Form 3520 Electronic Filing

Form 3520 Electronic Filing - The maximum penalty is 25% of the amount of the gift. Web when and where to file. Complete, edit or print tax forms instantly. Don't miss this 50% discount. Not everyone who is a us person and receives a gift from a foreign person will have to file form 3520. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Many americans who interact with a foreign trust are required to file form 3520. Form 3520 filers who are filing form 4970 will need to paper file their. Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. File form 3520 to report certain transactions with foreign.

Ad complete irs tax forms online or print government tax documents. Owner files this form annually to provide information about: Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Do i need to file irs form 3520? Internal revenue service center p.o. Complete, edit or print tax forms instantly. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and instructions on how to file. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Complete, edit or print tax forms instantly. File form 3520 to report certain transactions with foreign.

Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web form 3520 is an information return for a u.s. Send form 3520 to the following address. Ad talk to our skilled attorneys by scheduling a free consultation today. Upload, modify or create forms. Complete, edit or print tax forms instantly. File form 3520 to report certain transactions with foreign. It does not have to be a “foreign gift.” rather, if a foreign person gifts u.s. Person who is treated as an owner. Box 409101 ogden, ut 84409.

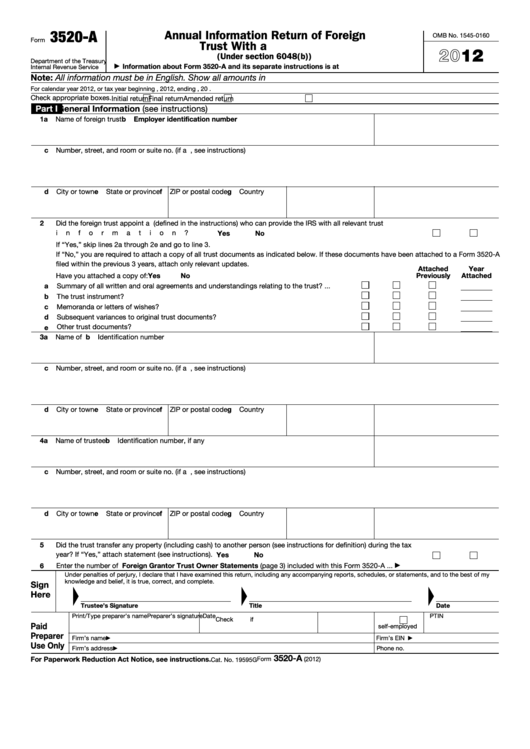

Form 3520A Annual Information Return of Foreign Trust with a U.S

Internal revenue service center p.o. Owner files this form annually to provide information about: Ad talk to our skilled attorneys by scheduling a free consultation today. Try it for free now! Form 4768, application for extension of time to file a return and/or pay u.s.

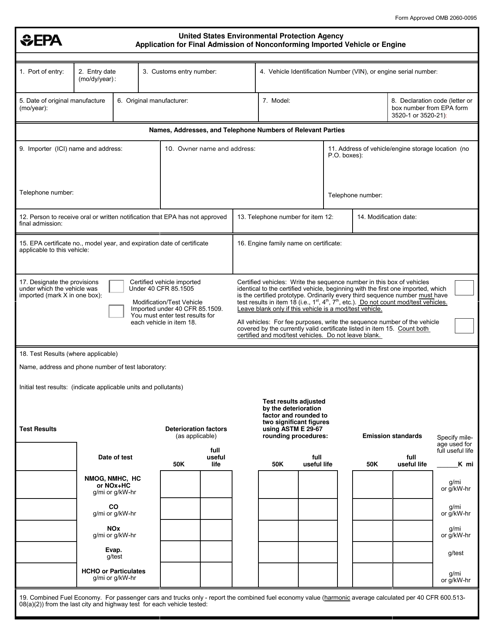

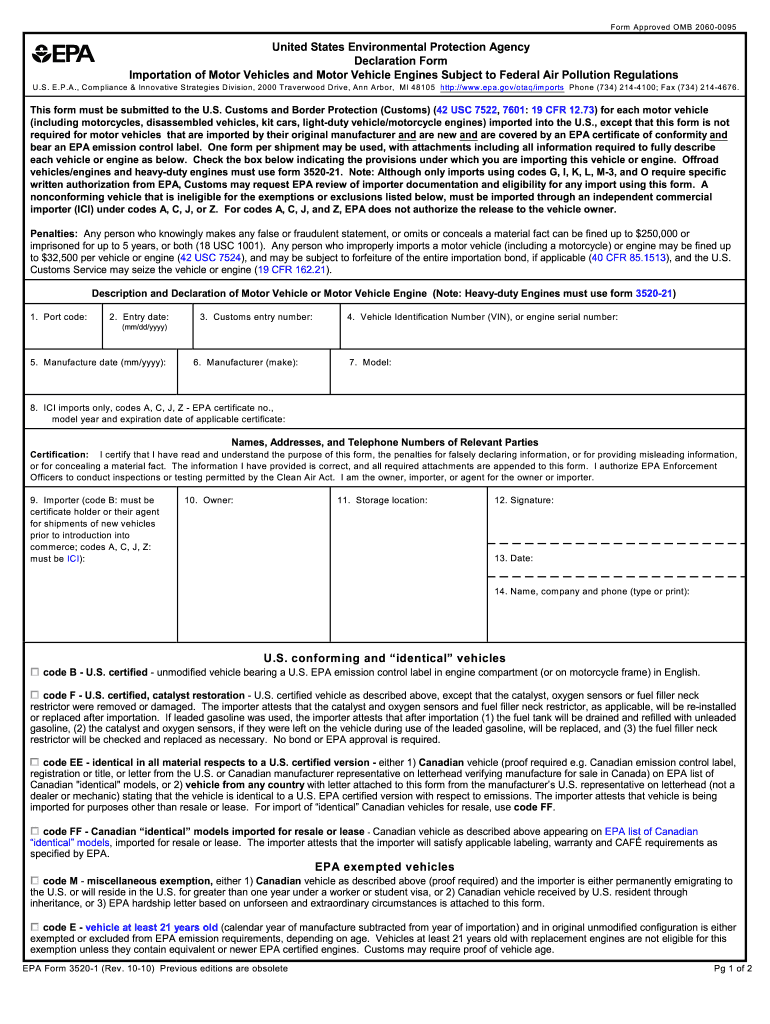

EPA Form 35208 Download Fillable PDF or Fill Online Application for

Complete, edit or print tax forms instantly. Don't miss this 50% discount. Form 4768, application for extension of time to file a return and/or pay u.s. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. It does not have to be a “foreign gift.” rather, if a foreign person gifts u.s.

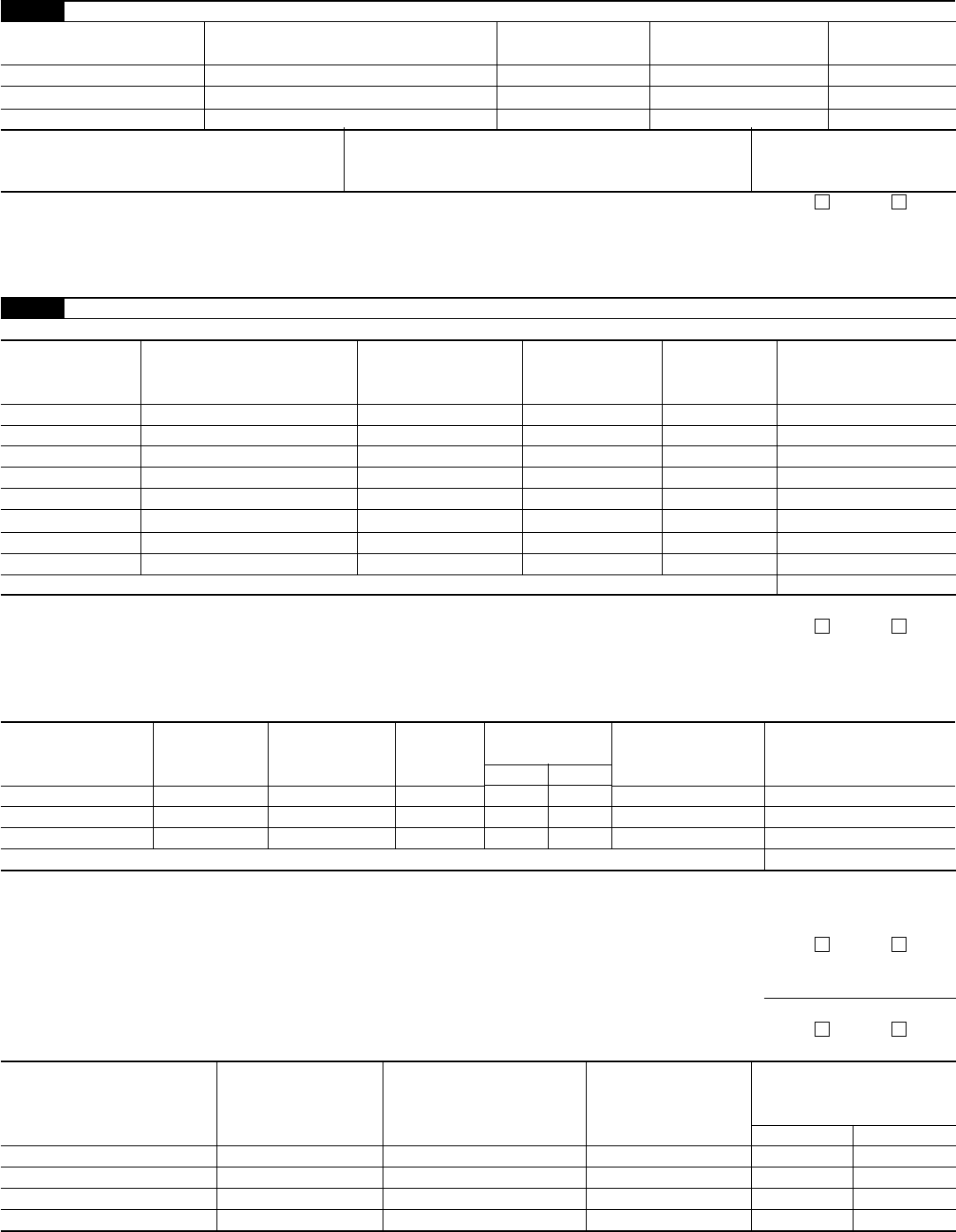

3520 1 Form Fill Out and Sign Printable PDF Template signNow

Try it for free now! Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Internal revenue service center p.o. Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701 (a) (31)] or to report.

Form 3520 2013 Edit, Fill, Sign Online Handypdf

Complete, edit or print tax forms instantly. Web form 3520 is a tax form used to report certain transactions involving foreign trusts. Form 3520 filers who are filing form 4970 will need to paper file their. Try it for free now! Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts,.

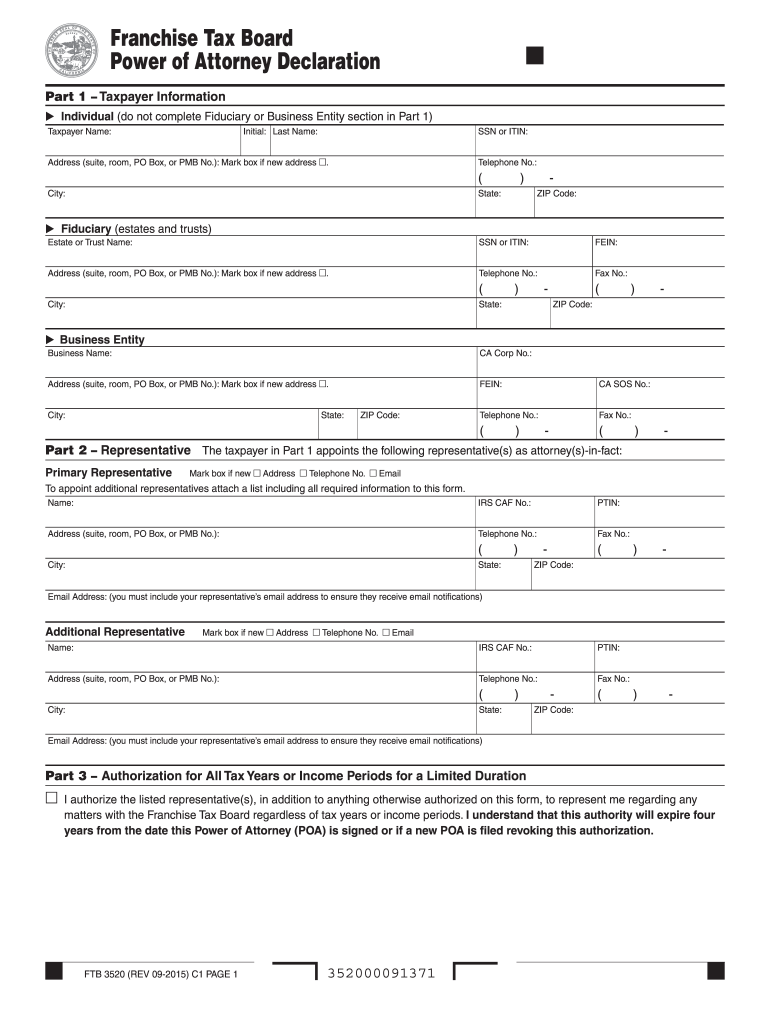

2015 Form CA FTB 3520 Fill Online, Printable, Fillable, Blank pdfFiller

It does not have to be a “foreign gift.” rather, if a foreign person gifts u.s. Internal revenue service center p.o. Box 409101, ogden, ut 84409, by the 15th day of the 3rd month after the end of the trust's tax year. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign.

해외금융계좌 신고 4 Form 3520 (Annual Return of Report Transactions with

Form 3520 is due at the time of a timely filing of the u.s. Person who is treated as an owner. Box 409101 ogden, ut 84409. Owner files this form annually to provide information about: However, if you are filing a substitute.

IRS 3520 A FILING DEADLINE FAST APPROACHING Southpac Group

Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701 (a) (31)] or to report the receipt of certain foreign gifts or bequests. However, if you are filing a substitute. Web when and where to file. Ad complete irs tax forms online or print government tax documents. Box 409101, ogden, ut 84409, by.

2020 Form IRS 3520 Fill Online, Printable, Fillable, Blank pdfFiller

Owner in late august, the irs announced a range for forms for which it. Owner files this form annually to provide information about: Many americans who interact with a foreign trust are required to file form 3520. Form 3520 is due at the time of a timely filing of the u.s. Box 409101 ogden, ut 84409.

DC Ruled That IRS Could Assess Only A 5 Penalty for an Untimely Filing

Don't miss this 50% discount. A foreign trust with at least one u.s. File form 3520 to report certain transactions with foreign. Web form 3520 is a tax form used to report certain transactions involving foreign trusts. It does not have to be a “foreign gift.” rather, if a foreign person gifts u.s.

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Box 409101, ogden, ut 84409, by the 15th day of the 3rd month after the end of the trust's tax year. A foreign trust with at least one u.s. Form 3520 filers who are filing form 4970 will need to paper file their. Not everyone who is a us person and receives a gift from a foreign person will have.

Person To Report Certain Transactions With Foreign Trusts [As Defined In Internal Revenue Code (Irc) Section 7701 (A) (31)] Or To Report The Receipt Of Certain Foreign Gifts Or Bequests.

Box 409101 ogden, ut 84409. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Owner files this form annually to provide information about: However, if you are filing a substitute.

Owner In Late August, The Irs Announced A Range For Forms For Which It.

Try it for free now! Send form 3520 to the following address. Form 4768, application for extension of time to file a return and/or pay u.s. Complete, edit or print tax forms instantly.

Box 409101, Ogden, Ut 84409, By The 15Th Day Of The 3Rd Month After The End Of The Trust's Tax Year.

Web when and where to file. Internal revenue service center p.o. A foreign trust with at least one u.s. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues.

Web Form 3520 Is A Tax Form Used To Report Certain Transactions Involving Foreign Trusts.

Complete, edit or print tax forms instantly. Person who is treated as an owner. The maximum penalty is 25% of the amount of the gift. Many americans who interact with a foreign trust are required to file form 3520.