Fincen Form 114 Penalty

Fincen Form 114 Penalty - Web it’s commonly known as an fbar. Web the actual form you’d file is fincen form 114, and you’ll have to file it if the combined balance of all your foreign accounts totals more than $10,000 at any point. Web what are the penalties for not filing fincen form 114? Web up to $40 cash back the penalty for the late filing of blank form 114, also known as the report of foreign bank and financial accounts (fbar), can vary depending on the. If there is reasonable cause for the. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. If the combined value of your foreign financial assets surpasses $10,000 anytime throughout. Web fincen form 114, report of foreign bank and financial accounts, is used to report a financial interest in or signature authority over a foreign financial account. Persons file a fincen form 114, report of foreign bank and financial accounts (fbar), if the aggregate maximum values of the. Citizens, residents, and entities to report foreign financial accounts.

Web the actual form you’d file is fincen form 114, and you’ll have to file it if the combined balance of all your foreign accounts totals more than $10,000 at any point. Persons file a fincen form 114, report of foreign bank and financial accounts (fbar), if the aggregate maximum values of the. Web this provision of the bsa requires that u.s. Web for improper reporting on the fincen 114, a person could receive a civil penalty of $10,000 per violation. Web before you know it, you have savings accounts, investments, and more. Citizens, residents, and entities to report foreign financial accounts. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. You could face fines or jail time if you fail to report your foreign accounts. Web in this case, you’ll have an obligation to file fincen form 114 since the total amount of money you possess across your foreign accounts meets the fbar threshold. Penalties depend on the amount of.

Web the actual form you’d file is fincen form 114, and you’ll have to file it if the combined balance of all your foreign accounts totals more than $10,000 at any point. Yellen issued the following statement on the recent decision by fitch ratings. Web for improper reporting on the fincen 114, a person could receive a civil penalty of $10,000 per violation. Web up to $40 cash back the penalty for the late filing of blank form 114, also known as the report of foreign bank and financial accounts (fbar), can vary depending on the. However, any person who “ willfully fails to report an account or account. If the combined value of your foreign financial assets surpasses $10,000 anytime throughout. You could face fines or jail time if you fail to report your foreign accounts. Penalties depend on the amount of. Web it’s commonly known as an fbar. Web a united states person must file an fbar (fincen form 114, report of foreign bank and financial accounts) if that person has a financial interest in or.

