Form 1120-S Schedule K-1 Instructions

Form 1120-S Schedule K-1 Instructions - Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. If you’ve elected to be treated. Complete, edit or print tax forms instantly. Ad access irs tax forms. A description of the credit items. Ad access irs tax forms. This code will let you know if you should. Fill in all required fields in the doc with our convenient. Click the button get form to open it and start editing. Complete, edit or print tax forms instantly.

Ad access irs tax forms. Ad access irs tax forms. (for shareholder's use only) department of the. Download or email inst 1120s & more fillable forms, register and subscribe now! A description of the credit items. If you’ve elected to be treated. Keep a copy for the corporation's records and. Get ready for tax season deadlines by completing any required tax forms today. Click the button get form to open it and start editing. Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick.

Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. If you’ve elected to be treated. Complete, edit or print tax forms instantly. Ad access irs tax forms. Click the button get form to open it and start editing. Information from the schedule k. (for shareholder's use only) department of the.

IRS Form 1120S Definition, Download & Filing Instructions

Get ready for tax season deadlines by completing any required tax forms today. Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. If you’ve elected to be treated. Ad access irs tax forms. Download or email inst 1120s & more fillable.

1120 EF Message 0042 Schedule M2 is out of Balance (M1, M2, ScheduleL)

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. If you’ve elected to be.

1120s k1 instructions Fill Online, Printable, Fillable Blank form

Download or email inst 1120s & more fillable forms, register and subscribe now! Ad access irs tax forms. Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. Information from the schedule k. Fill in all required fields in the doc with.

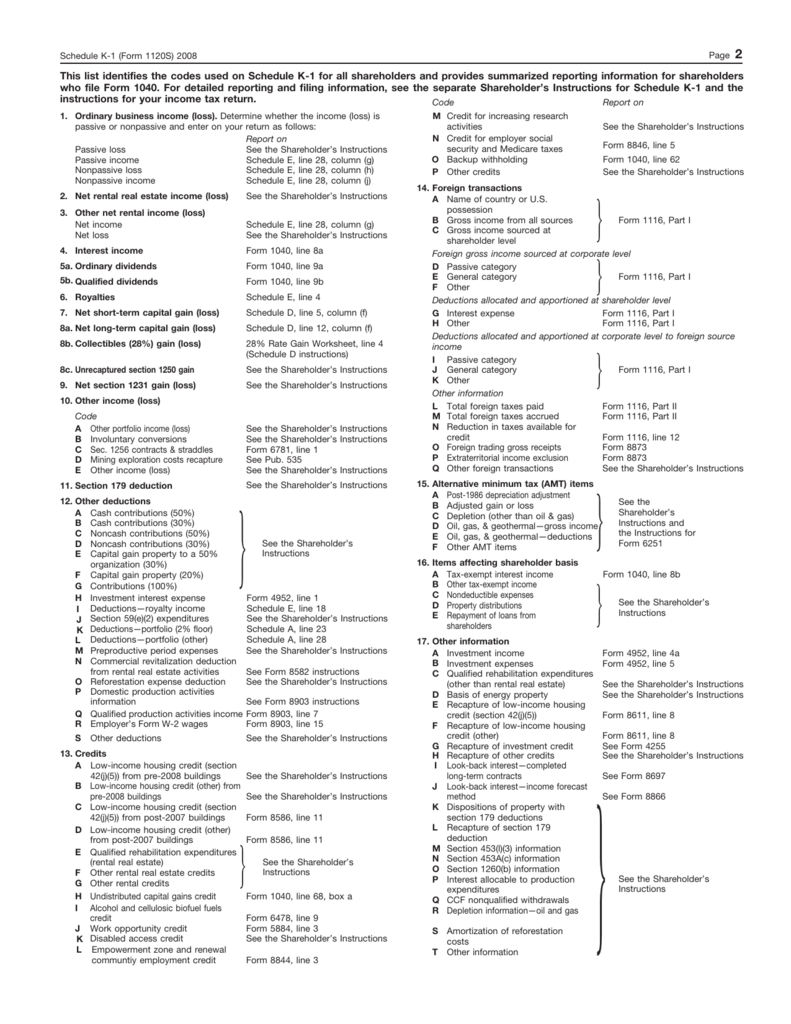

1120S K1 codes

Keep a copy for the corporation's records and. Fill in all required fields in the doc with our convenient. Download or email inst 1120s & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

How to Fill Out Schedule K1 Form 1120 S YouTube

Get ready for tax season deadlines by completing any required tax forms today. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for.

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 —

Fill in all required fields in the doc with our convenient. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts.

