Fed Rate Calendar

Fed Rate Calendar - Web 12 economic release dates for release: Web board of governors of the federal reserve system the federal reserve, the central bank of the united states, provides the nation with a safe, flexible, and stable monetary. The fomc has eight regularly scheduled meetings each year and announces its policy decisions at 2 p.m. Web the federal open market committee (fomc) sets a target range for the federal funds rate. Not a deposit • not. Web get the fed interest rate decision results in real time as they're announced and see the immediate global market impact. Shows the daily level of the federal funds rate back to 1954. Investment and insurance products are: Web 33 economic release dates. Economic reports & fed speakers.

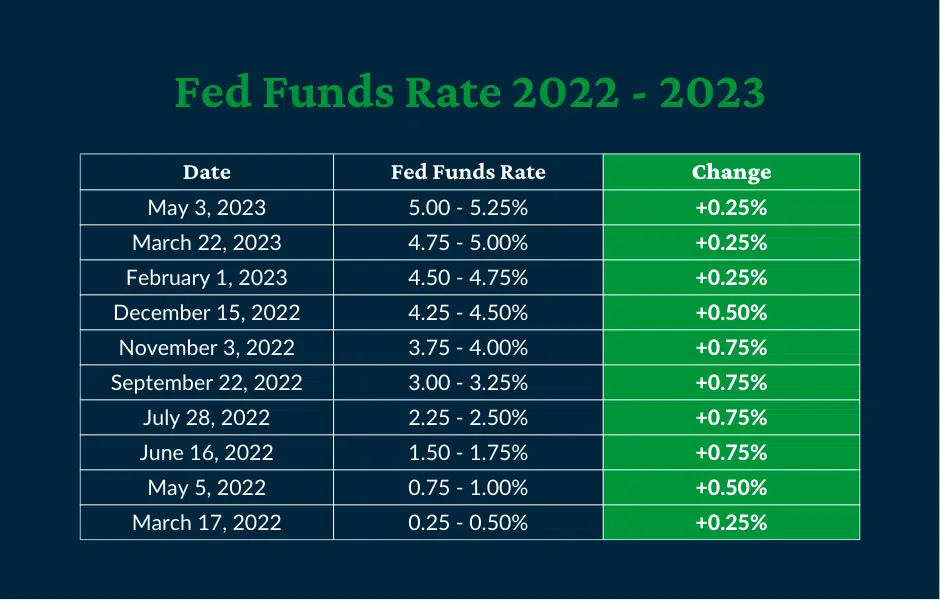

Web last week's major u.s. Web the current federal funds rate as of august 30, 2024 is 5.33%. In the span of just a year and a half, the fed hiked interest rates 11 times. Indexes edge up ahead of major fed interest rate decision. Web what is the likelihood that the fed will change the federal target rate at upcoming fomc meetings, according to interest rate traders? Use cme fedwatch to track the. Web 33 economic release dates. Web find the dates, statements, minutes, and projections of the federal open market committee (fomc) meetings from 2019 to 2024. Web the fed said the cut lowers the federal funds rate into a range of 4.75% to 5%, down from its prior range of 5.25% to 5.5%, which had been its highest level in 23 years. Web 12 economic release dates for release:

Web federal reserve cuts rates by 50 basis points. Economic reports & fed speakers. Federal reserve's federal open market committee (fomc) statement is the primary tool the panel uses to communicate with investors about monetary policy. Web board of governors of the federal reserve system the federal reserve, the central bank of the united states, provides the nation with a safe, flexible, and stable monetary. Investment and insurance products are: Web since march of 2022, the fomc has been tightening monetary policy by increasing the fed funds rate. Download, graph, and track economic data. Web here's when the fed will meet in 2023. Web 12 economic release dates for release: Download, graph, and track economic data.

Fed Rate Decision Schedule 2024 Calendar Cassi Wileen

The current odds of further rate hikes by the end of the. Web federal reserve cuts rates by 50 basis points. Download, graph, and track economic data. Shows the daily level of the federal funds rate back to 1954. Web the federal open market committee (fomc) sets a target range for the federal funds rate.

Us Fed Rate Cut 2024 Calendar Liuka Rosalynd

Web the current federal funds rate as of august 30, 2024 is 5.33%. The second half could even see rate cuts. Web 33 economic release dates. Not a deposit • not. The median forecasts in this calendar come from surveys of economists conducted by dow jones newswires and.

Fed Interest Rate Decision Calendar Michael Lewis

Not a deposit • not. Eastern time on the second day of each meeting. Sep 18, 2024, 6:32 am pdt. Web board of governors of the federal reserve system the federal reserve, the central bank of the united states, provides the nation with a safe, flexible, and stable monetary. The first half of the year could see the fed move.

Fed Rate Increase Calendar 2024 Rorie Lilian

Web board of governors of the federal reserve system the federal reserve, the central bank of the united states, provides the nation with a safe, flexible, and stable monetary. Indexes edge up ahead of major fed interest rate decision. Download, graph, and track economic data. Shows the daily level of the federal funds rate back to 1954. Web the current.

