Fill Out Form 8862 Online

Fill Out Form 8862 Online - You can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Enter the year for which you are filing this form to claim the credit(s) (for example,. Web taxpayers complete form 8862 and attach it to their tax return if: Web make these fast steps to edit the pdf tax form 8862 online for free: Complete irs tax forms online or print government tax documents. Log in to the editor with your credentials or click on create free account to. Put your name and social security number on the statement and attach it at. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Sign up and log in to your account. Web log into your account and click take me to my return.

In our review, you will discover who should fill out. Complete, edit or print tax forms instantly. Web 1 best answer. Go digital and save time with signnow, the best solution for. Web taxpayers complete form 8862 and attach it to their tax return if: Log in to the editor with your credentials or click on create free account to. This form is for income. Ad download or email irs 8862 & more fillable forms, try for free now! Web schedule eic, which is used to claim the earned income credit with a qualifying child, must be completed prior to filling out form 8862. Web you can submit form 8862 online or in the tax office.

We last updated federal form 8862 in december 2022 from the federal internal revenue service. Web complete form 8862 online with us legal forms. The following tips will allow you to fill. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Save or instantly send your ready documents. Web handy tips for filling out form 8862 online. Go to search box in top right cover and click there to type in 8862 and hit enter. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits select search ,. Then, type in the required information in the appropriate fields and place check marks where. Go digital and save time with signnow, the best solution for.

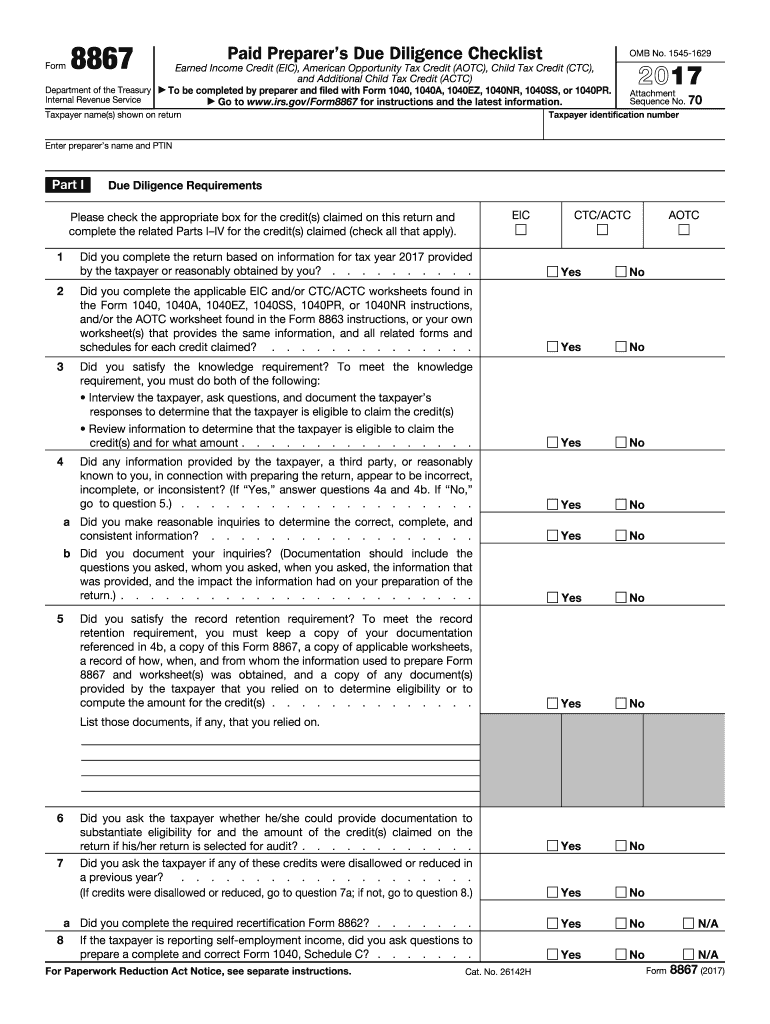

Form 8867 Fill Out and Sign Printable PDF Template signNow

Web irs form 8862 (information to claim certain credits after disallowance) must be included with your tax return if you have previously been denied the earned. Web correspond with the line number on form 8862. Register and log in to your account. Printing and scanning is no longer the best way to manage documents. Web questions for claiming american opportunity.

Irs Form 8862 Printable Master of Documents

Go digital and save time with signnow, the best solution for. In our review, you will discover who should fill out. Save or instantly send your ready documents. Complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly.

How to Fill out IRS Form 8962 Correctly?

Web simply go to the website and select form 8862 in the online library of fillable forms. Start completing the fillable fields and. Web handy tips for filling out form 8862 online. Ad download or email irs 8862 & more fillable forms, try for free now! Web you can submit form 8862 online or in the tax office.

IRS Formulario 8862(SP) Download Fillable PDF or Fill Online

In our review, you will discover who should fill out. Web complete form 8862 online with us legal forms. Web irs form 8862 (information to claim certain credits after disallowance) must be included with your tax return if you have previously been denied the earned. Web questions for claiming american opportunity credit. Complete, edit or print tax forms instantly.

2015 Form SSA795 Fill Online, Printable, Fillable, Blank PDFfiller

Web here's how to file form 8862 in turbotax. Web correspond with the line number on form 8862. Use get form or simply click on the template preview to open it in the editor. Complete, edit or print tax forms instantly. Then, type in the required information in the appropriate fields and place check marks where.

Top 14 Form 8862 Templates free to download in PDF format

Save or instantly send your ready documents. This form is for income. Put your name and social security number on the statement and attach it at. We last updated federal form 8862 in december 2022 from the federal internal revenue service. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits select.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Put your name and social security number on the statement and attach it at. Web taxpayers complete form 8862 and attach it to their tax return if: Web here's how to file form 8862 in turbotax. The following tips will allow you.

Form 8862 Information to Claim Earned Credit After

We last updated federal form 8862 in december 2022 from the federal internal revenue service. Log in to the editor using your credentials or click on create free. The principal idea is to fill out the paper correctly and submit it on time. This form is for income. Use get form or simply click on the template preview to open.

Irs Form 8862 Printable Master of Documents

Printing and scanning is no longer the best way to manage documents. Sign up and log in to your account. The following tips will allow you to fill. Log in to the editor using your credentials or click on create free. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),.

Irs Form 8862 Printable Master of Documents

Save or instantly send your ready documents. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is form 8862? Web correspond with the line number on form 8862. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Use get form or simply click on the template preview to open.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web schedule eic, which is used to claim the earned income credit with a qualifying child, must be completed prior to filling out form 8862. Save or instantly send your ready documents. Then click on jump to 8862 that. Put your name and social security number on the statement and attach it at.

Go Digital And Save Time With Signnow, The Best Solution For.

Web more about the federal form 8862 tax credit. Web handy tips for filling out form 8862 online. Start completing the fillable fields and. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits select search ,.

This Form Is For Income.

Use get form or simply click on the template preview to open it in the editor. Printing and scanning is no longer the best way to manage documents. Register and log in to your account. Web irs form 8862 (information to claim certain credits after disallowance) must be included with your tax return if you have previously been denied the earned.

Web Log Into Your Account And Click Take Me To My Return.

Web follow these quick steps to edit the pdf irs form 8862 online free of charge: Complete, edit or print tax forms instantly. Complete irs tax forms online or print government tax documents. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is form 8862?