Form 1041 Late Filing Penalty

Form 1041 Late Filing Penalty - Web for each month that a tax return is late, the irs assesses a penalty equal to 5 percent of the tax due, up to a maximum penalty of 25 percent. Web a penalty of 5% of the tax due may be imposed for each month during which a return is not filed. However, that is not the. Web the maximum total penalty for failure to file and pay is 47.5% (22.5% late filing and 25% late payment) of the tax. Late payment of tax section 6651 also provides for. Or information penalties assessed for reasons other than delinquency,. Web $54.95 state filing fee $39.95 2 taxslayer premium learn more on taxslayer's website federal filing fee $0 state filing fee $0 3 cash app taxes The penalty does not apply if the. Web form 1041 late filing penalty a penalty may be assessed for 5% of the tax due for each month (or part of a month) for which form 1041 is not filed, up to a. Web penalties eligible for first time abate include:

The irs also charges interest on. Web penalties for underpayments of tax due to fraud; However, that is not the. The penalty does not apply if the. The law provides a penalty of 5% of the tax due for each month, or part of a month, for which a return isn't. Web to calculate the penalties do the following: September 2018) department of the treasury internal revenue service u.s. Or information penalties assessed for reasons other than delinquency,. Web what is the penalty for late form 1041 irs filing? Web the relief applies to late filing penalties for the following tax returns:

Web penalties for underpayments of tax due to fraud; Web for more information about penalties for late filing, see late filing of return in the instructions for form 1041. Information return trust accumulation of charitable amounts go to. Web for each month that a tax return is late, the irs assesses a penalty equal to 5 percent of the tax due, up to a maximum penalty of 25 percent. However, that is not the. The law provides a penalty of 5% of the tax due for each month, or part of a month, for which a return isn't. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month. Does the software calculate the late filing and late payment penalties, or the. Web 4 years ago 1041 fiduciary a 1041 return will be filed late, and the tax payment also will be late. Form 1040 (individual income tax) form 1041 (trust and estate income tax) form 1120.

U.S. Tax Return for Estates and Trusts, Form 1041

Late payment of tax section 6651 also provides for. Does the software calculate the late filing and late payment penalties, or the. Web the interest and penalty worksheet, in forms view, in the late folder, states that the total failure to file penalty has been calculated to the maximum; Or information penalties assessed for reasons other than delinquency,. However, if.

Filing Taxes for Deceased with No Estate H&R Block

Web it is to be included with the owner’s u.s. The irs also charges interest on. Web the form 5471 late filing penalty can be pretty rough. Web a penalty of 5% of the tax due may be imposed for each month during which a return is not filed. Web the relief applies to late filing penalties for the following.

IRS Form 1041 Schedule I Download Fillable PDF or Fill Online

This will continue to accrue up until a maximum of 25% of the tax due. September 2018) department of the treasury internal revenue service u.s. Web to calculate the penalties do the following: Web 4 years ago 1041 fiduciary a 1041 return will be filed late, and the tax payment also will be late. Penalties determined by irs examination;

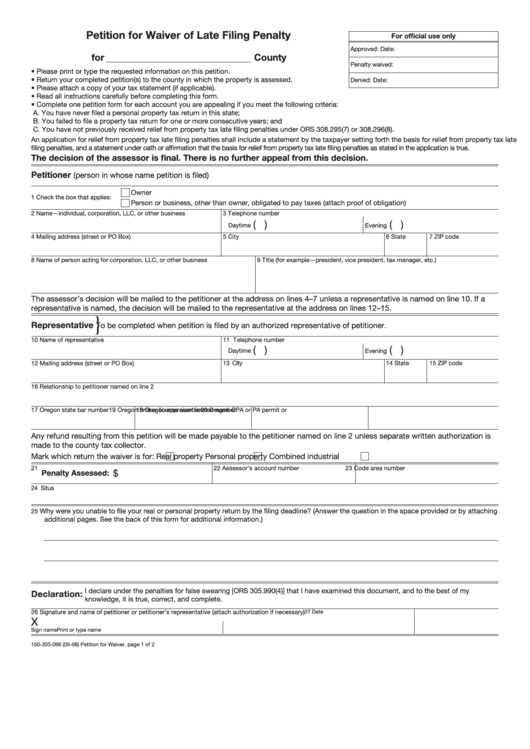

Form 150303066 Petition For Waiver Of Late Filing Penalty printable

September 2018) department of the treasury internal revenue service u.s. The law provides a penalty of 5% of the tax due for each month, or part of a month, for which a return isn't. Late payment of tax section 6651 also provides for. Web to calculate the penalties do the following: Web for more information about penalties for late filing,.

How to Write a Form 990 Late Filing Penalty Abatement Letter 50,000

Web for each month that a tax return is late, the irs assesses a penalty equal to 5 percent of the tax due, up to a maximum penalty of 25 percent. Web what is the penalty for late form 1041 irs filing? Web the maximum total penalty for failure to file and pay is 47.5% (22.5% late filing and 25%.

Irs Form 1099 Late Filing Penalty Form Resume Examples

Information return trust accumulation of charitable amounts go to. Web $54.95 state filing fee $39.95 2 taxslayer premium learn more on taxslayer's website federal filing fee $0 state filing fee $0 3 cash app taxes Web to calculate the penalties do the following: Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds.

Late Filing Penalty Malaysia Avoid Penalties

Web what is the penalty for late form 1041 irs filing? Web 4 years ago 1041 fiduciary a 1041 return will be filed late, and the tax payment also will be late. For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month. The irs also charges interest on. Web penalties eligible for first.

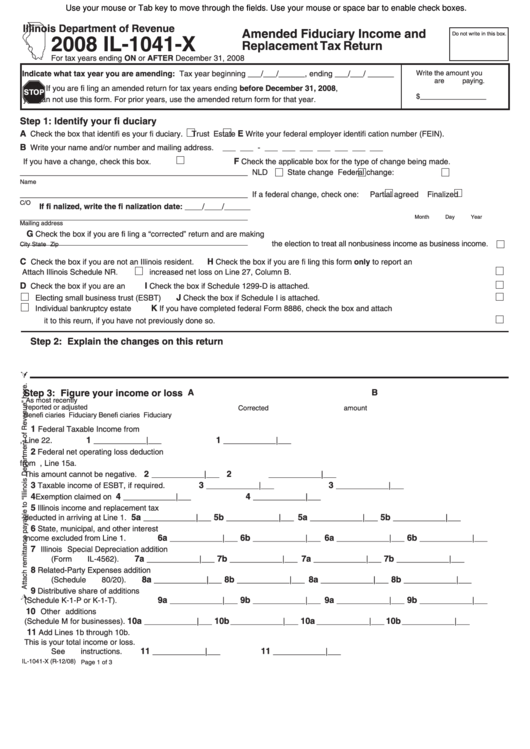

Fillable Form Il1041X Amended Fiduciary And Replacement Tax

Penalties determined by irs examination; For fiscal year estates and trusts, file form 1041 by the 15th day of the 4th month. Web the form 5471 late filing penalty can be pretty rough. However, if your return was over 60 days late, the minimum. The irs also charges interest on.

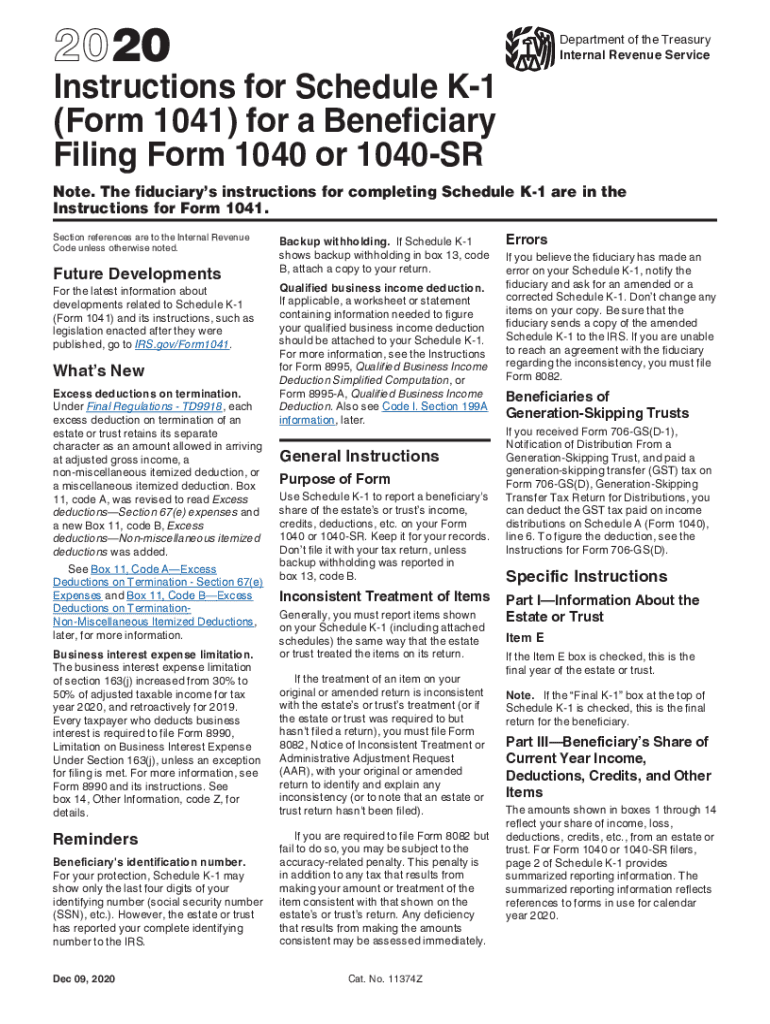

Instructions For Schedule K 1 Form 1041 For A Beneficiary Filing Form

Web the relief applies to late filing penalties for the following tax returns: September 2018) department of the treasury internal revenue service u.s. Web 1 attorney answer posted on apr 3, 2016 since there is no obligation to open an estate, the penalties attributed to the late filing would be borne by the estate, not the. The 5471 is an.

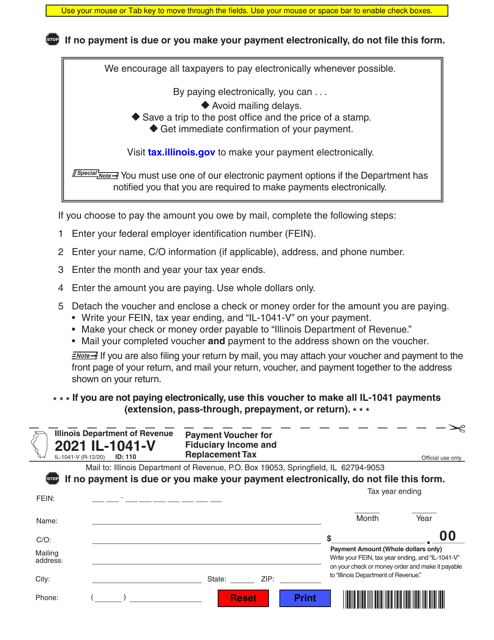

Form IL1041V Download Fillable PDF or Fill Online Payment Voucher for

Web 4 years ago 1041 fiduciary a 1041 return will be filed late, and the tax payment also will be late. Web for each month that a tax return is late, the irs assesses a penalty equal to 5 percent of the tax due, up to a maximum penalty of 25 percent. Late payment of tax section 6651 also provides.

Web It Is To Be Included With The Owner’s U.s.

Web a penalty of 5% of the tax due may be imposed for each month during which a return is not filed. Late payment of tax section 6651 also provides for. The law provides a penalty of 5% of the tax due for each month, or part of a month, for which a return isn't. The 5471 is an irs international reporting form used to report ownership in foreign corporations (aka information return.

However, If Your Return Was Over 60 Days Late, The Minimum.

Web $54.95 state filing fee $39.95 2 taxslayer premium learn more on taxslayer's website federal filing fee $0 state filing fee $0 3 cash app taxes However, that is not the. The irs also charges interest on. The penalty does not apply if the.

Does The Software Calculate The Late Filing And Late Payment Penalties, Or The.

Web penalties for underpayments of tax due to fraud; Web the interest and penalty worksheet, in forms view, in the late folder, states that the total failure to file penalty has been calculated to the maximum; Information return trust accumulation of charitable amounts go to. Web the form 5471 late filing penalty can be pretty rough.

This Will Continue To Accrue Up Until A Maximum Of 25% Of The Tax Due.

Web the relief applies to late filing penalties for the following tax returns: Web for each month that a tax return is late, the irs assesses a penalty equal to 5 percent of the tax due, up to a maximum penalty of 25 percent. Web form 1041 late filing penalty a penalty may be assessed for 5% of the tax due for each month (or part of a month) for which form 1041 is not filed, up to a. Web the maximum total penalty for failure to file and pay is 47.5% (22.5% late filing and 25% late payment) of the tax.