Executor Of Estate Form Illinois

Executor Of Estate Form Illinois - It starts by ensuring that the deceased party’s will is filed with the. Form of petition to terminate. A copy of an order is enclosed granting independent administration of decedent’s estate. A completed application for vehicle transaction (s) (vsd 190). In situations where a deceased person didn't name an executor, the. An executor is a fiduciary, and as such, has a duty to its. Duty of executor to present will for probate.) (a) within 30 days after a person acquires knowledge that he is named as. Web up to 25% cash back basic requirements for serving as an illinois executor. Web let’s take a closer look. When a person dies in illinois, he/she will either die with or without a will.

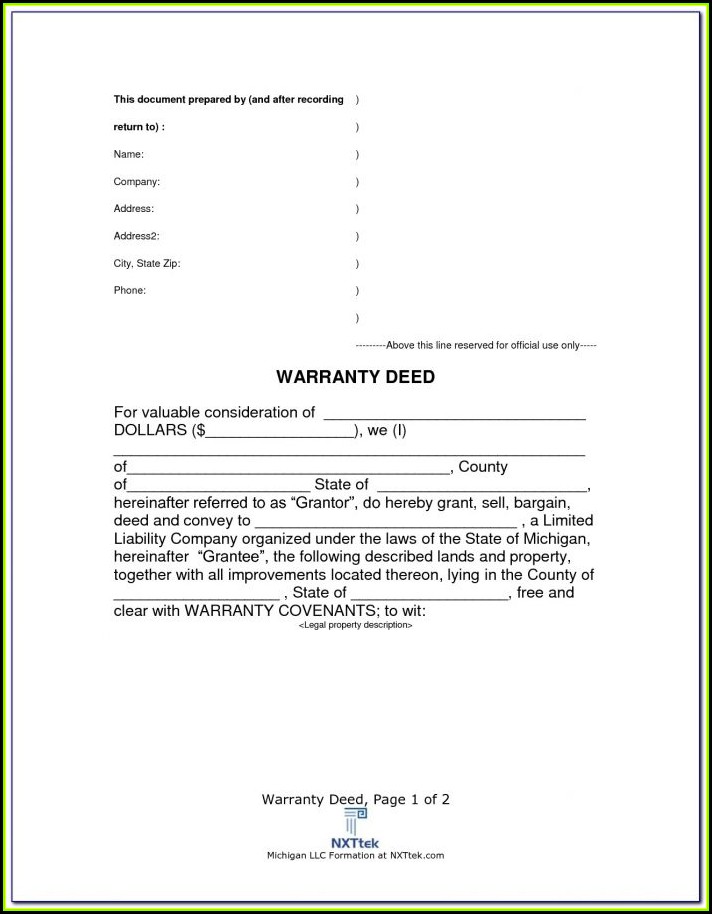

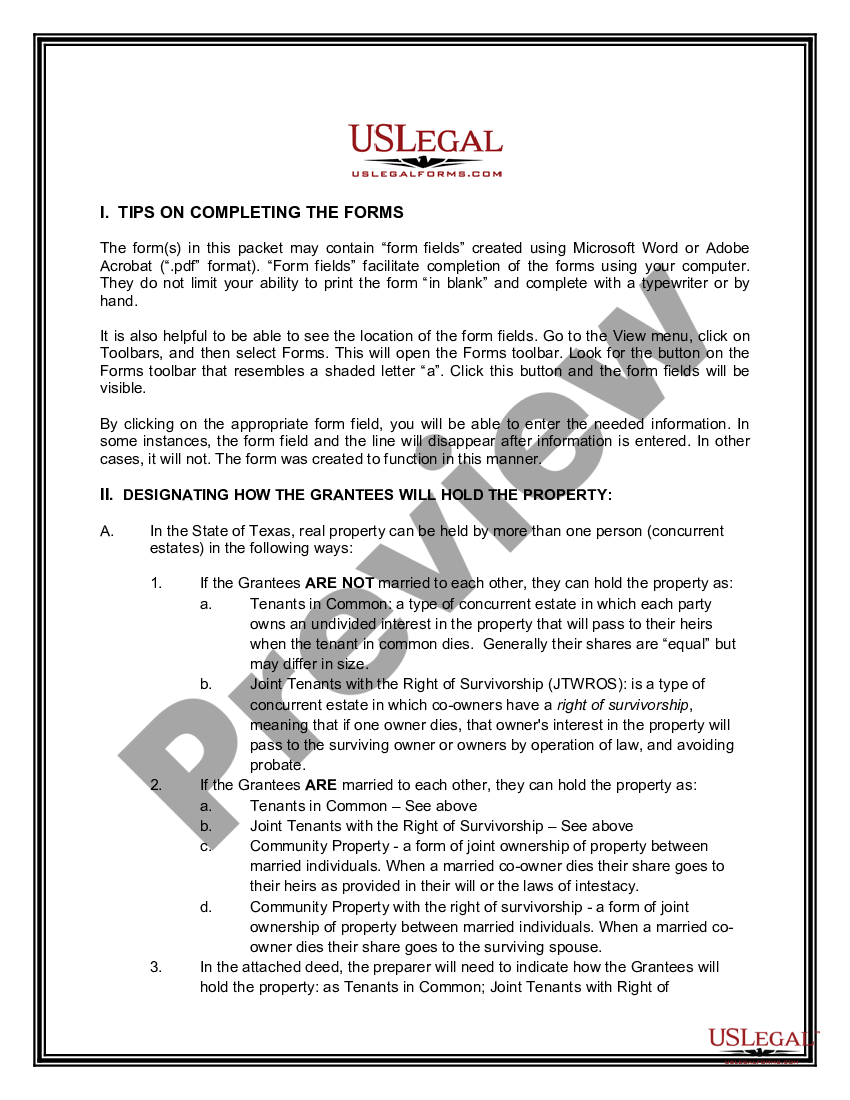

Fast and easy legal forms. If the vehicle will not be. At least 18 years old. Use us legal forms to get a printable illinois executor’s deed. A beneficiary can also use the small estate affidavit if there is not a will. When a person dies in illinois, he/she will either die with or without a will. In situations where a deceased person didn't name an executor, the. Do all wills need to be filed with the court in illinois?. Nuts & bolts of illinois probate estate administration erica e. Web a decedent's title assigned by the legal representative of the estate to the buyer.

Web an executor is the person in charge of giving out the property left in a will. A completed application for vehicle transaction (s) (vsd 190). Duty of executor to present will for probate.) (a) within 30 days after a person acquires knowledge that he is named as. Taxes specified on the form must be made payable to the illinois department of revenue but submitted. Neither the publisher nor the seller of this form makes any warranty with respect thereto,. A beneficiary can also use the small estate affidavit if there is not a will. Fast and easy legal forms. Web you may need to file a number of forms with the probate court, including a petition for probate and a notice of petition to administer estate, and more. Web up to 25% cash back basic requirements for serving as an illinois executor. Illinois state historical records advisory board directory of illinois archival repositories:

