Form 2848 Poa

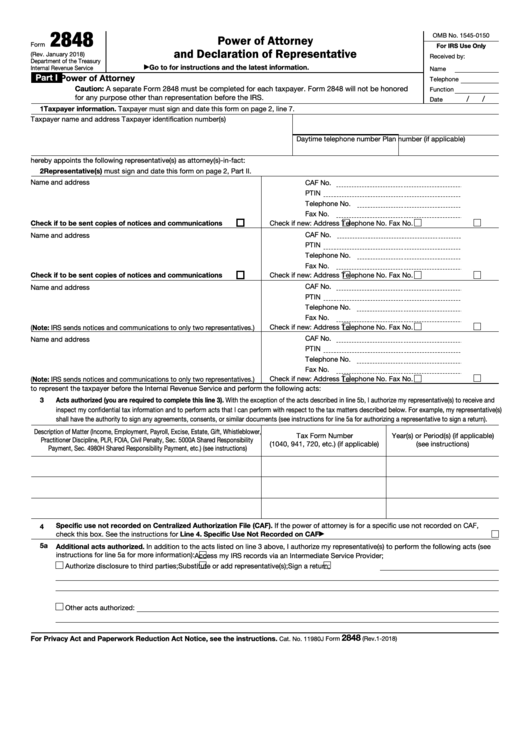

Form 2848 Poa - Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. January 2021) department of the treasury internal revenue service. Use form 2848 to authorize an individual to represent you before the irs. Form 8821, tax information authorization pdf. Print out and complete the 2848 form to authorize the attorney to act on your behalf. Date / / part i power of attorney. March 2012) department of the treasury internal revenue service. Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. Power of attorney *65203221w* this form is authorized by various acts found in illinois compiled statutes. Form 2848, power of attorney and declaration of representative pdf.

Failure to provide information could result in a penalty. In november 2022, the irs updated its guidance regarding who can sign form 2848, power of attorney and declaration of representative (poa), submitted on behalf of a limited liability company (llc) treated as a partnership or disregarded entity for federal income tax purposes. Web get form 2848, power of attorney, to file in 2023. The individual you authorize must be a person eligible to practice before the irs. Web about form 2848, power of attorney and declaration of representative. January 2021) department of the treasury internal revenue service. Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. For instructions and the latest information. Form 2848, power of attorney and declaration of representative pdf. Web for more information on designating a partnership representative, see form 8979, partnership representative revocation, designation, and resignation, and its instructions.

In november 2022, the irs updated its guidance regarding who can sign form 2848, power of attorney and declaration of representative (poa), submitted on behalf of a limited liability company (llc) treated as a partnership or disregarded entity for federal income tax purposes. Form 2848, power of attorney and declaration of representative pdf. Power of attorney and declaration of representative. Use form 2848 to authorize an individual to represent you before the irs. Form 8821, tax information authorization pdf. Web submit forms 2848 and 8821 online. The individual you authorize must be a person eligible to practice before the irs. Print out and complete the 2848 form to authorize the attorney to act on your behalf. Date / / part i power of attorney. For instructions and the latest information.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Form 2848, power of attorney and declaration of representative pdf. For instructions and the latest information. January 2021) department of the treasury internal revenue service. Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. Web for more information on designating a partnership representative,.

The Purpose of IRS Form 2848

Web for more information on designating a partnership representative, see form 8979, partnership representative revocation, designation, and resignation, and its instructions. Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. Form 2848, power of attorney and declaration of representative pdf. Failure to provide.

