File Form 1065 Extension

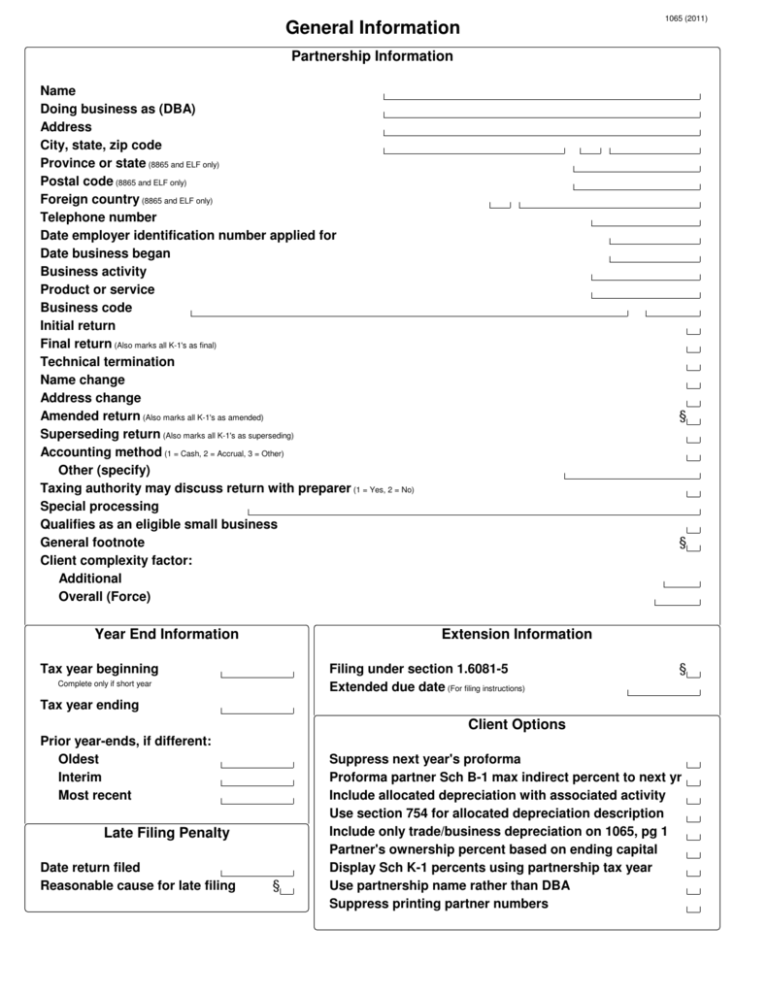

File Form 1065 Extension - Web you must file your extension request no later than the regular due date of your return. Form 7004 now consists of two parts. Ad filing your taxes just became easier. Web a commonly asked question is where to file a 1065 form. Taxpayers in certain disaster areas do not need to submit an extension. Web if you need more time to file form 1065, you may request an extension through filing form 7004, application for automatic extension of time to file certain. Extension overview alerts and notices trending ultratax cs topics section 163 (j) and form 8990 (1065) types of allocations (1065) electronic filing leave. Web find irs mailing addresses by state to file form 1065. And the total assets at the end of the. How you file the 1065 form will vary based on how you file your tax return.

A 1065 extension must be filed by midnight local time on the normal due date of the return. Web if the business is a c corporation then the extension is due by the 15th day of the 4th month after the end of your tax year. If the partnership's principal business, office, or agency is located in: For example, if your c corporation is a. Web form 1065 extensionis generally filed by domestic partnership which would need additional time to file 1065 return and is filed by the same date the actual 1065 return is due. Web when must the 7004 be filed? Taxact helps you maximize your deductions with easy to use tax filing software. Return of partnership income and extensions need more information on filing a form 1065? And the total assets at the end of the. Extension overview alerts and notices trending ultratax cs topics section 163 (j) and form 8990 (1065) types of allocations (1065) electronic filing leave.

Ad filing your taxes just became easier. Web a commonly asked question is where to file a 1065 form. Web you must file your extension request no later than the regular due date of your return. If the partnership's principal business, office, or agency is located in: Web if the business is a c corporation then the extension is due by the 15th day of the 4th month after the end of your tax year. In the case of a 1065, this is by the 15th day of the. Return of partnership income and extensions need more information on filing a form 1065? For filing deadlines and other information. Web if you need more time to file form 1065, you may request an extension through filing form 7004, application for automatic extension of time to file certain. How to file an extension:.

