Form 15-8821

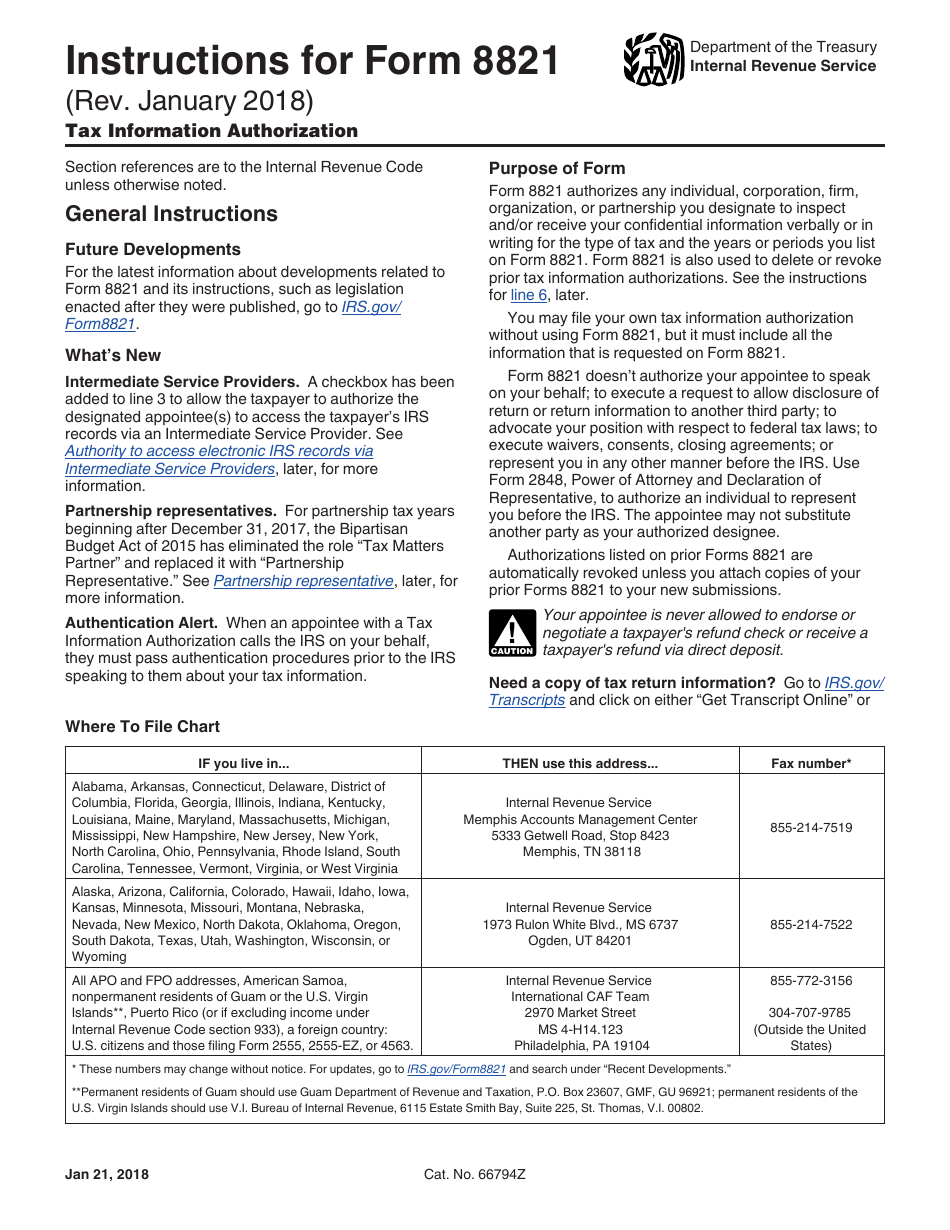

Form 15-8821 - Form 8821 is the tax information authorization form. Web form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect where to file chart and/or receive your confidential information. Form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential. Web purpose of form. Form 8821 is used to authorize certain. Do not use form 8821 to request. Web the appointee is authorized to inspect and/or receive confidential tax information in any office of the irs for the tax matters listed on this line. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information. This form enables the filer to give permission to view their confidential tax information to an individual,. Web we last updated the tax information authorization in february 2023, so this is the latest version of form 8821, fully updated for tax year 2022.

Form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information. This form enables the filer to give permission to view their confidential tax information to an individual,. Web we last updated the tax information authorization in february 2023, so this is the latest version of form 8821, fully updated for tax year 2022. Web registration forms the bureau of corporations and charitable organizations makes available a wide range of forms to assist individuals and business entities in filing with the. Do not use form 8821 to request. Form 8821 is used to authorize certain. Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file. The table below provides a list of forms that are used to register a business in pennsylvania, as well as. You can download or print current.

Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information. Web form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information in any office of the irs. Web irs form 8821 allows the irs to post your compliant status on the hce system. Form 8821 is used to authorize certain. This form enables the filer to give permission to view their confidential tax information to an individual,. Do not use form 8821 to request. Name telephone function date tax year (enter the tax year for which your return, and. You can download or print current. Web we last updated the tax information authorization in february 2023, so this is the latest version of form 8821, fully updated for tax year 2022. Form 8821 is the tax information authorization form.

Form 8821 Edit, Fill, Sign Online Handypdf

Form 8821 is used to authorize certain. February 2020) don’t sign this form unless all applicable. This form enables the filer to give permission to view their confidential tax information to an individual,. Do not use form 8821 to request. Web registration forms the bureau of corporations and charitable organizations makes available a wide range of forms to assist individuals.

Form 8821 Fillable Fill Out and Sign Printable PDF Template signNow

Form 8821 is used to authorize certain. The table below provides a list of forms that are used to register a business in pennsylvania, as well as. This form enables the filer to give permission to view their confidential tax information to an individual,. Web form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or.

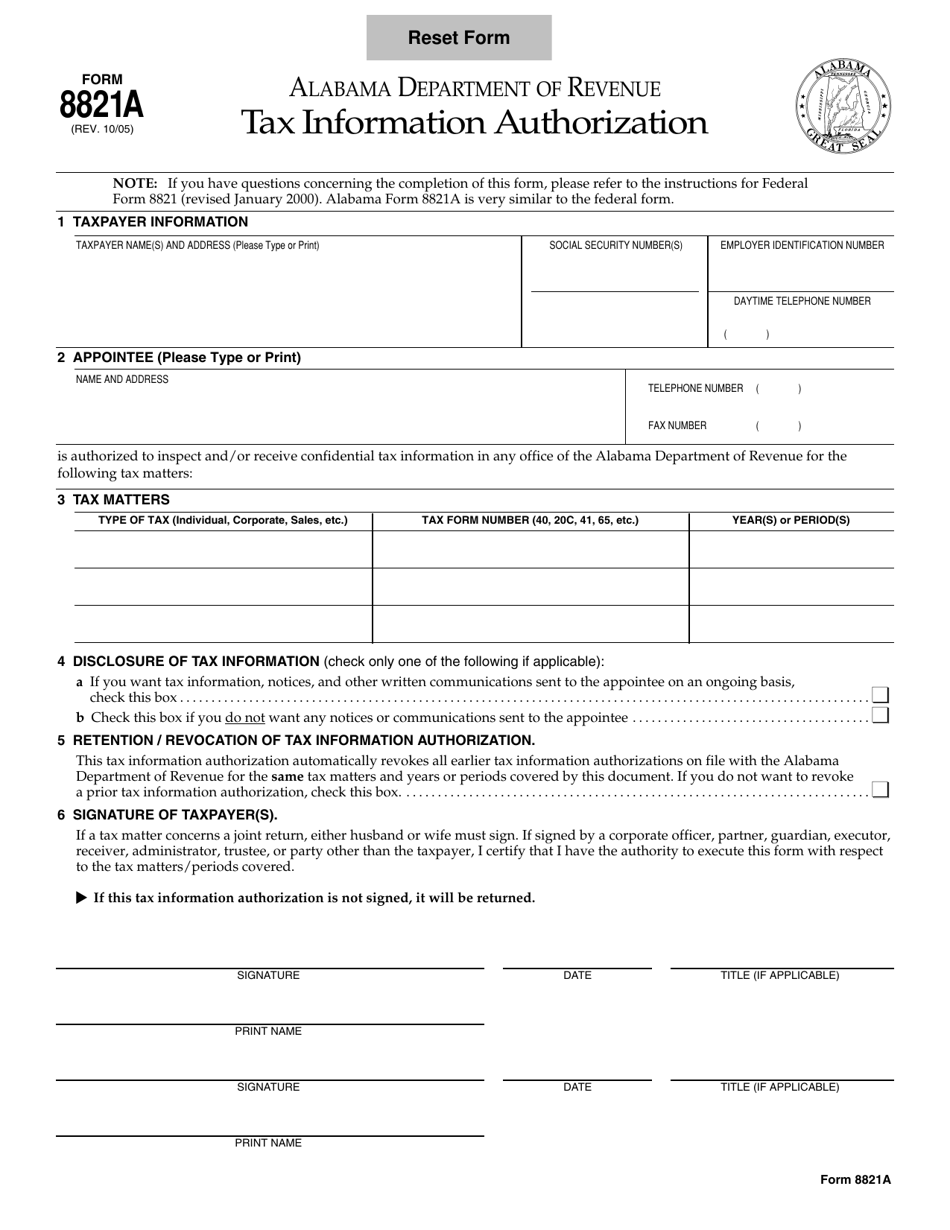

Form 8821A Download Fillable PDF or Fill Online Tax Information

Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file. February 2020) don’t sign this form unless all applicable. Save or instantly send your ready documents. Web form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information in any office of the.

Get your form 8821 online YouTube

Web irs form 8821 allows the irs to post your compliant status on the hce system. You can download or print current. This form enables the filer to give permission to view their confidential tax information to an individual,. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of.

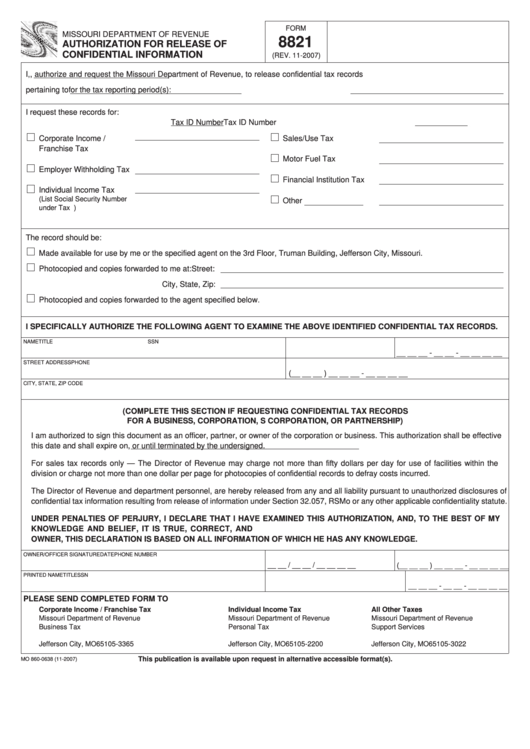

Fillable Form 8821 Authorization For Release Of Confidential

Save or instantly send your ready documents. You can download or print current. Name telephone function date tax year (enter the tax year for which your return, and. Web registration forms the bureau of corporations and charitable organizations makes available a wide range of forms to assist individuals and business entities in filing with the. Do not use form 8821.

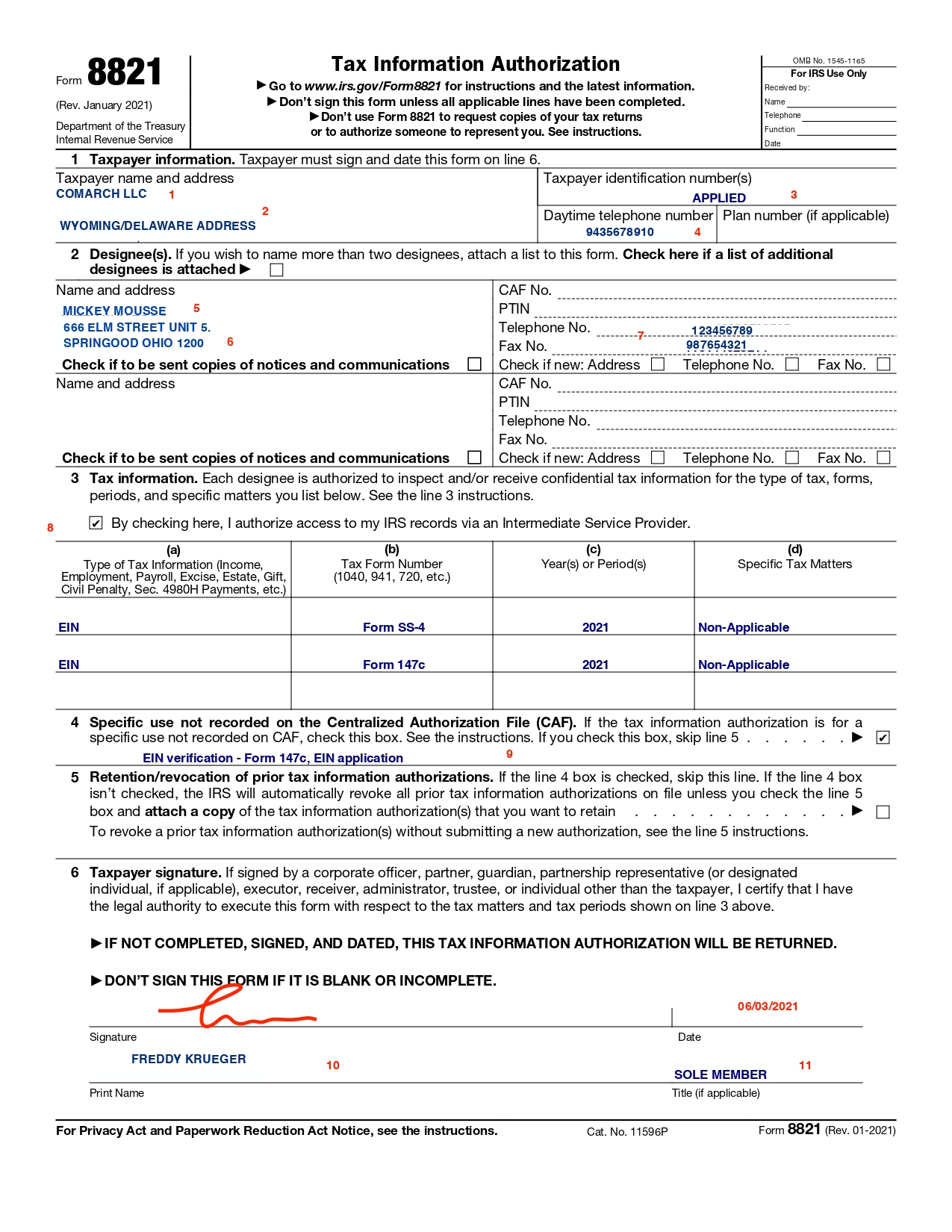

Understanding the 8821 form Firstbase.io

Form 8821 is the tax information authorization form. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information. Easily fill out pdf blank, edit, and sign them. February 2020) don’t sign this form unless all applicable. Form 8821 is used to authorize certain.

