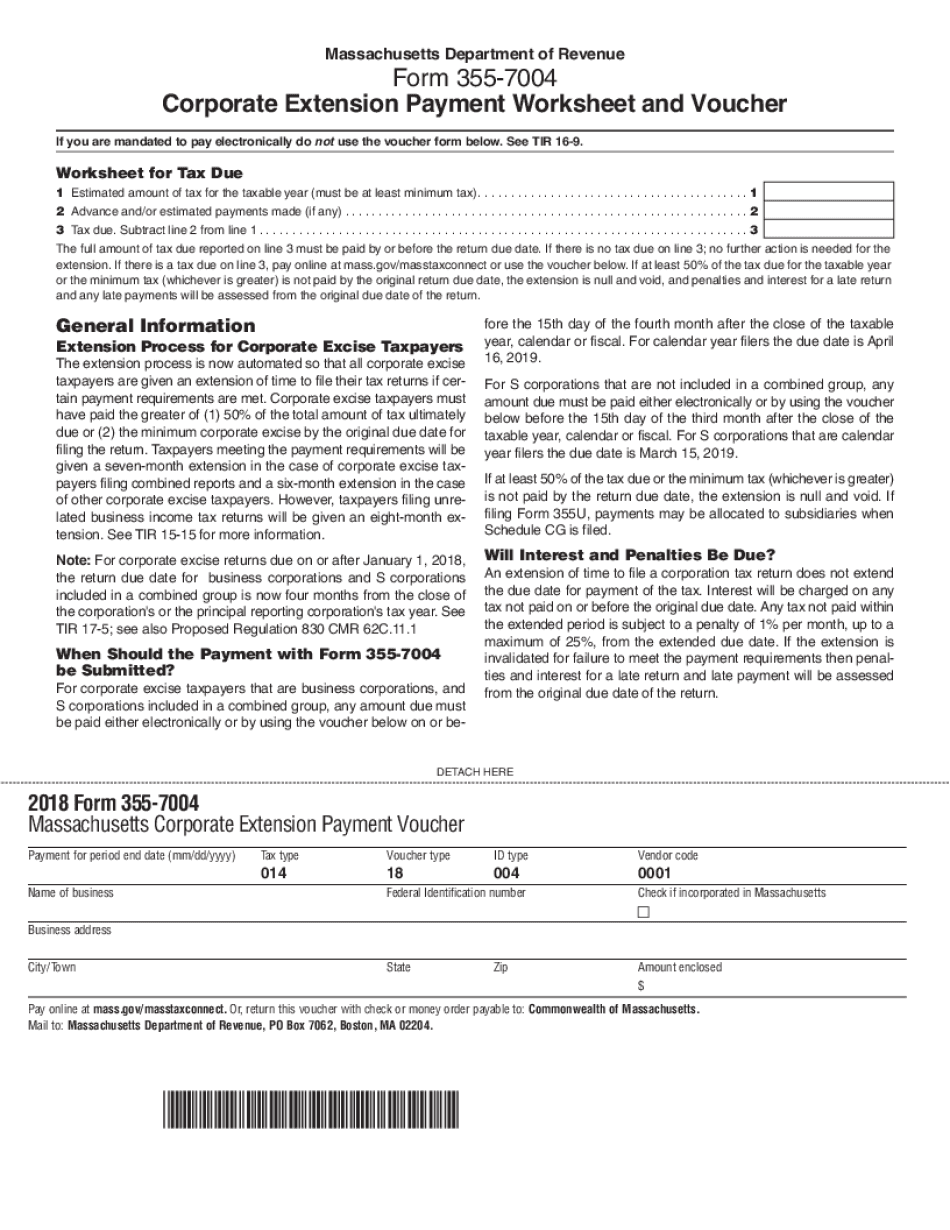

Form 355-7004

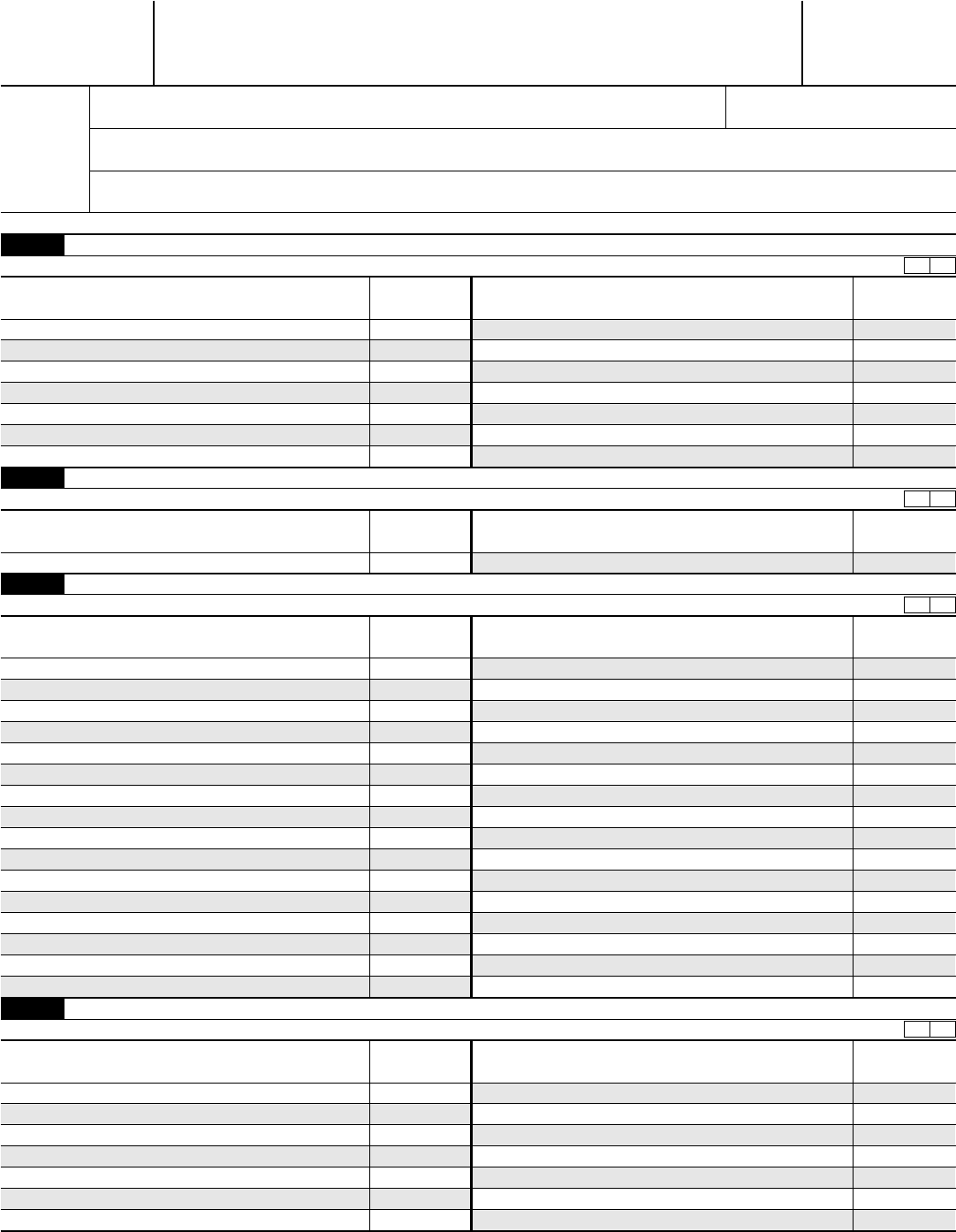

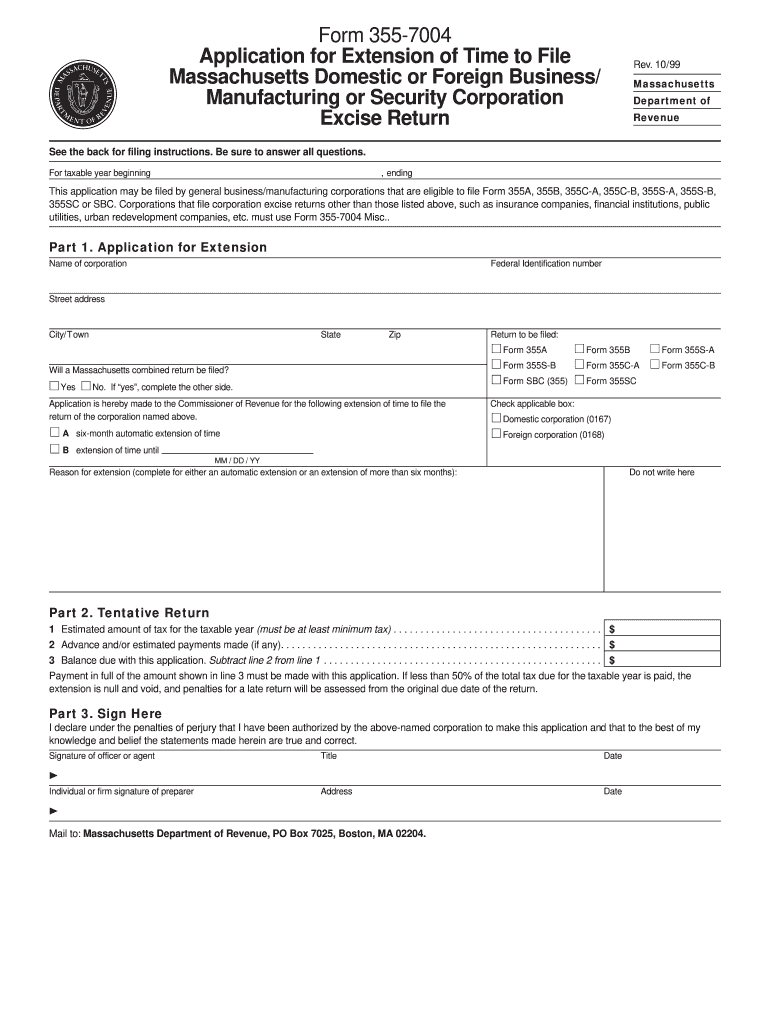

Form 355-7004 - This application must be filed on or before the 15th day of the third month after the close of the taxable year, calendar or fiscal. If the year ends on december 31st,. The reason for delay must be stated on all requests for extension. Web we last updated the massachusetts business or manufacturing corporation in january 2023, so this is the latest version of form 355, fully updated for tax year 2022. Web what form does the state of massachusetts require to apply for an extension? This form is for income earned in tax year 2022, with tax. Taxes for corporations need to be paid by the 15th day of the fourth month after the end of their fiscal year. Form 355 7004 is an important form that you will likely need to submit if your business engages in any type of foreign trade. Corporate extension payment worksheet and voucher (english, pdf 701.18 kb) open pdf file, 153.27 kb,. You can download or print.

Web form 355 7004 pdf details. The reason for delay must be stated on all requests for extension. You can download or print. (1) before submission of an. Web deadlines for filing form 7004. This application must be filed on or before the 15th day of the third month after the close of the taxable year, calendar or fiscal. Corporate extension payment worksheet and voucher (english, pdf 683.13 kb) open pdf file, 181.82 kb,. When should this form be filed? Financial institution, insurance or miscellaneous excise extension payment worksheet and voucher. If the year ends on december 31st,.

