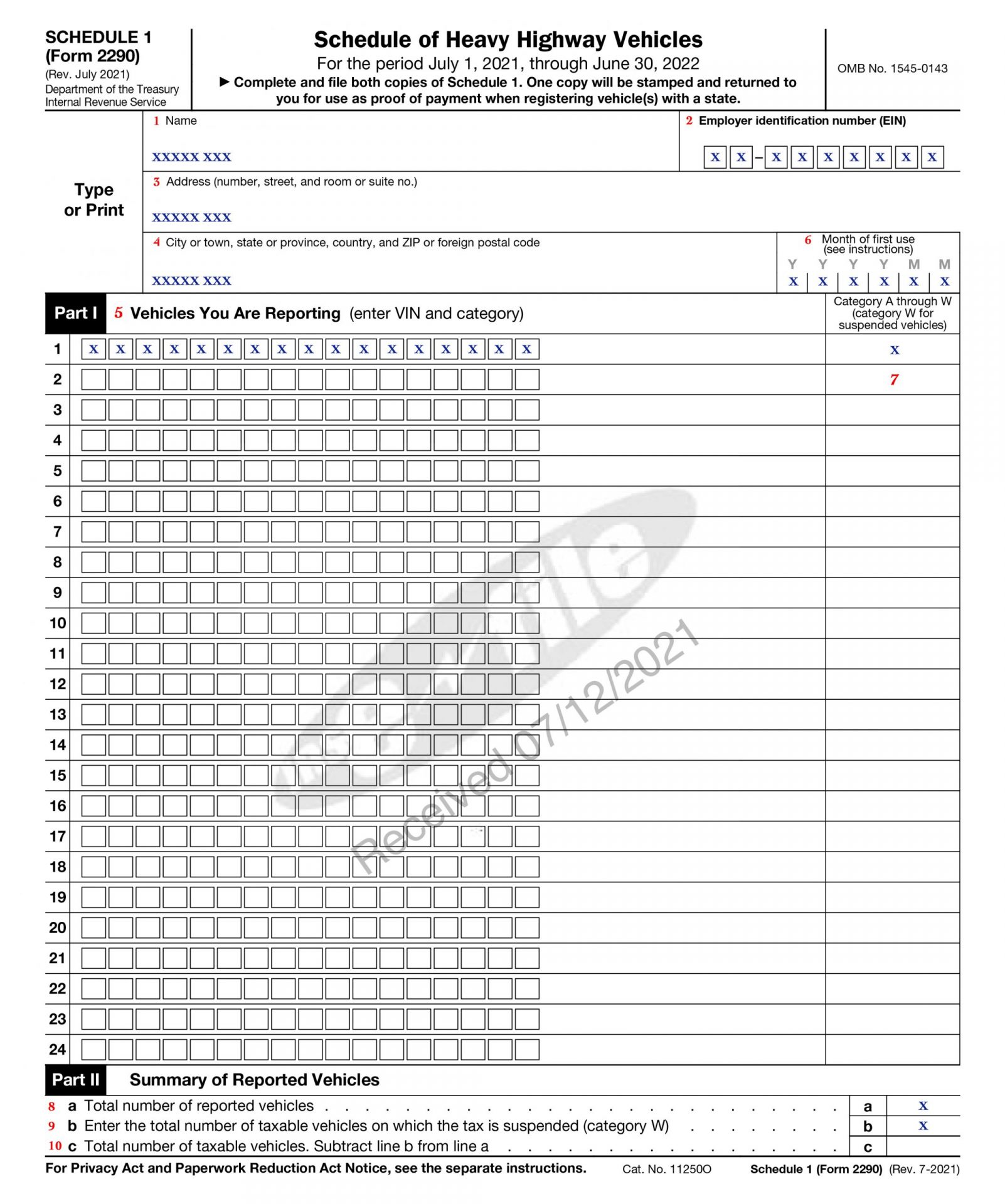

Federal Form 2290 Schedule 1

Federal Form 2290 Schedule 1 - Provide consent to tax information disclosure as part of schedule 1. Web go to www.irs.gov/form2290 for instructions and the latest information. A federal highway use tax is a yearly fee levied on vehicle operators who travel on public highways with heavy loads. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Filing 2290 online document do not specifically prevent reporters from using online tools for submission purposes. See month of first use under schedule 1 (form 2290) ,. Web irs schedule 1 form 2290 is a crucial document that comes in handy during vehicle inspections and tax verification proceedings. Truckers pay heavy vehicle use taxes by filing form 2290 with the irs. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. You can choose to use v version as a payment voucher.