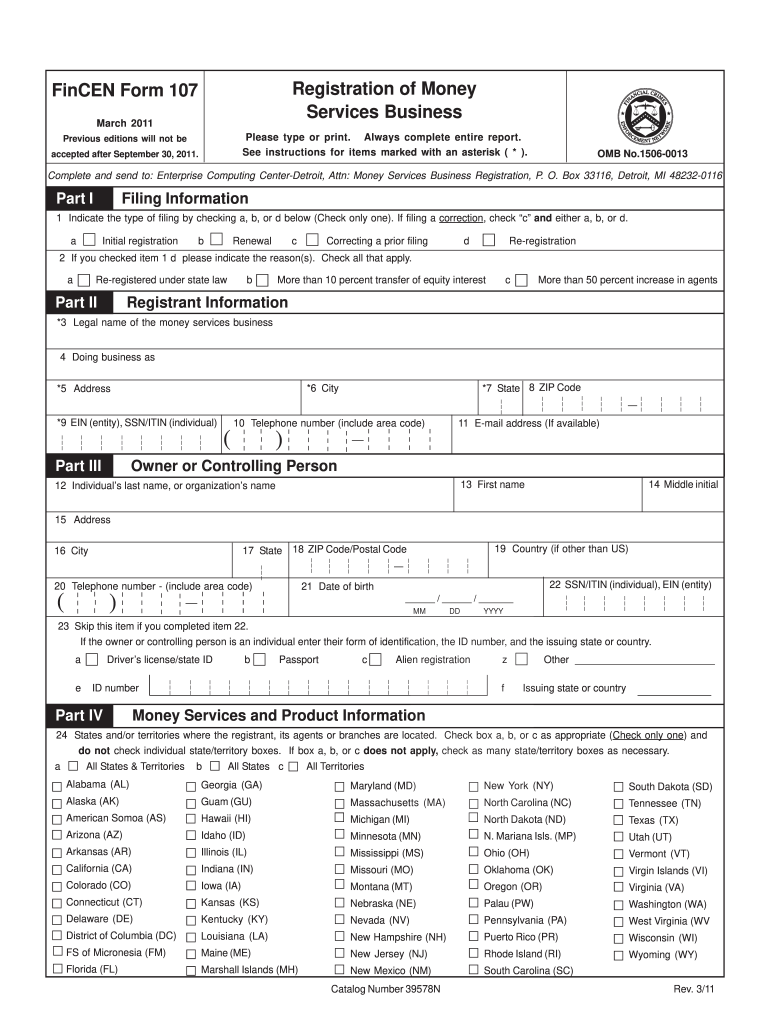

Fincen Registration Fill Out and Sign Printable PDF Template signNow

However, any person who “ willfully fails to report an account or account. If there is reasonable cause for the. Web for improper reporting on the fincen 114, a person could receive a civil penalty of $10,000 per violation. Persons file a fincen form 114, report of foreign bank and financial accounts (fbar), if the aggregate maximum values of the..

Fincen Form 114 Sample Fill and Sign Printable Template Online US

Any person who fails to comply with the registration requirements may be liable for a civil penalty of up to $5,000 for each violation. Web for improper reporting on the fincen 114, a person could receive a civil penalty of $10,000 per violation. Web fincen form 114, report of foreign bank and financial accounts, is used to report a financial.

New FBAR Form in 2019! (FinCEN Form 114) Cantucky

Web a person who must file an fbar and fails to file correctly may be subject to a civil penalty not to exceed $10,000 per violation. Yellen issued the following statement on the recent decision by fitch ratings. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s.

FinCEN Form 114 How to File the FBAR

Citizens, residents, and entities to report foreign financial accounts. Web a person who must file an fbar and fails to file correctly may be subject to a civil penalty not to exceed $10,000 per violation. If the combined value of your foreign financial assets surpasses $10,000 anytime throughout. Persons file a fincen form 114, report of foreign bank and financial.

Fincen Form 114 Pdf Sample Resume Examples

Yellen issued the following statement on the recent decision by fitch ratings. If there is reasonable cause for the. Web a united states person must file an fbar (fincen form 114, report of foreign bank and financial accounts) if that person has a financial interest in or. You could face fines or jail time if you fail to report your.

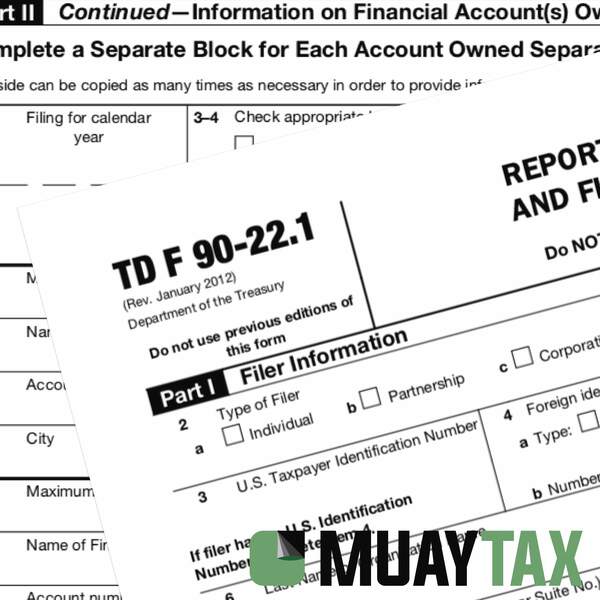

Presentación del Form FBAR (FinCEN Form 114) Muay Tax LLC

Web includes investigating possible civil violations, assessing and collecting civil penalties, and issuing administrative ruling s. The fbar 2023 deadline is the same as your. Persons file a fincen form 114, report of foreign bank and financial accounts (fbar), if the aggregate maximum values of the. Web the actual form you’d file is fincen form 114, and you’ll have to.

FBAR And Filing FinCEN Form 114 Step By Step Instructions For

Penalties depend on the amount of. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. Web the fbar is an annual filing and if you want to avoid penalties, make sure to file fincen form 114 by the due date. Web for improper.

FinCEN Form 114 2023 Banking

The fbar 2023 deadline is the same as your. Web a person who must file an fbar and fails to file correctly may be subject to a civil penalty not to exceed $10,000 per violation. Penalties depend on the amount of. In a nutshell, form 114 is used by u.s. However, any person who “ willfully fails to report an.