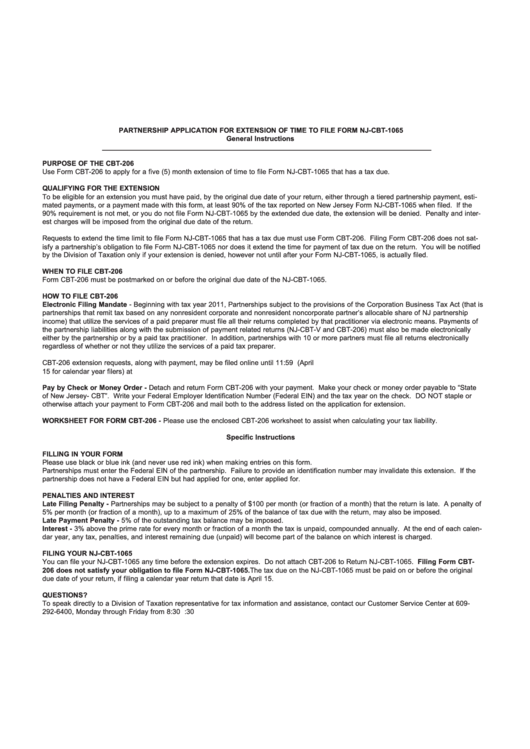

Form NjCbt1065 Partnership Application For Extension Of Time To

And the total assets at the end of the. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. For example, if your c corporation is a. How.

