Form 1120 W

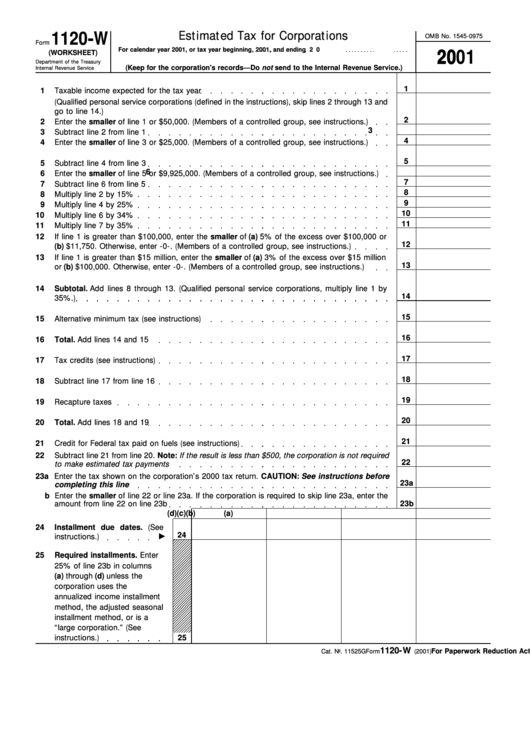

Form 1120 W - All other entities must determine their estimated tax liability by using the. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a. It’s a tax worksheet used to determine required installments of estimated. Use this form to report the. It isn't sent to the irs but is retained by the corporation. A corporation is obliged to submit. If your corporation follows a calendar year, your estimated corporate tax payments are due april. For calendar year 2021, or tax year beginning , 2021,. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a. If you are part of a corporation that has a tax liability of $500 or.

If you are part of a corporation that has a tax liability of $500 or. It’s a tax worksheet used to determine required installments of estimated. It isn't sent to the irs but is retained by the corporation. Use this form to report the. If your corporation follows a calendar year, your estimated corporate tax payments are due april. Web if you have completed your tax return, locate your estimated tax due in taxact® by following these steps: Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a. Web showing 8 worksheets for 1120 line 26 supporting details. For calendar year 2021, or tax year beginning , 2021,. C corporations that expect to owe more than.

C corporations that expect to owe more than. It isn't sent to the irs but is retained by the corporation. Worksheets are 2020 form 1120 w work, 1120 s income tax return for an s corporation, instruc. Use this form to report the. It’s a tax worksheet used to determine required installments of estimated. All other entities must determine their estimated tax liability by using the. If you are part of a corporation that has a tax liability of $500 or. Filers should see publication 542, corporations, and the. Start the taxact business 1120 program. Web showing 8 worksheets for 1120 line 26 supporting details.

IRS Form 1120W 2018 2019 Fillable and Editable PDF Template

It isn't sent to the irs but is retained by the corporation. Worksheets are 2020 form 1120 w work, 1120 s income tax return for an s corporation, instruc. You can download or print. Web if you have completed your tax return, locate your estimated tax due in taxact® by following these steps: A corporation is obliged to submit.

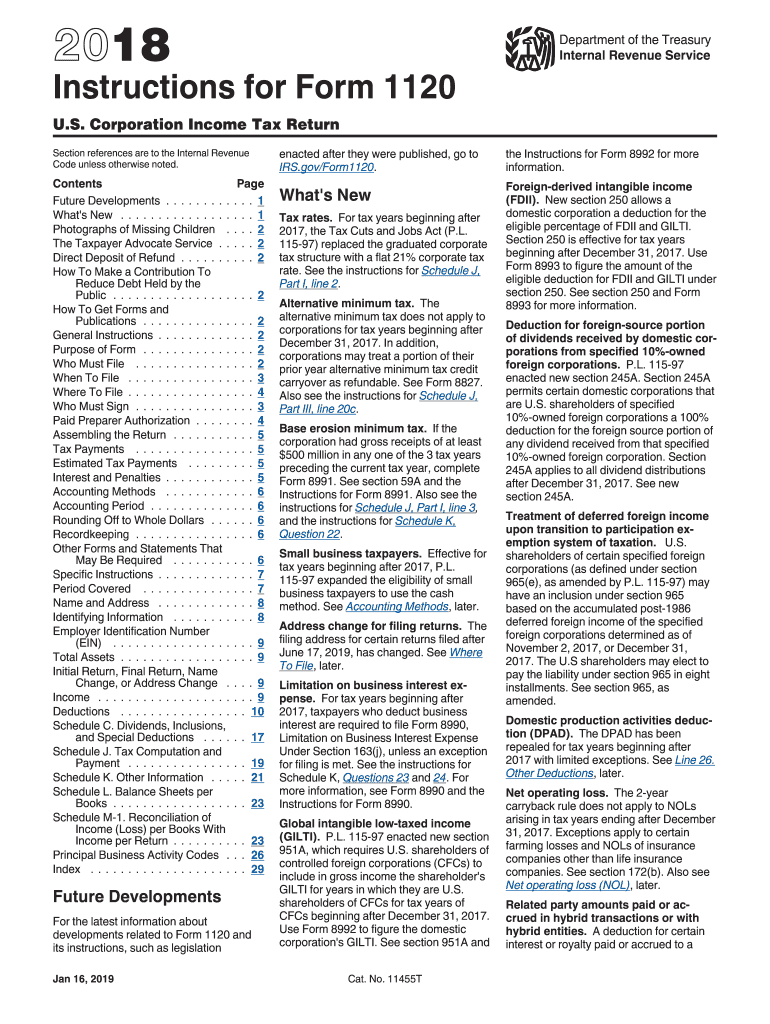

Tax form 1120 instructions

It’s a tax worksheet used to determine required installments of estimated. You can download or print. For calendar year 2021, or tax year beginning , 2021,. If you are part of a corporation that has a tax liability of $500 or. Worksheets are 2020 form 1120 w work, 1120 s income tax return for an s corporation, instruc.

