Form 1040 Instructions 2012

Form 1040 Instructions 2012 - Web popular forms & instructions; Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Order online and have them delivered by. It is a statement you send with your check or money order for any balance due. Exceptions are explained earlier in these instructions for line 32. Web popular forms & instructions; 2010 (99) irs use only—do not write or staple in this space. Web get the current filing year’s forms, instructions, and publications for free from the irs. Form 1040 instructions form 8379 when is an amended return required? Individual tax return form 1040 instructions;

Web exception in the line 5a and 5b instructions to see if you can use this worksheet instead of a publication to find out if any of your benefits are taxable. If you have to file form 8938, you must use form 1040. Individual income tax return 2012. Order online and have them delivered by. Certain expenses, payments, contributions, fees, etc. Filing status name changed from qualifying widow(er) to quali ying surviving spouse. Exceptions are explained earlier in these instructions for line 32. Department of the treasury—internal revenue service. Web instructions form 1040 has new lines. Web select your state(s) and download, complete, print, and sign your 2012 state tax return income forms.

Web form 1040 is the basic form for filing your federal income taxes. Department of the treasury—internal revenue service (99) irs use only—do not write or staple in this space. Form 1040 instructions form 8379 when is an amended return required? 2010 (99) irs use only—do not write or staple in this space. Web adjustments to income section of form 1040, schedule 1. Web exception in the line 5a and 5b instructions to see if you can use this worksheet instead of a publication to find out if any of your benefits are taxable. Individual income tax return 2012. Web if you had foreign financial assets in 2012, you may have to file form 8938 with your return. It is a statement you send with your check or money order for any balance due. Exceptions are explained earlier in these instructions for line 32.

Form 1040 U.S. Individual Tax Return Definition

Certain expenses, payments, contributions, fees, etc. Web form 1040 is the basic form for filing your federal income taxes. Web instructions form 1040 has new lines. •alimony and separate maintenance payments reported on. Web select your state(s) and download, complete, print, and sign your 2012 state tax return income forms.

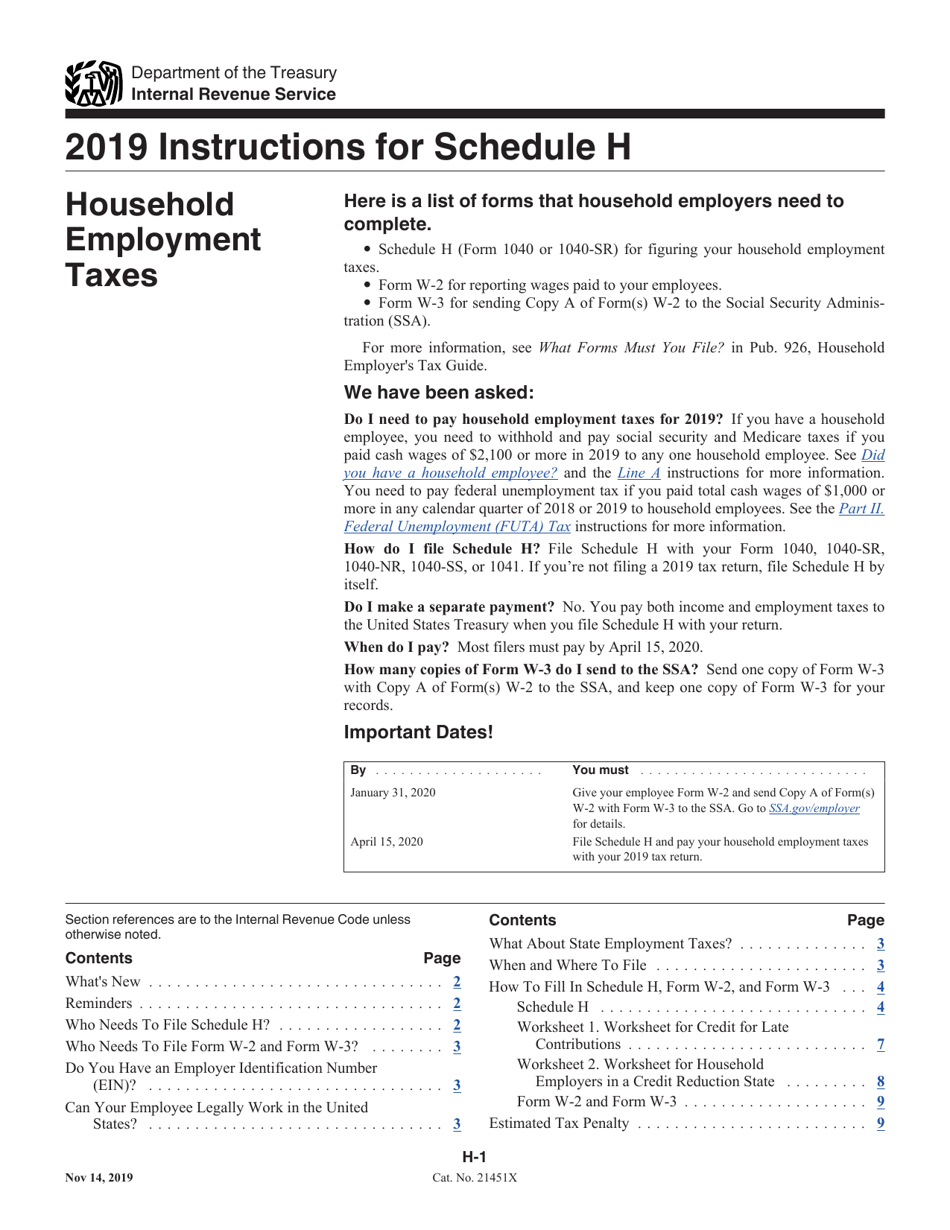

Download Instructions for IRS Form 1040, 1040SR Schedule H Household

20 copies for each form (one copy of the corresponding instructions is automatically included) 5 copies for each instruction or publication; Web if you had foreign financial assets in 2012, you may have to file form 8938 with your return. Web popular forms & instructions; Web select your state(s) and download, complete, print, and sign your 2012 state tax return.

Download 1040 Instructions for Free Page 47 FormTemplate

Web if you had foreign financial assets in 2012, you may have to file form 8938 with your return. You can no longer claim a tax refund for tax year 2012. The form walks you through calculating your agi and claiming any credits or deductions for which. Web form 1040 is the basic form for filing your federal income taxes..

Www.irs.govform 1040 For Instructions And The Latest Information Form

Individual tax return form 1040 instructions; Individual income tax return 2012. Web select your state(s) and download, complete, print, and sign your 2012 state tax return income forms. Department of the treasury—internal revenue service. Form 1040 instructions form 8379 when is an amended return required?

Download 1040 Instructions for Free Page 7 FormTemplate

Web get the current filing year’s forms, instructions, and publications for free from the irs. It is a statement you send with your check or money order for any balance due. Web get federal tax return forms and file by mail. Taxpayers should file amended returns using. Department of the treasury—internal revenue service (99) irs use only—do not write or.

Download 1040 Instructions for Free Page 28 FormTemplate

Schedule 1 has new lines. You can no longer claim a tax refund for tax year 2012. Web exception in the line 5a and 5b instructions to see if you can use this worksheet instead of a publication to find out if any of your benefits are taxable. Web get the current filing year’s forms, instructions, and publications for free.

Download 1040 Instructions for Free Page 32 FormTemplate

Individual income tax return 2012. Web exception in the line 5a and 5b instructions to see if you can use this worksheet instead of a publication to find out if any of your benefits are taxable. Department of the treasury—internal revenue service. Web form 1040 is the basic form for filing your federal income taxes. 20 copies for each form.

1040ez 2022 Fill Out Digital PDF Sample

Web if you had foreign financial assets in 2012, you may have to file form 8938 with your return. Order online and have them delivered by. Web instructions form 1040 has new lines. 2010 (99) irs use only—do not write or staple in this space. Web get federal tax return forms and file by mail.

2020 Irs 1040 Schedule Instructions Fill Out and Sign Printable PDF

Taxpayers should file amended returns using. It is a statement you send with your check or money order for any balance due. Web get federal tax return forms and file by mail. Schedule 1 has new lines. Exceptions are explained earlier in these instructions for line 32.

•Alimony And Separate Maintenance Payments Reported On.

Schedule 1 has new lines. Form 1040 instructions form 8379 when is an amended return required? Web adjustments to income section of form 1040, schedule 1. Certain expenses, payments, contributions, fees, etc.

Department Of The Treasury—Internal Revenue Service (99) Irs Use Only—Do Not Write Or Staple In This Space.

Web instructions form 1040 has new lines. Taxpayers should file amended returns using. The form walks you through calculating your agi and claiming any credits or deductions for which. Web get federal tax return forms and file by mail.

Web Exception In The Line 5A And 5B Instructions To See If You Can Use This Worksheet Instead Of A Publication To Find Out If Any Of Your Benefits Are Taxable.

Web select your state(s) and download, complete, print, and sign your 2012 state tax return income forms. Individual income tax return 2012. Web if you had foreign financial assets in 2012, you may have to file form 8938 with your return. 20 copies for each form (one copy of the corresponding instructions is automatically included) 5 copies for each instruction or publication;

Filing Status Name Changed From Qualifying Widow(Er) To Quali Ying Surviving Spouse.

Individual tax return form 1040 instructions; Web popular forms & instructions; Web get the current filing year’s forms, instructions, and publications for free from the irs. You can no longer claim a tax refund for tax year 2012.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)