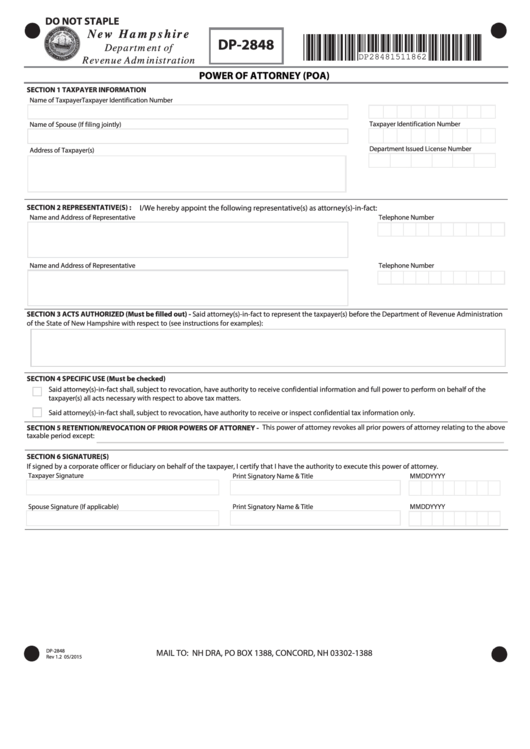

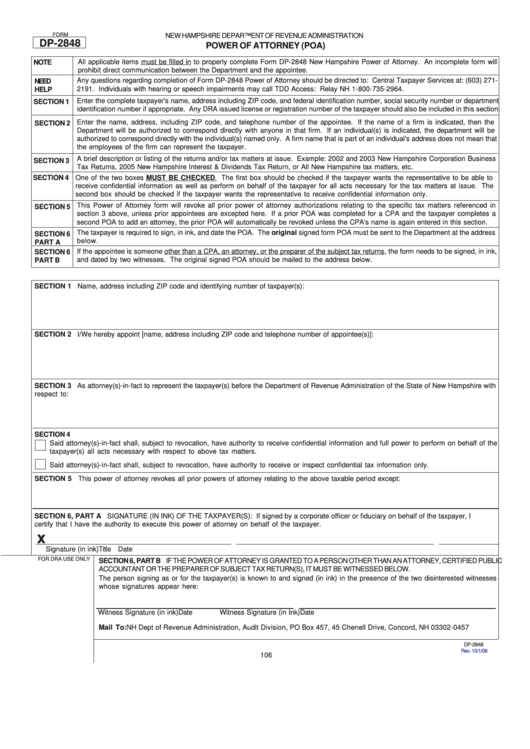

Form Dp2848 Power Of Attorney (Poa) New Hampshire Department Of

Check out our detailed instructions & examples to complete the declaration efficiently & quickly Date / / part i power of attorney. You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic. Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic.

Form Dp2848 Power Of Attorney (Poa) New Hampshire Department Of

Print out and complete the 2848 form to authorize the attorney to act on your behalf. Form 2848, power of attorney and declaration of representative pdf. Power of attorney and declaration of representative. Form 8821, tax information authorization pdf. Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity.

Fillable Form 2848 Power Of Attorney And Declaration Of

Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Web about form 2848, power of attorney and declaration of representative. In november 2022, the irs updated its guidance regarding who can sign form 2848, power of attorney and declaration of representative.

Form 2848 Power of Attorney and Declaration of Representative IRS

Web get form 2848, power of attorney, to file in 2023. Date / / part i power of attorney. Web for more information on designating a partnership representative, see form 8979, partnership representative revocation, designation, and resignation, and its instructions. The individual you authorize must be a person eligible to practice before the irs. Students with a special order to.

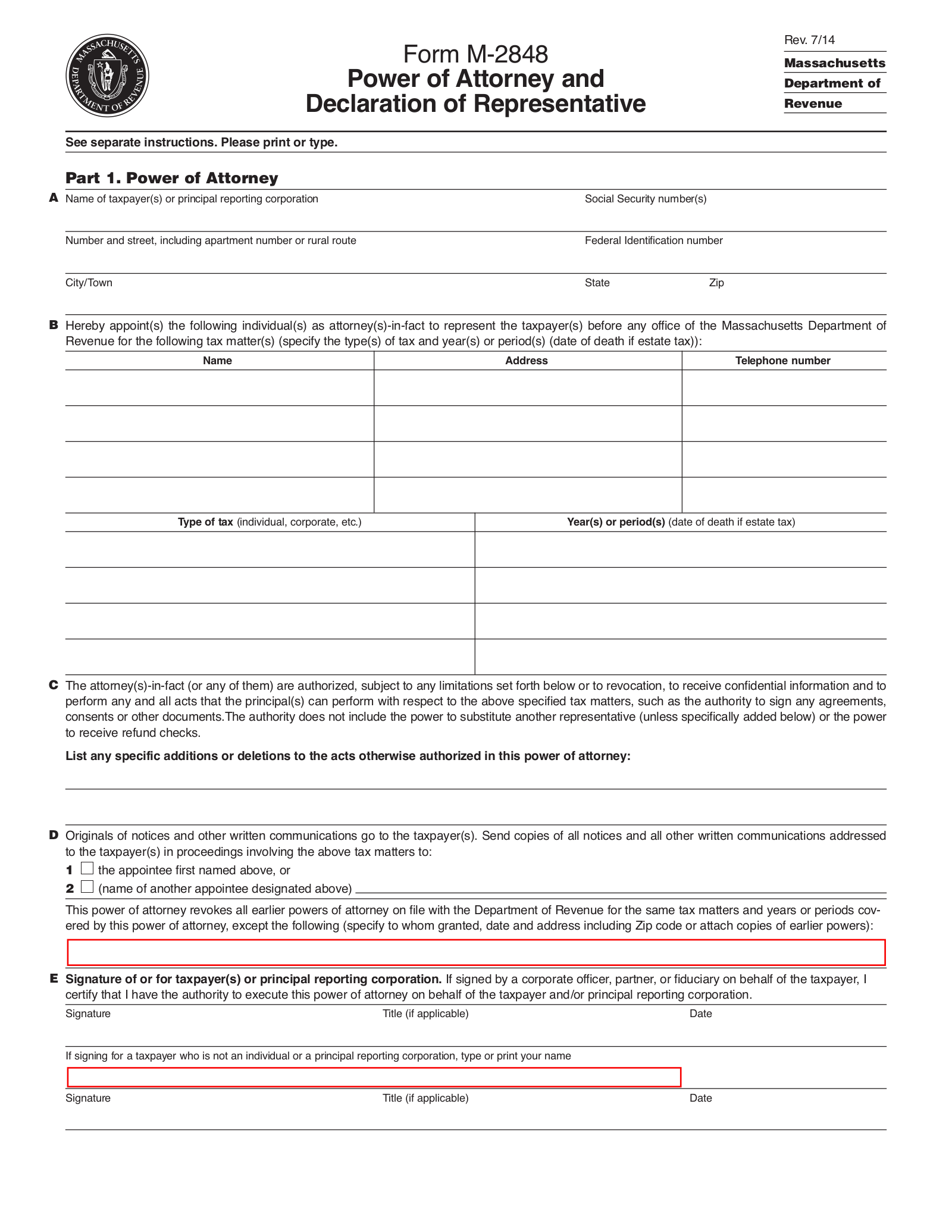

Massachusetts Tax Power of Attorney Form (M2848) eForms

You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic. Form 2848, power of attorney and declaration of representative pdf. Web for more information on designating a partnership representative, see form 8979, partnership representative revocation, designation, and resignation, and its instructions. Power of attorney and declaration of representative. Form 2848 is.

Publication 947 Practice Before the IRS and Power of Attorney

For instructions and the latest information. Web get form 2848, power of attorney, to file in 2023. Web about form 2848, power of attorney and declaration of representative. Failure to provide information could result in a penalty. You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic.

4.31.2 TEFRA Examinations Field Office Procedures Internal Revenue

You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic. Check out our detailed instructions & examples to complete the declaration efficiently & quickly January 2021) department of the treasury internal revenue service. Web for more information on designating a partnership representative, see form 8979, partnership representative revocation, designation, and resignation,.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Print out and complete the 2848 form to authorize the attorney to act on your behalf. Web for more information on designating a partnership representative, see form 8979, partnership representative revocation, designation, and resignation, and its instructions. The individual you authorize must be a person eligible to practice before the irs. Date / / part i power of attorney. Form.

Students With A Special Order To Represent Taxpayers In Qualified Low Income Taxpayer Clinics Or The Student Tax Clinic Program, See The Instructions For Part Ii.

The individual you authorize must be a person eligible to practice before the irs. Power of attorney and declaration of representative. Power of attorney *65203221w* this form is authorized by various acts found in illinois compiled statutes. Power of attorney and declaration of representative.

Check Out Our Detailed Instructions & Examples To Complete The Declaration Efficiently & Quickly

Use form 2848 to authorize an individual to represent you before the irs. Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Web submit forms 2848 and 8821 online. Failure to provide information could result in a penalty.

January 2021) Department Of The Treasury Internal Revenue Service.

Web get form 2848, power of attorney, to file in 2023. Date / / part i power of attorney. Date / / part i power of attorney. Web about form 2848, power of attorney and declaration of representative.

For Instructions And The Latest Information.

March 2012) department of the treasury internal revenue service. Form 2848, power of attorney and declaration of representative pdf. In november 2022, the irs updated its guidance regarding who can sign form 2848, power of attorney and declaration of representative (poa), submitted on behalf of a limited liability company (llc) treated as a partnership or disregarded entity for federal income tax purposes. Form 8821, tax information authorization pdf.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at11.45.57AM-685a3de0020a41b7a4b15d2226d2a93b.png)