Form 100 100S 100W Or 100X

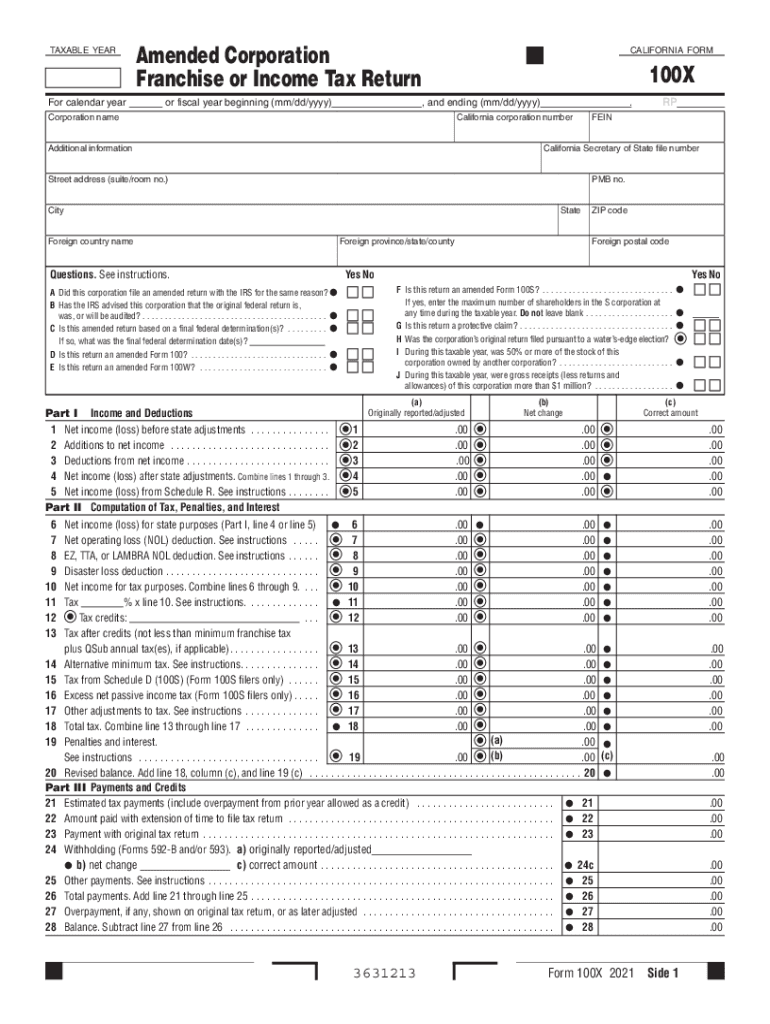

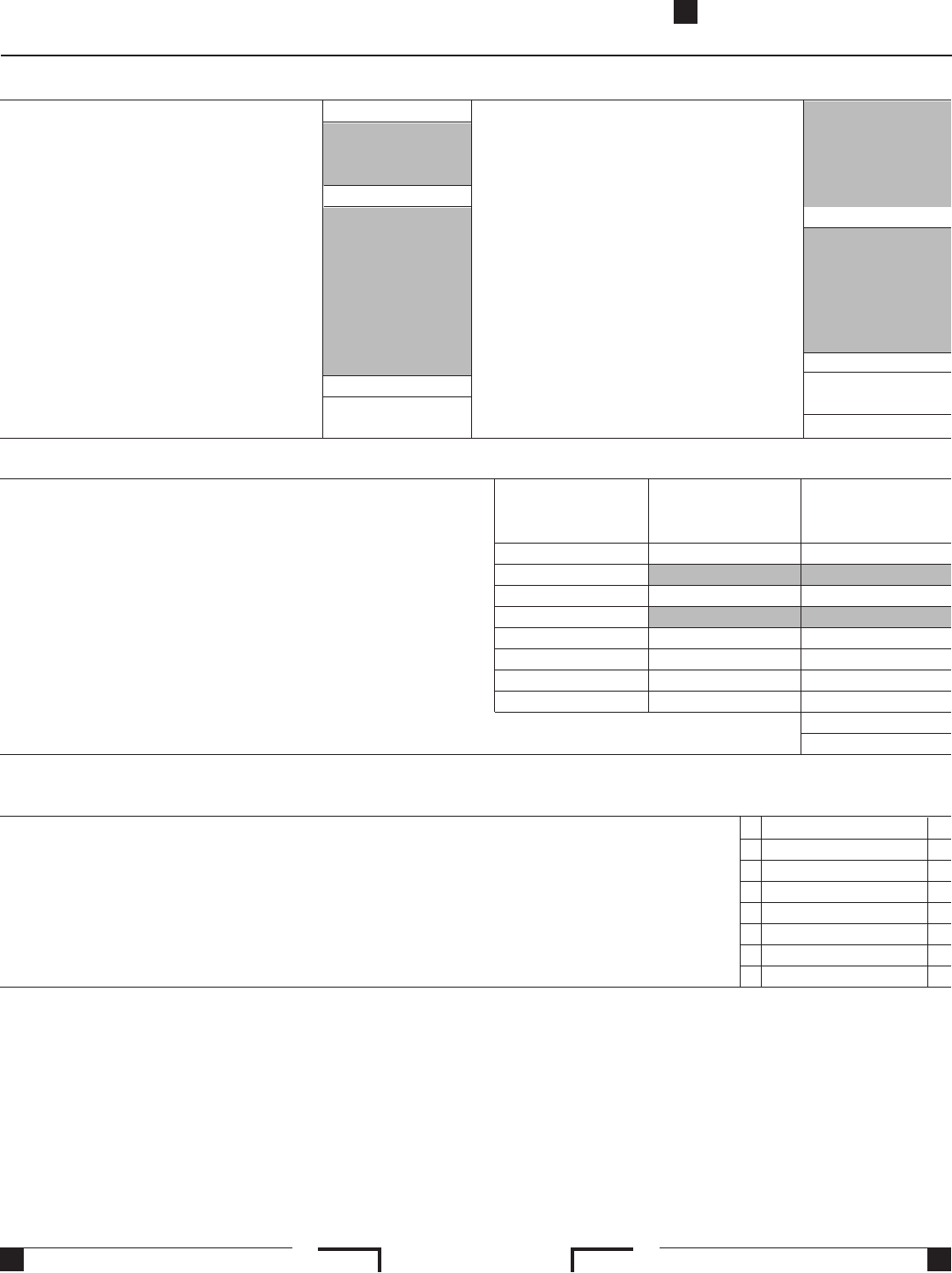

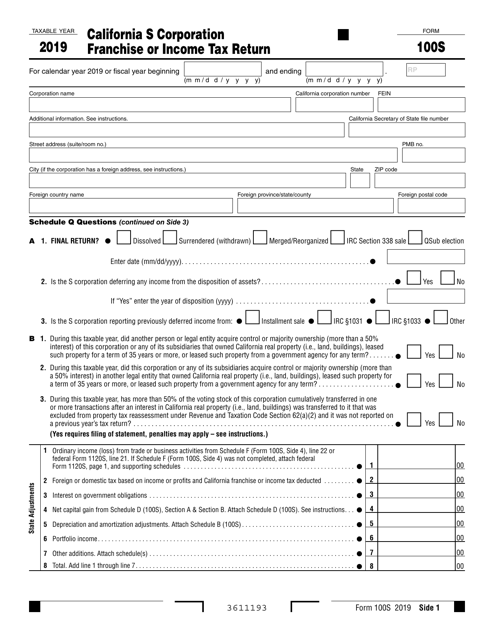

Form 100 100S 100W Or 100X - This is required for electronic. Web california corporation franchise or income tax return (form 100) california s corporation franchise or income tax return (form 100s) california corporation franchise or. Is this return an amended form 100s? During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation. Is this return an amended form 100w? Web general information use form ftb 3539, payment for automatic extension for corporations and exempt organizations, only if both of the following apply: Web 64 rows form 100s: Web 3631213 form 100x 2021 side 1. Taxable income equal to or less than $100:. Edit your amending 100x online type text, add images, blackout confidential details, add comments, highlights and more.

