Form 2290 Due Date 2022-2023

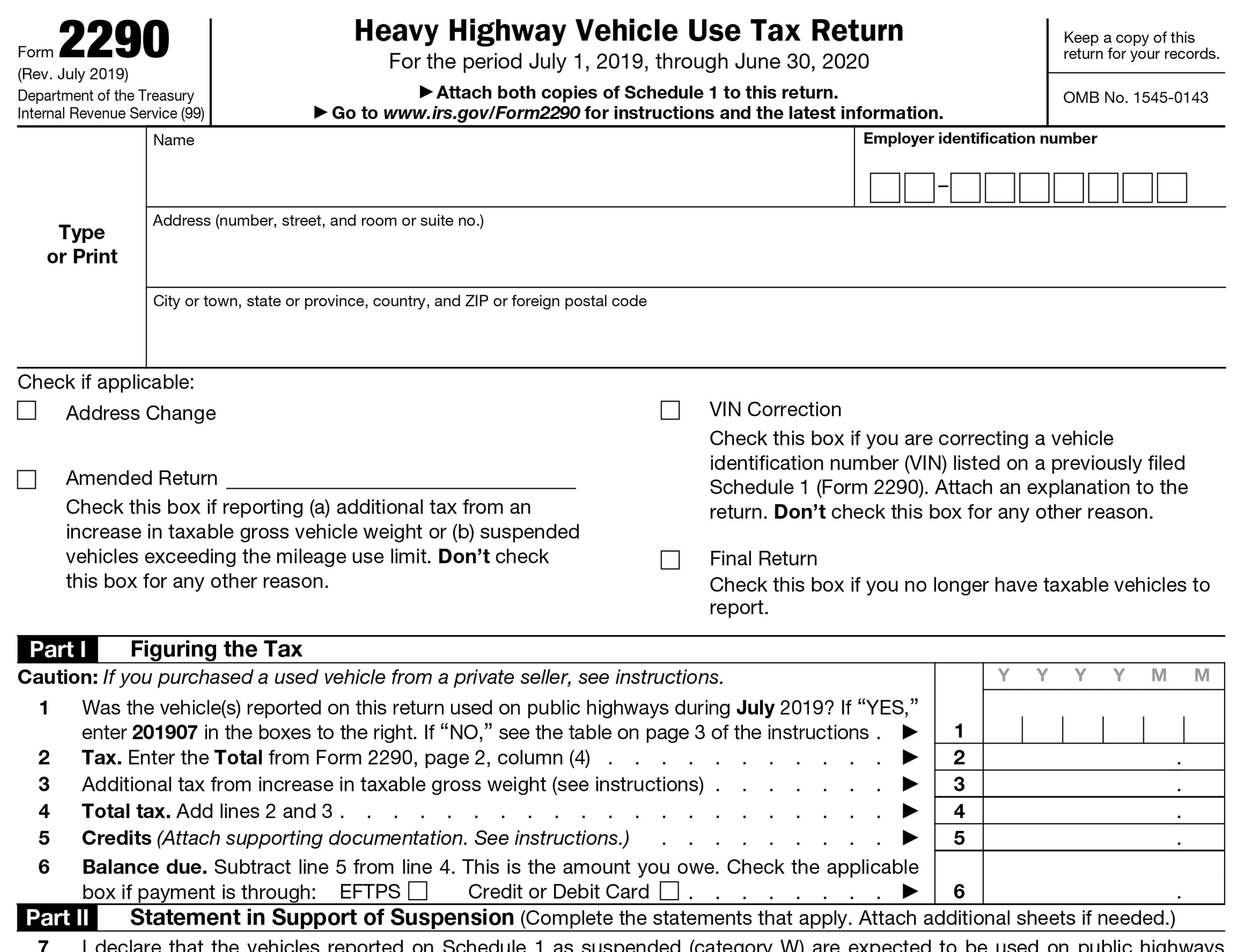

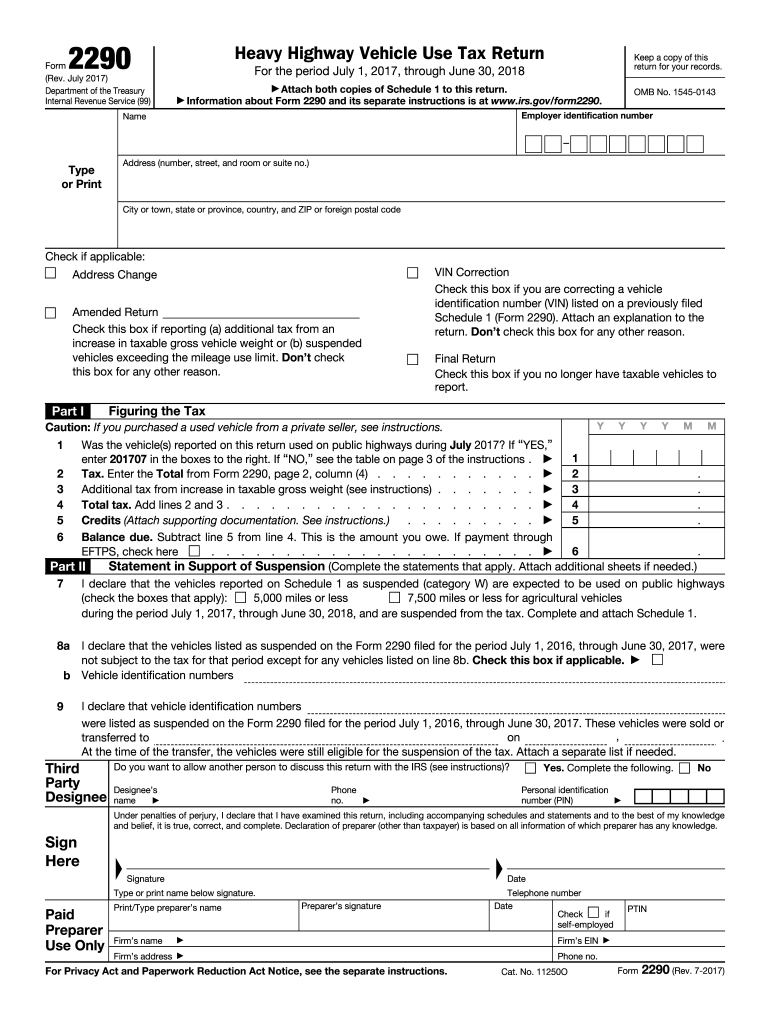

Form 2290 Due Date 2022-2023 - If any due date falls on a saturday,. It’s time for you to renew your heavy vehicle use tax, form 2290, with the irs for the new tax period, july 1st 2022 to june 30th 2023. This revision if you need to file a return for a tax period that began on. The due date will be on august 31st, 2023. Web the current period begins july 1, 2023, and ends june 30, 2024. Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach both copies of. Get ready for tax season deadlines by completing any required tax forms today. Irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every. The deadline to file your form 2290 is on the last day of the month following the first used month (fum) of. *file by this date regardless of when the state registration for the vehicle is due.

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Ad upload, modify or create forms. Web hey there wonderful truckers; File now and get your stamped schedule 1 in minutes. This revision if you need to file a return for a tax period that began on. If any due date falls on a saturday,. Register already have an account,. If you own a heavy vehicle with a taxable gross weight of 55,000 pounds or more, then you must renew your form 2290 by august 31 of. Easy, fast, secure & free to try. Heavy highway vehicle use tax return is usually august 31st each year.

Heavy highway vehicle use tax return is usually august 31st each year. For heavy vehicles with a taxable gross weight of 55,000 pounds or more, the irs form 2290 due date is by. It is important to file and pay all your form 2290 taxes on time to avoid paying. This revision if you need to file a return for a tax period that began on. If any due date falls on a saturday,. Do your truck tax online & have it efiled to the irs! *file by this date regardless of when the state registration for the vehicle is due. Web hey there wonderful truckers; Web when is form 2290 due date? Easy, fast, secure & free to try.