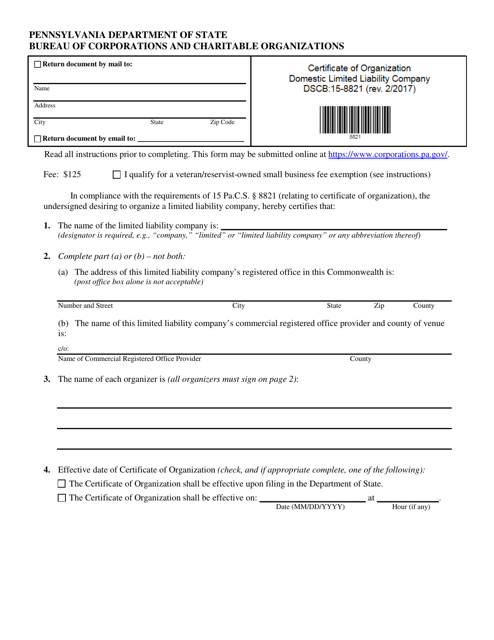

Fill Free fillable 158821 Cert Of OrgDom LLC PDF form

Web form 8821 tax information authorization go to www.irs.gov/form8821 for instructions and the latest information. Web form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect where to file chart and/or receive your confidential information. Form 8821 is the tax information authorization form. February 2020) don’t sign this form unless all applicable. Web the taxpayer first.

Form DSCB158821 (DSCB1588212) Download Fillable PDF or Fill Online

Web we last updated the tax information authorization in february 2023, so this is the latest version of form 8821, fully updated for tax year 2022. Form 8821 is used to authorize certain. Form 8821 is the tax information authorization form. Web form 8821 tax information authorization go to www.irs.gov/form8821 for instructions and the latest information. Web information about form.

Download Instructions for IRS Form 8821 Tax Information Authorization

Save or instantly send your ready documents. Web purpose of form. Form 8821 is the tax information authorization form. Web irs form 8821 allows the irs to post your compliant status on the hce system. Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file.

Form 8821/2848 Tax Information Authorization Power Of Attorney And

Do not use form 8821 to request. Web irs form 8821 allows the irs to post your compliant status on the hce system. Form 8821 is the tax information authorization form. Web form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect where to file chart and/or receive your confidential information. Easily fill out pdf blank,.

Web We Last Updated The Tax Information Authorization In February 2023, So This Is The Latest Version Of Form 8821, Fully Updated For Tax Year 2022.

Web irs disclosure authorization for victims of identity theft for irs use only received by: Web the appointee is authorized to inspect and/or receive confidential tax information in any office of the irs for the tax matters listed on this line. Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file. Do not use form 8821 to request.

Web The Taxpayer First Act (Tfa) Of 2019 Requires The Irs To Provide Digital Signature Options For Form 2848, Power Of Attorney, And Form 8821, Tax Information.

Web irs form 8821 allows the irs to post your compliant status on the hce system. Web purpose of form. The table below provides a list of forms that are used to register a business in pennsylvania, as well as. Form 8821 is the tax information authorization form.

Web Form 8821 Tax Information Authorization Go To Www.irs.gov/Form8821 For Instructions And The Latest Information.

Form 8821 is used to authorize certain. You can download or print current. Name telephone function date tax year (enter the tax year for which your return, and. This form enables the filer to give permission to view their confidential tax information to an individual,.

Web Form 8821 Authorizes Any Individual, Corporation, Firm, Organization, Or Partnership You Designate To Inspect And/Or Receive Your Confidential Information In Any Office Of The Irs.

Easily fill out pdf blank, edit, and sign them. Web form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect where to file chart and/or receive your confidential information. Web registration forms the bureau of corporations and charitable organizations makes available a wide range of forms to assist individuals and business entities in filing with the. Form 8821 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential.