Form 1099S Instructions

Form 1099S Instructions - Sign in to turbotax and select pick up where you left off; This revised form and condensed instructions streamline the materials and. Reportable real estate generally, you are required. The sales price is the gross proceeds you received in. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Those preparing the form will need to include the date of closing and the gross proceeds from. In field 2, enter the. In field 1, you need to enter the date of closing for the real estate. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. If you sold your main home.

• instructions for form 1099. Those preparing the form will need to include the date of closing and the gross proceeds from. This revised form and condensed instructions streamline the materials and. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Further, in the fields, you have to fill in: Learn more about how to simplify your businesses 1099 reporting. Reportable real estate generally, you are required. Web instructions for transferor for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the real estate proceeds to the. In field 1, you need to enter the date of closing for the real estate.

• instructions for form 1099. Web enter your full name, tin, and address. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web instructions for transferor for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the real estate proceeds to the. Learn more about how to simplify your businesses 1099 reporting. Sign in to turbotax and select pick up where you left off; Reportable real estate generally, you are required. In field 2, enter the. If you sold your main home. This revised form and condensed instructions streamline the materials and.

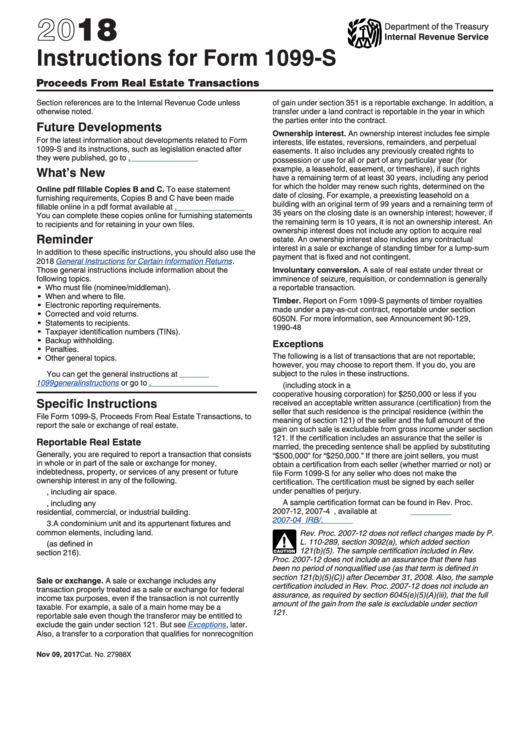

Instructions for Form 1099s Proceeds From Real Estate Transactions

This revised form and condensed instructions streamline the materials and. In field 1, you need to enter the date of closing for the real estate. Sign in to turbotax and select pick up where you left off; • instructions for form 1099. Learn more about how to simplify your businesses 1099 reporting.

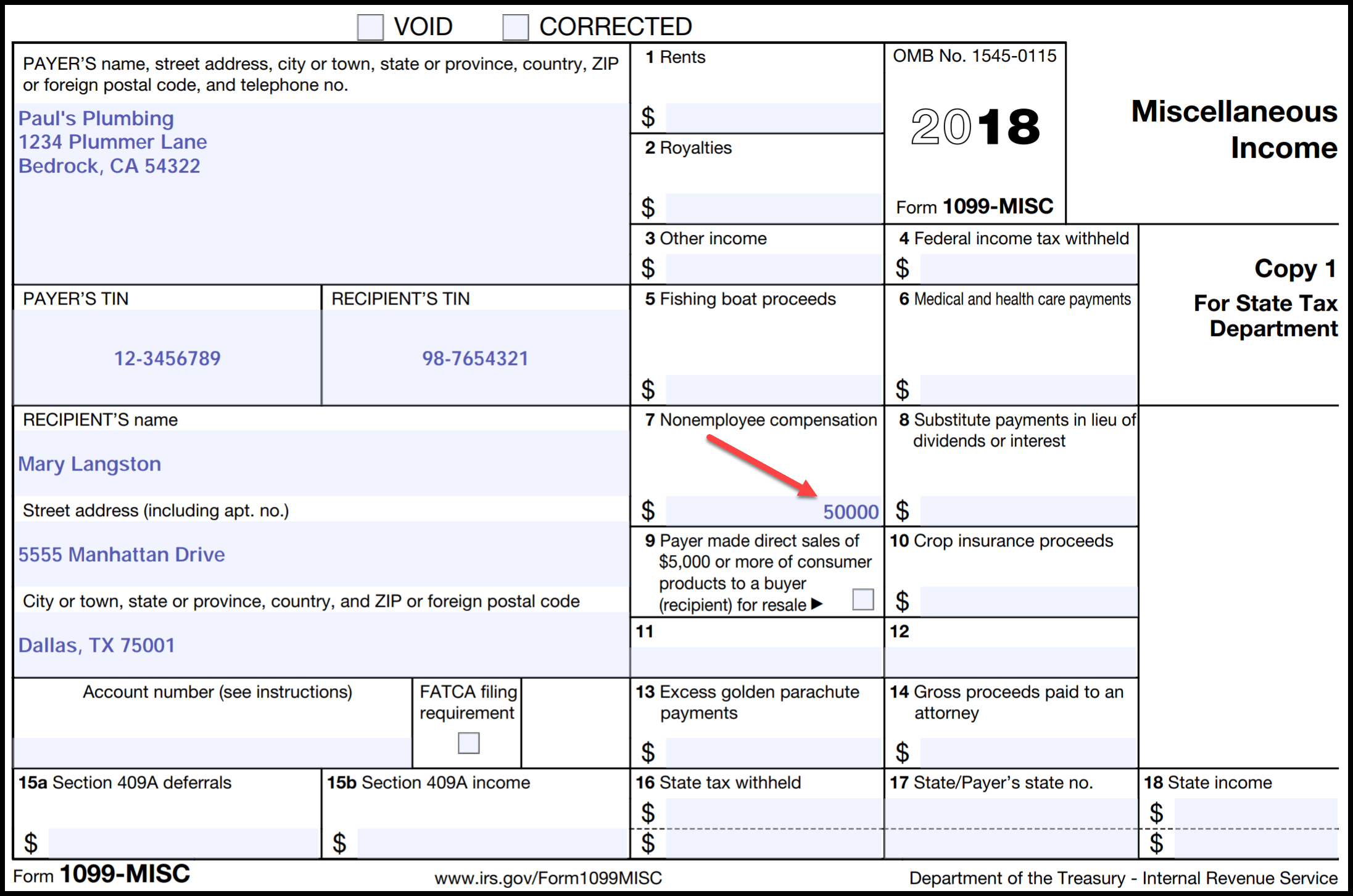

11 Common Misconceptions About Irs Form 11 Form Information Free

Web instructions for transferor for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the real estate proceeds to the. The sales price is the gross proceeds you received in. Those preparing the form will need to include the date of closing and the gross proceeds from. Ap leaders rely on iofm’s.

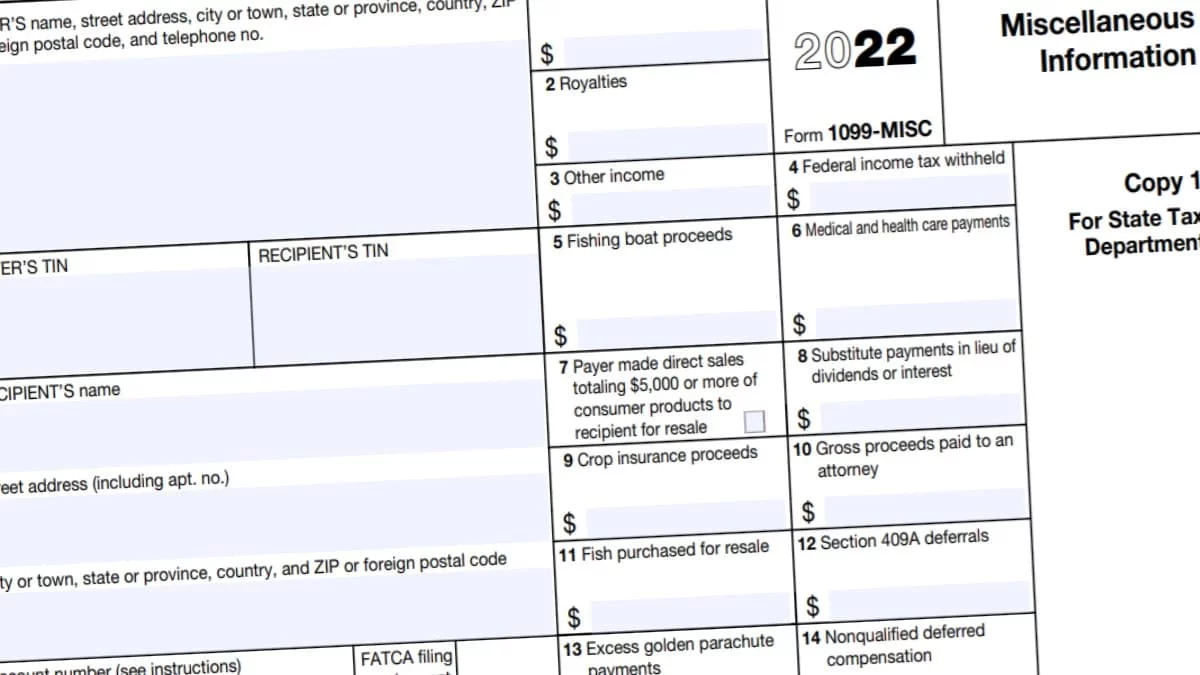

Difference Between 1099MISC and 1099NEC

Learn more about how to simplify your businesses 1099 reporting. • instructions for form 1099. Web instructions for transferor for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the real estate proceeds to the. The sales price is the gross proceeds you received in. Report the sale of your rental property.

What Are 10 Things You Should Know About 1099s?

In field 2, enter the. The sales price is the gross proceeds you received in. Sign in to turbotax and select pick up where you left off; In field 1, you need to enter the date of closing for the real estate. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations.

What the Heck is "IRS Form 1099S" and Why Does it Matter? REtipster

The sales price is the gross proceeds you received in. Those preparing the form will need to include the date of closing and the gross proceeds from. In field 2, enter the. If you sold your main home. Reportable real estate generally, you are required.

1099 S Fillable Form Form Resume Examples X42M5Ra2kG

In field 1, you need to enter the date of closing for the real estate. Report the sale of your rental property on form 4797. This revised form and condensed instructions streamline the materials and. If you sold your main home. Web enter your full name, tin, and address.

Form 1099 S Fill and Sign Printable Template Online US Legal Forms

In field 1, you need to enter the date of closing for the real estate. Learn more about how to simplify your businesses 1099 reporting. If you sold your main home. • instructions for form 1099. Web enter your full name, tin, and address.

Instructions For Form 1099S Proceeds From Real Estate Transactions

Web instructions for transferor for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the real estate proceeds to the. Sign in to turbotax and select pick up where you left off; This revised form and condensed instructions streamline the materials and. If you sold your main home. The sales price is.

Fillable Form 1099 S Form Resume Examples v19xKBO27E

In field 1, you need to enter the date of closing for the real estate. • instructions for form 1099. In field 2, enter the. Further, in the fields, you have to fill in: If you sold your main home.

