Form 2555 Instructions

Form 2555 Instructions - Person works overseas, and is able to meet the requirements of the foreign earned income exclusion (feie), they may qualify to file a 2555 form and exclude foreign income from u.s. Form 2555 can make an expat’s life a lot easier! The exclusion amount adjusts each year for inflation, but currently hovers around $105,000. Citizens and resident aliens only. Web form 2555 is used by united states citizens who live and earn income abroad to claim an exclusion for foreign earned income. Trust the tax experts at h&r block Future developments for the latest information about developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to Publication 54, tax guide for u.s. Ad access irs tax forms. Create legally binding electronic signatures on any device.

Go to www.irs.gov/form2555 for instructions and the latest information. Trust the tax experts at h&r block Ad download or email irs 2555 & more fillable forms, register and subscribe now! If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web form 2555 instructions for expats. Web form 2555 instructions. The exclusion amount adjusts each year for inflation, but currently hovers around $105,000. Form 2555 can make an expat’s life a lot easier! Publication 514, foreign tax credit for individuals. In addition, filers may also qualify for.

Web form 2555 instructions. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web instructions for form 2555, foreign earned income. Go to www.irs.gov/form2555 for instructions and the latest information. The exclusion amount adjusts each year for inflation, but currently hovers around $105,000. Read our guide below and follow the simple form 2555 instructions, and you’ll be saving money in no. You cannot exclude or deduct more than the amount of your foreign earned income for the year. Ad download or email irs 2555 & more fillable forms, register and subscribe now! If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction.

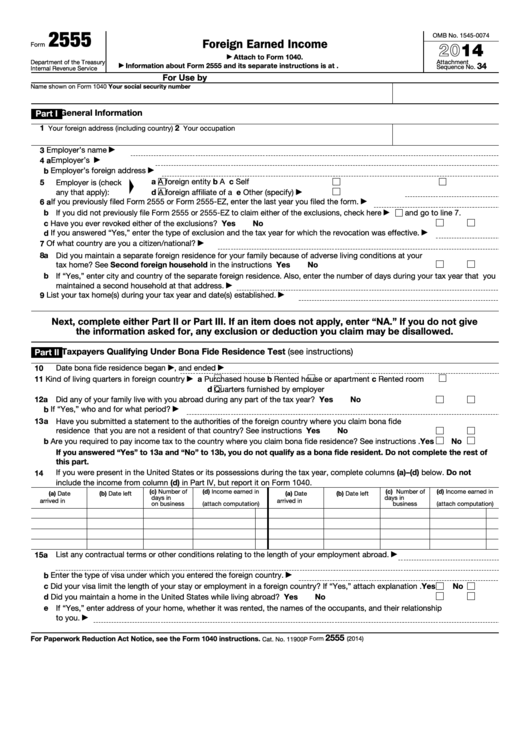

Fillable Form 2555 Foreign Earned 2014 printable pdf download

Web form 2555 is used by united states citizens who live and earn income abroad to claim an exclusion for foreign earned income. Citizens and resident aliens only. Create legally binding electronic signatures on any device. Publication 54, tax guide for u.s. Your form 2555 instructions can be found on the irs’ website, but because making a mistake can cost.

