Form 2555 S

Form 2555 S - Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. Expats use to claim the foreign earned income. Web enter the following in the form 2555 share of gross foreign earned income/expenses field. Total foreign earned income has a value for foreign earned income but dates for the foreign earned income exclusion aren't entered. Web a foreign country, u.s. Web irs form 2555 what is form 2555? Web what is form 2555? A foreign affiliate of a u.s. Web 235 rows purpose of form. Get ready for tax season deadlines by completing any required tax forms today.

Web enter the following in the form 2555 share of gross foreign earned income/expenses field. Web form 2555, alternatively referred to as the foreign earned income form, is an important tax document that u.s. Web foreign earned income exclusion (form 2555) u.s. Web irs form 2555 what is form 2555? Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Employers engaged in a trade or business who pay compensation form 9465. Company c self any that apply): Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Get ready for tax season deadlines by completing any required tax forms today. *if you live in american.

Get ready for tax season deadlines by completing any required tax forms today. Go to www.irs.gov/form2555 for instructions and the latest. Company e other (specify) 6 a if you previously filed form 2555 or. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Form 2555 is used by united states citizens who live and earn income abroad to claim an exclusion for foreign earned income. Web form 2555, alternatively referred to as the foreign earned income form, is an important tax document that u.s. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web enter the following in the form 2555 share of gross foreign earned income/expenses field. Complete, edit or print tax forms instantly.

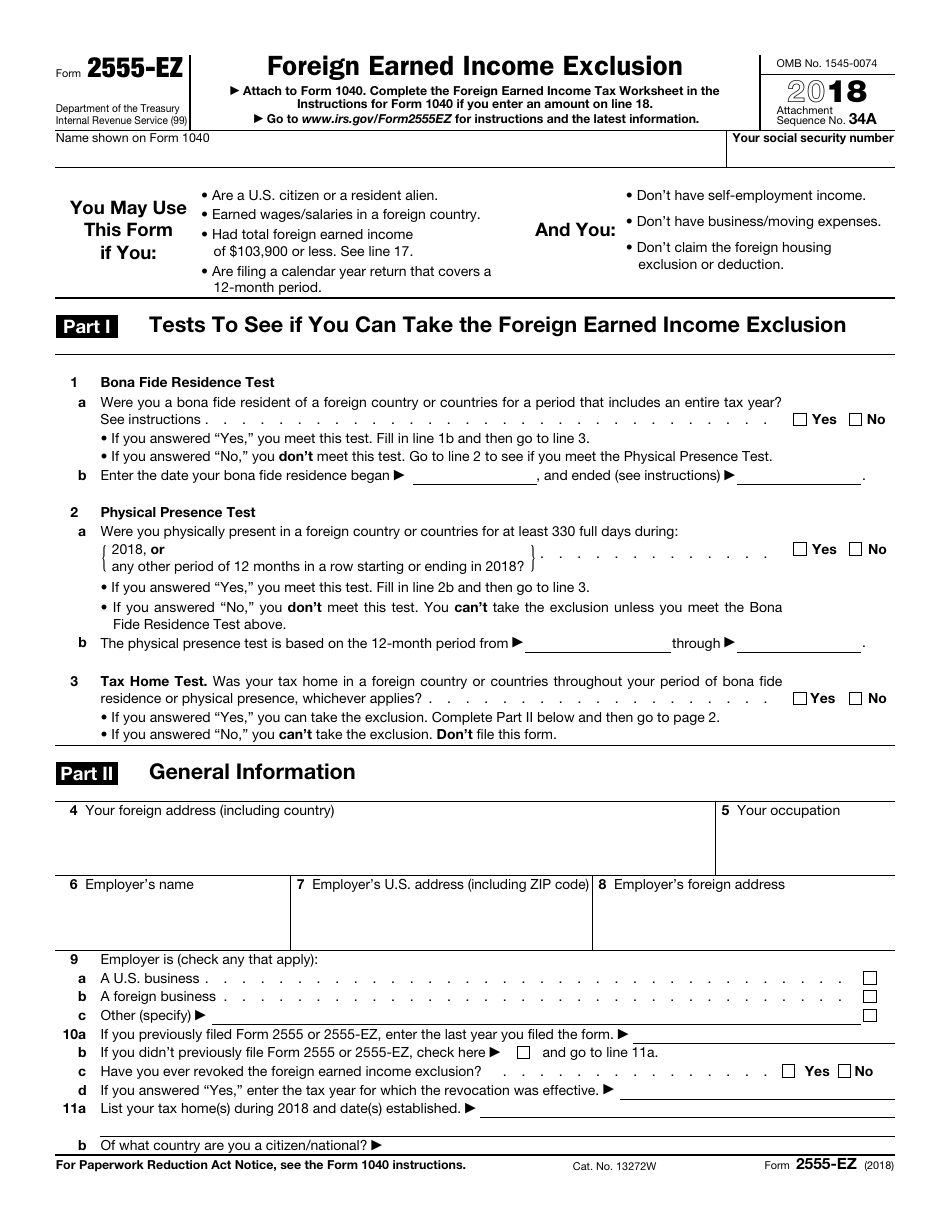

IRS Form 2555EZ Download Fillable PDF or Fill Online Foreign Earned

Web irs form 2555 what is form 2555? Form 2555 is used by united states citizens who live and earn income abroad to claim an exclusion for foreign earned income. Company c self any that apply): Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Company e.

IRS Form 2555 and the Foreign Earned Exclusion A Practical

Web developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2555. Form 2555 is used by united states citizens who live and earn income abroad to claim an exclusion for foreign earned income. D a foreign affiliate of a u.s. Enter the code that represents the appropriate allocation of the entity's.

Ssurvivor Form 2555 Instructions 2016

*if you live in american. If you qualify, you can use form 2555 to figure your foreign. Web irs form 2555 what is form 2555? Web developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2555. Web form 2555, alternatively referred to as the foreign earned income form, is an important.

Foreign Earned Tax Worksheet Worksheet List

Web 5 employer is (check a a foreign entity b a u.s. Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. Web form 2555, alternatively referred to as the foreign earned income form, is an important tax document that u.s. Web irs form 2555 what.

Breanna Form 2555 Example

Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Ad access irs tax forms. Total foreign earned income has a value for foreign earned income but dates for the foreign earned income exclusion aren't entered. Expats use to claim the foreign earned income. Company e other (specify).

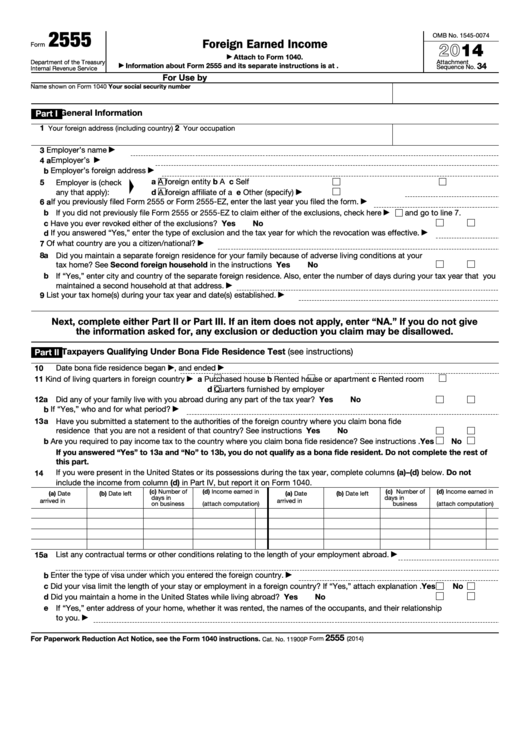

Fillable Form 2555 Foreign Earned 2014 printable pdf download

Enter the code that represents the appropriate allocation of the entity's foreign. Company e other (specify) 6 a if you previously filed form 2555 or. Web developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2555. Web 3651 s interregional hwy 35 mail stop 6542 austin, tx 78741 new york brookhaven.

Form 2555EZ U.S Expat Taxes Community Tax

A foreign affiliate of a u.s. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Go to www.irs.gov/form2555 for instructions and the latest. Company e other (specify) 6 a if you previously filed form 2555 or. Expats use to claim the foreign earned income.

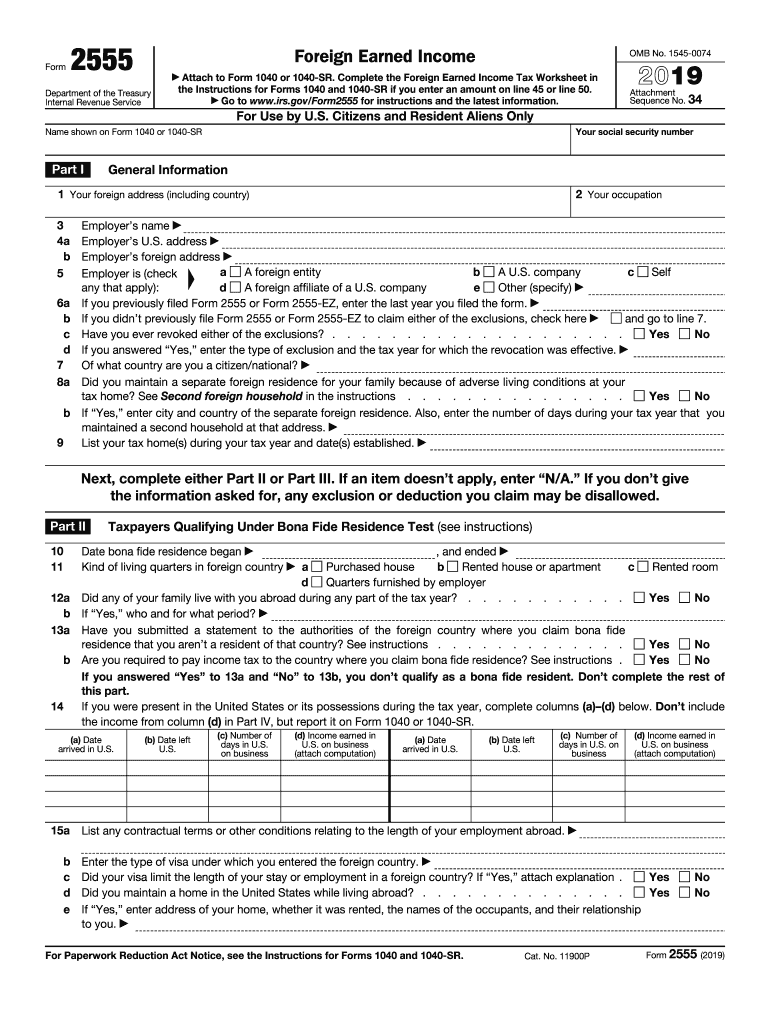

2019 Form 2555 Fill Out and Sign Printable PDF Template signNow

Web 5 employer is (check a a foreign entity b a u.s. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. *if you live in american. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Form 2555EZ Foreign Earned Exclusion (2014) Free Download

Go to www.irs.gov/form2555 for instructions and the latest. Web foreign earned income exclusion form 2555 if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income. Address, or file form 2555 or. Web developments related to form 2555 and its instructions, such as legislation enacted after they were published, go.

Ssurvivor Form 2555 Instructions

If you qualify, you can use form 2555 to figure your foreign. Web 3651 s interregional hwy 35 mail stop 6542 austin, tx 78741 new york brookhaven refund inquiry unit 5000 corporate ct. Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. D a foreign.

Employers Engaged In A Trade Or Business Who Pay Compensation Form 9465.

Web 5 employer is (check a a foreign entity b a u.s. Company e other (specify) 6 a if you previously filed form 2555 or. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Web foreign earned income exclusion form 2555 if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income.

Go To Www.irs.gov/Form2555 For Instructions And The Latest.

Web 235 rows purpose of form. Web what is form 2555? Company c self any that apply): Ad access irs tax forms.

Form 2555 Is Used By United States Citizens Who Live And Earn Income Abroad To Claim An Exclusion For Foreign Earned Income.

Web form 2555, alternatively referred to as the foreign earned income form, is an important tax document that u.s. Complete, edit or print tax forms instantly. Web a foreign country, u.s. Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web enter the following in the form 2555 share of gross foreign earned income/expenses field. If you qualify, you can use form 2555 to figure your foreign. Get ready for tax season deadlines by completing any required tax forms today. D a foreign affiliate of a u.s.