Fillable Form 940

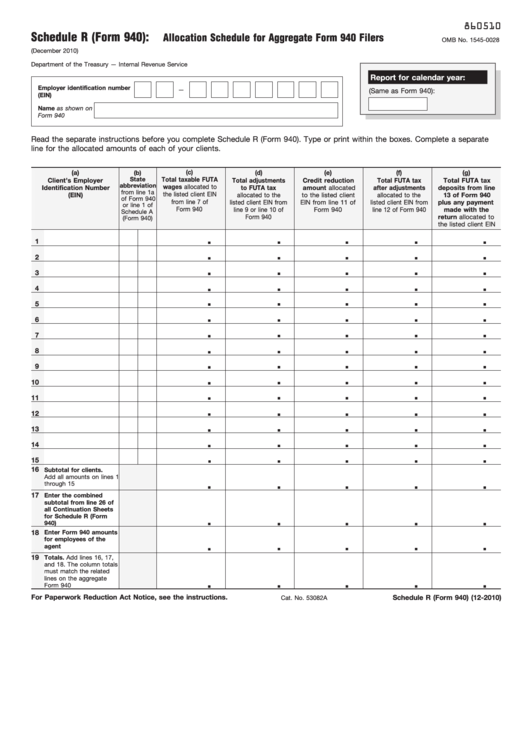

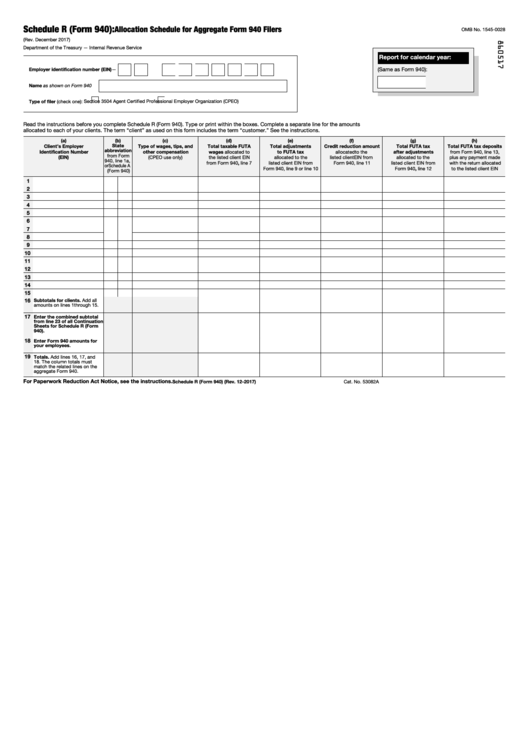

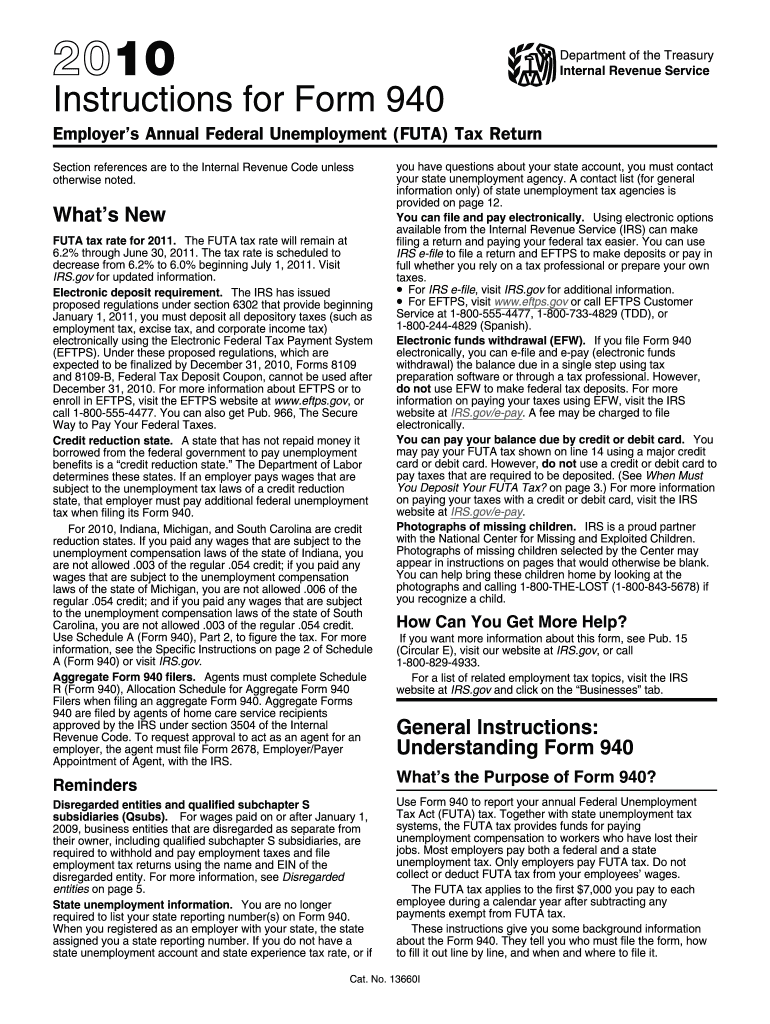

Fillable Form 940 - Web file this schedule with form 940. 940, 941, 943, 944 and 945. Employers can also get the form from. Use form 940 to report your annual federal unemployment tax act (futa) tax. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. For each state with a credit reduction rate greater than zero, enter the futa taxable wages, multiply by the reduction rate, and enter the credit reduction amount. Form 941, employer's quarterly federal tax return. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Form 940, employer's annual federal unemployment tax return. See the instructions for line 9 before completing the schedule a (form 940).

