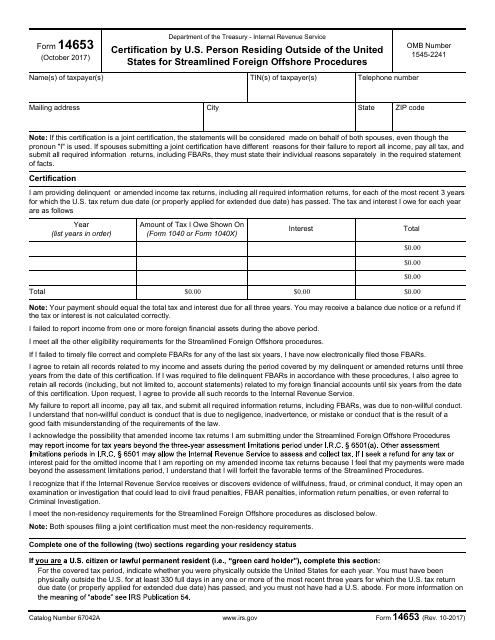

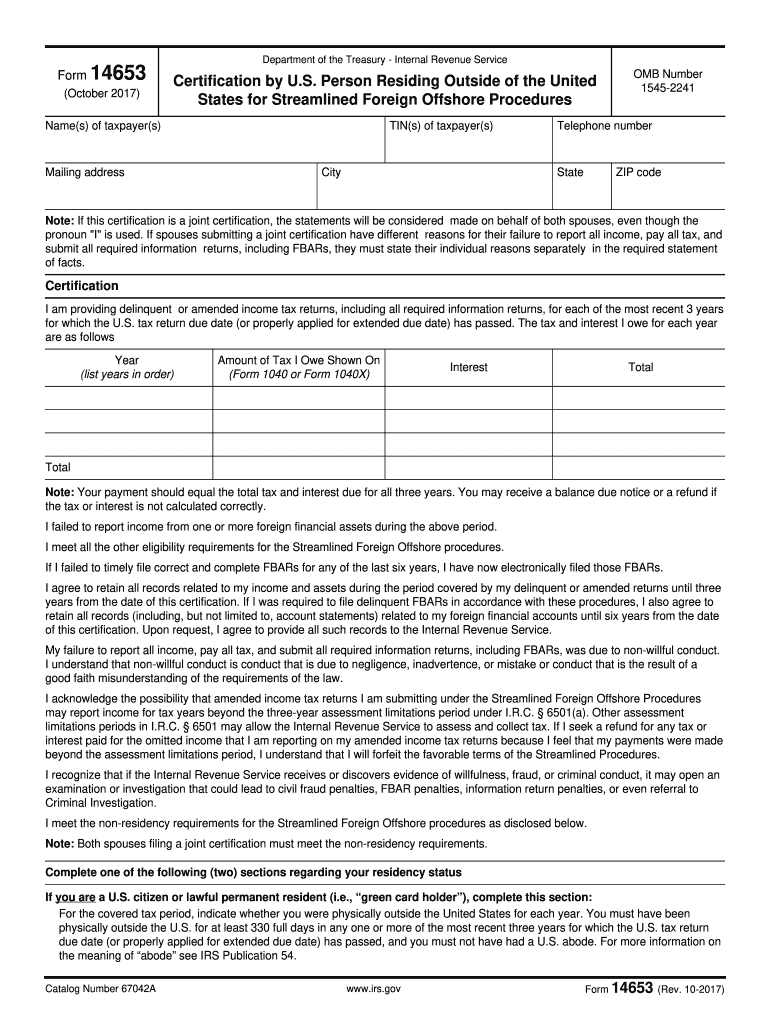

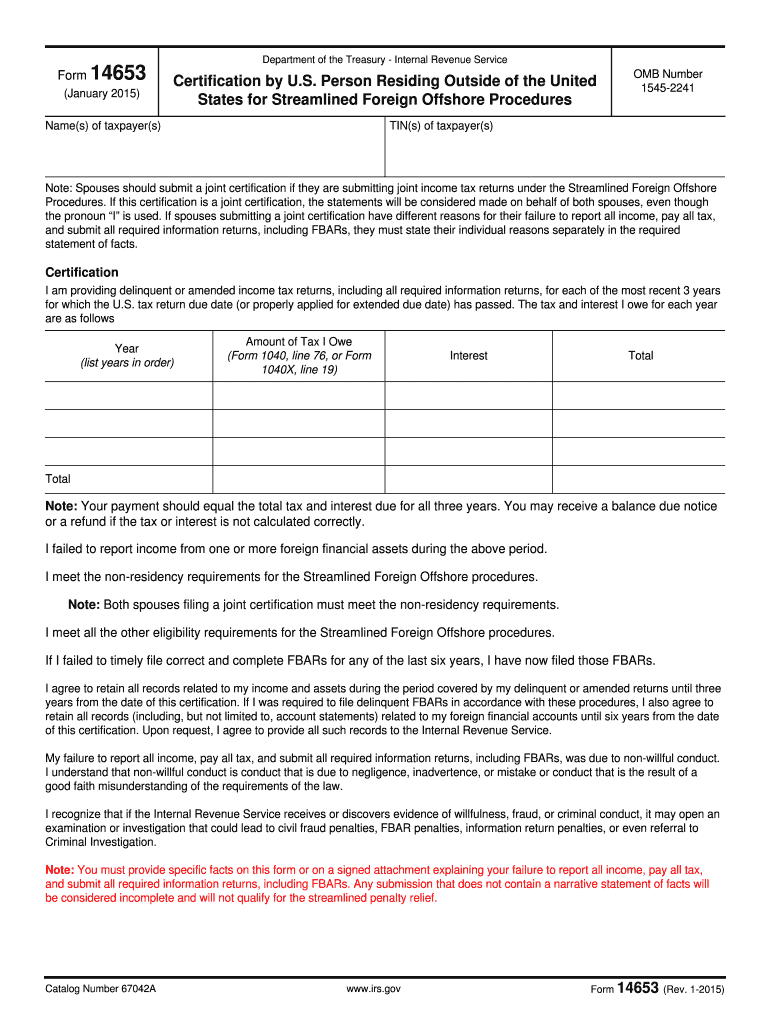

Form 14653 Fillable Pdf

Form 14653 Fillable Pdf - Web catalog number 67042a www.irs.gov form 14653 (rev. Taxpayer a must file forms 5471 reporting her ownership of foreign corp. To get started on the form, utilize the fill camp; Show details this website is not affiliated with irs. Form 14653 certifies that your failure to file your taxes was not a willful act. Edit your form 14653 pdf online. Web follow the simple instructions below: You can also create a form using the developer tab. Type text, add images, blackout confidential details, add comments, highlights and more. Person residing outside of the u.s.(form 14653)pdf dochubing (1) that you are.

Ad upload, edit, sign & export pdf forms online. Web edit form 14653 (rev. Web send irs form 14653 via email, link, or fax. Secure and trusted digital platform! Web catalog number 67042a www.irs.gov form 14653 (rev. Sign it in a few clicks. Form 14653 is intended to verify that your tax delinquency was not willful, which is required to utilize the streamlined program for getting caught up on taxes without penalties. You can also download it, export it or print it out. Person residing outside of the u.s.(form 14653)pdf dochubing (1) that you are. The advanced tools of the editor will direct you through the editable pdf template.

Web form 14653 is an irs tax form expats must file when using the streamlined filing compliance procedures program. Signnow allows users to edit, sign, fill and share all type of documents online. Once complete, click file > save as to save your form to your desired location. Enter your official identification and contact details. Ad download or email irs 14653 & more fillable forms, register and subscribe now! Web follow the simple instructions below: Web edit form 14653 (rev. Form 14653 certifies that your failure to file your taxes was not a willful act. Fill form 14653 instantly, edit online. Coast guard bill of sale fedex freight claim form fillable online irs form 14653 (4.9 / 5) 57.

Form W9 Internal Revenue Service

As the society takes a step away from office working conditions, the completion of paperwork more and more occurs electronically. Fill form 14653 instantly, edit online. Ad download or email irs 14653 & more fillable forms, try for free now! Enter your official identification and contact details. Web catalog number 67042a www.irs.gov form 14653 (rev.

Guide for Submitting Form 14653

You can also download it, export it or print it out. With our platform filling out form 14653 usually takes a couple of minutes. Download blank or fill out online in pdf format. Feel all the key benefits of submitting and completing documents on the internet. Signnow allows users to edit, sign, fill and share all type of documents online.

Download Instructions for Form 3, SEC Form 1473 Initial Statement of

Once complete, click file > save as to save your form to your desired location. Sign, fax and printable from pc, ipad, tablet or mobile. Quickly add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable fields, and rearrange or remove pages from your document. Web how it works open form follow the instructions easily sign the form.

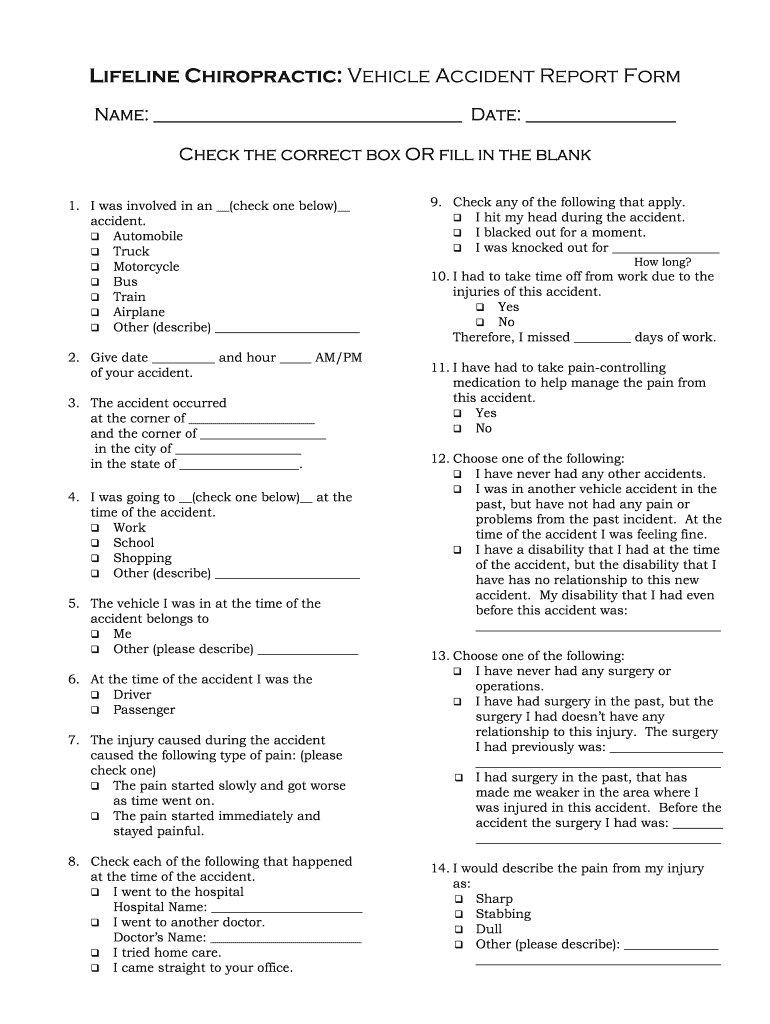

Chiropractic Accident Form Fill Online, Printable, Fillable, Blank

Web what is form 14653? As the society takes a step away from office working conditions, the completion of paperwork more and more occurs electronically. Form 14653 is intended to verify that your tax delinquency was not willful, which is required to utilize the streamlined program for getting caught up on taxes without penalties. With our platform filling out form.

Form 14653 Fill out & sign online DocHub

Sign it in a few clicks. Form 14653 is intended to verify that your tax delinquency was not willful, which is required to utilize the streamlined program for getting caught up on taxes without penalties. Sign online button or tick the preview image of the form. Web the amended form 14653 must include all facts and circumstances concerning the error.

IRS Form 14653 Download Fillable PDF or Fill Online Certification by U

Web send irs form 14653 via email, link, or fax. Ad download or email irs 14653 & more fillable forms, register and subscribe now! Taxpayer a separately electronically filed fbars with fincen. Download blank or fill out online in pdf format. Fill form 14653 instantly, edit online.