How to find your Form 2290 Due Date and Avoid Penalty From the IRS

Web the current tax period for heavy highway vehicles begins on july 1, 2023, and ends on june 30, 2024. Web these due date rules apply whether you are paying the tax or reporting the suspension of tax. If you own a heavy vehicle with a taxable gross weight of 55,000 pounds or more, then you must renew your form.

File IRS 2290 Form Online for 20222023 Tax Period

File now and get your stamped schedule 1 in minutes. Ad upload, modify or create forms. Easy, fast, secure & free to try. Get ready for tax season deadlines by completing any required tax forms today. Web the tax year for form 2290 goes from july 1st to june 30th.

IRS Form 2290 Due Date For 20222023 Tax Period

Click here to know more about form 2290 due date file form 2290 now irs form. Do your truck tax online & have it efiled to the irs! It is important to file and pay all your form 2290 taxes on time to avoid paying. It takes only 50 seconds. Just fill 3 fields to have an account.

IRS Form 2290 Due Date For 20222023 Tax Period

According to irs regulations, the truck tax year is from july 1st, 2023 to the next year on june 30th, 2023.the irs typically receives 2290 tax. Easy, fast, secure & free to try. Web due date to renew your form 2290. If any due date falls on a saturday,. Web the due date to file irs form 2290:

IRS Form 2290 Due Date For 20222023 Tax Period

The deadline to file your form 2290 is on the last day of the month following the first used month (fum) of. It takes only 50 seconds. Web due date to renew your form 2290. Easy, fast, secure & free to try. Web the due date to file irs form 2290:

IRS Form 2290 Due Date For 20222023 Tax Period

This revision if you need to file a return for a tax period that began on. It is important to file and pay all your form 2290 taxes on time to avoid paying. Web the due date for the vehicles having july as their fum is august 31, 2023. File now and get your stamped schedule 1 in minutes. Web.

Printable IRS Form 2290 for 2020 Download 2290 Form

Click here to know more about form 2290 due date file form 2290 now irs form. Ad upload, modify or create forms. Get ready for tax season deadlines by completing any required tax forms today. Web this july 2023 revision is for the tax period beginning on july 1, 2023, and ending on june 30, 2024. Irs heavy vehicle use.

IRS Form 2290 Instructions for 20222023 Tax Period

Web the due date to file irs form 2290: The due date will be on august 31st, 2023. It takes only 50 seconds. Web the due date for the vehicles having july as their fum is august 31, 2023. *file by this date regardless of when the state registration for the vehicle is due.

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach both copies of. Just fill 3 fields to have an account. Try it for free now! Web these due date rules apply whether you are paying the tax or reporting the suspension of tax..

Irs Form 2290 Printable Form Resume Examples

Web hey there wonderful truckers; File now and get your stamped schedule 1 in minutes. Irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every. Web the current period begins july 1, 2023, and ends june 30, 2024. Web the current tax period for heavy highway vehicles begins on july 1, 2023, and ends on.

The Due Date Will Be On August 31St, 2023.

Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Web 13 rows month form 2290 must be filed; File now and get your stamped schedule 1 in minutes. It takes only 50 seconds.

For Heavy Vehicles With A Taxable Gross Weight Of 55,000 Pounds Or More, The Irs Form 2290 Due Date Is By.

Web this july 2023 revision is for the tax period beginning on july 1, 2023, and ending on june 30, 2024. Web due date to renew your form 2290. It is important to file and pay all your form 2290 taxes on time to avoid paying. Just fill 3 fields to have an account.

The Deadline To File Your Form 2290 Is On The Last Day Of The Month Following The First Used Month (Fum) Of.

Get ready for tax season deadlines by completing any required tax forms today. Web form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. This deadline is set to cover the tax period beginning on july 1st. Web hey there wonderful truckers;

Try It For Free Now!

Web then, file irs form 2290 and make your payment by* july, 2022 august 31, 2022 august, 2022 september 30, 2022 september, 2022 october 31, 2022 october, 2022 november. *file by this date regardless of when the state registration for the vehicle is due. Web when is form 2290 due date? According to irs regulations, the truck tax year is from july 1st, 2023 to the next year on june 30th, 2023.the irs typically receives 2290 tax.