Web use form 100x to amend a previously filed form 100, form 100s, or form 100w. Exempt under rtc sections 23701t or 23701r form 100 filing requirement; Web form 100 or form 100w, schedule q, question b1 has been checked yes, however, question b3 and/or question b4 have not been answered. Web 3611213 form 100s 2021 side 1 b 1. Web taxpayers must use form 100x to amend a previously filed form 100, california corporation franchise or income tax return, form 100s, california s. Ca s corporation franchise or income tax return: Form 100x, amended corporation franchise or income tax. A claim for refund of an overpayment of tax should be made by filing form 100x. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation. Is this return an amended form 100w?

This is required for electronic. Taxable income equal to or less than $100:. Sign it in a few clicks draw your signature, type it,. Taxable income greater than $100: Web general information use form ftb 3539, payment for automatic extension for corporations and exempt organizations, only if both of the following apply: Web use form 100x, to amend a previously filed form 100, california corporation franchise or income tax return; Web 3611213 form 100s 2021 side 1 b 1. Web use form 100x to amend a previously filed form 100, form 100s, or form 100w. Is this return an amended form 100s? During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation.

Form 100 100S 100W Or 100X Fill Out and Sign Printable PDF Template

Edit your amending 100x online type text, add images, blackout confidential details, add comments, highlights and more. Web use form 100x to amend a previously filed form 100, form 100s, or form 100w. Is this return an amended form 100s? Web 64 rows form 100s: Taxable income equal to or less than $100:.

2012 Form 100S Franchise Tax Board Edit, Fill, Sign Online Handypdf

Is this return an amended form 100w? Web 3631213 form 100x 2021 side 1. Web form 100 or form 100w, schedule q, question b1 has been checked yes, however, question b3 and/or question b4 have not been answered. Taxable income greater than $100: Is this return an amended form 100s?

Form 100S Download Fillable PDF or Fill Online California S Corporation

Web use form 100x to amend a previously filed form 100, form 100s, or form 100w. Choose the correct version of the editable pdf form from the list and. If yes, enter the maximum number of shareholders in the s. This is required for electronic. Web find and fill out the correct ftb 100x.

100w Tax Form Fill Out and Sign Printable PDF Template signNow

Web corporations filing form 100, california corporation franchise or income tax return, including combined reports and certain accompanying forms and schedules. Exempt under rtc sections 23701t or 23701r form 100 filing requirement; • form 100, california corporation franchise or income tax return, including. Is this return an amended form 100s? Edit your amending 100x online type text, add images, blackout.

2012 Form 100S Franchise Tax Board Edit, Fill, Sign Online Handypdf

Taxable income equal to or less than $100:. Form 100w, california corporation franchise or income tax return. Exempt under rtc sections 23701t or 23701r form 100 filing requirement; This is required for electronic. Ca s corporation franchise or income tax return:

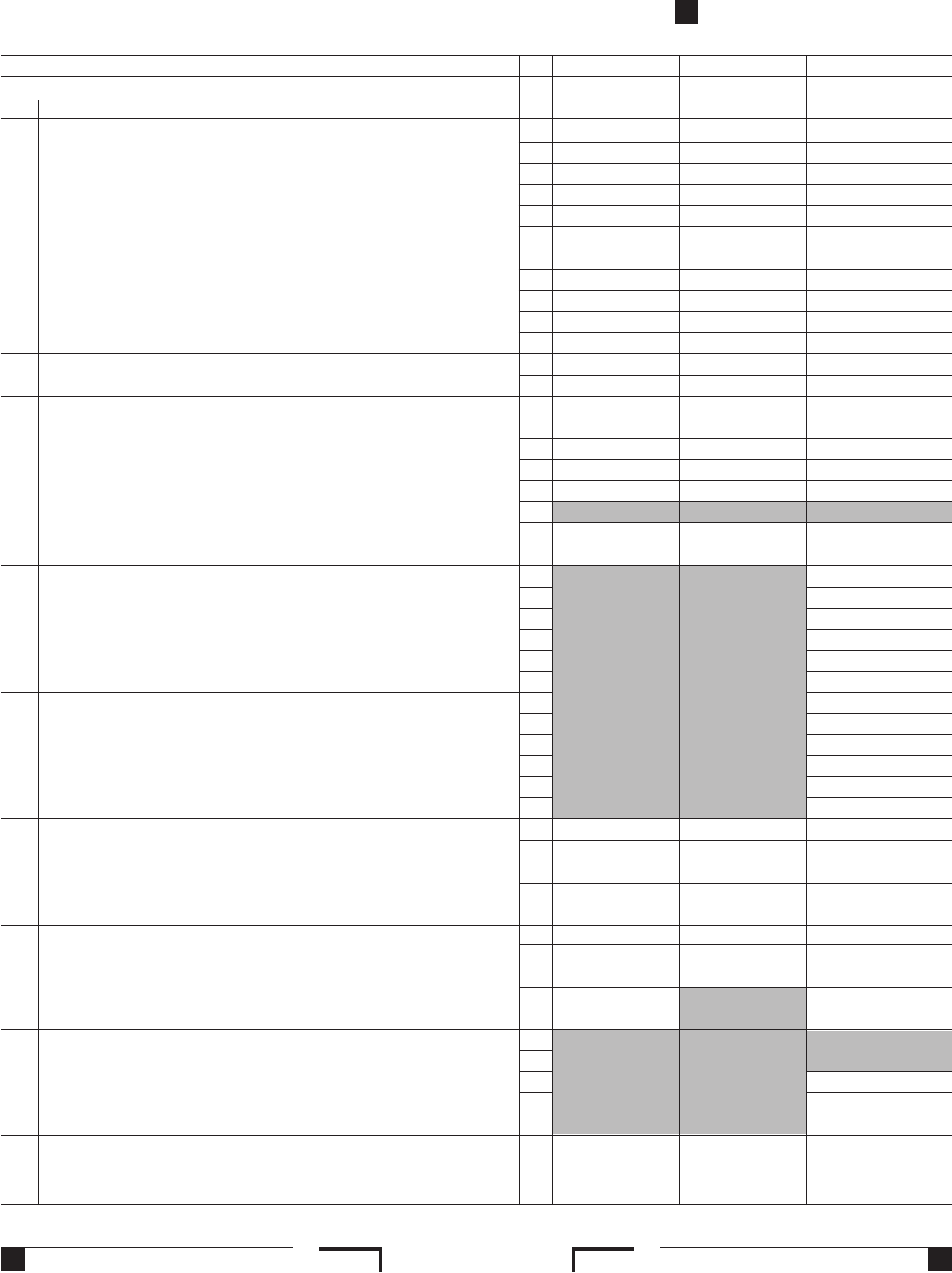

Form 100S Schedule D Download Printable PDF or Fill Online S

Taxable income equal to or less than $100:. Web use form 100x, to amend a previously filed form 100, california corporation franchise or income tax return; Sign it in a few clicks draw your signature, type it,. Web find and fill out the correct ftb 100x. Web 3631213 form 100x 2021 side 1.

Fill Free fillable Form100 Form 100 Application_revised PDF form

Web taxpayers must use form 100x to amend a previously filed form 100, california corporation franchise or income tax return, form 100s, california s. Under penalties of perjury, i declare that i have examined this return, including accompanying schedules and statements, and to the best. If yes, enter the maximum number of shareholders in the s. Web find and fill.

100x YouTube

Sign it in a few clicks draw your signature, type it,. Web use form 100x to amend a previously filed form 100, form 100s, or form 100w. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation. Ca s corporation franchise or income tax return: A claim.

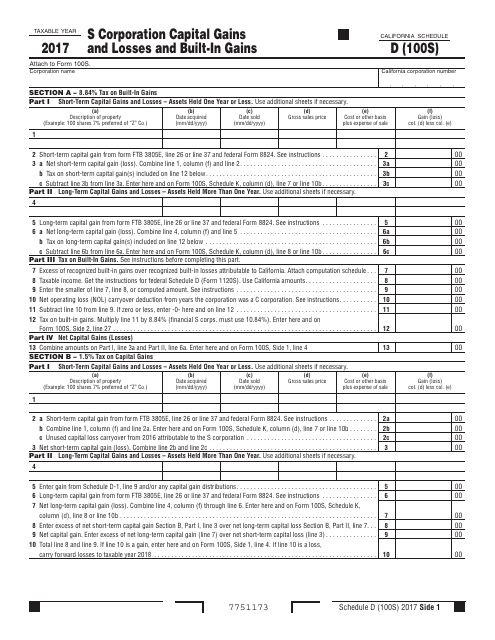

Form 100Es Corporation Estimated Tax California printable pdf download

Is this return an amended form 100w? Is this return an amended form 100s? During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation. Web corporations filing form 100, california corporation franchise or income tax return, including combined reports and certain accompanying forms and schedules. Web 3611213.

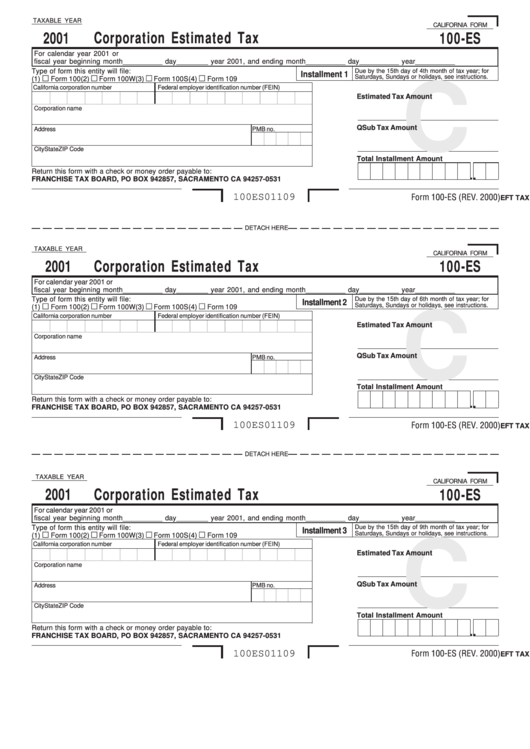

Form 100s California S Corporation Franchise Or Tax Return

Web corporations filing form 100, california corporation franchise or income tax return, including combined reports and certain accompanying forms and schedules. • form 100, california corporation franchise or income tax return, including. If yes, enter the maximum number of shareholders in the s. Under penalties of perjury, i declare that i have examined this return, including accompanying schedules and statements,.

A Claim For Refund Of An Overpayment Of Tax Should Be Made By Filing Form 100X.

Web 3611213 form 100s 2021 side 1 b 1. Web general information use form ftb 3539, payment for automatic extension for corporations and exempt organizations, only if both of the following apply: Taxable income equal to or less than $100:. Ca s corporation franchise or income tax return:

Web 64 Rows Form 100S:

Sign it in a few clicks draw your signature, type it,. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation. This is required for electronic. If yes, enter the maximum number of shareholders in the s.

Form 100X, Amended Corporation Franchise Or Income Tax.

Under penalties of perjury, i declare that i have examined this return, including accompanying schedules and statements, and to the best. Is this return an amended form 100w? Choose the correct version of the editable pdf form from the list and. Web taxpayers must use form 100x to amend a previously filed form 100, california corporation franchise or income tax return, form 100s, california s.

Edit Your Amending 100X Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Taxable income greater than $100: Is this return an amended form 100s? Web use form 100x to amend a previously filed form 100, form 100s, or form 100w. Web form 100 or form 100w, schedule q, question b1 has been checked yes, however, question b3 and/or question b4 have not been answered.