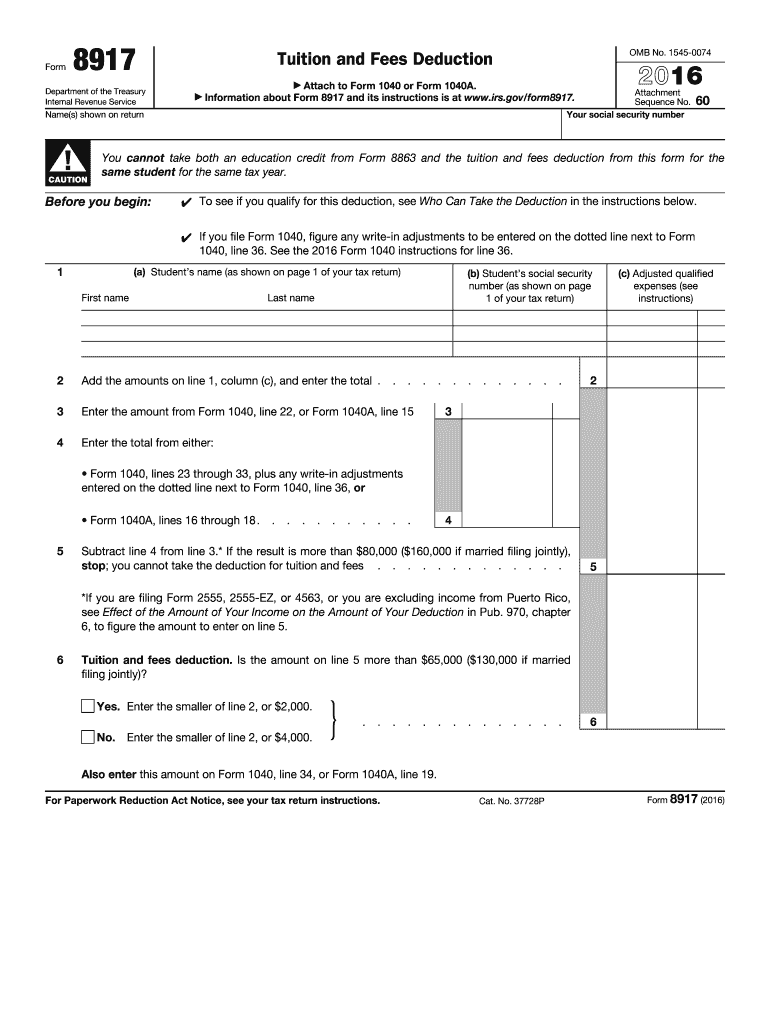

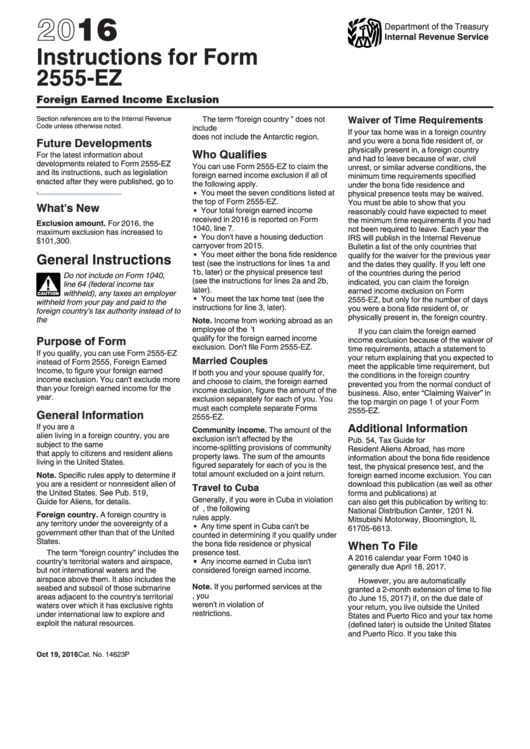

Ssurvivor Form 2555 Instructions 2016

Form 2555 can make an expat’s life a lot easier! If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. All expats must fill out parts i through v, while part vi is only for. Need help with form 2555, the foreign earned income exclusion? Ad download or email.

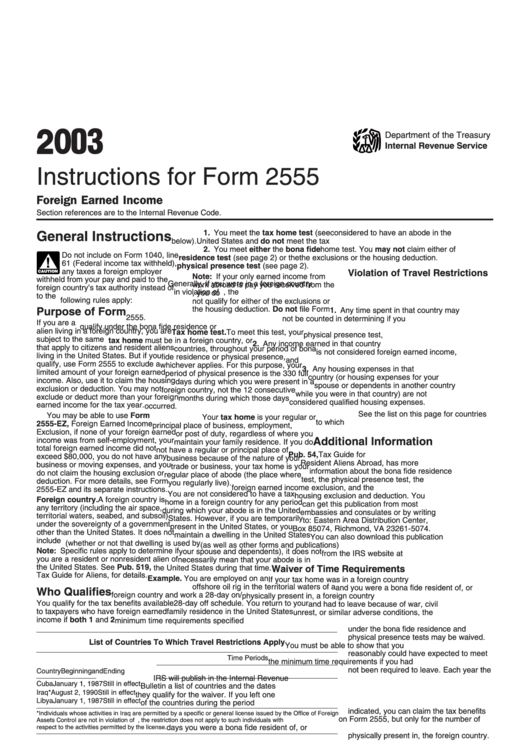

Instructions for form 2555 2013

Web form 2555 instructions for expats. Publication 54, tax guide for u.s. Ad download or email irs 2555 & more fillable forms, register and subscribe now! 34 for use by u.s. Person works overseas, and is able to meet the requirements of the foreign earned income exclusion (feie), they may qualify to file a 2555 form and exclude foreign income.

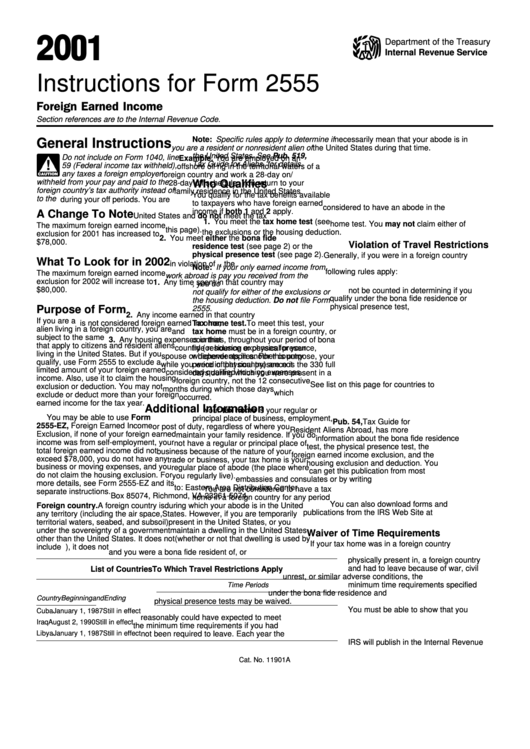

Ssurvivor Form 2555 Instructions

Trust the tax experts at h&r block Citizens and resident aliens only. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Create legally binding electronic signatures on any device. Web form 2555 is used by united states citizens who live and earn income abroad to claim an exclusion.