U.S. TREAS Form treasirs1120w1993

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a. Use this form to report the. Corporation income tax return, including recent updates, related forms and instructions on how to file. A corporation is obliged to submit. Filers should see publication 542, corporations, and the.

2018 1120 Fill Out and Sign Printable PDF Template signNow

Select the document you want to sign and click upload. Web if you have completed your tax return, locate your estimated tax due in taxact® by following these steps: All other entities must determine their estimated tax liability by using the. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability.

Form 1120PC U.S. Property and Company Tax Return (2015) Free

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a. C corporations that expect to owe more than. Filers should see publication 542, corporations, and the. Select the document you want to sign and click upload. You can download or print.

Fillable Form 1120W (Worksheet) Estimated Tax For Corporations

Corporation income tax return, including recent updates, related forms and instructions on how to file. Web if you have completed your tax return, locate your estimated tax due in taxact® by following these steps: It’s a tax worksheet used to determine required installments of estimated. Web information about form 1120, u.s. Worksheets are 2020 form 1120 w work, 1120 s.

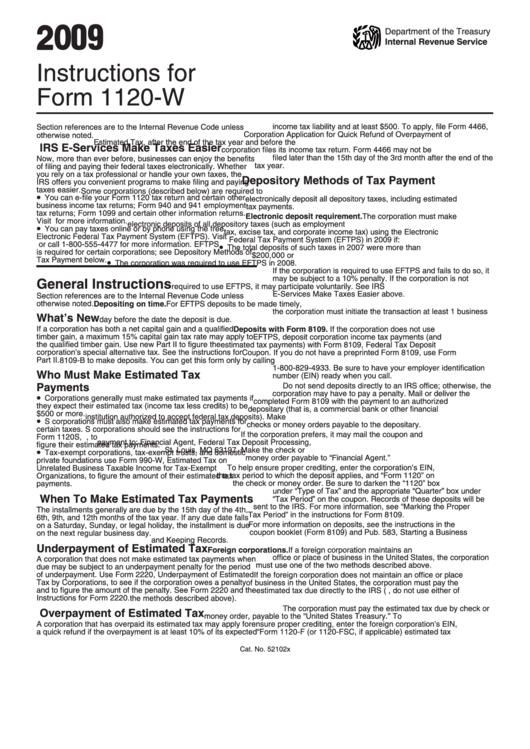

Instructions For Form 1120W 2009 printable pdf download

C corporations that expect to owe more than. Worksheets are 2020 form 1120 w work, 1120 s income tax return for an s corporation, instruc. Start the taxact business 1120 program. Penalties may apply if the corporation does. Filers should see publication 542, corporations, and the.

Instructions For Form 1120W Estimated Tax For Corporations 2017

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a. Web showing 8 worksheets for 1120 line 26 supporting details. Filers should see publication 542, corporations, and the. Web if you have completed your tax return, locate your estimated tax due in taxact® by following these steps: It isn't.

Printed Form 1120 W 4 On Paper Close Up Stock Photo Download Image

Corporation income tax return, including recent updates, related forms and instructions on how to file. Start the taxact business 1120 program. Worksheets are 2020 form 1120 w work, 1120 s income tax return for an s corporation, instruc. All other entities must determine their estimated tax liability by using the. Penalties may apply if the corporation does.

form 1120l instructions Fill Online, Printable, Fillable Blank

For calendar year 2021, or tax year beginning , 2021,. Start the taxact business 1120 program. Worksheets are 2020 form 1120 w work, 1120 s income tax return for an s corporation, instruc. Select the document you want to sign and click upload. You can download or print.

C Corporations That Expect To Owe More Than.

Web showing 8 worksheets for 1120 line 26 supporting details. Worksheets are 2020 form 1120 w work, 1120 s income tax return for an s corporation, instruc. Penalties may apply if the corporation does. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a.

Web Information About Form 1120, U.s.

Select the document you want to sign and click upload. Web if you have completed your tax return, locate your estimated tax due in taxact® by following these steps: All other entities must determine their estimated tax liability by using the. For calendar year 2021, or tax year beginning , 2021,.

Start The Taxact Business 1120 Program.

Filers should see publication 542, corporations, and the. It isn't sent to the irs but is retained by the corporation. It’s a tax worksheet used to determine required installments of estimated. You can download or print.

If Your Corporation Follows A Calendar Year, Your Estimated Corporate Tax Payments Are Due April.

A corporation is obliged to submit. If you are part of a corporation that has a tax liability of $500 or. Use this form to report the. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a.