Web schedule 1 (form 2290)—month of first use. Filing 2290 online document do not specifically prevent reporters from using online tools for submission purposes. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. This is important, as the hvut is due by the last day of the month following the month you first used the vehicle. A federal highway use tax is a yearly fee levied on vehicle operators who travel on public highways with heavy loads. Provide consent to tax information disclosure as part of schedule 1. Web schedule 1 form 2290 acts as proof of highway tax paid to the irs for operating vehicles weighing 55,000 pounds or more. Keep a copy of this return for your records. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the period and the vehicle h.

You can choose to use v version as a payment voucher. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web irs schedule 1 form 2290 is a crucial document that comes in handy during vehicle inspections and tax verification proceedings. Web complete and file two copies of schedule 1, schedule of heavy highway vehicles. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Keep a copy of this return for your records. A federal highway use tax is a yearly fee levied on vehicle operators who travel on public highways with heavy loads. Truckers pay heavy vehicle use taxes by filing form 2290 with the irs. Web schedule 1 form 2290 acts as proof of highway tax paid to the irs for operating vehicles weighing 55,000 pounds or more.

Printable IRS Form 2290 for 2020 Download 2290 Form

See month of first use under schedule 1 (form 2290) ,. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Filing 2290 online document do not specifically prevent reporters from using online tools for submission purposes. Web irs schedule 1 form 2290 is a crucial document that comes in handy during vehicle.

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the.

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

Web go to www.irs.gov/form2290 for instructions and the latest information. Truckers pay heavy vehicle use taxes by filing form 2290 with the irs. This is important, as the hvut is due by the last day of the month following the month you first used the vehicle. Web schedule 1 (form 2290)—month of first use. Everyone must complete the first and.

Federal Form 2290 Schedule 1 Universal Network

Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the.

A Guide to Form 2290 Schedule 1

Filing 2290 online document do not specifically prevent reporters from using online tools for submission purposes. See when to file form 2290 for more details. Truckers pay heavy vehicle use taxes by filing form 2290 with the irs. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june.

Free Printable Form 2290 Printable Templates

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. See when to file form 2290 for more details. Web irs schedule 1 form 2290 is a crucial document that comes in handy during vehicle inspections and tax verification proceedings. Everyone must complete the first and second pages.

Schedule 1 2290 IRS Form 2290 Schedule 1 eForm 2290

Web complete and file two copies of schedule 1, schedule of heavy highway vehicles. A federal highway use tax is a yearly fee levied on vehicle operators who travel on public highways with heavy loads. Keep a copy of this return for your records. Web irs schedule 1 form 2290 is a crucial document that comes in handy during vehicle.

Get Form 2290 Schedule 1 in Minutes HVUT Proof of Payment

Truckers pay heavy vehicle use taxes by filing form 2290 with the irs. Web go to www.irs.gov/form2290 for instructions and the latest information. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Filing 2290 online document do not specifically prevent.

Understanding Form 2290 StepbyStep Instructions for 20222023

You can choose to use v version as a payment voucher. See when to file form 2290 for more details. Provide consent to tax information disclosure as part of schedule 1. Web irs schedule 1 form 2290 is a crucial document that comes in handy during vehicle inspections and tax verification proceedings. A federal highway use tax is a yearly.

File IRS 2290 Form Online for 20222023 Tax Period

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under.

Web You Must File Form 2290 And Schedule 1 For The Tax Period Beginning On July 1, 2023, And Ending On June 30, 2024, If A Taxable Highway Motor Vehicle (Defined Below) Is Registered, Or Required To Be Registered, In Your Name Under State, District Of Columbia, Canadian, Or Mexican Law At The Time Of Its First Use During The Period And The Vehicle H.

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web irs schedule 1 form 2290 is a crucial document that comes in handy during vehicle inspections and tax verification proceedings. A federal highway use tax is a yearly fee levied on vehicle operators who travel on public highways with heavy loads. See month of first use under schedule 1 (form 2290) ,.

Web Schedule 1 (Form 2290)—Month Of First Use.

Filing 2290 online document do not specifically prevent reporters from using online tools for submission purposes. This is important, as the hvut is due by the last day of the month following the month you first used the vehicle. You can choose to use v version as a payment voucher. See when to file form 2290 for more details.

Web Complete And File Two Copies Of Schedule 1, Schedule Of Heavy Highway Vehicles.

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Truckers pay heavy vehicle use taxes by filing form 2290 with the irs. Web schedule 1 form 2290 acts as proof of highway tax paid to the irs for operating vehicles weighing 55,000 pounds or more. Provide consent to tax information disclosure as part of schedule 1.

Web Go To Www.irs.gov/Form2290 For Instructions And The Latest Information.

Keep a copy of this return for your records. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use.