Form 14653 / 14654 Narrative Solid Reason or flimsy Excuse?

B, and taxpayer a must address the section 965 transition tax on her 2017 income tax. Enter your official identification and contact details. Once complete, click file > save as to save your form to your desired location. Ad upload, edit, sign & export pdf forms online. Taxpayer a must file forms 5471 reporting her ownership of foreign corp.

Form 14653 Fill Out and Sign Printable PDF Template signNow

Complete, sign, print and send your tax documents easily with us legal forms. Sign, fax and printable from pc, ipad, tablet or mobile. The official name of form 14653 is: Coast guard bill of sale fedex freight claim form fillable online irs form 14653 (4.9 / 5) 57. Get the form 14653 (rev.

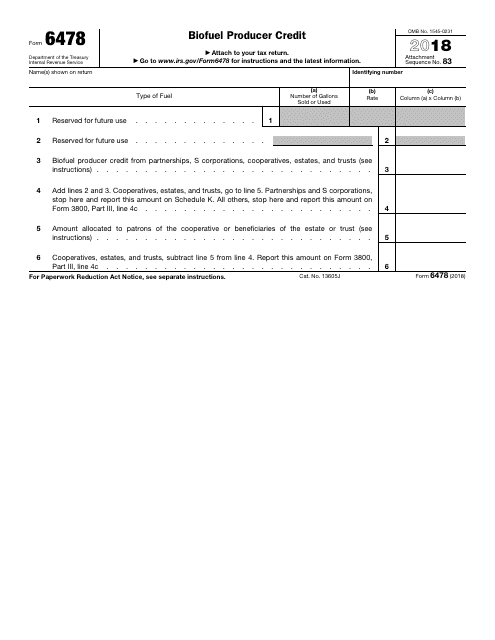

IRS Form 6478 Download Fillable PDF or Fill Online Biofuel Producer

Web the amended form 14653 must include all facts and circumstances concerning the error in the original streamlined submission. Person residing outside of the u.s.(form 14653)pdf dochubing (1) that you are. You can also create a form using the developer tab. Signnow allows users to edit, sign, fill and share all type of documents online. Download blank or fill out.

2014 Form IRS 14653 Fill Online, Printable, Fillable, Blank pdfFiller

Fill form 14653 instantly, edit online. Edit your form 14653 pdf online. Certification by us person residing outside of the united states for streamlined foreign offshore procedures. Type text, add images, blackout confidential details, add comments, highlights and more. B, and taxpayer a must address the section 965 transition tax on her 2017 income tax.

Person Residing Outside Of The U.s.(Form 14653)Pdf Dochubing (1) That You Are.

Taxpayer a must file forms 5471 reporting her ownership of foreign corp. Web edit form 14653 (rev. This will prompt acrobat to find the horizontal lines and create fillable fields. Form 14653 is a section of the us tax code that covers business expenses and provides an income break for those who own their own businesses.

Form 14653 Certifies That Your Failure To File Your Taxes Was Not A Willful Act.

Certification by us person residing outside of the united states for streamlined foreign offshore procedures. Ad download or email irs 14653 & more fillable forms, register and subscribe now! Web taxpayer a's sfo submission includes a form 14653 and delinquent income tax returns for tax years, 2017, 2018, 2019, and 2020. Get the form 14653 (rev.

Complete, Sign, Print And Send Your Tax Documents Easily With Us Legal Forms.

Quickly add and highlight text, insert pictures, checkmarks, and symbols, drop new fillable fields, and rearrange or remove pages from your document. Secure and trusted digital platform! Enter your official identification and contact details. Edit your form 14653 pdf online.

Person Residing Outside Of The United States For Streamlined Foreign Offshore Procedures Created Date:

B, and taxpayer a must address the section 965 transition tax on her 2017 income tax. To get started on the form, utilize the fill camp; Sign it in a few clicks. The maximum project notification fee required to be paid in any calendar year by a building owner is $2,000.00.) send check or money order made payable to division of industrial relations.