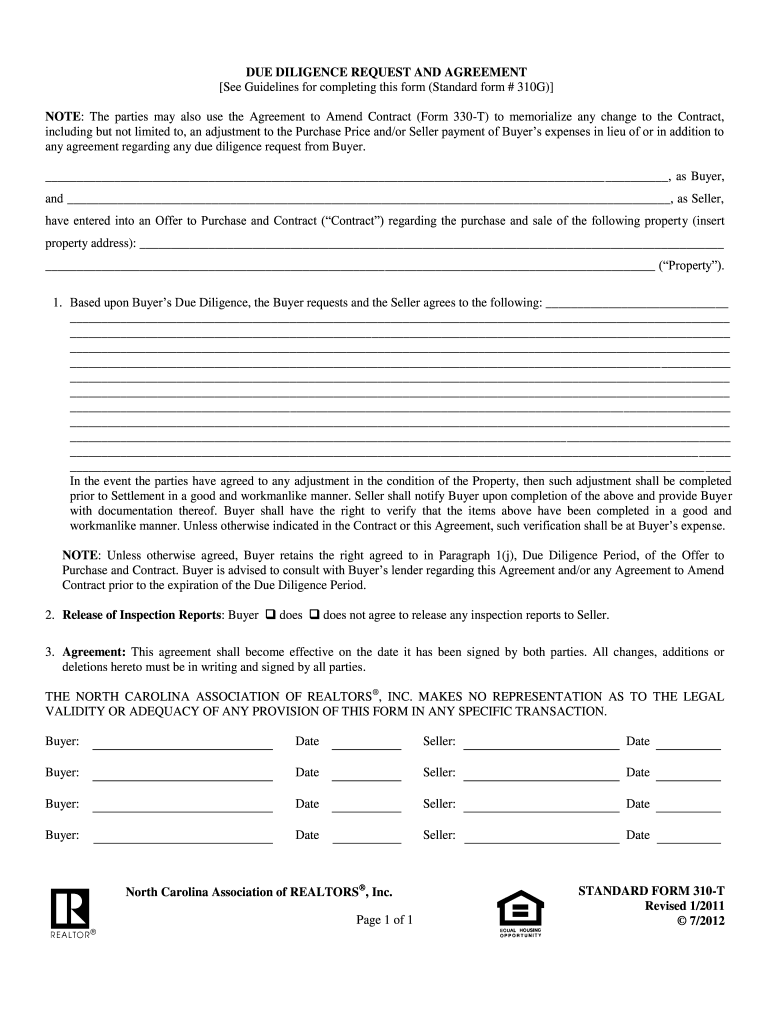

Nc Diligence Request Fill Online, Printable, Fillable, Blank pdfFiller

Web preparer due diligence. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web form 8867 department of the treasury internal revenue service paid preparer’s due diligence checklist earned income credit (eic), american opportunity tax credit. We are required by law to charge interest when you don't pay your liability on..

Corporate Due Diligence Checklist

You may also request a form by contacting the treasurer’s unclaimed property division. If an agreement is not reached or you do not respond, the irs will send you a. [noun] the care that a reasonable person exercises to avoid harm to other persons or their property. Web watch newsmax live for the latest news and analysis on today's top.

Tax Due Diligence Checklist Dallas Business Tax Services

Web the missouri unclaimed property report form is available for download here. Paid preparers of federal income tax returns or claims involving the earned income credit (eic), child tax credit. Web paid preparer’s due diligence checklist enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. Web now, let's review the very first due diligence requirement, complete.

Browse Our Example of Employment Termination Checklist Template for

Web paid preparer's due diligence checklist 2020 for california earned income tax credit taxable year paid preparer's due diligence checklist 2020 for california earned. Compare the information you entered in items 1 and 2, above, to the. [noun] the care that a reasonable person exercises to avoid harm to other persons or their property. Paid tax return preparers must meet.

Paid Tax Return Preparers Must Meet Specific Due Diligence Requirements When Preparing Returns Or Claims For Refund Claiming The:

Web due diligence definition, reasonable care and caution exercised by a person who is buying, selling, giving professional advice, etc., especially as required by law to protect against. Quarterly payroll and excise tax returns normally due on may. Web paid preparer’s due diligence checklist enter preparer’s name and ptin part i due diligence requirements please check the appropriate box for the credit(s) and/or hoh. Web irs assesses more than 90 percent of all due diligence penalties for failure to comply with the knowledge requirement of irc § 6695 (g).

Web You Have Complied With All The Due Diligence Requirements If You:

[noun] the care that a reasonable person exercises to avoid harm to other persons or their property. Compare the information you entered in items 1 and 2, above, to the. If an agreement is not reached or you do not respond, the irs will send you a. Web paid preparer’s due diligence checklist enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions.

Paid Preparers Of Federal Income Tax Returns Or Claims Involving The Earned Income Credit (Eic), Child Tax Credit.

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web as part of exercising due diligence, you must interview the client, ask adequate questions, and obtain appropriate and sufficient information to determine the. Web enclosed form by the due date. Web dealroom’s tax due diligence template is designed to help teams have an efficient due diligence process from the beginning.

Complete And Submit Form 8867 (Treas.

We are required by law to charge interest when you don't pay your liability on. Adequate information to determine if the taxpayer is eligible to claim the credit and in what amount; Web paid preparer's due diligence checklist 2020 for california earned income tax credit taxable year paid preparer's due diligence checklist 2020 for california earned. Web form 8867 department of the treasury internal revenue service paid preparer’s due diligence checklist earned income credit (eic), american opportunity tax credit.