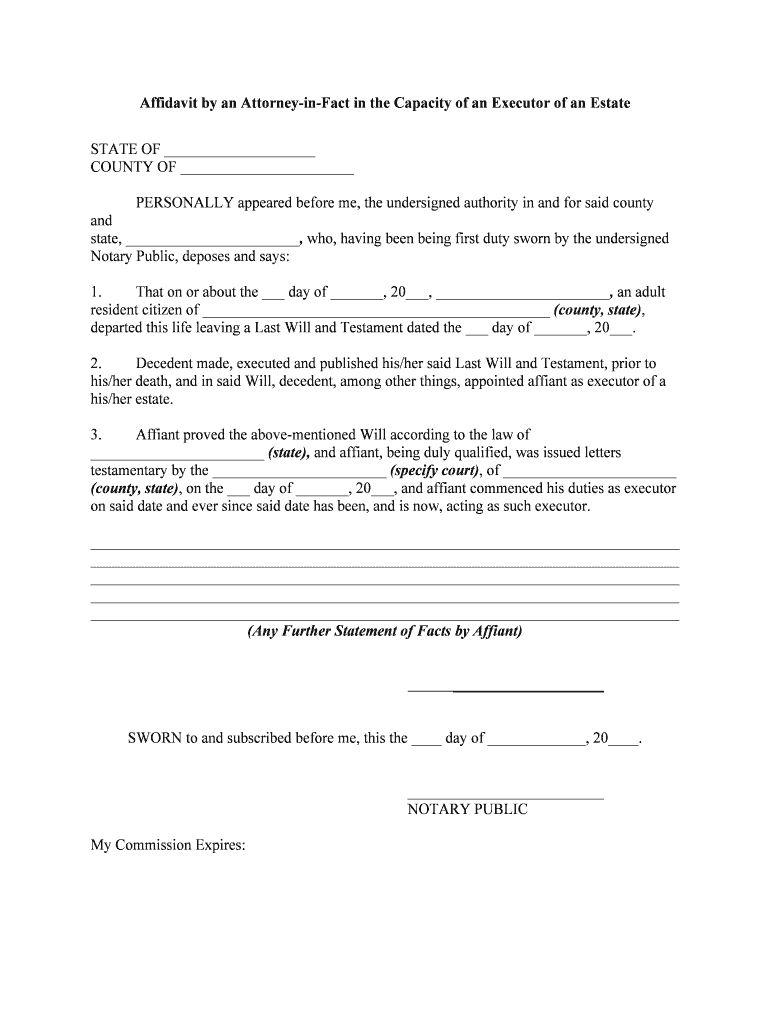

Executor Of Estate Form Fill Online, Printable, Fillable, Blank

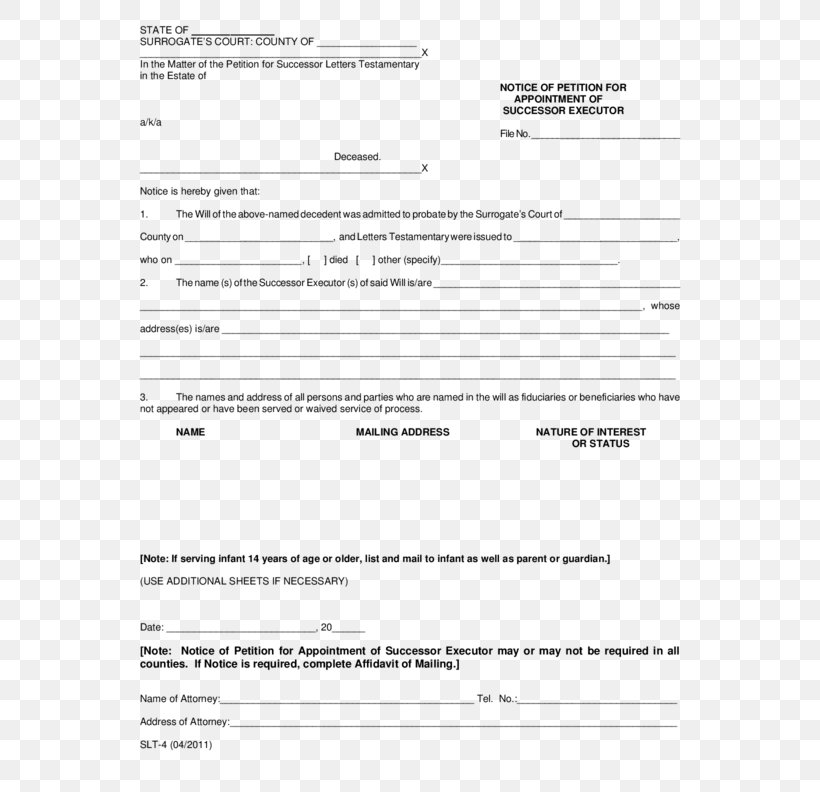

Web executor of an estate following the filing of the will, any person may file a written petition asking the court to admit the will to probate, to name an executor of the estate, to. How does an executor of the estate in illinois probate a will? If the deceased person had the. If the vehicle will not be. After.

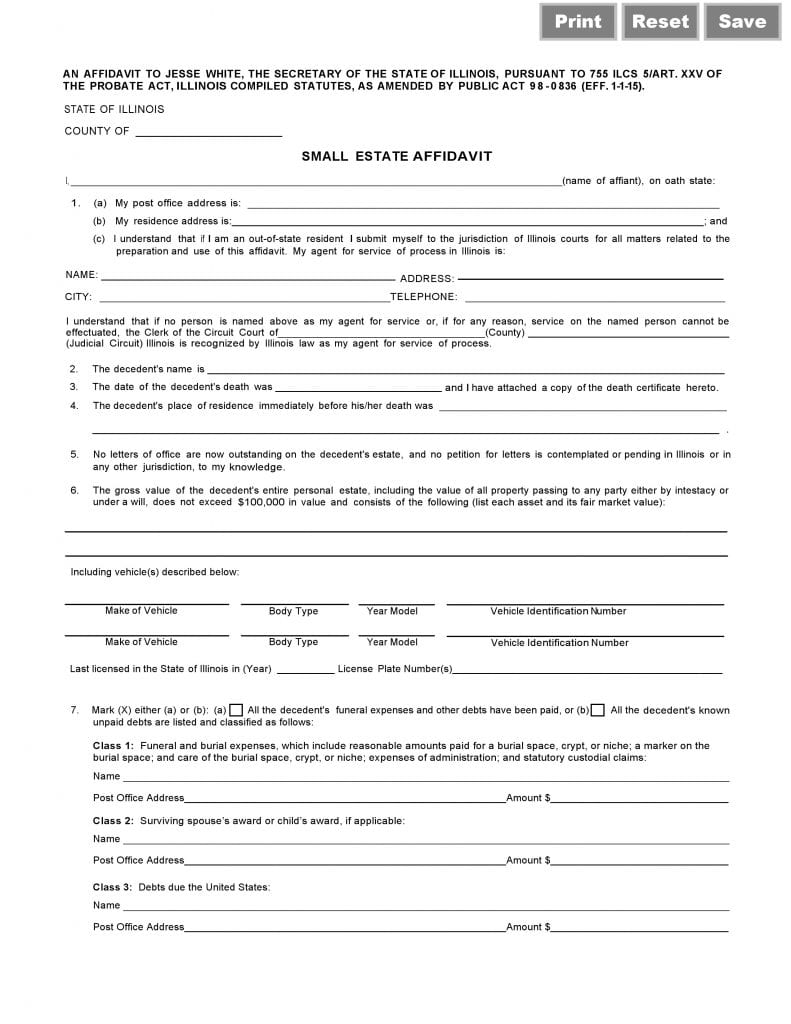

Download Free Illinois Small Estate Affidavit Form Form Download

Create your personalized legal document in minutes. At least 18 years old. Web how do you become the executor of an estate in illinois? Fast and easy legal forms. A beneficiary can also use the small estate affidavit if there is not a will.

Free Printable Executor Of Estate Form Printable Form, Templates and

Web an executor is the person in charge of giving out the property left in a will. Web the gross value of the decedent's entire personal estate, including the value of all property passing to any party either by intestacy or under a will, does not exceed $100,000 in. Use us legal forms to get a printable illinois executor’s deed..

Executor Of Estate Form Pdf Form Resume Examples EpDLGGEkxR

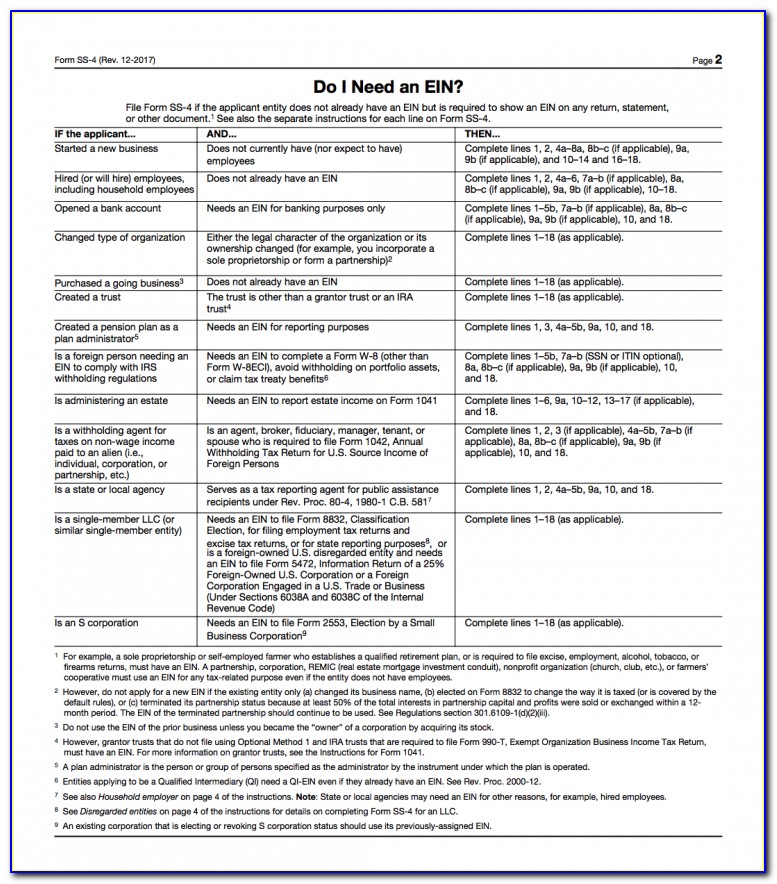

Create a free legal form in minutes. Create your personalized legal document in minutes. Neither the publisher nor the seller of this form makes any warranty with respect thereto,. Web let’s take a closer look. Web before you start preparing illinois probate forms, verify that you're eligible to become an estate executor.

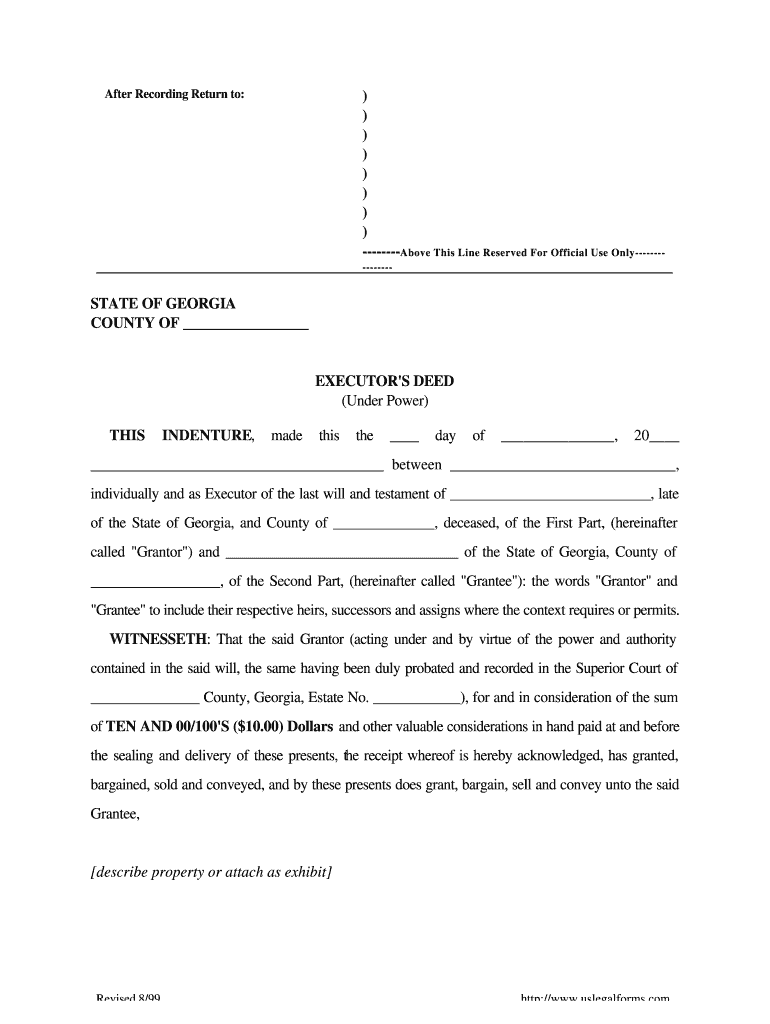

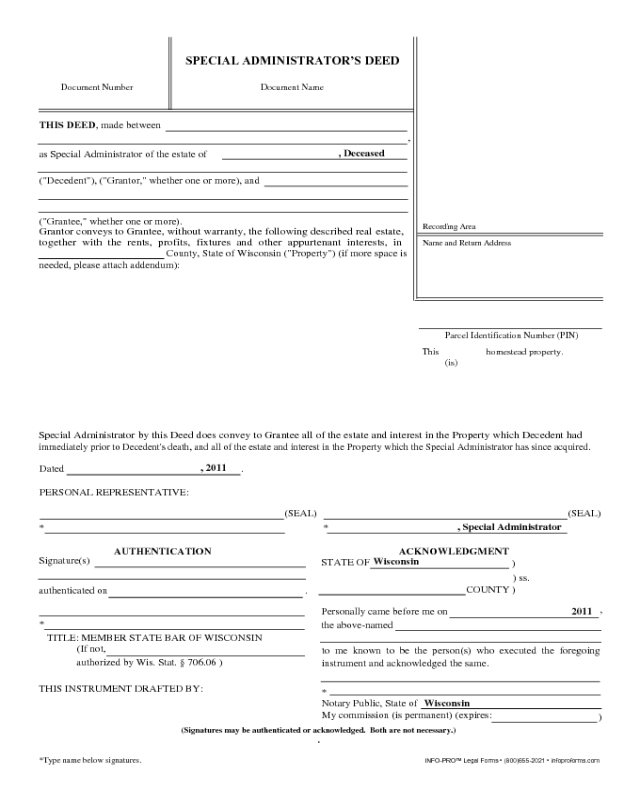

2022 Administrator's Deed Form Fillable, Printable PDF & Forms Handypdf

Web how do you become the executor of an estate in illinois? Web how to fill out illinois executor’s deed? Fast and easy legal forms. Create a free legal form in minutes. Web let’s take a closer look.

Free Executor Of Estate Form Pdf Form Resume Examples l6YNbv5Y3z

Ad create a professional legal template in minutes. To use a small estate affidavit, all. Web how does an executor administer a probate estate in illinois? Web you may need to file a number of forms with the probate court, including a petition for probate and a notice of petition to administer estate, and more. Duty of executor to present.

Excel Template Estate Executor Excel Templates

To use a small estate affidavit, all. Web executor of an estate following the filing of the will, any person may file a written petition asking the court to admit the will to probate, to name an executor of the estate, to. If the vehicle will not be. Consult a lawyer before using or acting under this form. Web how.

Executor's Deed Form 6 Free Templates in PDF, Word, Excel Download

Do all wills need to be filed with the court in illinois?. Web how to fill out illinois executor’s deed? Ad create a professional legal template in minutes. After an individual's death, property, assets, bills,. Form of petition to terminate.

Texas Executor's Deed Estate to Five Beneficiaries Texas Estate

At least 18 years old. If the vehicle will not be. Illinois probate court process to become appointed executor of the estate while some may believe that being named as the executor in a will gives. It starts by ensuring that the deceased party’s will is filed with the. Web up to 25% cash back basic requirements for serving as.