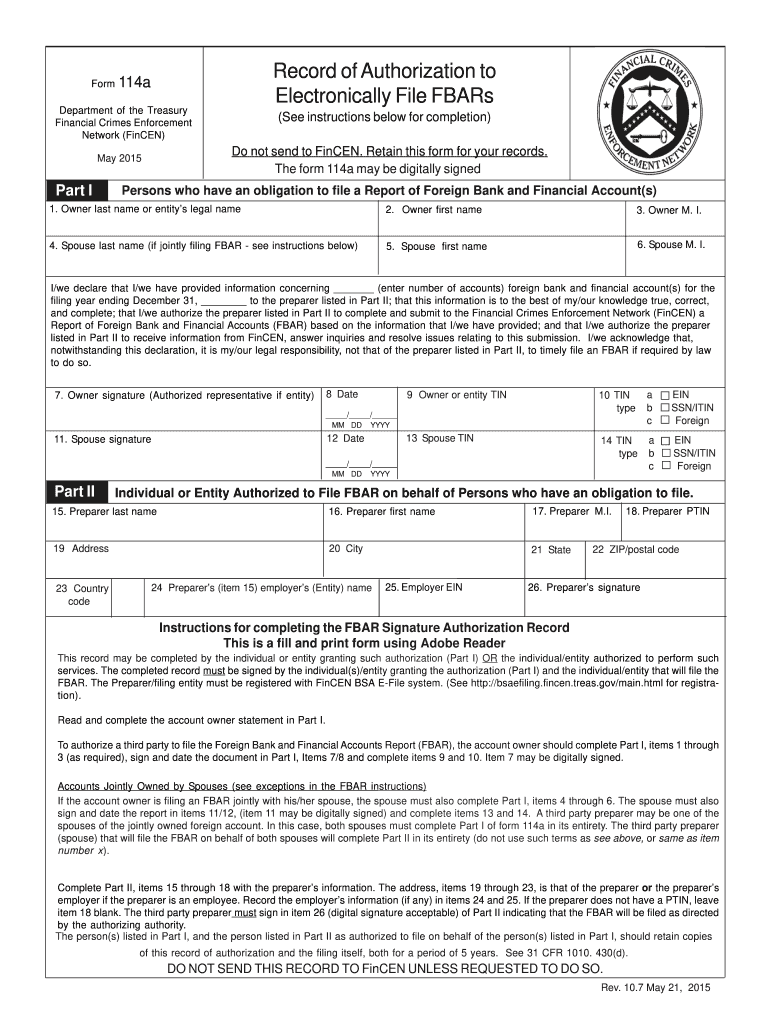

20152021 FinCen Form 114a Fill Online, Printable, Fillable, Blank

Web in this case, you’ll have an obligation to file fincen form 114 since the total amount of money you possess across your foreign accounts meets the fbar threshold. Web fincen form 114, report of foreign bank and financial accounts, is used to report a financial interest in or signature authority over a foreign financial account. Web the actual form.

A Closer Look at the NonWillful FBAR Penalty Associated with Not

Persons file a fincen form 114, report of foreign bank and financial accounts (fbar), if the aggregate maximum values of the. Web a united states person must file an fbar (fincen form 114, report of foreign bank and financial accounts) if that person has a financial interest in or. If there is reasonable cause for the. Web a person who.

However, Any Person Who “ Willfully Fails To Report An Account Or Account.

Yellen issued the following statement on the recent decision by fitch ratings. Web a united states person must file an fbar (fincen form 114, report of foreign bank and financial accounts) if that person has a financial interest in or. Persons file a fincen form 114, report of foreign bank and financial accounts (fbar), if the aggregate maximum values of the. Citizens, residents, and entities to report foreign financial accounts.

Web What Are The Penalties For Not Filing Fincen Form 114?

If the combined value of your foreign financial assets surpasses $10,000 anytime throughout. In a nutshell, form 114 is used by u.s. Web for improper reporting on the fincen 114, a person could receive a civil penalty of $10,000 per violation. Web fincen form 114, report of foreign bank and financial accounts, is used to report a financial interest in or signature authority over a foreign financial account.

You Could Face Fines Or Jail Time If You Fail To Report Your Foreign Accounts.

Web a person who must file an fbar and fails to file correctly may be subject to a civil penalty not to exceed $10,000 per violation. If there is reasonable cause for the. Web includes investigating possible civil violations, assessing and collecting civil penalties, and issuing administrative ruling s. Web this provision of the bsa requires that u.s.

The Fbar 2023 Deadline Is The Same As Your.

Penalties depend on the amount of. Web the fbar is an annual filing and if you want to avoid penalties, make sure to file fincen form 114 by the due date. Web it’s commonly known as an fbar. The bsa requires a usp to file fincen form 114 ,.