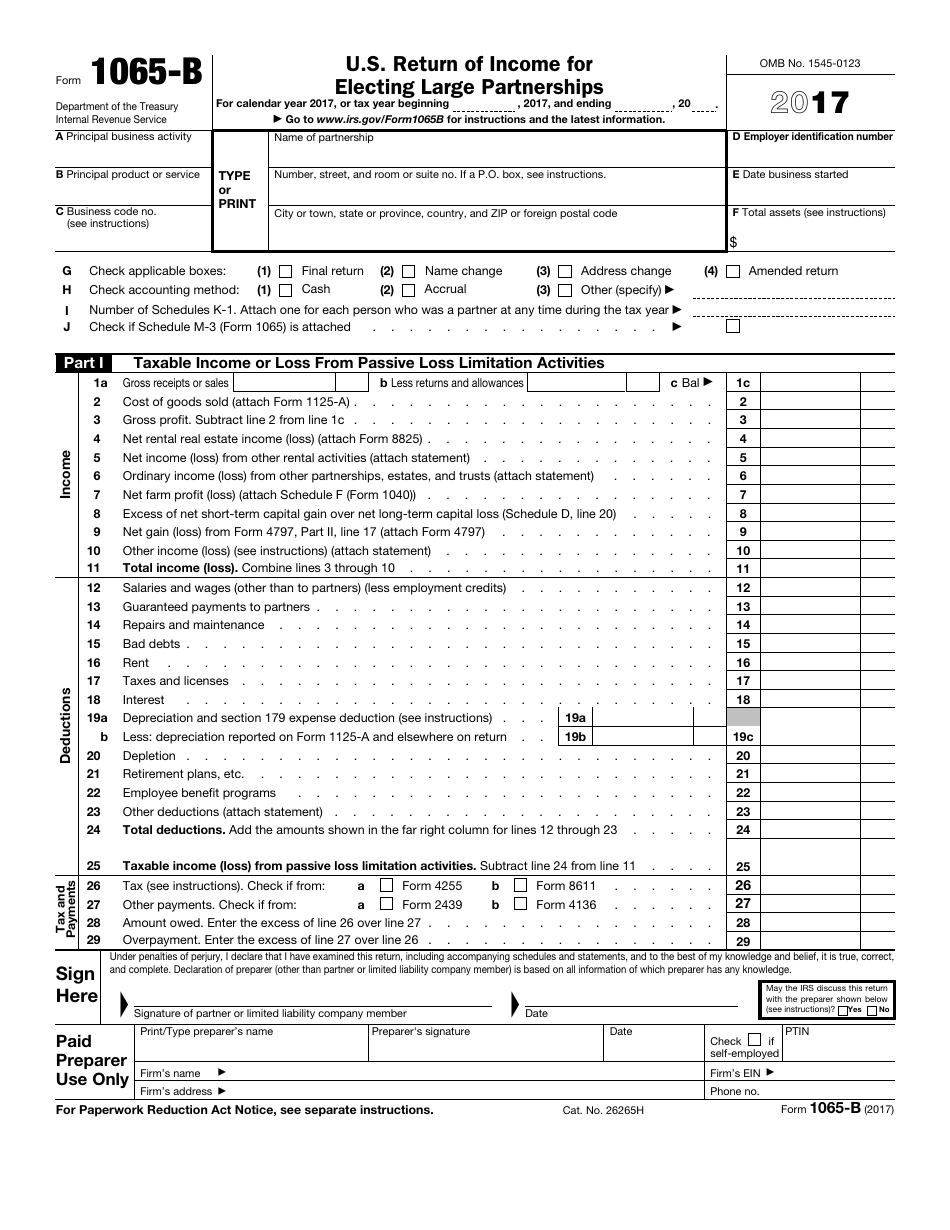

IRS Form 1065B Download Fillable PDF or Fill Online U.S. Return of

A 1065 extension must be filed by midnight local time on the normal due date of the return. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. For.

Form 1065 E File Requirements Universal Network

Web form 1065 extensionis generally filed by domestic partnership which would need additional time to file 1065 return and is filed by the same date the actual 1065 return is due. If the partnership's principal business, office, or agency is located in: Read this article to learn more. How you file the 1065 form will vary based on how you.

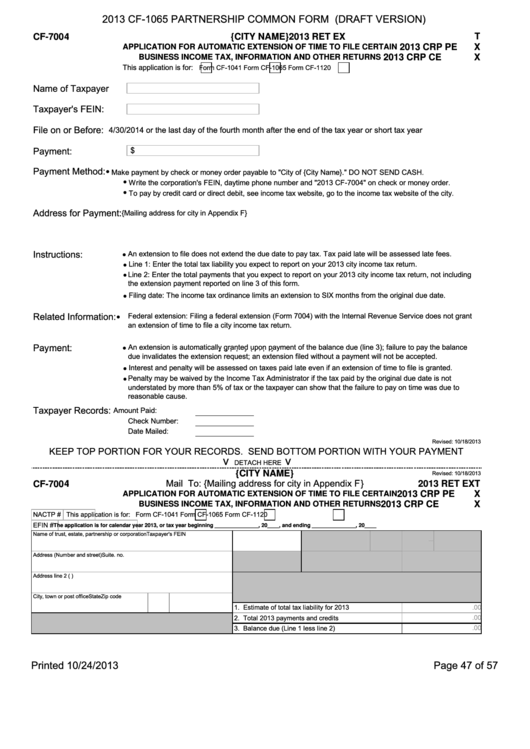

Form Cf1065 Draft Partnership Common Form 2013 printable pdf

For example, if your c corporation is a. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Web if the business is a c corporation then the extension is due by the 15th day of the 4th month after the end of your tax year. How you.

