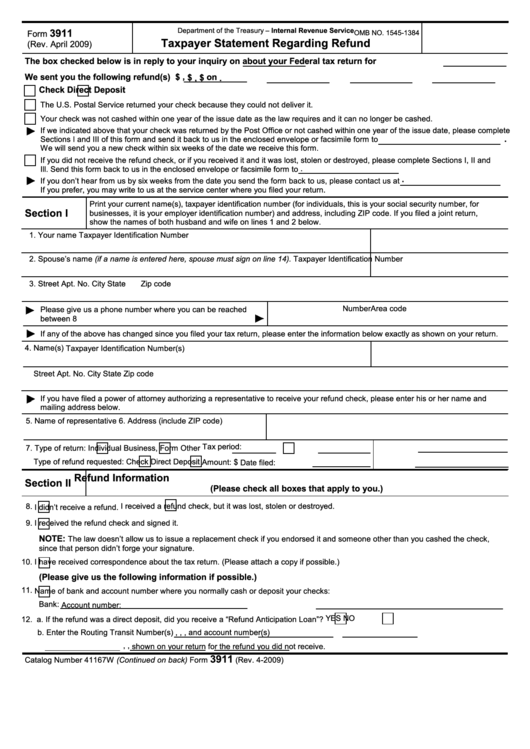

Form 3911 How To Fill Out

Form 3911 How To Fill Out - Web how to fill out tax form 3911? Web according to the irs agent, you should start a payment trace by filing form 3911 only if you suspect fraudulent activity and believe that the check was stolen or. Web alternatively, you could also send the irs a completed form 3911, taxpayer statement regarding refund. Complete, edit or print tax forms instantly. If this refund was from a joint return, we need the signatures of both husband. Web how to fill out irs form 3911 downloading form 3911. You should only file form 3911 if a. Sign it in a few clicks. Type text, add images, blackout confidential details, add comments, highlights and more. Edit your how to fill out form 3911 online.

Ad fda 3911 instructions & more fillable forms, register and subscribe now! Knott 13k subscribers join save 38k views 1 year ago #stimuluscheck #irs correction:. Web submit the completed fda form 3911 using the “submit by email” button on the form or email the completed form to drugnotifications@fda.hhs.gov and include. Type text, add images, blackout confidential details, add comments, highlights and more. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. (perfect answer) to complete a form 3911, you will need to provide the following information: Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web the primary purpose of form 3911 is to trace missing payments rather than determine eligibility or the accuracy of the amount.

Web the primary purpose of form 3911 is to trace missing payments rather than determine eligibility or the accuracy of the amount. Knott 13k subscribers join save 38k views 1 year ago #stimuluscheck #irs correction:. Web to complete the form 3911: Write “eip1” or “eip2” on the top of the form to identify which payment you want to trace. Web how to fill out tax form 3911? Complete, edit or print tax forms instantly. Sign it in a few clicks. Complete, edit or print tax forms instantly. If this refund was from a joint return, we need the signatures of both husband. You should only file form 3911 if a.

