Form 3520 Requirements

Form 3520 Requirements - Persons (and executors of estates of u.s. Web form 3520 filing requirements. Complete, edit or print tax forms instantly. Certain transactions with foreign trusts. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Ad talk to our skilled attorneys by scheduling a free consultation today. If you were the responsible party for overseeing and reporting. Form 3520 is technically referred to as the a nnual return to report transactions with foreign trusts and receipt of certain. Decedents) file form 3520 to report: The form provides information about the foreign trust, its u.s.

Form 3520 is technically referred to as the a nnual return to report transactions with foreign trusts and receipt of certain. Ownership of foreign trusts under the rules of sections. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web if you have an interest in a foreign trust or received gifts from a foreign entity, you may be required to also complete form 3520, annual return to report transactions with. The form provides information about the foreign trust, its u.s. Web form 3520 filing requirements. Persons may not be aware of their requirement to file a form 3520. Ad talk to our skilled attorneys by scheduling a free consultation today. Taxpayer will need to file form 3520: Complete, edit or print tax forms instantly.

Complete, edit or print tax forms instantly. Send form 3520 to the. Owner of a foreign trust (part ii on form 3520). Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Register and subscribe now to work on your irs form 3520 & more fillable forms. Persons (and executors of estates of u.s. If you were the responsible party for overseeing and reporting. Persons may not be aware of their requirement to file a form 3520. Form 3520 is technically referred to as the a nnual return to report transactions with foreign trusts and receipt of certain. Decedents) file form 3520 to report:

Form 3520 Blank Sample to Fill out Online in PDF

Taxpayer will need to file form 3520: Complete, edit or print tax forms instantly. Web as provided by the irs: Web any us person who meets at least one of the following requirements must file form 3520 : If you were the responsible party for overseeing and reporting.

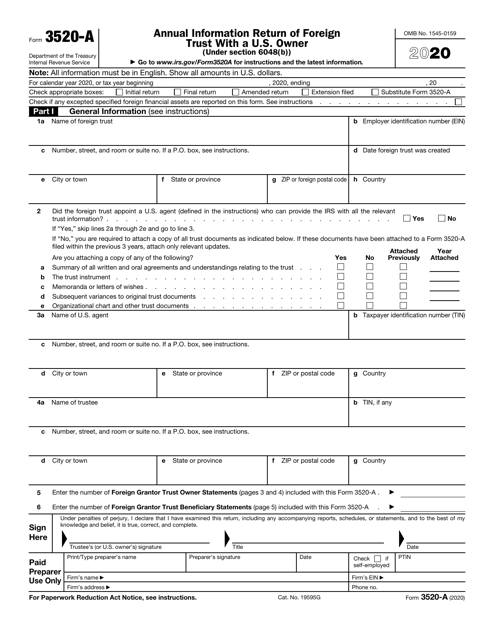

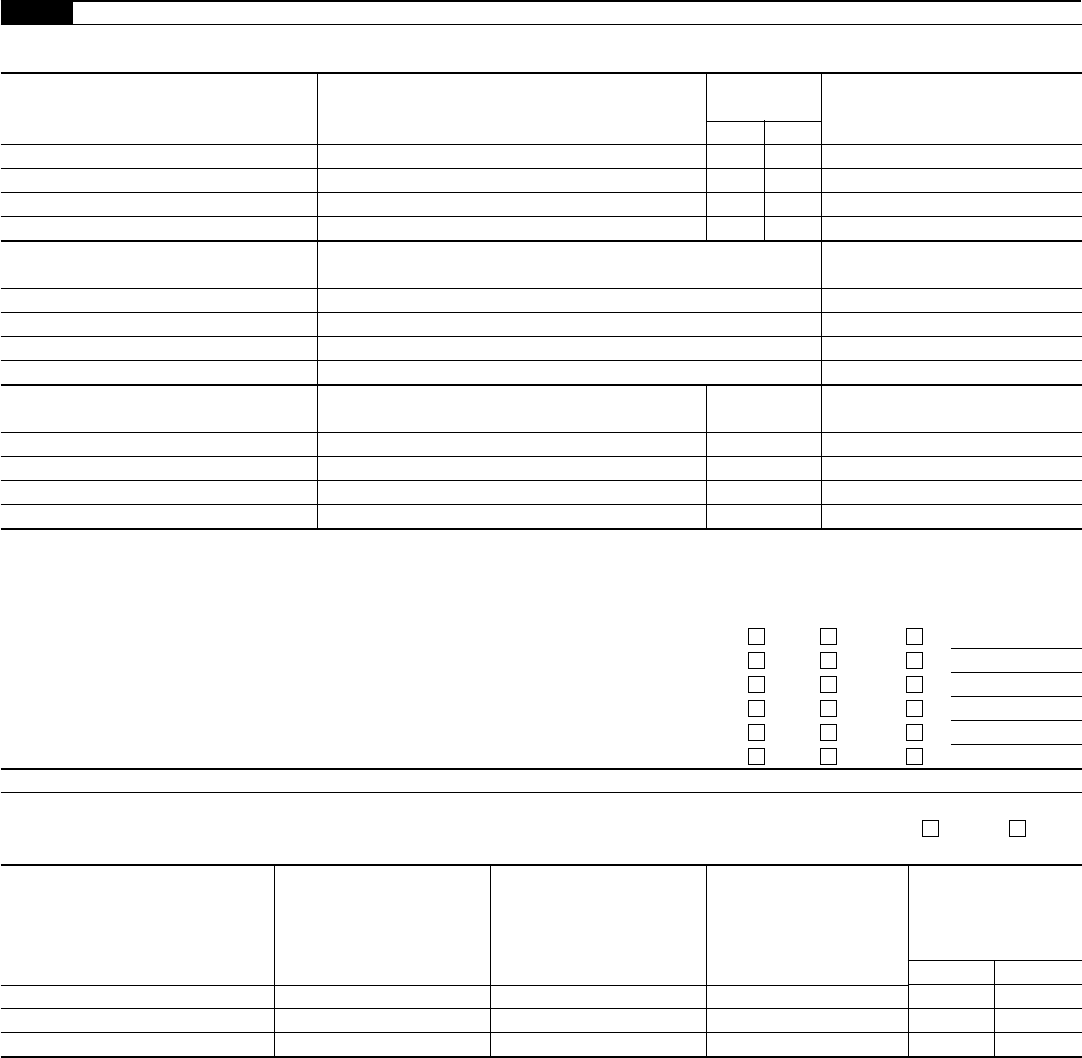

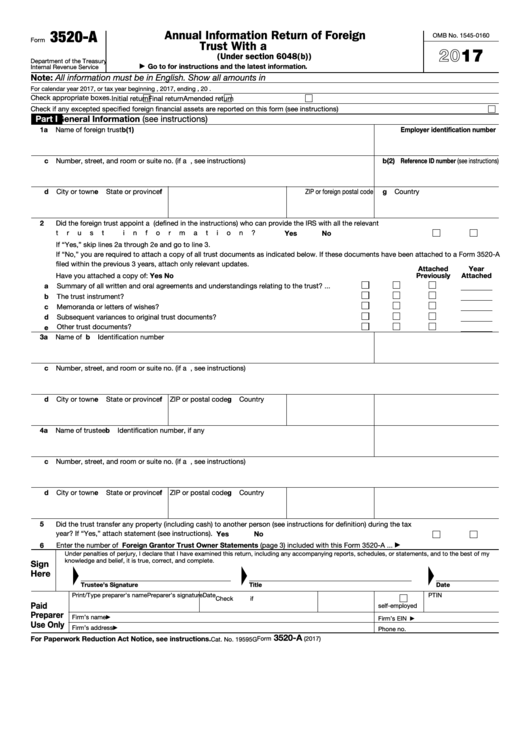

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

The form provides information about the foreign trust, its u.s. Ad talk to our skilled attorneys by scheduling a free consultation today. Owner of a foreign trust (part ii on form 3520). Ownership of foreign trusts under the rules of sections. Web if you have an interest in a foreign trust or received gifts from a foreign entity, you may.

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

Web in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required to be filed when a u.s. Form 3520 is technically referred to as the a nnual return to report transactions with foreign trusts and receipt of certain. Owner of a foreign trust (part ii on form 3520). Web.

Form 3520 2012 Edit, Fill, Sign Online Handypdf

The form provides information about the foreign trust, its u.s. Web there are three circumstances under which a u.s. Taxpayer will need to file form 3520: The form provides information about the foreign trust, its u.s. Persons may not be aware of their requirement to file a form 3520.

The Tax Times IRS Posts Lists of Foreign Trust Reporting Requirements

Complete, edit or print tax forms instantly. Web as provided by the irs: Web in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required to be filed when a u.s. Persons may not be aware of their requirement to file a form 3520. Certain transactions with foreign trusts.

US Taxes and Offshore Trusts Understanding Form 3520

Owner of a foreign trust (part ii on form 3520). Owner is required to file in order to report to the irs, and to the u.s. Register and subscribe now to work on your irs form 3520 & more fillable forms. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Ownership of foreign trusts under the.

Top 16 Form 3520a Templates free to download in PDF format

Web form 3520 filing requirements. Owner is required to file in order to report to the irs, and to the u.s. Send form 3520 to the. If you were the responsible party for overseeing and reporting. Register and subscribe now to work on your irs form 3520 & more fillable forms.

Form 3520A Annual Information Return of Foreign Trust with a U.S

Web in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required to be filed when a u.s. Web if you have an interest in a foreign trust or received gifts from a foreign entity, you may be required to also complete form 3520, annual return to report transactions with..

Expat Tax Planning Understanding Form 3520 Filing Requirements

Web if you have an interest in a foreign trust or received gifts from a foreign entity, you may be required to also complete form 3520, annual return to report transactions with. The form provides information about the foreign trust, its u.s. Complete, edit or print tax forms instantly. The form provides information about the foreign trust, its u.s. Register.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Taxpayer will need to file form 3520: Register and subscribe now to work on your irs form 3520 & more fillable forms. Send form 3520 to the. Web any us person who meets at least one of the following requirements must file form 3520 : Web if you have an interest in a foreign trust or received gifts from a.

Web In General, A Form 3520, Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts Is Required To Be Filed When A U.s.

Certain transactions with foreign trusts. Ownership of foreign trusts under the rules of sections. Web any us person who meets at least one of the following requirements must file form 3520 : Web form 3520 is used to report the existence of a gift, trust, or inheritance received from foreign persons.

Taxpayer Will Need To File Form 3520:

Persons may not be aware of their requirement to file a form 3520. Web if you have an interest in a foreign trust or received gifts from a foreign entity, you may be required to also complete form 3520, annual return to report transactions with. Web there are three circumstances under which a u.s. Web as provided by the irs:

The Form Provides Information About The Foreign Trust, Its U.s.

Owner is required to file in order to report to the irs, and to the u.s. Register and subscribe now to work on your irs form 3520 & more fillable forms. Send form 3520 to the. Persons (and executors of estates of u.s.

Complete, Edit Or Print Tax Forms Instantly.

Owner of a foreign trust (part ii on form 3520). Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Complete, edit or print tax forms instantly. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues.