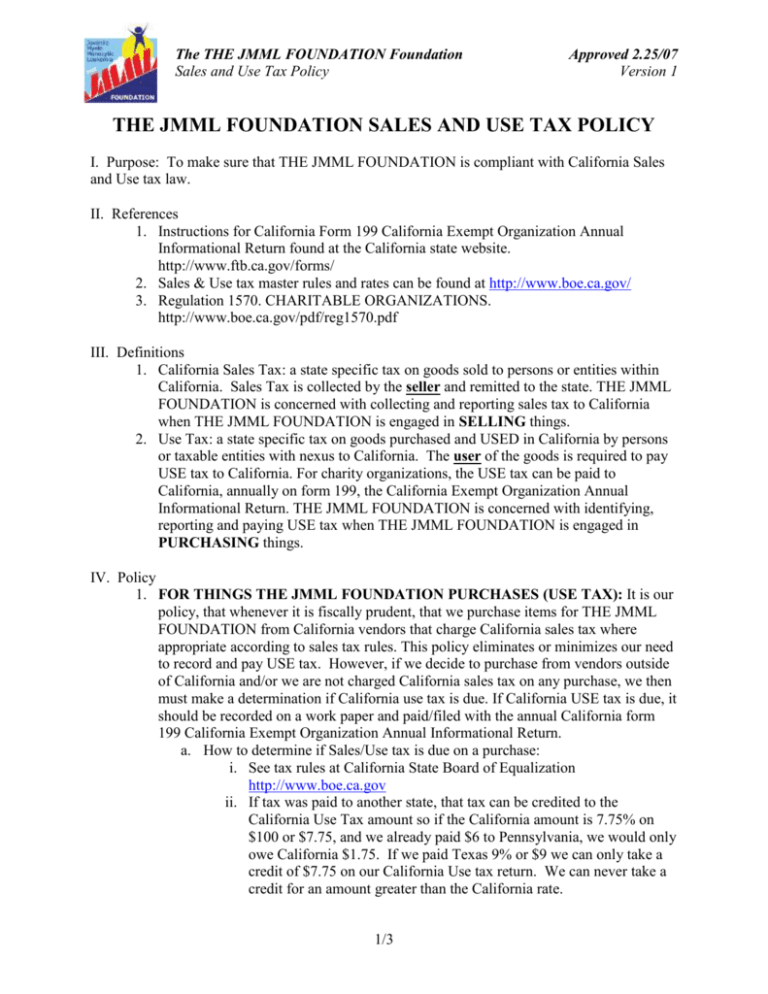

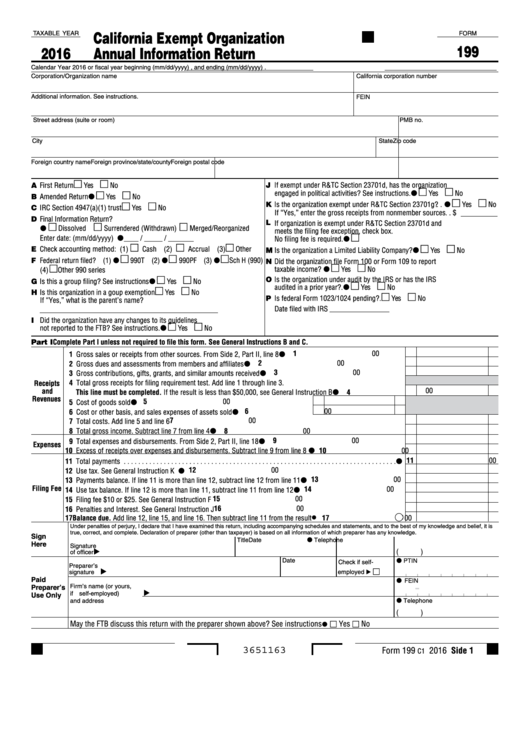

Form 199 California

Form 199 California - Form 199 is the california exempt organization annual information return. The trust may be required to file form 199. Web use the tables to determine your organization's filing requirement for the following forms: Click here to learn more about form 199. 1gross sales or receipts from other sources. This form is for income earned in tax year 2022, with tax returns due in april 2023. You can print other california tax forms here. 2gross dues and assessments from members and affiliates.•200. This form allows your nonprofit to report receipts, revenue, expenses, and disbursements to the ftb. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government.