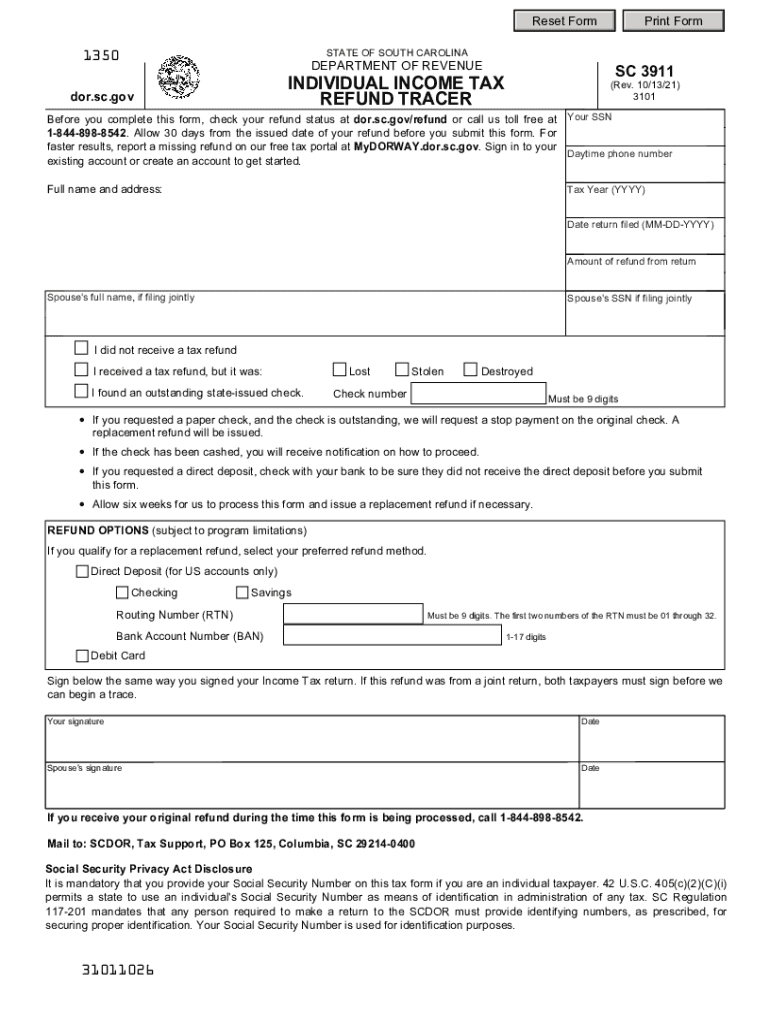

SC SC 3911 20212022 Fill and Sign Printable Template Online US

Type text, add images, blackout confidential details, add comments, highlights and more. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web according to the irs agent, you should start a payment trace by filing form 3911 only if you suspect fraudulent activity and believe that the check was stolen or. Web to complete the.

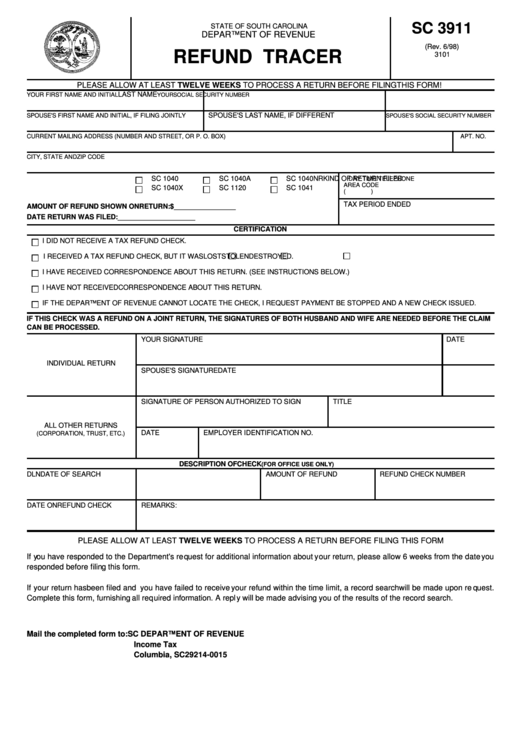

Fillable Form Sc 3911 Refund Tracer 1998 printable pdf download

Ad access irs tax forms. Web submit the completed fda form 3911 using the “submit by email” button on the form or email the completed form to drugnotifications@fda.hhs.gov and include. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Sign it in a few clicks.

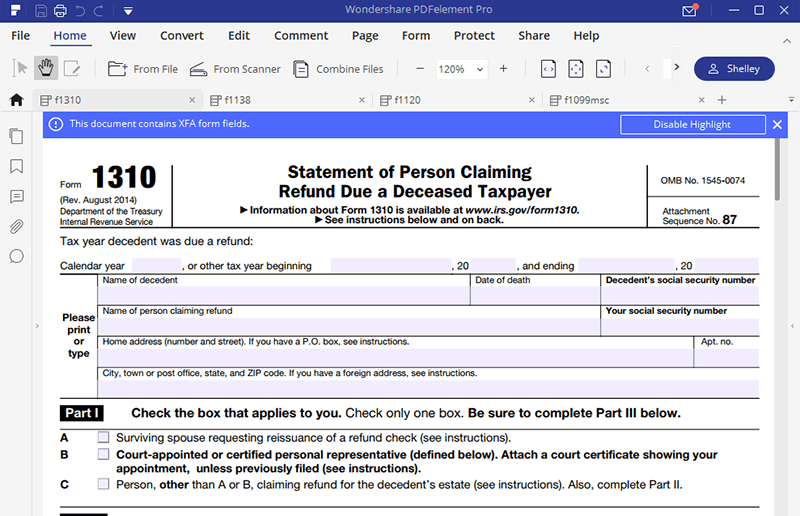

The Fastest Way To Edit Document IRS Form 3911

Edit your form 3911 online. This ensures that the proper taxes are paid. Web any llcs must fill out a w9 form for their owners in order to report any income received. Type text, add images, blackout confidential details, add comments, highlights and more. Complete, edit or print tax forms instantly.

What Is IRS Form 8821? IRS Tax Attorney

If this refund was from a joint return, we need the signatures of both husband. This ensures that the proper taxes are paid. Web how to fill out irs form 3911 downloading form 3911. Complete, edit or print tax forms instantly. Type text, add images, blackout confidential details, add comments, highlights and more.

Form 3911 Printable

Type text, add images, blackout confidential details, add comments, highlights and more. Complete, edit or print tax forms instantly. Edit your how to fill out form 3911 online. Download irs form 3911 from the internal revenue service website. Edit your form 3911 online.

Form 3911 Fill out & sign online DocHub

Type text, add images, blackout confidential details, add comments, highlights and more. Ad fda 3911 instructions & more fillable forms, register and subscribe now! Sign it in a few clicks. If this refund was from a joint return, we need the signatures of both husband. Web any llcs must fill out a w9 form for their owners in order to.

FORM FDA 3911 Instructional Supplement. Instructions for Completion of

Web the primary purpose of form 3911 is to trace missing payments rather than determine eligibility or the accuracy of the amount. The form is typically used to track down missing tax. This ensures that the proper taxes are paid. Sign it in a few clicks. Complete, edit or print tax forms instantly.

Form 3911 Printable

Complete, edit or print tax forms instantly. Edit your form 3911 online. Sign it in a few clicks. Web any llcs must fill out a w9 form for their owners in order to report any income received. Web according to the irs agent, you should start a payment trace by filing form 3911 only if you suspect fraudulent activity and.

Tax Form 8332 Printable Master of Documents

Web download your fillable irs form 3911 in pdf table of contents when to use irs form 3911 what to do with the form how to fill out irs form 3911 tax refunds do not. Web submit the completed fda form 3911 using the “submit by email” button on the form or email the completed form to drugnotifications@fda.hhs.gov and include..

Form 3911 Edit, Fill, Sign Online Handypdf

Download irs form 3911 from the internal revenue service website. Sign it in a few clicks. Web the primary purpose of form 3911 is to trace missing payments rather than determine eligibility or the accuracy of the amount. Complete the form answering all refund. Edit your how to fill out form 3911 online.

Complete, Edit Or Print Tax Forms Instantly.

Complete, edit or print tax forms instantly. If this refund was from a joint return, we need the signatures of both husband. Web how to fill out irs form 3911 downloading form 3911. Complete, edit or print tax forms instantly.

Complete, Edit Or Print Tax Forms Instantly.

Web download your fillable irs form 3911 in pdf table of contents when to use irs form 3911 what to do with the form how to fill out irs form 3911 tax refunds do not. Edit your how to fill out form 3911 online. Type text, add images, blackout confidential details, add comments, highlights and more. Web to complete the form 3911:

Web Submit The Completed Fda Form 3911 Using The “Submit By Email” Button On The Form Or Email The Completed Form To Drugnotifications@Fda.hhs.gov And Include.

Edit your form 3911 online. Web any llcs must fill out a w9 form for their owners in order to report any income received. You should only file form 3911 if a. This ensures that the proper taxes are paid.

Ad Access Irs Tax Forms.

Ad fda 3911 instructions & more fillable forms, register and subscribe now! (the item numbers below correspond to the numbered areas on form fda 3911) 1. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web according to the irs agent, you should start a payment trace by filing form 3911 only if you suspect fraudulent activity and believe that the check was stolen or.