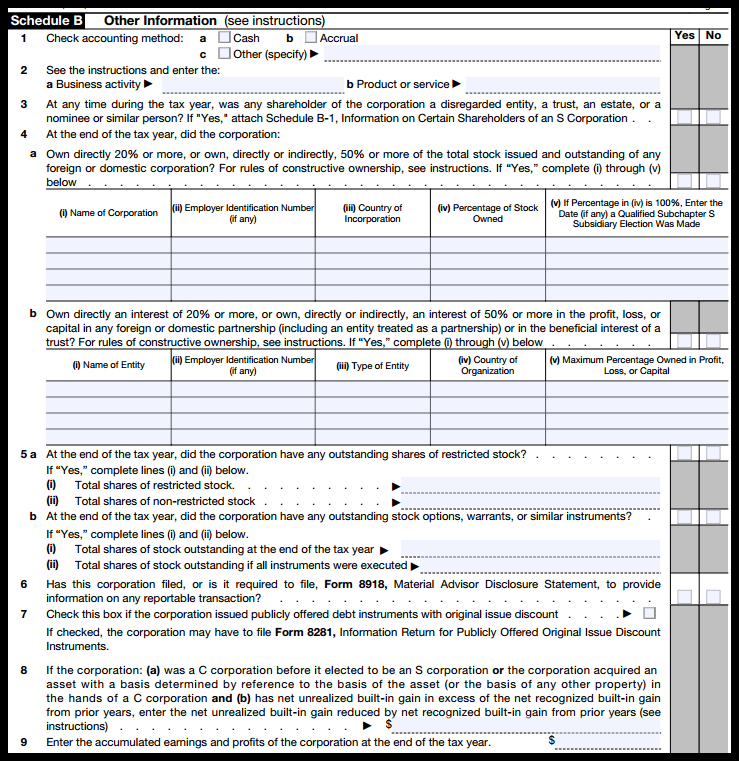

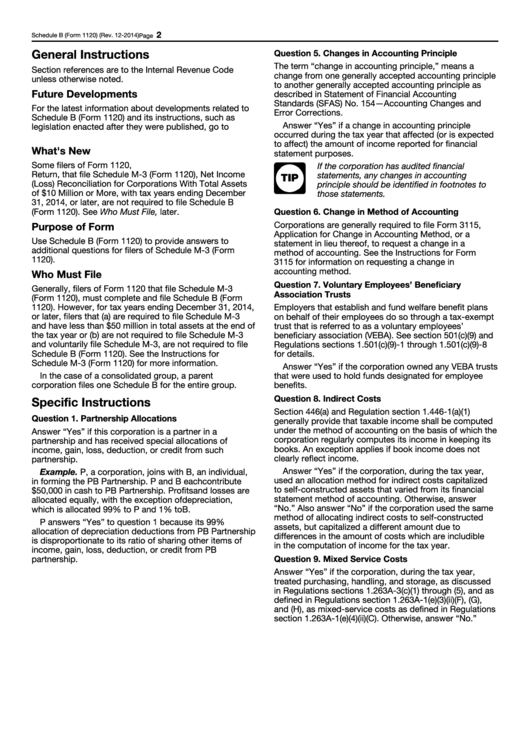

Instructions For Form 1120 Schedule B 2014 printable pdf download

Complete, edit or print tax forms instantly. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Get ready for tax season deadlines by completing any required tax forms today. Fill in all required fields in the doc with our convenient. (for shareholder's use only) department.

K1 Basis Worksheet

If you’ve elected to be treated. A description of the credit items. This code will let you know if you should. (for shareholder's use only) department of the. Click the button get form to open it and start editing.

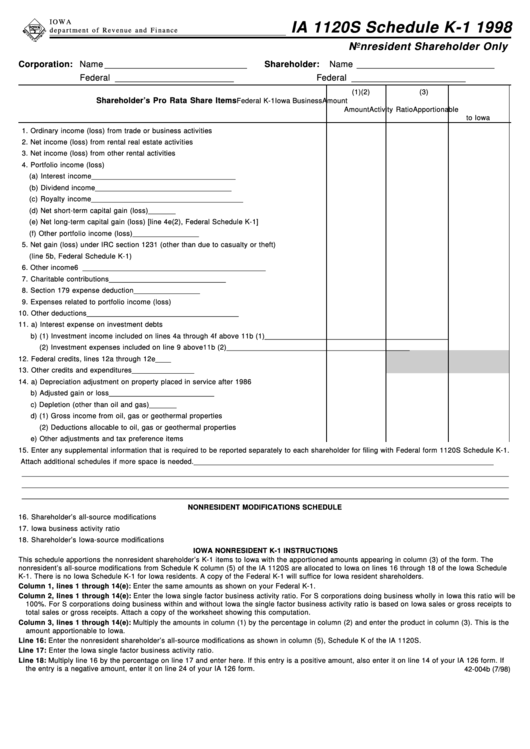

Fillable Form 1120s Schedule K1 Nonresident Shareholder Only 1998

Information from the schedule k. Complete, edit or print tax forms instantly. (for shareholder's use only) department of the. Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. Keep a copy for the corporation's records and.

Form 1120S (Schedule M3) Net (Loss) Reconciliation for S

(for shareholder's use only) department of the. If you’ve elected to be treated. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Keep a copy for the corporation's records and.

Fill In All Required Fields In The Doc With Our Convenient.

Get ready for tax season deadlines by completing any required tax forms today. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Ad access irs tax forms. If you’ve elected to be treated.

Ad Access Irs Tax Forms.

Click the button get form to open it and start editing. Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. Download or email inst 1120s & more fillable forms, register and subscribe now! A description of the credit items.

Keep A Copy For The Corporation's Records And.

This code will let you know if you should. Information from the schedule k. Complete, edit or print tax forms instantly. (for shareholder's use only) department of the.