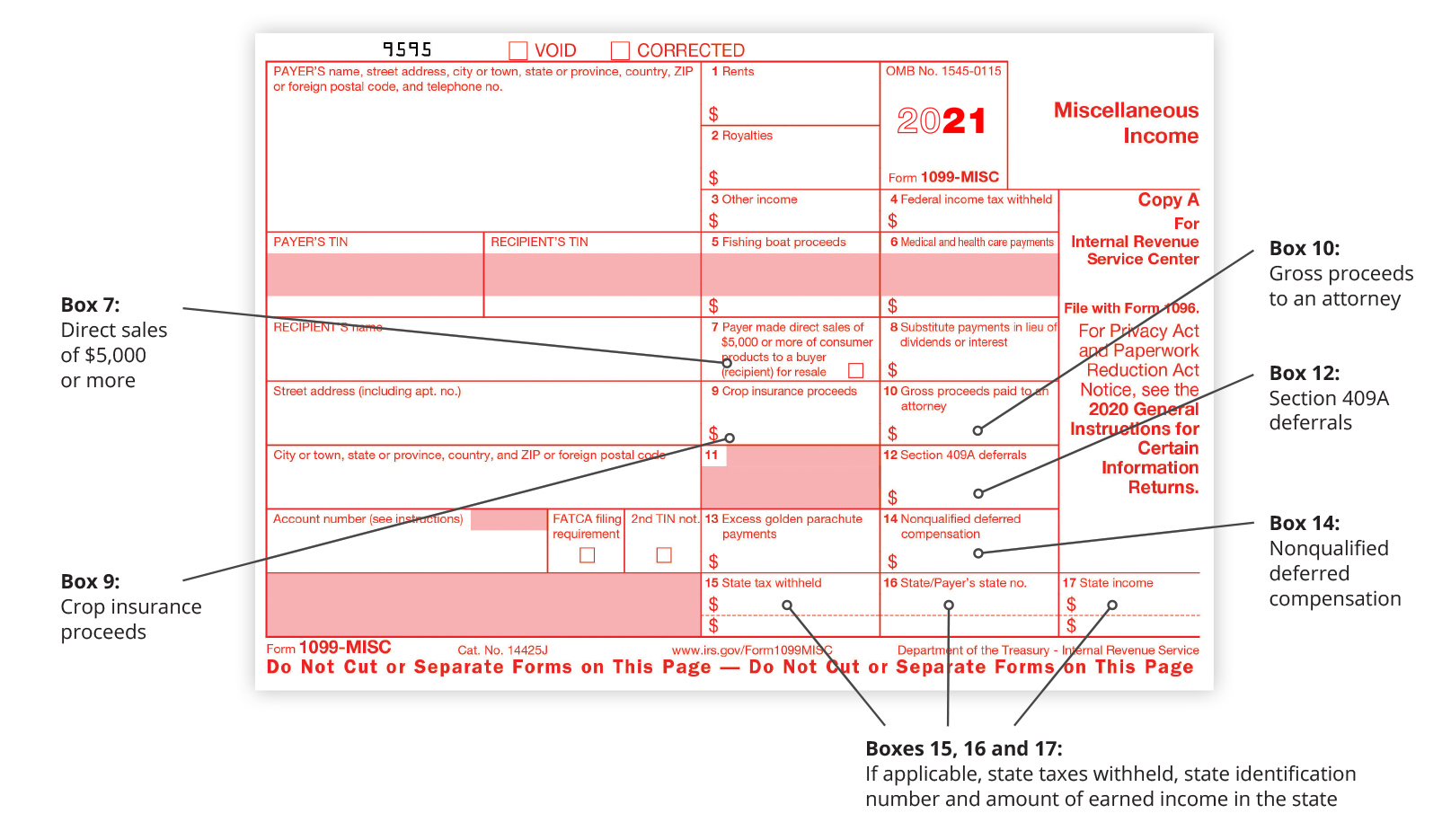

1099 NEC vs 1099 MISC 2021 2022 1099 Forms TaxUni

Further, in the fields, you have to fill in: This revised form and condensed instructions streamline the materials and. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. In field 2, enter the. • instructions for form 1099.

Those Preparing The Form Will Need To Include The Date Of Closing And The Gross Proceeds From.

The sales price is the gross proceeds you received in. Web instructions for transferor for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the real estate proceeds to the. Further, in the fields, you have to fill in: Report the sale of your rental property on form 4797.

Web Enter Your Full Name, Tin, And Address.

Learn more about how to simplify your businesses 1099 reporting. Reportable real estate generally, you are required. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. In field 2, enter the.

Ap Leaders Rely On Iofm’s Expertise To Keep Them Up To Date On Changing Irs Regulations.

• instructions for form 1099. If you sold your main home. This revised form and condensed instructions streamline the materials and. Sign in to turbotax and select pick up where you left off;

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)