Form 199 is the california exempt organization annual information return. This form allows your nonprofit to report receipts, revenue, expenses, and disbursements to the ftb. Web we last updated california form 199 in january 2023 from the california franchise tax board. The trust may be required to file form 199. This form is for income earned in tax year 2022, with tax returns due in april 2023. You can print other california tax forms here. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. What is ca form 199? 2gross dues and assessments from members and affiliates.•200. 1gross sales or receipts from other sources.

Web we last updated california form 199 in january 2023 from the california franchise tax board. Form 199 is the california exempt organization annual information return. Supports filing for 2022, 2021, & 2020 tax year. Web form 199, california exempt organization annual information return, is used by the following organizations to report the receipts and revenues, expenses, and disbursements. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web 2020 california exempt organization annual information return. Web use the tables to determine your organization's filing requirement for the following forms: Click here to learn more about form 199. What is ca form 199? You can print other california tax forms here.

Sales and Use Tax Policy

Web form 199 2020 side 1. Most of the information requested on form 199 is virtually the same as the federal return, though much less information is requested. You can print other california tax forms here. Web california form 199 is an annual information return filed by the following organizations to report the income & expenses. This form allows your.

Fillable Form 199 California Exempt Organization Annual Information

Form 199 is the california exempt organization annual information return. Supports filing for 2022, 2021, & 2020 tax year. 3gross contributions, gifts, grants, and similar amounts received.•300. This form allows your nonprofit to report receipts, revenue, expenses, and disbursements to the ftb. Web we last updated the exempt organization annual information return in january 2023, so this is the latest.

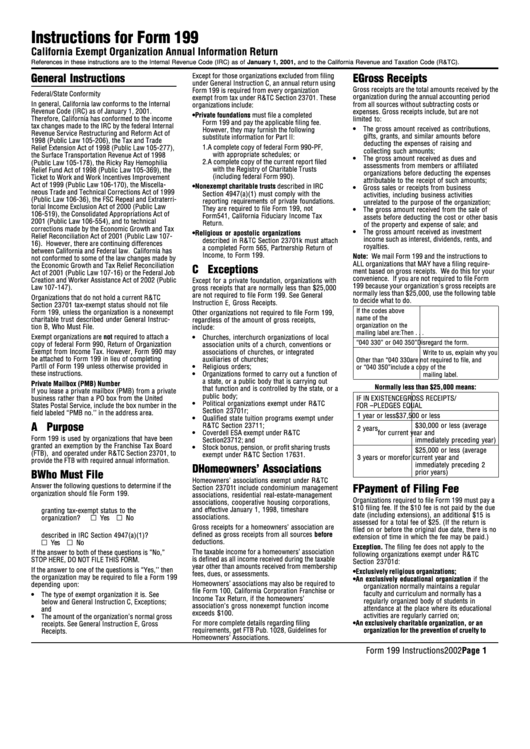

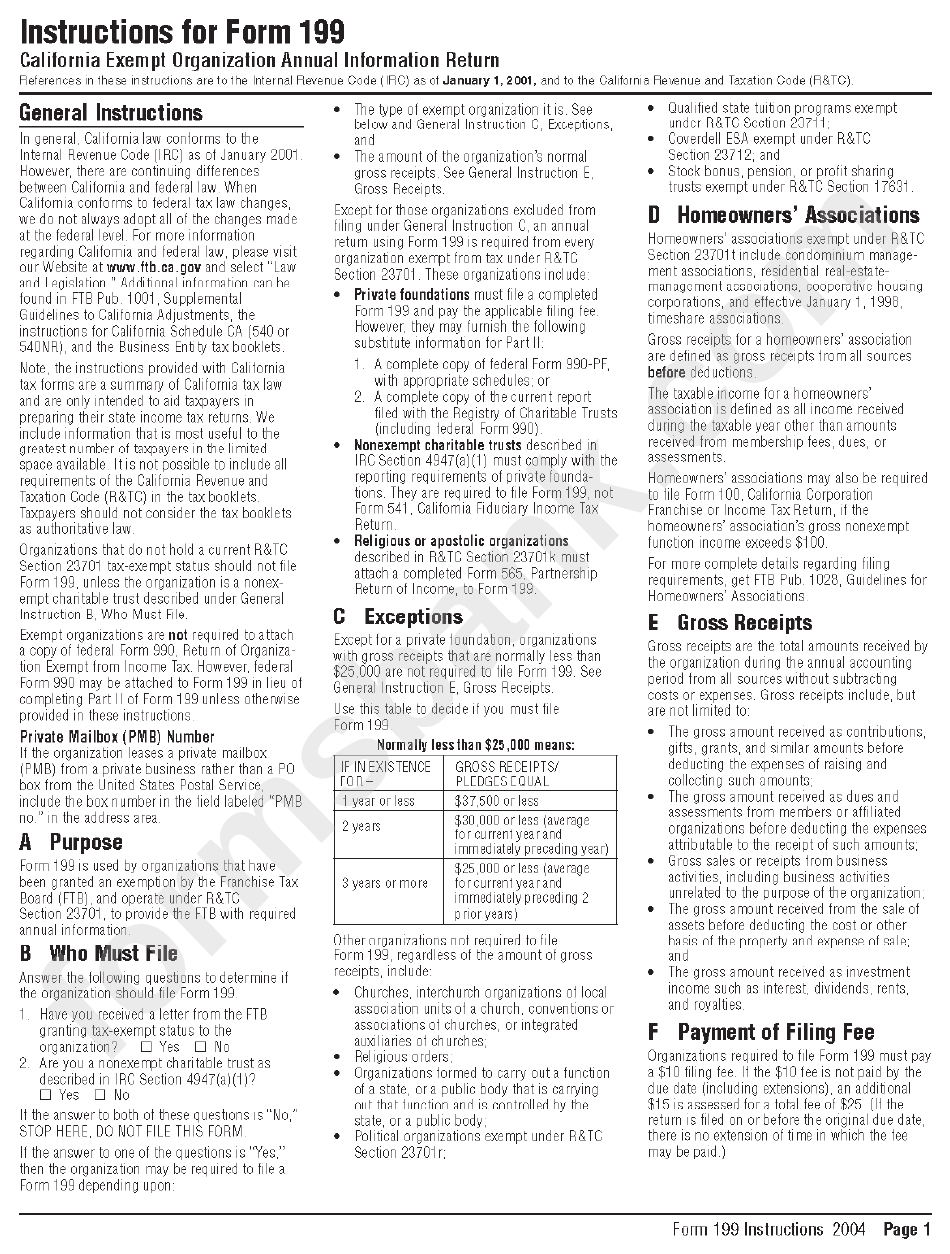

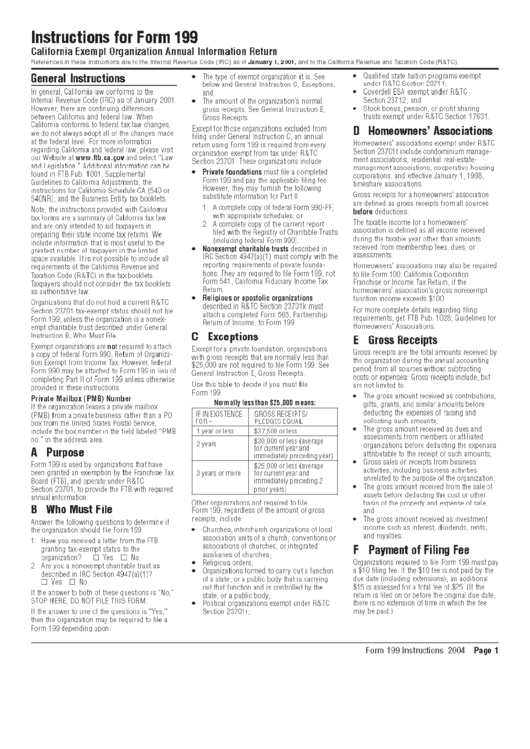

Instructions For Form 199 printable pdf download

Most of the information requested on form 199 is virtually the same as the federal return, though much less information is requested. Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Web form 199, california exempt organization annual information return, is.