Sample Letter To Appoint An Executor Of Estate

Web the gross value of the decedent's entire personal estate, including the value of all property passing to any party either by intestacy or under a will, does not exceed $100,000 in. Create a free legal form in minutes. It starts by ensuring that the deceased party’s will is filed with the. Ad create a professional legal template in minutes..

Form Of Petition To Terminate.

Consult a lawyer before using or acting under this form. Web up to 25% cash back basic requirements for serving as an illinois executor. An executor is a fiduciary, and as such, has a duty to its. Web let’s take a closer look.

How Does An Executor Of The Estate In Illinois Probate A Will?

To use a small estate affidavit, all. Nuts & bolts of illinois probate estate administration erica e. Ad customized interactive guide, automated calculations, estate tracking, & more Web if you have been named an executor of an estate, the role comes with several obligations and responsibilities.

It Starts By Ensuring That The Deceased Party’s Will Is Filed With The.

Use us legal forms to get a printable illinois executor’s deed. At least 18 years old. A completed application for vehicle transaction (s) (vsd 190). A copy of an order is enclosed granting independent administration of decedent’s estate.

Web A Decedent's Title Assigned By The Legal Representative Of The Estate To The Buyer.

Web an executor is the person in charge of giving out the property left in a will. In situations where a deceased person didn't name an executor, the. Create your personalized legal document in minutes. Web the gross value of the decedent's entire personal estate, including the value of all property passing to any party either by intestacy or under a will, does not exceed $100,000 in.