Form 3804 Instructions

Form 3804 Instructions - Almost every form and publication has a page on irs.gov with a friendly shortcut. In general, for taxable years beginning on or after january 1,. Go to sch e, p. The vouchers amounts can be changed or suppressed by using the override inputs. For example, the form 1040 page is at. Web the program uses your entries on screen 7, partner information to exclude partners who don’t qualify. Business name (as shown on tax return) fein corp no. Web home about form 8804, annual return for partnership withholding tax (section 1446) use form 8804 to report the total liability under section 1446 for the partnership’s tax year. Web procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Web instructions, and pubs is at irs.gov/forms.

Web procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Web home about form 8804, annual return for partnership withholding tax (section 1446) use form 8804 to report the total liability under section 1446 for the partnership’s tax year. Go to sch e, p. Ssn or itin fein part i elective tax credit amount. Web up to 10% cash back by june 15 of the tax year of the election, at least 50% of the elective tax paid in the prior tax year or $1,000, whichever is greater; Web the program uses your entries on screen 7, partner information to exclude partners who don’t qualify. Almost every form and publication has a page on irs.gov with a friendly shortcut. Web there are several ways to submit form 4868. Business name (as shown on tax return) fein corp no. Web for business filers:

Business name (as shown on tax return) fein corp no. Web up to 10% cash back by june 15 of the tax year of the election, at least 50% of the elective tax paid in the prior tax year or $1,000, whichever is greater; Attach to form 100s, form 565, or form 568. Automatically include all shareholders go to california > other information worksheet. The vouchers amounts can be changed or suppressed by using the override inputs. Web home about form 8804, annual return for partnership withholding tax (section 1446) use form 8804 to report the total liability under section 1446 for the partnership’s tax year. Both the form and instructions. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. In general, for taxable years beginning on or after january 1,. Web instructions, and pubs is at irs.gov/forms.

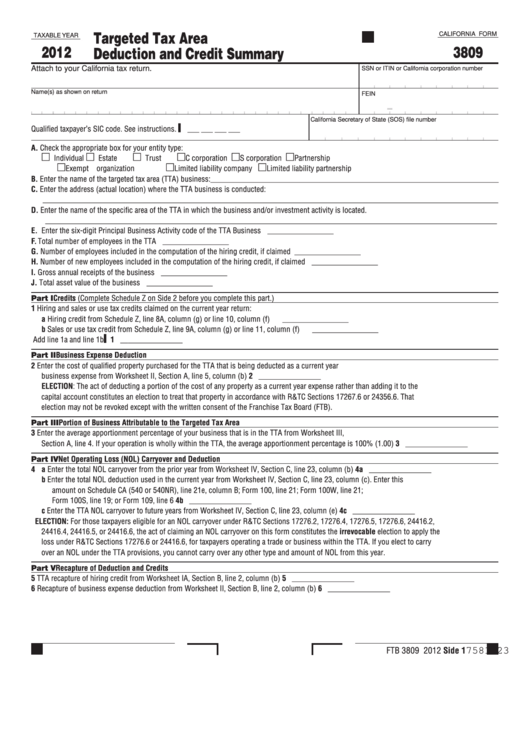

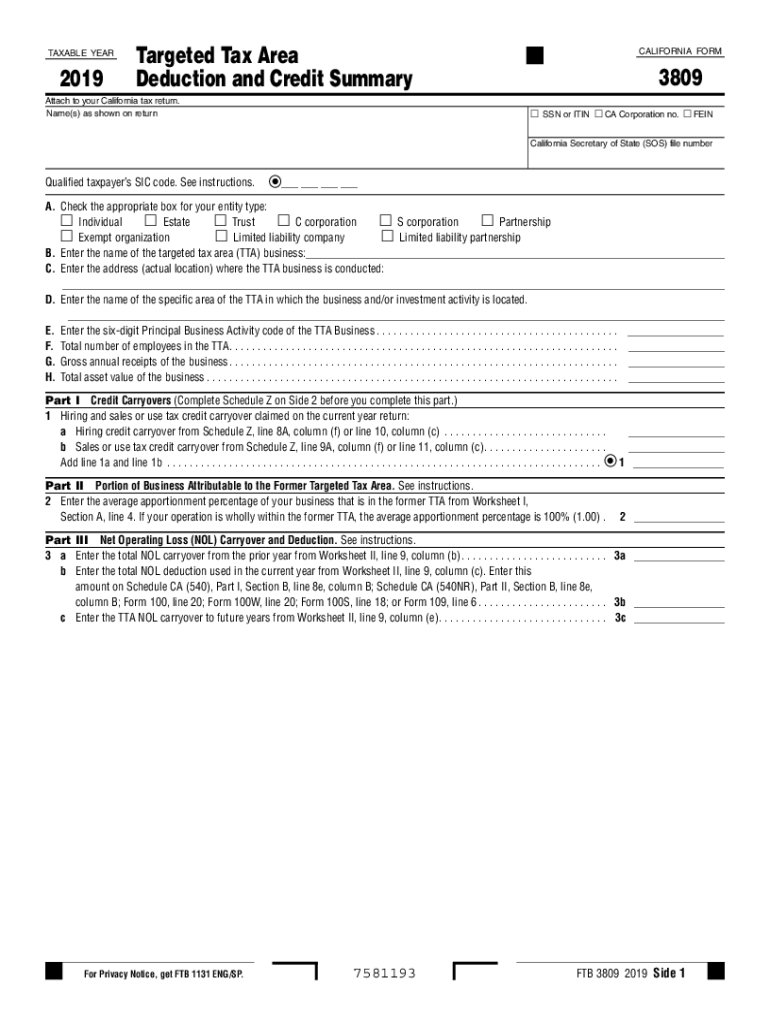

Fillable California Form 3809 Targeted Tax Area Deduction And Credit

Web procedure tax software 2022 prepare the 3804 go to california > ca29. Both the form and instructions. The vouchers amounts can be changed or suppressed by using the override inputs. I have two shareholders and need to get them the form 3804. Go to sch e, p.

Form 3903 Instructions 2017

Go to sch e, p. Web the program uses your entries on screen 7, partner information to exclude partners who don’t qualify. Ssn or itin fein part i elective tax credit amount. The pte elective tax credit will flow to form. Business name (as shown on tax return) fein corp no.

Barbara Johnson Blog Form 2553 Instructions How and Where to File

Web there are several ways to submit form 4868. Web the program uses your entries on screen 7, partner information to exclude partners who don’t qualify. The vouchers amounts can be changed or suppressed by using the override inputs. Web home about form 8804, annual return for partnership withholding tax (section 1446) use form 8804 to report the total liability.

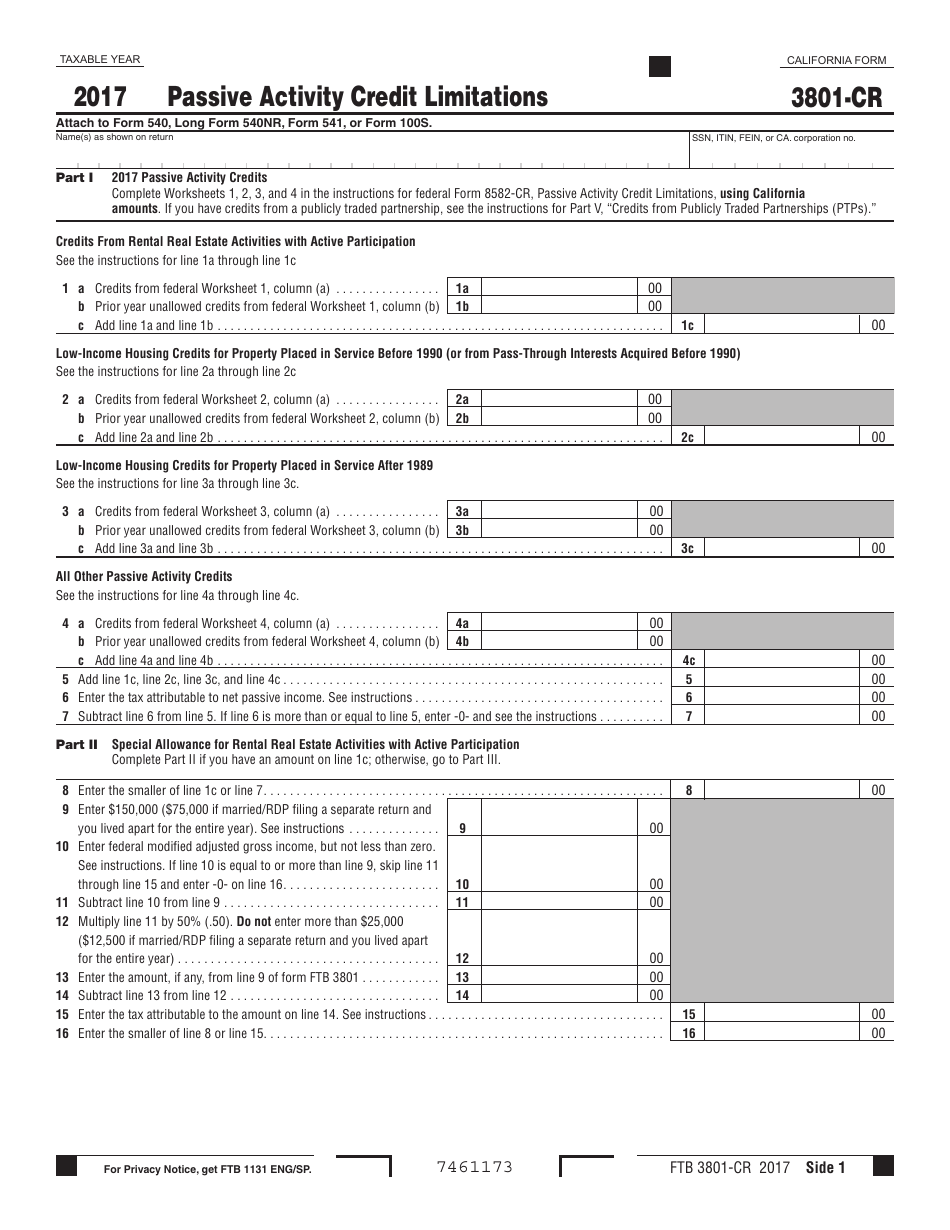

Form FTB3801CR Download Printable PDF or Fill Online Passive Activity

The vouchers amounts can be changed or suppressed by using the override inputs. Both the form and instructions. For example, the form 1040 page is at. Business name (as shown on tax return) fein corp no. Web for business filers:

MINDSTORMS ROBOTICS INVENTION 2.0 SYSTEM

Web they will automatically generate when activating form 3804. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web up to 10% cash back by june 15 of the tax year of the election, at least 50% of the elective tax paid in the prior tax year or $1,000, whichever.

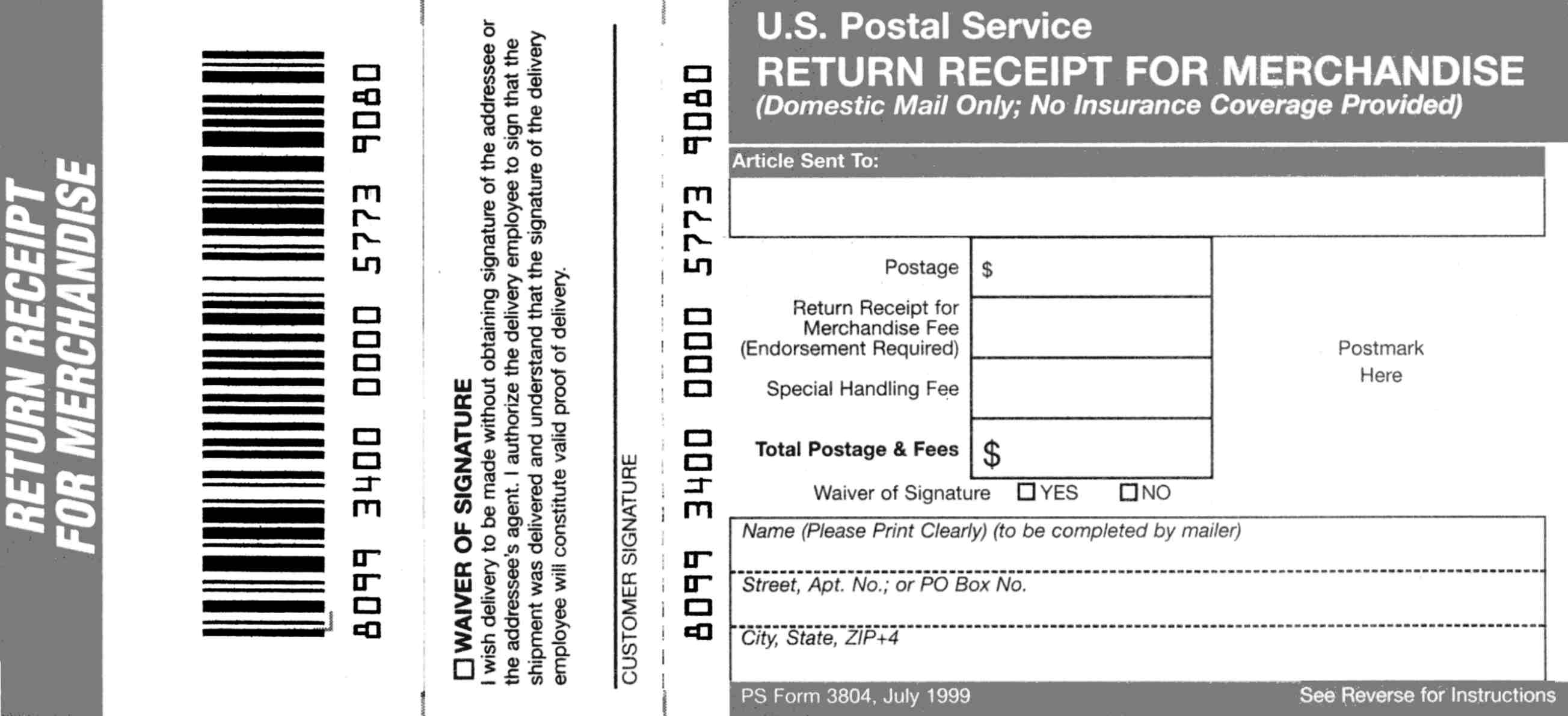

Domestic Mail Manual S917 Return Receipt for Merchandise

The vouchers amounts can be changed or suppressed by using the override inputs. Go to sch e, p. For example, the form 1040 page is at. Business name (as shown on tax return) fein corp no. In general, for taxable years beginning on or after january 1,.

설비제작의뢰서 부서별서식

Both the form and instructions. Automatically include all shareholders go to california > other information worksheet. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web procedure tax software 2022 prepare the 3804 go to california > ca29. The vouchers amounts can be changed or suppressed by using the override.

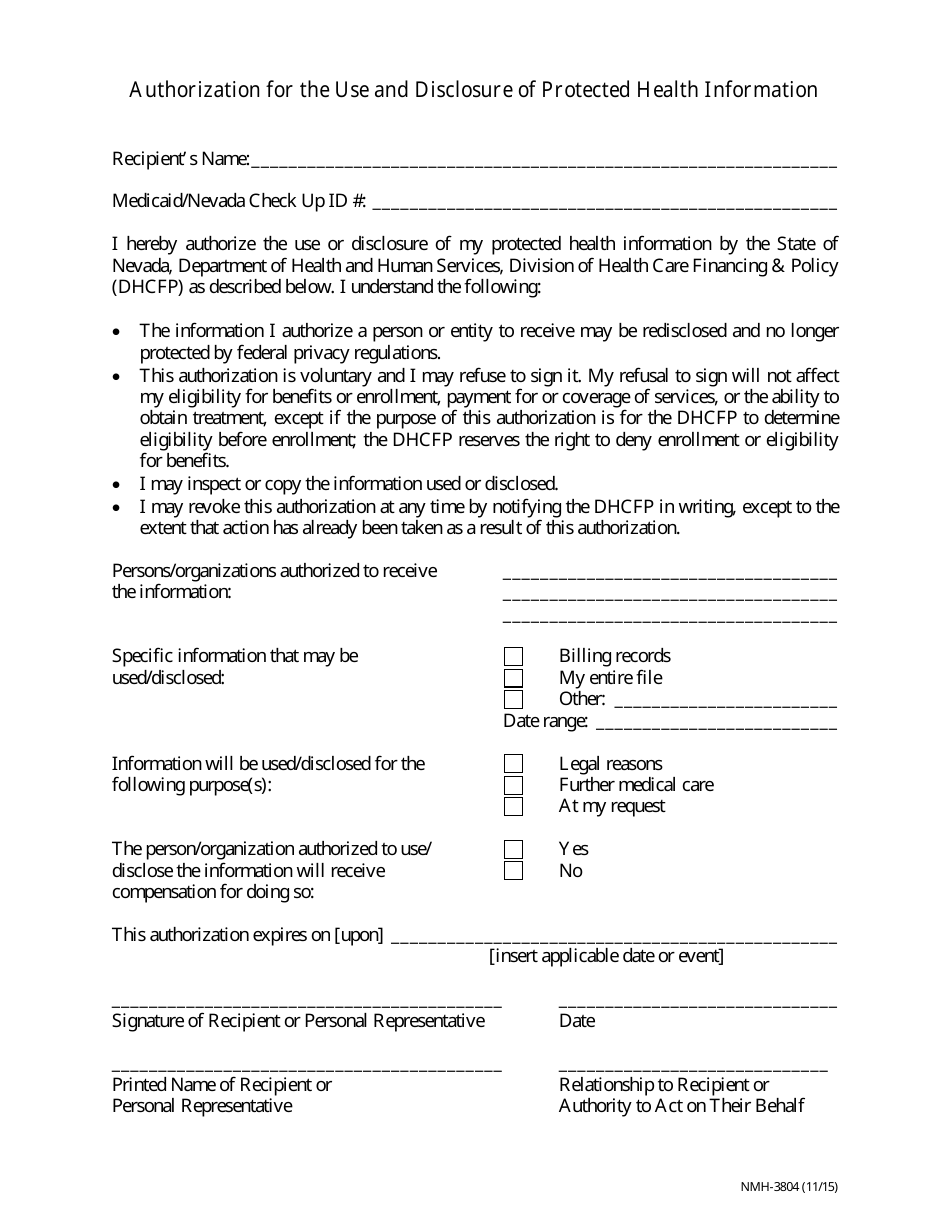

Form NMH3804 Download Fillable PDF or Fill Online Authorization for

The vouchers amounts can be changed or suppressed by using the override inputs. Web for business filers: The pte elective tax credit will flow to form. Web they will automatically generate when activating form 3804. Form 8804 and these instructions have been converted from an annual revision to continuous use.

Form 590 Withholding Exemption Certificate City Of Fill Out and Sign

In general, for taxable years beginning on or after january 1,. Go to sch e, p. I have two shareholders and need to get them the form 3804. Web up to 10% cash back by june 15 of the tax year of the election, at least 50% of the elective tax paid in the prior tax year or $1,000, whichever.

Lego mindstorms fighting robot instructions Canadian Manuals Stepby

Ssn or itin fein part i elective tax credit amount. Form 8804 and these instructions have been converted from an annual revision to continuous use. Both the form and instructions. Web instructions, and pubs is at irs.gov/forms. The vouchers amounts can be changed or suppressed by using the override inputs.

Web Instructions, And Pubs Is At Irs.gov/Forms.

Web for business filers: Form 8804 and these instructions have been converted from an annual revision to continuous use. Web up to 10% cash back by june 15 of the tax year of the election, at least 50% of the elective tax paid in the prior tax year or $1,000, whichever is greater; The vouchers amounts can be changed or suppressed by using the override inputs.

Both The Form And Instructions.

Go to sch e, p. Business name (as shown on tax return) fein corp no. Web home about form 8804, annual return for partnership withholding tax (section 1446) use form 8804 to report the total liability under section 1446 for the partnership’s tax year. Attach to form 100s, form 565, or form 568.

Web Procedure Tax Software 2022 Prepare The 3804 Go To California > Ca29.

I have two shareholders and need to get them the form 3804. Ssn or itin fein part i elective tax credit amount. For example, the form 1040 page is at. Web the program uses your entries on screen 7, partner information to exclude partners who don’t qualify.

Taxpayers Can File Form 4868 By Mail, But Remember To Get Your Request In The Mail By Tax Day.

Web procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. In general, for taxable years beginning on or after january 1,. Web there are several ways to submit form 4868. Almost every form and publication has a page on irs.gov with a friendly shortcut.