Us Fed Meeting Dates 2024 Naomi Virgina

The fed funds rate is the interest rate at which. The median forecasts in this calendar come from surveys of economists conducted by dow jones newswires and. Eastern time on the second day of each meeting. Download, graph, and track economic data. The first half of the year could see the fed move to pause rates.

Fed Rate Increase Calendar 2024 Rorie Lilian

The fomc has eight regularly scheduled meetings each year and announces its policy decisions at 2 p.m. Trading economics provides an economic calendar for several countries and historical data for. Web here's when the fed will meet in 2023. Web the fed said the cut lowers the federal funds rate into a range of 4.75% to 5%, down from its.

When Is The Next Fed Rate Meeting In 2024 Pris Catrina

Web find the dates, statements, minutes, and projections of the federal open market committee (fomc) meetings from 2019 to 2024. Web 33 economic release dates. Economic reports & fed speakers. Web here's when the fed will meet in 2023. Web last week's major u.s.

Fed Rate Increase Calendar 2024 Rorie Lilian

Web the current federal funds rate as of august 30, 2024 is 5.33%. Web stock market today: Web get the fed interest rate decision results in real time as they're announced and see the immediate global market impact. Web to support the committee's decision to raise the target range for the federal funds rate, the board of governors of the.

Us Fed Rate Cut 2024 Calendar Moll Teresa

In the span of just a year and a half, the fed hiked interest rates 11 times. The fomc has eight regularly scheduled meetings each year and announces its policy decisions at 2 p.m. Use cme fedwatch to track the. Economic reports & fed speakers. Federal reserve bank chair jerome powell.

Fed rate hike AndersonMyda

Federal reserve's federal open market committee (fomc) statement is the primary tool the panel uses to communicate with investors about monetary policy. Download, graph, and track economic data. In the span of just a year and a half, the fed hiked interest rates 11 times. Web 12 economic release dates for release: Web 33 economic release dates.

Web Board Of Governors Of The Federal Reserve System The Federal Reserve, The Central Bank Of The United States, Provides The Nation With A Safe, Flexible, And Stable Monetary.

The first half of the year could see the fed move to pause rates. The current odds of further rate hikes by the end of the. Eastern time on the second day of each meeting. Web get the fed interest rate decision results in real time as they're announced and see the immediate global market impact.

Web 12 Economic Release Dates For Release:

Investment and insurance products are: The second half could even see rate cuts. Web 33 economic release dates. Federal reserve's federal open market committee (fomc) statement is the primary tool the panel uses to communicate with investors about monetary policy.

The Fomc Has Eight Regularly Scheduled Meetings Each Year And Announces Its Policy Decisions At 2 P.m.

Federal reserve bank chair jerome powell. Web federal reserve cuts rates by 50 basis points. The fed funds rate is the interest rate at which. Not a deposit • not.

Indexes Edge Up Ahead Of Major Fed Interest Rate Decision.

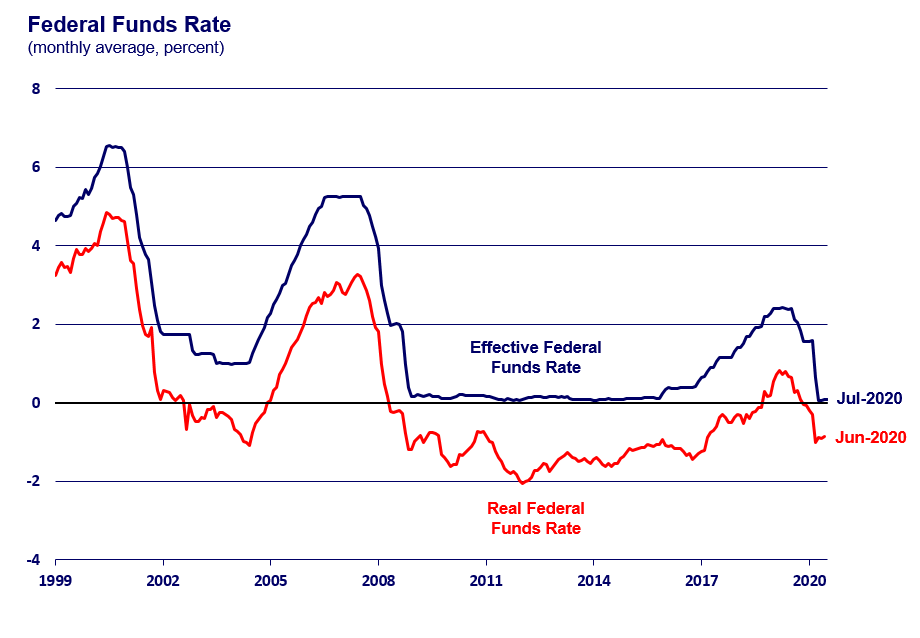

Shows the daily level of the federal funds rate back to 1954. Web the current federal funds rate as of august 30, 2024 is 5.33%. Economic reports & fed speakers. Web what is the likelihood that the fed will change the federal target rate at upcoming fomc meetings, according to interest rate traders?