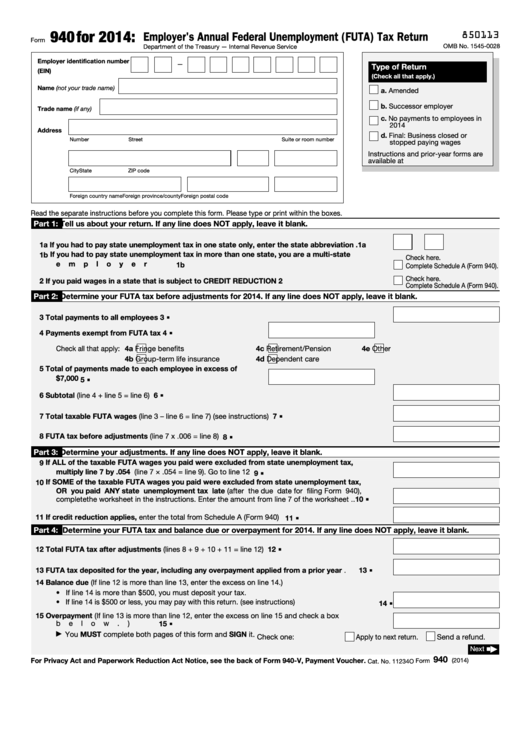

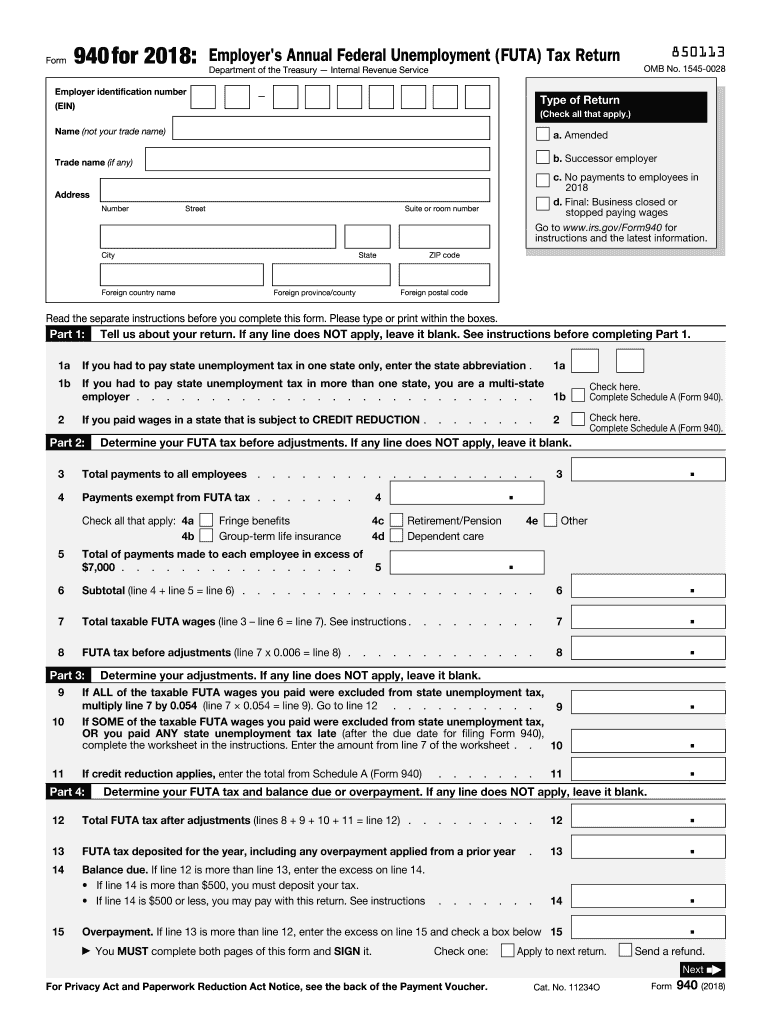

Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Web the due date for filing form 940 for 2021 is january 31, 2022. Web city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.) amended successor employer no payments to employees in 2022 final: Web file this schedule with form 940. If you paid wages subject to the unemployment tax laws of these states, check the box on line 2 and fill out schedule a (form 940). Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Web form 940 needs to be filed annually by employers if they paid wages of $1,500 or more in any quarter of a calendar year, or if they had one or more employees working for 20 or more different weeks. You receive acknowledgement within 24 hours. (however, if you’re up to date on all your futa payments, you can take an additional ten days and file form 940 by february 10, 2022.) how bench can help the deadline for filing form 940 is one of many tax form filing deadlines that can make the start of your year stressful. Form 941, employer's quarterly federal tax return.

940, 941, 943, 944 and 945. Web form 940 needs to be filed annually by employers if they paid wages of $1,500 or more in any quarter of a calendar year, or if they had one or more employees working for 20 or more different weeks. Web for tax year 2022, there are credit reduction states. It is secure and accurate. Web the due date for filing form 940 for 2021 is january 31, 2022. See the instructions for line 9 before completing the schedule a (form 940). Form 941, employer's quarterly federal tax return. Form 940, employer's annual federal unemployment tax return. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Web to complete and file form 940, download the current pdf version of the form from the irs website.

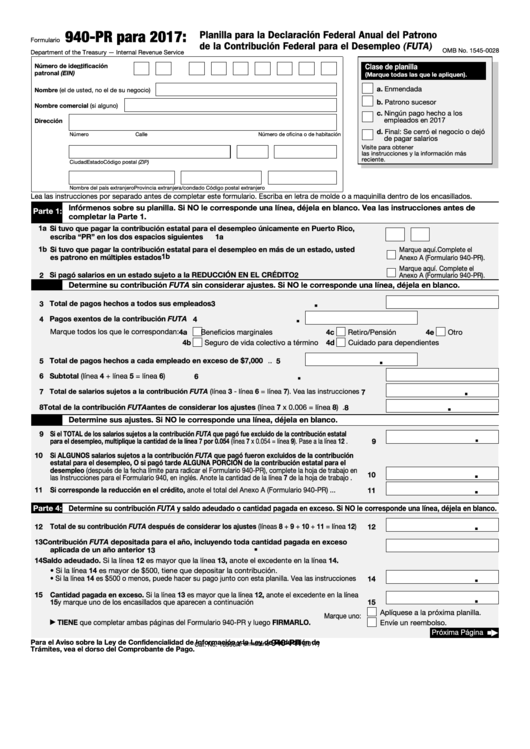

Fillable Form 940 (Pr) Planilla Para La Declaracion Federal Anual Del

Web file this schedule with form 940. The due date to file form 940 is january 31st of the year following the calendar year being reported. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. It is secure and accurate. 940, 941, 943, 944 and 945.

940 Form 2023 Fillable Form 2023

Web form 940 needs to be filed annually by employers if they paid wages of $1,500 or more in any quarter of a calendar year, or if they had one or more employees working for 20 or more different weeks. While you can fill out the form by hand, the pdf form has editable fields you can fill out using..