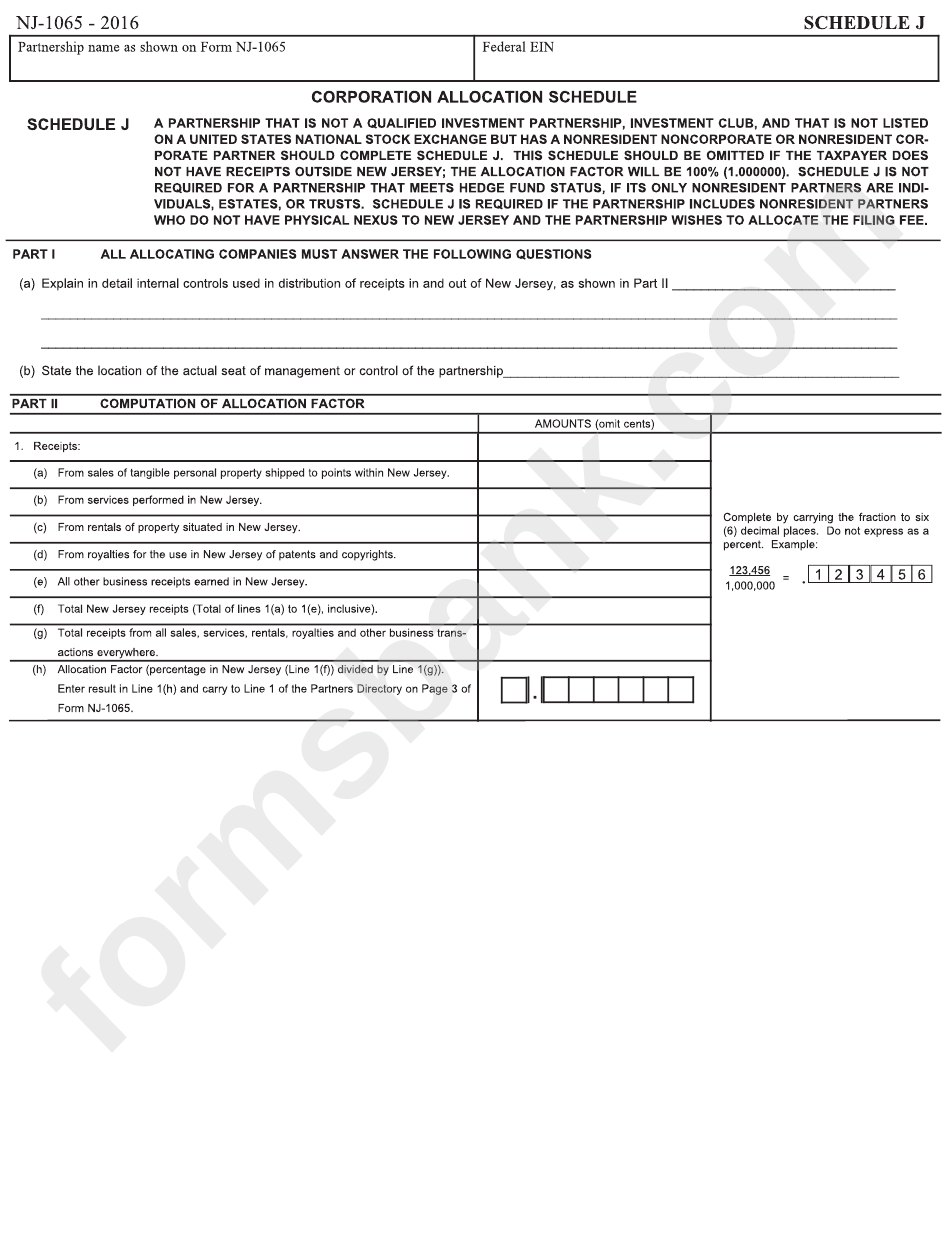

Fillable Form Nj1065 Corporation Allocation Schedule 2016

Ad filing your taxes just became easier. Read this article to learn more. Web find irs mailing addresses by state to file form 1065. For example, if your c corporation is a. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top.

Irs Form 1065 K 1 Instructions Universal Network

Web find irs mailing addresses by state to file form 1065. Web if the business is a c corporation then the extension is due by the 15th day of the 4th month after the end of your tax year. Taxact helps you maximize your deductions with easy to use tax filing software. Web you must file your extension request no.

Extension to file 1065 tax form asrposii

Form 7004 now consists of two parts. Read this article to learn more. Extension overview alerts and notices trending ultratax cs topics section 163 (j) and form 8990 (1065) types of allocations (1065) electronic filing leave. Web form 1065 extensionis generally filed by domestic partnership which would need additional time to file 1065 return and is filed by the same.

