Form 3520 Filing Deadline

Form 3520 Filing Deadline - It does not have to be a “foreign gift.” rather, if a. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Web the irs changed the instructions to form 3520 for the 2017 taxable year, however, to provide that april 15 is the due date for form 3520 for all filers, both resident. A calendar year trust is due march 15. Owner, is march 15, and the due date for. Web form 3520 is used to report certain transactions involving foreign trusts, including the creation of a foreign trust, the transfer of property to a foreign trust, and the receipt of. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign. But what happens if the taxpayer never files. Owner files this form annually to provide information. Talk to our skilled attorneys by scheduling a free consultation today.

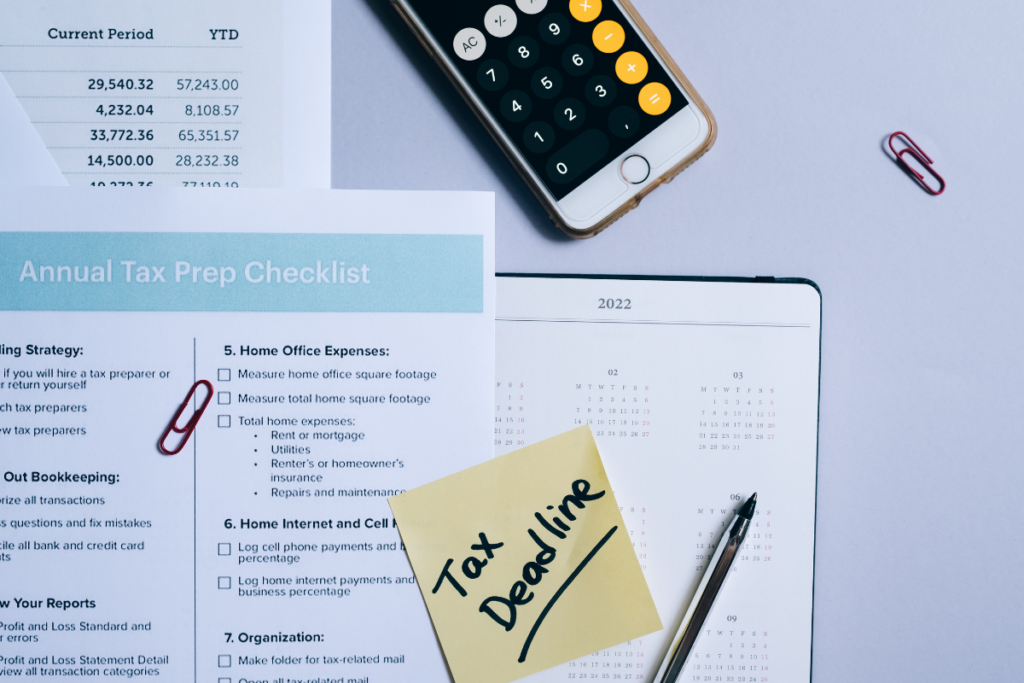

Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Web information reporting form 3520 in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required. Web form 3520 filing requirements. Web the form is due when a person’s tax return is due to be filed. It does not have to be a “foreign gift.” rather, if a. This deadline applies to any individual or small business seeking to file their taxes with the. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Web one example of a situation in which a taxpayer fails to file a form 3520 and probably should have a solid reasonable cause argument is this: Web the irs changed the instructions to form 3520 for the 2017 taxable year, however, to provide that april 15 is the due date for form 3520 for all filers, both resident. Talk to our skilled attorneys by scheduling a free consultation today.

Web form 3520 & instructions: Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Web the form is due when a person’s tax return is due to be filed. Web one example of a situation in which a taxpayer fails to file a form 3520 and probably should have a solid reasonable cause argument is this: Web form 3520 is used to report certain transactions involving foreign trusts, including the creation of a foreign trust, the transfer of property to a foreign trust, and the receipt of. A calendar year trust is due march 15. Owner files this form annually to provide information. It does not have to be a “foreign gift.” rather, if a. Web form 3520 filing requirements. Web information reporting form 3520 in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required.

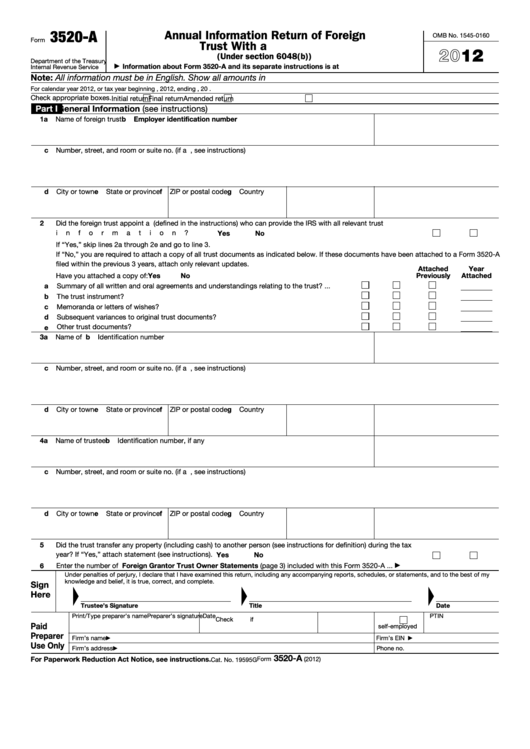

IRS FILING OBLIGATIONS FORM 3520A Southpac Group

But what happens if the taxpayer never files. A calendar year trust is due march 15. Web the form is due when a person’s tax return is due to be filed. Web there are certain filing threshold requirements that the gift (s) must meet before the u.s. Web one example of a situation in which a taxpayer fails to file.

해외금융계좌 신고 4 Form 3520 (Annual Return of Report Transactions with

Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Owner files this form annually to provide information. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and.

The Tax Times Foreign Trust Form 3520A Filing Date Reminder & Tips To

Owner a foreign trust with at least one u.s. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Talk to our skilled attorneys by scheduling a free consultation today. Web the form is due.

Steuererklärung dienstreisen Form 3520

Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Owner files this form annually to provide information. Web form 3520 & instructions:.

IRS 3520 A FILING DEADLINE FAST APPROACHING Southpac Group

Person is required to file the form, and the related party rules apply. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. But what happens if the taxpayer never files. Web form 3520 is used to report certain transactions involving foreign trusts, including the creation of a foreign.

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Web the irs changed the instructions to form 3520 for the 2017 taxable year, however, to provide that april 15 is the due date for form 3520 for all filers, both resident. A calendar year trust is due march 15. Web one example of a situation in which a taxpayer fails to file a form 3520 and probably should have.

Relief from Filing Forms 3520 and Form 3520A for Some SF Tax Counsel

Owner a foreign trust with at least one u.s. It does not have to be a “foreign gift.” rather, if a. Web one example of a situation in which a taxpayer fails to file a form 3520 and probably should have a solid reasonable cause argument is this: Owner files this form annually to provide information. Web tax day for.

IRS Form 3520 Reporting Foreign Trusts for Expats Bright!Tax

Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign. Web the form is due when a person’s tax return is due to be filed. Web information reporting form 3520 in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web form 3520 filing requirements. Web the irs changed the instructions to form 3520 for the 2017 taxable year, however, to provide that april 15 is the due date for form 3520 for all filers, both resident. But what happens if the taxpayer never files. Even if the person does not have to file a tax return, they still must.

Form 3520 Blank Sample to Fill out Online in PDF

Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. But what happens if the taxpayer never files. Web form 3520 is used to report certain transactions involving foreign trusts, including the creation of a foreign trust,.

The Irs F Orm 3520 Is Used To Report A Foreign Gift, Inheritance Or Trust Distribution From A Foreign Person.

Web there are certain filing threshold requirements that the gift (s) must meet before the u.s. This deadline applies to any individual or small business seeking to file their taxes with the. Web form 3520 filing requirements. Owner a foreign trust with at least one u.s.

Owner, Is March 15, And The Due Date For.

Web the irs changed the instructions to form 3520 for the 2017 taxable year, however, to provide that april 15 is the due date for form 3520 for all filers, both resident. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign. Web information reporting form 3520 in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required. But what happens if the taxpayer never files.

Web Form 3520 Is Used To Report Certain Transactions Involving Foreign Trusts, Including The Creation Of A Foreign Trust, The Transfer Of Property To A Foreign Trust, And The Receipt Of.

Web the form is due when a person’s tax return is due to be filed. It does not have to be a “foreign gift.” rather, if a. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. A calendar year trust is due march 15.

Ad Don’t Feel Alone If You’re Dealing With Irs Form 3520 Penalty Abatement Issues.

Owner files this form annually to provide information. Web form 3520 & instructions: Web one example of a situation in which a taxpayer fails to file a form 3520 and probably should have a solid reasonable cause argument is this: Person is required to file the form, and the related party rules apply.