Fillable Form 940 Employer'S Annual Federal Unemployment (Futa) Tax

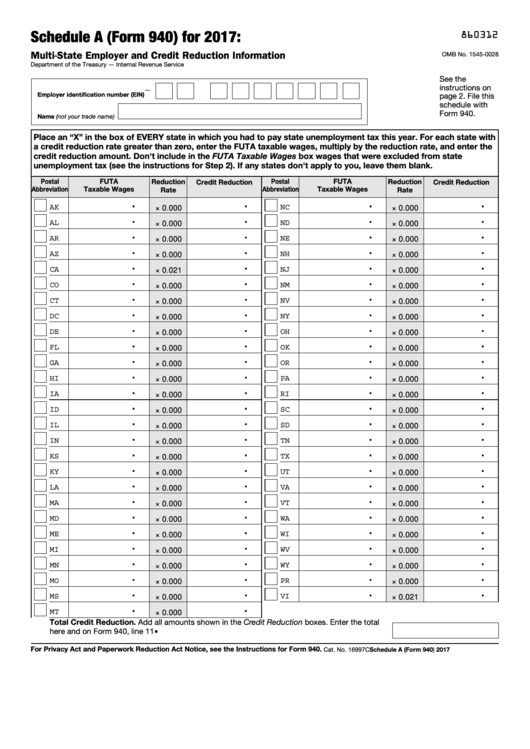

(however, if you’re up to date on all your futa payments, you can take an additional ten days and file form 940 by february 10, 2022.) how bench can help the deadline for filing form 940 is one of many tax form filing deadlines that can make the start of your year stressful. Place an “x” in the box of.

Fillable Schedule A (Form 940) MultiState Employer And Credit

Place an “x” in the box of every state in which you had to pay state unemployment tax this year. Employers can also get the form from. Web form 940 needs to be filed annually by employers if they paid wages of $1,500 or more in any quarter of a calendar year, or if they had one or more employees.

Fill Free fillable form 940 for 2018 employer's annual federal

Web to get the printable version of the 940 form, employers can visit the irs website and download the form. Business closed or stopped paying wages go to www.irs.gov/form940 for instructions and the latest information. Form 941, employer's quarterly federal tax return. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who.

Fillable Schedule R (Form 940) Allocation Schedule For Aggregate Form

Business closed or stopped paying wages go to www.irs.gov/form940 for instructions and the latest information. (however, if you’re up to date on all your futa payments, you can take an additional ten days and file form 940 by february 10, 2022.) how bench can help the deadline for filing form 940 is one of many tax form filing deadlines that.

Fillable Schedule R (Form 940) Allocation Schedule For Aggregate Form

Employers can also get the form from. Use form 940 to report your annual federal unemployment tax act (futa) tax. Web form 940 needs to be filed annually by employers if they paid wages of $1,500 or more in any quarter of a calendar year, or if they had one or more employees working for 20 or more different weeks..

2010 Form 940 Fill Out and Sign Printable PDF Template signNow

If you paid wages subject to the unemployment tax laws of these states, check the box on line 2 and fill out schedule a (form 940). Web to complete and file form 940, download the current pdf version of the form from the irs website. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation.

Fill Free fillable IRS form 940 schedule A 2019 PDF form

The due date to file form 940 is january 31st of the year following the calendar year being reported. Use form 940 to report your annual federal unemployment tax act (futa) tax. 940, 941, 943, 944 and 945. See the instructions for line 9 before completing the schedule a (form 940). Web to get the printable version of the 940.

Form 940 For 2018 Fill Out and Sign Printable PDF Template signNow

Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Web city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.) amended successor employer no payments to employees in 2022 final: Web employment tax forms: It is secure and accurate. If you paid wages subject to the unemployment tax.

(However, If You’re Up To Date On All Your Futa Payments, You Can Take An Additional Ten Days And File Form 940 By February 10, 2022.) How Bench Can Help The Deadline For Filing Form 940 Is One Of Many Tax Form Filing Deadlines That Can Make The Start Of Your Year Stressful.

Form 940, employer's annual federal unemployment tax return. Use form 940 to report your annual federal unemployment tax act (futa) tax. You receive acknowledgement within 24 hours. For each state with a credit reduction rate greater than zero, enter the futa taxable wages, multiply by the reduction rate, and enter the credit reduction amount.

Web To Complete And File Form 940, Download The Current Pdf Version Of The Form From The Irs Website.

Web the due date for filing form 940 for 2021 is january 31, 2022. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Business closed or stopped paying wages go to www.irs.gov/form940 for instructions and the latest information. Form 941, employer's quarterly federal tax return.

Web City State Zip Code Foreign Country Name Foreign Province/County Foreign Postal Code Type Of Return (Check All That Apply.) Amended Successor Employer No Payments To Employees In 2022 Final:

It is secure and accurate. Web for tax year 2022, there are credit reduction states. While you can fill out the form by hand, the pdf form has editable fields you can fill out using. The due date to file form 940 is january 31st of the year following the calendar year being reported.

940, 941, 943, 944 And 945.

See the instructions for line 9 before completing the schedule a (form 940). Web employment tax forms: Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. If you paid wages subject to the unemployment tax laws of these states, check the box on line 2 and fill out schedule a (form 940).