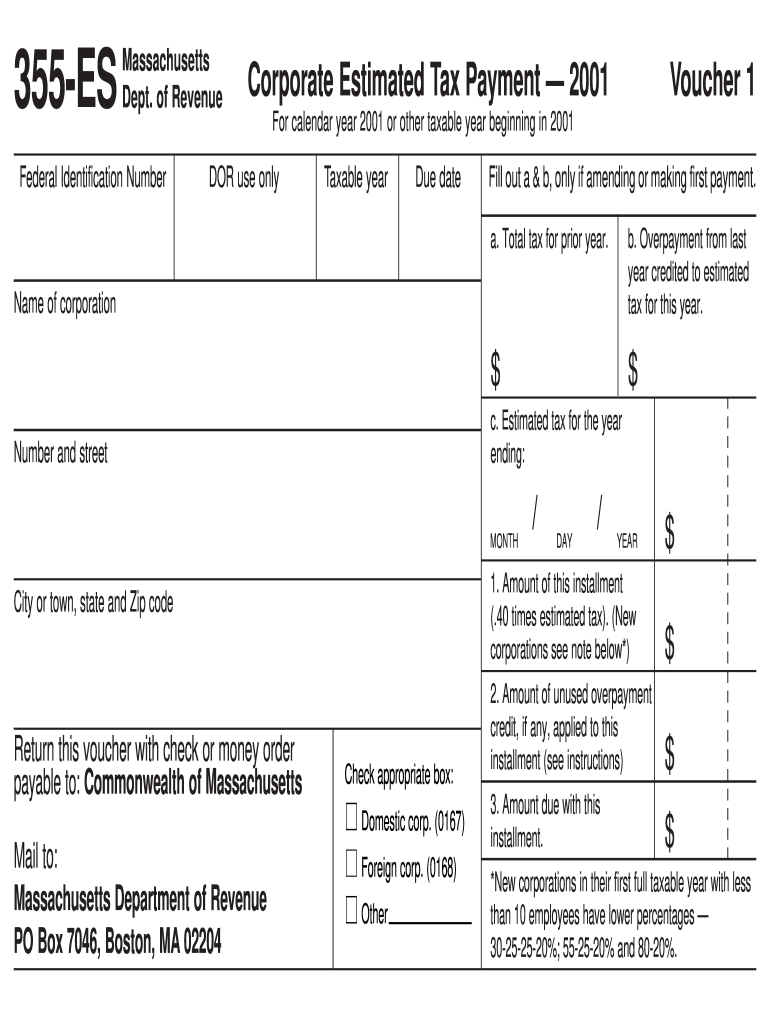

Financial institution, insurance or miscellaneous excise extension payment worksheet and voucher. This application must be filed on or before the 15th day of the third month after the close of the taxable year, calendar or fiscal. Online document managing has become popular with enterprises and individuals. (1) before submission of an. How do i pay my balance due to the state of massachusetts with my. (1) (2) if a receiving bank has received more than one (1). Web deadlines for filing form 7004. If the year ends on december 31st,. This form is for income earned in tax year 2022, with tax. The reason for delay must be stated on all requests for extension.

2021 Form 355 7004 Fill Out and Sign Printable PDF Template signNow

This application must be filed on or before the 15th day of the third month after the close of the taxable year, calendar or fiscal. Financial institution, insurance or miscellaneous excise extension payment worksheet and voucher. (1) before submission of an. Web massachusetts department of revenue. Web we last updated the massachusetts business or manufacturing corporation in january 2023, so.

2012 Form MA 3557004 Fill Online, Printable, Fillable, Blank pdfFiller

Taxes for corporations need to be paid by the 15th day of the fourth month after the end of their fiscal year. Web we last updated the massachusetts business or manufacturing corporation in january 2023, so this is the latest version of form 355, fully updated for tax year 2022. If the year ends on december 31st,. Web deadlines for.

Form 7004 Edit, Fill, Sign Online Handypdf

The reason for delay must be stated on all requests for extension. How do i pay my balance due to the state of massachusetts with my. If the year ends on december 31st,. When should this form be filed? Web form 355 7004 pdf details.

MA 3557004 1999 Fill out Tax Template Online US Legal Forms

How do i pay my balance due to the state of massachusetts with my. The reason for delay must be stated on all requests for extension. You can download or print. Web what form does the state of massachusetts require to apply for an extension? Online document managing has become popular with enterprises and individuals.

355 Massachusetts Form Fill Out and Sign Printable PDF Template signNow

Taxes for corporations need to be paid by the 15th day of the fourth month after the end of their fiscal year. You can download or print. Corporate extension payment worksheet and voucher (english, pdf 701.18 kb) open pdf file, 153.27 kb,. Corporate extension payment worksheet and voucher (english, pdf 683.13 kb) open pdf file, 181.82 kb,. Web prepare 2021.

Form 355 2013 Edit, Fill, Sign Online Handypdf

Web we last updated the massachusetts business or manufacturing corporation in january 2023, so this is the latest version of form 355, fully updated for tax year 2022. Financial institution, insurance or miscellaneous excise extension payment worksheet and voucher. (1) before submission of an. The reason for delay must be stated on all requests for extension. (1) (2) if a.

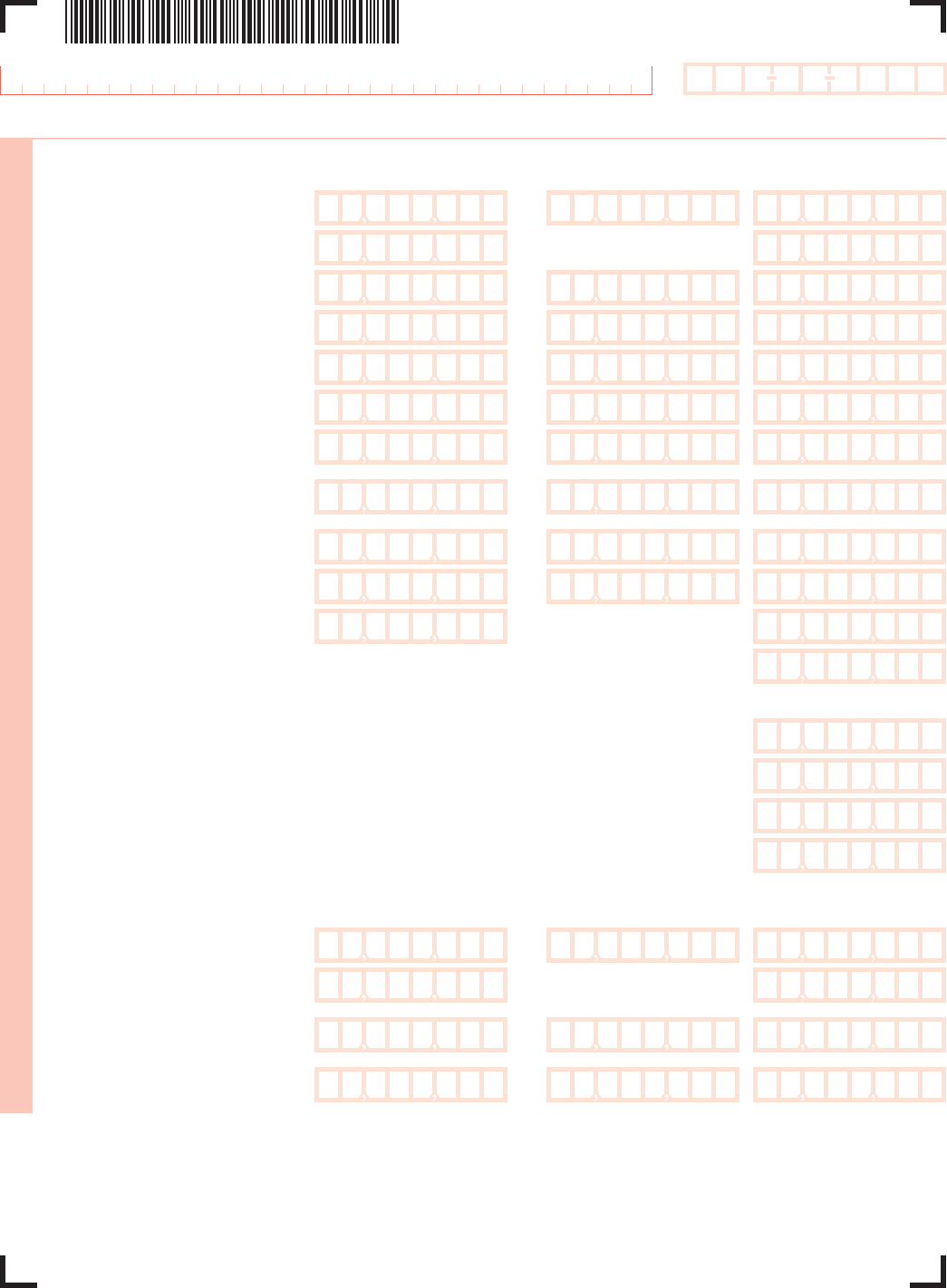

Massachusetts Department Of Revenue Form 355 Es Fill Out and Sign

How do i pay my balance due to the state of massachusetts with my. This form is for income earned in tax year 2022, with tax. Web deadlines for filing form 7004. Online document managing has become popular with enterprises and individuals. You can download or print.

Form 355 2013 Edit, Fill, Sign Online Handypdf

How do i pay my balance due to the state of massachusetts with my. When should this form be filed? You can download or print. Web what form does the state of massachusetts require to apply for an extension? Web massachusetts department of revenue.

Form 3557004 Misc. Download Printable PDF or Fill Online Financial

Corporate extension payment worksheet and voucher (english, pdf 701.18 kb) open pdf file, 153.27 kb,. Online document managing has become popular with enterprises and individuals. How do i pay my balance due to the state of massachusetts with my. Web what form does the state of massachusetts require to apply for an extension? Web deadlines for filing form 7004.

SBA Form 355 A StepbyStep Guide to How to Fill It Out

The form is used to. This application must be filed on or before the 15th day of the third month after the close of the taxable year, calendar or fiscal. (1) before submission of an. You can download or print. Financial institution, insurance or miscellaneous excise extension payment worksheet and voucher.

Web We Last Updated The Massachusetts Business Or Manufacturing Corporation In January 2023, So This Is The Latest Version Of Form 355, Fully Updated For Tax Year 2022.

(a) presubmission and citizen participation requirements. When should this form be filed? Web prepare 2021 form 355 7004 effortlessly on any device. You can download or print.

This Form Is For Income Earned In Tax Year 2022, With Tax.

Online document managing has become popular with enterprises and individuals. Web what form does the state of massachusetts require to apply for an extension? Web deadlines for filing form 7004. How do i pay my balance due to the state of massachusetts with my.

(1) (2) If A Receiving Bank Has Received More Than One (1).

Web massachusetts department of revenue. (1) before submission of an. The reason for delay must be stated on all requests for extension. Taxes for corporations need to be paid by the 15th day of the fourth month after the end of their fiscal year.

Financial Institution, Insurance Or Miscellaneous Excise Extension Payment Worksheet And Voucher.

Web form 355 7004 pdf details. Corporate extension payment worksheet and voucher (english, pdf 683.13 kb) open pdf file, 181.82 kb,. If the year ends on december 31st,. Form 355 7004 is an important form that you will likely need to submit if your business engages in any type of foreign trade.