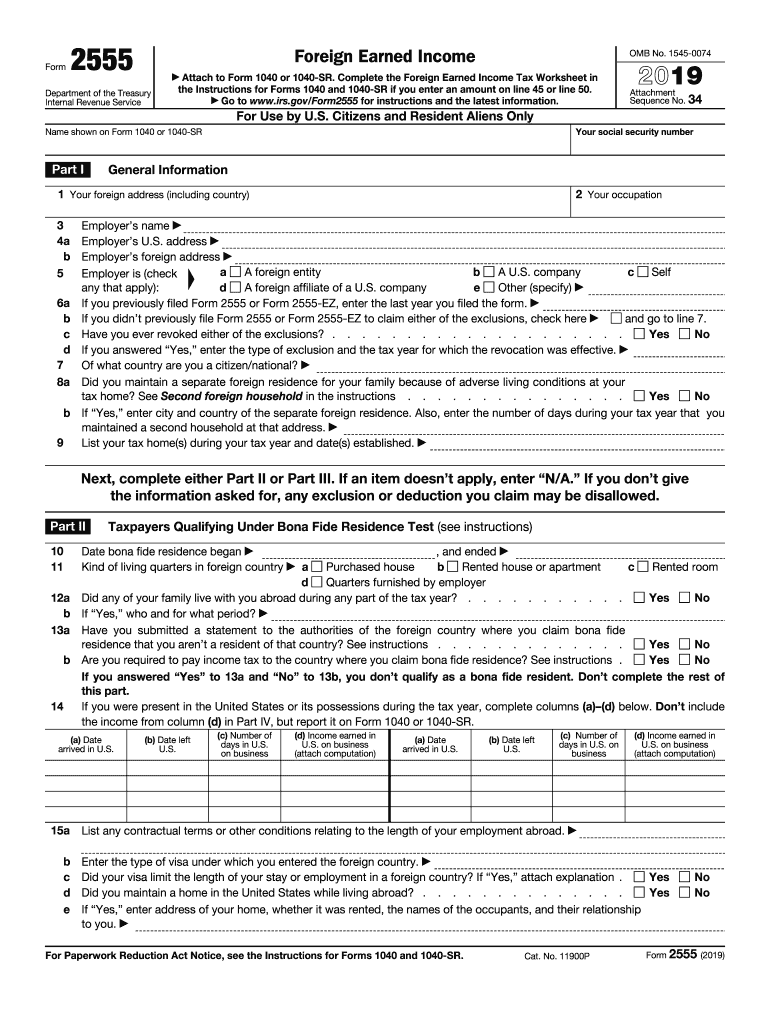

Ssurvivor Form 2555 Instructions 2019

34 for use by u.s. Person works overseas, and is able to meet the requirements of the foreign earned income exclusion (feie), they may qualify to file a 2555 form and exclude foreign income from u.s. Your form 2555 instructions can be found on the irs’ website, but because making a mistake can cost you (literally), we recommend you leave.

Instructions for IRS Form 2555 Foreign Earned Download

Go to www.irs.gov/form2555 for instructions and the latest information. Publication 54, tax guide for u.s. In addition, filers may also qualify for. Create legally binding electronic signatures on any device. Read our guide below and follow the simple form 2555 instructions, and you’ll be saving money in no.

2019 Form 2555 Fill Out and Sign Printable PDF Template signNow

You cannot exclude or deduct more than the amount of your foreign earned income for the year. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Need help with form 2555, the foreign earned income exclusion? All expats must fill out parts i through v, while part vi.

Instructions For Form 2555 Foreign Earned Internal Revenue

Complete irs tax forms online or print government tax documents. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Trust the tax experts at h&r block Citizens and resident aliens only. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how.

Instructions For Form 2555 Foreign Earned 2001 printable pdf

If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web instructions for form 2555 foreign earned income department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. In addition, filers may also qualify for. All expats must fill out parts.

Instructions For Form 2555Ez Foreign Earned Exclusion 2016

Trust the tax experts at h&r block Web form 2555 is used by united states citizens who live and earn income abroad to claim an exclusion for foreign earned income. Publication 514, foreign tax credit for individuals. Web form 2555 instructions for expats. Future developments for the latest information about developments related to form 2555 and its instructions, such as.

You Cannot Exclude Or Deduct More Than The Amount Of Your Foreign Earned Income For The Year.

Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web form 2555 instructions. Create legally binding electronic signatures on any device. Web form 2555 instructions for expats.

Publication 54, Tax Guide For U.s.

Complete irs tax forms online or print government tax documents. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Complete, edit or print tax forms instantly. Trust the tax experts at h&r block

Future Developments For The Latest Information About Developments Related To Form 2555 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To

Read our guide below and follow the simple form 2555 instructions, and you’ll be saving money in no. Form 2555 can make an expat’s life a lot easier! Ad download or email irs 2555 & more fillable forms, register and subscribe now! 34 for use by u.s.

See The Instructions For Form 1040.

Web form 2555 is used by united states citizens who live and earn income abroad to claim an exclusion for foreign earned income. All expats must fill out parts i through v, while part vi is only for. Citizens and resident aliens only. Web instructions for form 2555, foreign earned income.