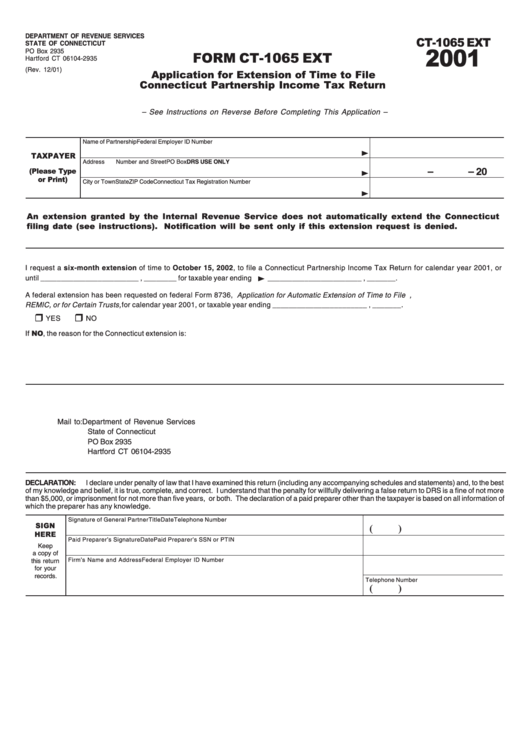

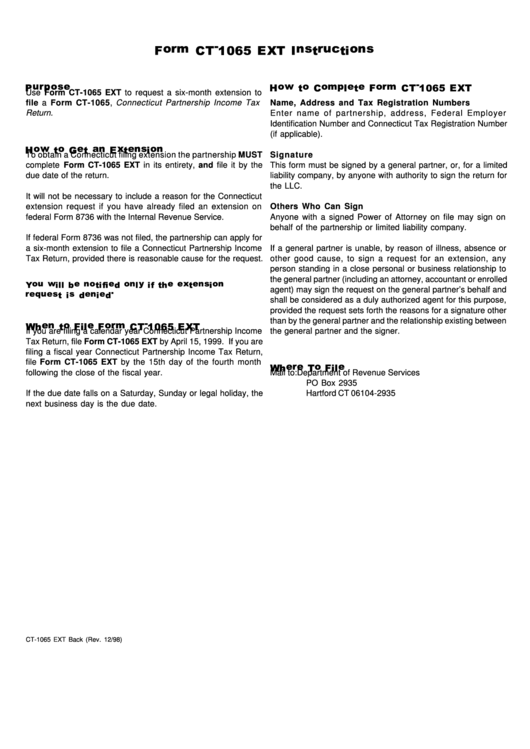

Form Ct1065 Ext Application For Extension Of Time To File

How to file an extension:. Ad filing your taxes just became easier. Extension overview alerts and notices trending ultratax cs topics section 163 (j) and form 8990 (1065) types of allocations (1065) electronic filing leave. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Or getting income.

File Form 1065 Extension Online Partnership Tax Extension

Taxpayers in certain disaster areas do not need to submit an extension. Taxact helps you maximize your deductions with easy to use tax filing software. And the total assets at the end of the. If the partnership's principal business, office, or agency is located in: Web if you need more time to file form 1065, you may request an extension.

Form Ct1065 Ext Instructions printable pdf download

Web form 1065 extensionis generally filed by domestic partnership which would need additional time to file 1065 return and is filed by the same date the actual 1065 return is due. And the total assets at the end of the. Extension overview alerts and notices trending ultratax cs topics section 163 (j) and form 8990 (1065) types of allocations (1065).

Web Form 1065 Is Used To Report The Income Of Every Domestic Partnership And Every Foreign Partnership Doing Business In The U.s.

Web this topic provides electronic filing opening day information and information about relevant due dates for 1065 returns. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership. Return of partnership income and extensions need more information on filing a form 1065? In the case of a 1065, this is by the 15th day of the.

Web A Commonly Asked Question Is Where To File A 1065 Form.

Web when must the 7004 be filed? Extension overview alerts and notices trending ultratax cs topics section 163 (j) and form 8990 (1065) types of allocations (1065) electronic filing leave. Ad filing your taxes just became easier. How you file the 1065 form will vary based on how you file your tax return.

Form 7004 Now Consists Of Two Parts.

For example, if your c corporation is a. Web if you need more time to file form 1065, you may request an extension through filing form 7004, application for automatic extension of time to file certain. Web you must file your extension request no later than the regular due date of your return. And the total assets at the end of the.

Generally, A Domestic Partnership Must File Form 1065 By The 15Th Day Of The 3Rd Month Following The Date Its Tax Year Ended As Shown At The Top Of.

Web there are several ways to submit form 4868. How to file an extension:. For filing deadlines and other information. If the partnership's principal business, office, or agency is located in: