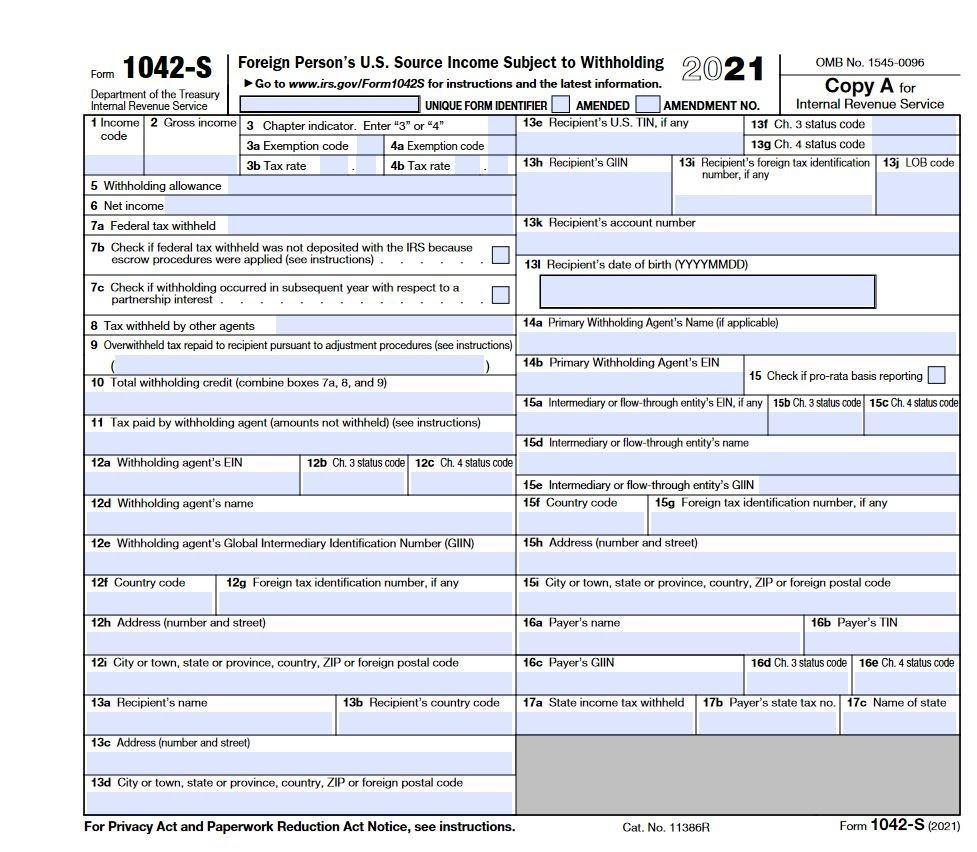

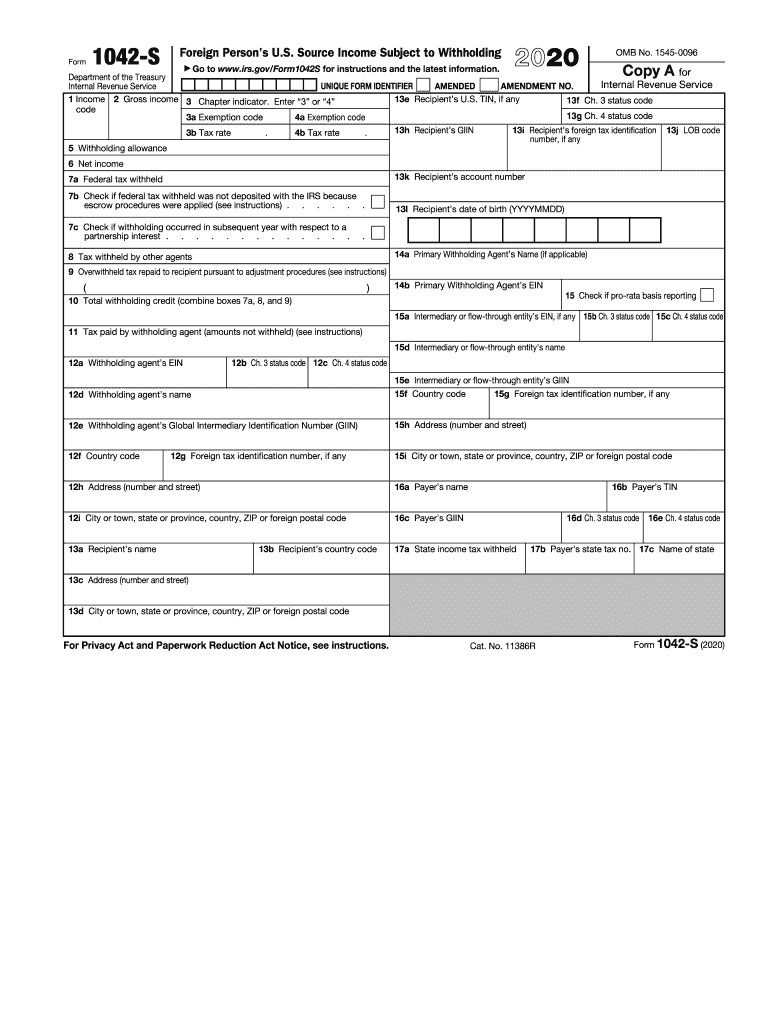

Form 1042S 2022

Form 1042S 2022 - There are a number of changes to codes: Dividend code 40 other dividend. (1) $185 ($500 x 37%) withholding under section 1446(a); Source income subject to withholding) for your. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Complete, edit or print tax forms instantly. Web withholding of $325, comprised of: (2) $20 ($200 x 10%) withholding under section 1446(f); Source income of foreign persons, is used to report tax withheld on certain income of foreign persons.

Get ready for tax season deadlines by completing any required tax forms today. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Web form 1042 [ edit] form 1042, also annual withholding tax return for u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web withholding of $325, comprised of: There are a number of changes to codes: As withholding agents prepare these forms, they should. (3) $120 ($400 x 30%). (1) $185 ($500 x 37%) withholding under section 1446(a); Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return.

(2) $20 ($200 x 10%) withholding under section 1446(f); Complete, edit or print tax forms instantly. Turn on the wizard mode in the top toolbar to acquire additional suggestions. (3) $120 ($400 x 30%). Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Try it for free now! Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Source income subject to withholding, are due on march 15, 2022. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. (1) $185 ($500 x 37%) withholding under section 1446(a);

ITIN for Foreign Person Wages Salary Compensation and Honoraria

Get ready for tax season deadlines by completing any required tax forms today. Fill in every fillable area. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. (3) $120 ($400 x 30%). Web form 1042 [ edit] form 1042, also annual withholding tax return for u.s.

What is Filing of 1042 Form?

Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Income and amounts withheld as described in the instructions for form. Dividend code 40 other dividend. (3) $120 ($400 x 30%). Source income subject to withholding, including recent updates,.

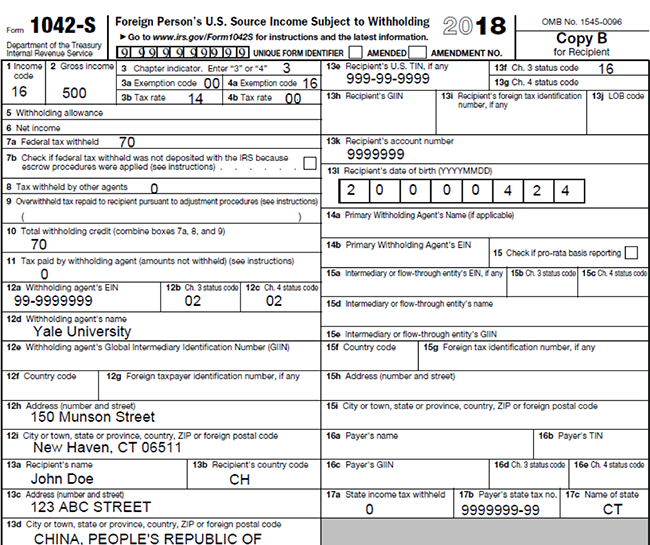

Form 1042S It's Your Yale

Income and amounts withheld as described in the instructions for form. Complete, edit or print tax forms instantly. Source income subject to withholding, are due on march 15, 2022. (1) $185 ($500 x 37%) withholding under section 1446(a); Web hit the get form button to start editing.

Irs 1042 s instructions 2019

Upload, modify or create forms. (1) $185 ($500 x 37%) withholding under section 1446(a); Source income subject to withholding to assess penalties and to send out notices for incorrectly filed forms 1042. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Web hit the get form button to start editing.

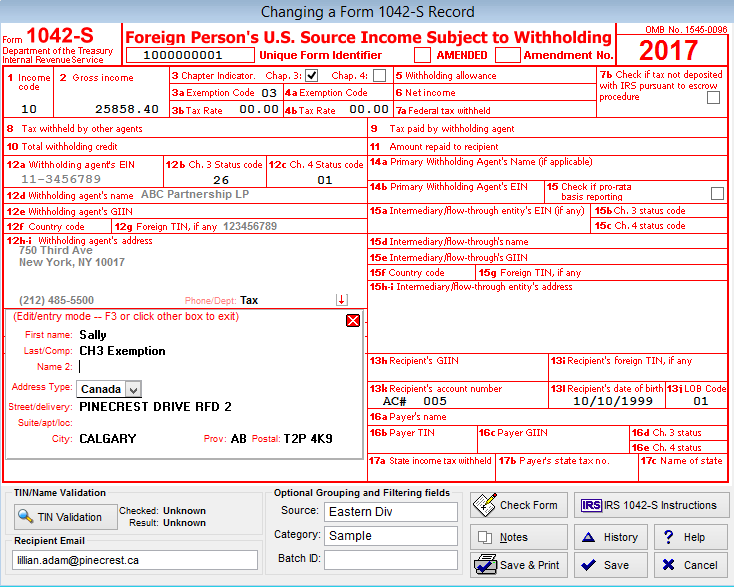

The Tax Times The Newly Issued Form 1042S Foreign Person's U.S

Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Ad get ready for tax season deadlines by completing any required tax.

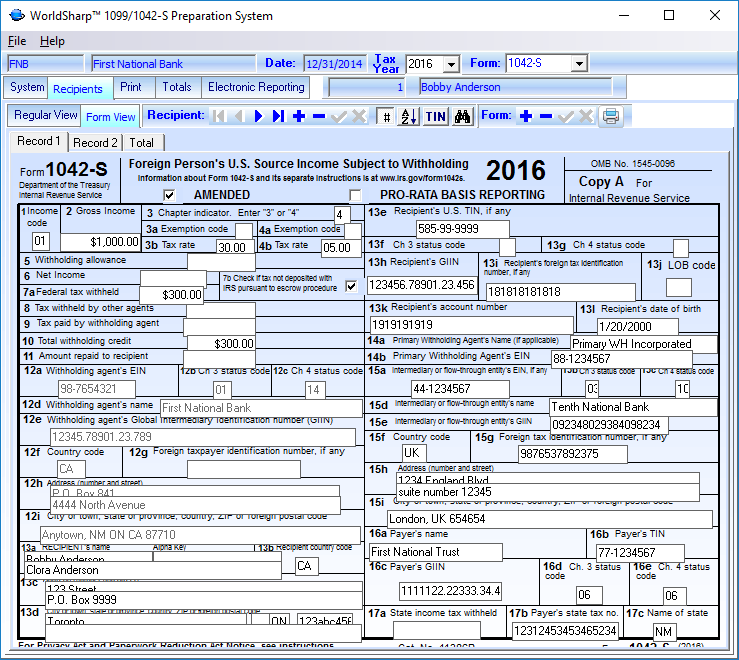

1042 S Form slideshare

Web form 1042 [ edit] form 1042, also annual withholding tax return for u.s. Web hit the get form button to start editing. (1) $185 ($500 x 37%) withholding under section 1446(a); Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Turn on the wizard mode in the top toolbar to acquire additional.

Form 1042s 2022 instructions Fill online, Printable, Fillable Blank

There are a number of changes to codes: Web hit the get form button to start editing. Try it for free now! (2) $20 ($200 x 10%) withholding under section 1446(f); Ad get ready for tax season deadlines by completing any required tax forms today.

form 1042s instructions 2021 Fill Online, Printable, Fillable Blank

Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Try it for free now! (3) $120 ($400 x 30%). Web withholding.

1042 S Form slideshare

There are a number of changes to codes: Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Try it for free now! (1) $185 ($500 x 37%) withholding under section 1446(a); Income and amounts withheld as described in the instructions for form.

1042 Fill out & sign online DocHub

Try it for free now! Web form 1042 [ edit] form 1042, also annual withholding tax return for u.s. Complete, edit or print tax forms instantly. Source income subject to withholding, are due on march 15, 2022. Get ready for tax season deadlines by completing any required tax forms today.

Web Get Tax Form (1099/1042S) Get Tax Form (1099/1042S) Download A Copy Of Your 1099 Or 1042S Tax Form So You Can Report Your Social Security Income On Your Tax Return.

Web withholding of $325, comprised of: Ad get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding. Web form 1042 [ edit] form 1042, also annual withholding tax return for u.s.

Web Form 1042 Department Of The Treasury Internal Revenue Service Annual Withholding Tax Return For U.s.

(1) $185 ($500 x 37%) withholding under section 1446(a); Source income of foreign persons go to www.irs.gov/form1042 for. Web hit the get form button to start editing. (3) $120 ($400 x 30%).

Upload, Modify Or Create Forms.

There are a number of changes to codes: Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Source Income Subject To Withholding, Are Due On March 15, 2022.

As withholding agents prepare these forms, they should. Source income subject to withholding to assess penalties and to send out notices for incorrectly filed forms 1042. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Try it for free now!