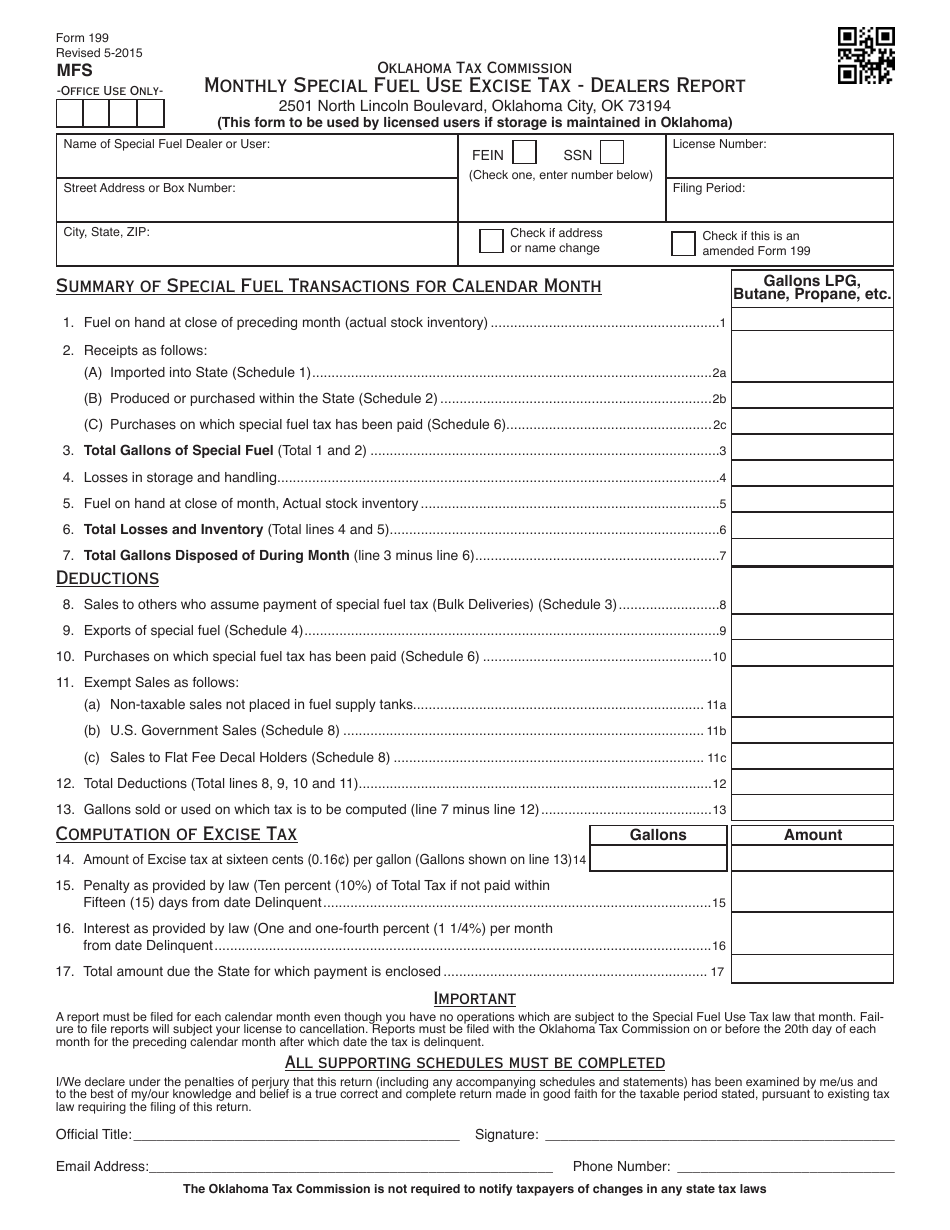

OTC Form 199 Download Fillable PDF or Fill Online Monthly Special Fuel

From side 2, part ii, line 8.•100. 2gross dues and assessments from members and affiliates.•200. Web california form 199 is an annual information return filed by the following organizations to report the income & expenses. Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for.

2015 Form CA FTB 199 Instructions Fill Online, Printable, Fillable

Web form 199 is called the california exempt organization annual information return. Web expresstaxexempt now supports form 199 and offers the best filing solution for california nonprofits. Click here to learn more about form 199. You can print other california tax forms here. Web california form 199 is an annual information return filed by the following organizations to report the.

California Fundraising Registration

Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Web 2020 california exempt organization annual information return. Religious or apostolic organizations described in r&tc section 23701k must attach a. We will update this page with a new version of the form.

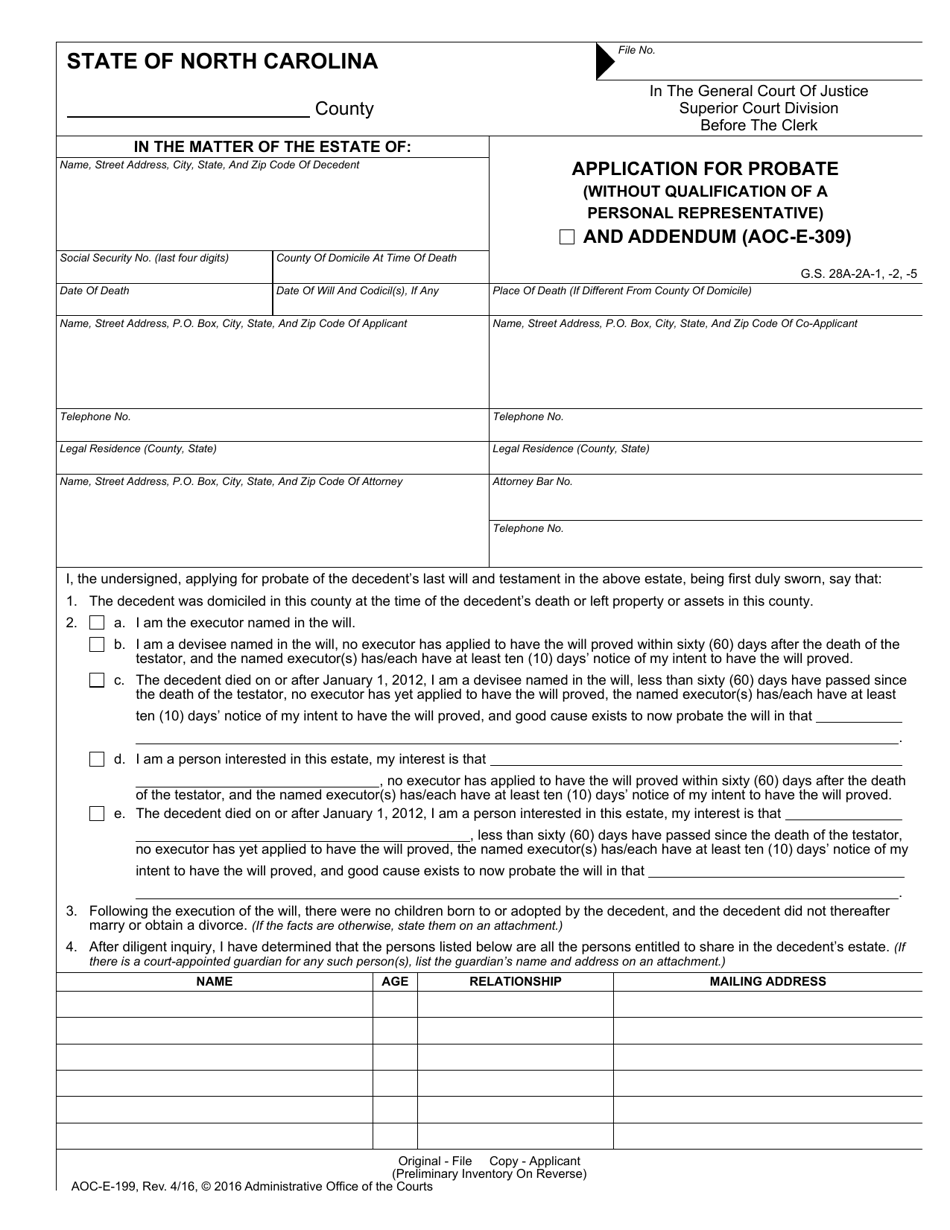

Form AOCE199 Download Fillable PDF or Fill Online Application for

1gross sales or receipts from other sources. Web form 199 2020 side 1. Most of the information requested on form 199 is virtually the same as the federal return, though much less information is requested. Form 199 is the california exempt organization annual information return. This form is for income earned in tax year 2022, with tax returns due in.

Instructions For Form 199 California Exempt Organization Annual

Click here to learn more about form 199. Web expresstaxexempt now supports form 199 and offers the best filing solution for california nonprofits. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Web california form 199 is an annual information return filed by the.

Instructions For Form 199 California Exempt Organization Annual

3gross contributions, gifts, grants, and similar amounts received.•300. 2gross dues and assessments from members and affiliates.•200. This form allows your nonprofit to report receipts, revenue, expenses, and disbursements to the ftb. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web expresstaxexempt now supports form 199 and offers the best filing solution.

California Fundraising Registration

Web 2020 california exempt organization annual information return. Form 199 is the california exempt organization annual information return. Web we last updated california form 199 in january 2023 from the california franchise tax board. Web form 199 is called the california exempt organization annual information return. Web california form 199 is an annual information return filed by the following organizations.

1Gross Sales Or Receipts From Other Sources.

Web california form 199 is an annual information return filed by the following organizations to report the income & expenses. Nonexempt charitable trusts as described in irc section 4947 (a) (1). Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. This form is for income earned in tax year 2022, with tax returns due in april 2023.

Most Of The Information Requested On Form 199 Is Virtually The Same As The Federal Return, Though Much Less Information Is Requested.

What is ca form 199? Web 2020 california exempt organization annual information return. This form allows your nonprofit to report receipts, revenue, expenses, and disbursements to the ftb. Web form 199, california exempt organization annual information return, is used by the following organizations to report the receipts and revenues, expenses, and disbursements.

Web Expresstaxexempt Now Supports Form 199 And Offers The Best Filing Solution For California Nonprofits.

It can best be thought of as california’s version of irs form 990. Web we last updated california form 199 in january 2023 from the california franchise tax board. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Religious or apostolic organizations described in r&tc section 23701k must attach a.

Web Use The Tables To Determine Your Organization's Filing Requirement For The Following Forms:

Supports filing for 2022, 2021, & 2020 tax year. Click here to learn more about form 199. 3gross contributions, gifts, grants, and similar amounts received.•300. Web form 199 2020 side 1.