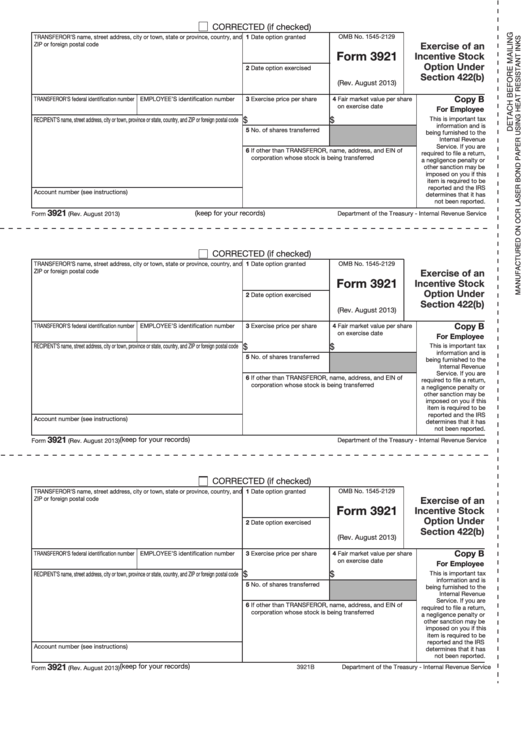

Form 3921 Irs

Form 3921 Irs - The information on form 3921 will help in determining your cost or other basis as well as your holding period. Although this information is not taxable unless disposed of, you may have to include the information for alternative minimum tax purposes (if required). Web may 22, 2023. One form needs to be filed for each transfer of stock that occurs pursuant to an iso exercise during the applicable calendar year. Companies also need to provide each applicable shareholder with a copy of this form. Form 3921 informs the irs which shareholders received iso compensation. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). About form 3921, exercise of an incentive stock option under section 422(b) |. Form 3921 is an irs form that must be filed by a company when an employee has exercised an incentive stock option (iso) in the last tax year. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed.

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section 422(b) must, for that calendar year, file form 3921 for each. You must file one form per iso exercise. You must recognize (report) gain or loss on your tax return for the year in which you sell or otherwise dispose of the stock. Form 3921 is an irs form that must be filed by a company when an employee has exercised an incentive stock option (iso) in the last tax year. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Although this information is not taxable unless disposed of, you may have to include the information for alternative minimum tax purposes (if required). Web february 28, 2023. Web you have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive stock option (iso). Web may 22, 2023. Companies also need to provide each applicable shareholder with a copy of this form.

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section 422 (b) must, for that calendar year, file form 3921 for each transfer made during that year. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. About form 3921, exercise of an incentive stock option under section 422(b) |. You must file one form per iso exercise. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Companies also need to provide each applicable shareholder with a copy of this form. The information on form 3921 will help in determining your cost or other basis as well as your holding period. Form 3921 is an irs form that must be filed by a company when an employee has exercised an incentive stock option (iso) in the last tax year. Web february 28, 2023. One form needs to be filed for each transfer of stock that occurs pursuant to an iso exercise during the applicable calendar year.

3921, Tax Reporting Instructions & Filing Requirements for Form 3921

One form needs to be filed for each transfer of stock that occurs pursuant to an iso exercise during the applicable calendar year. Web february 28, 2023. You must file one form per iso exercise. Form 3921 informs the irs which shareholders received iso compensation. The form has to be filed in the year in which the iso is exercised.

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

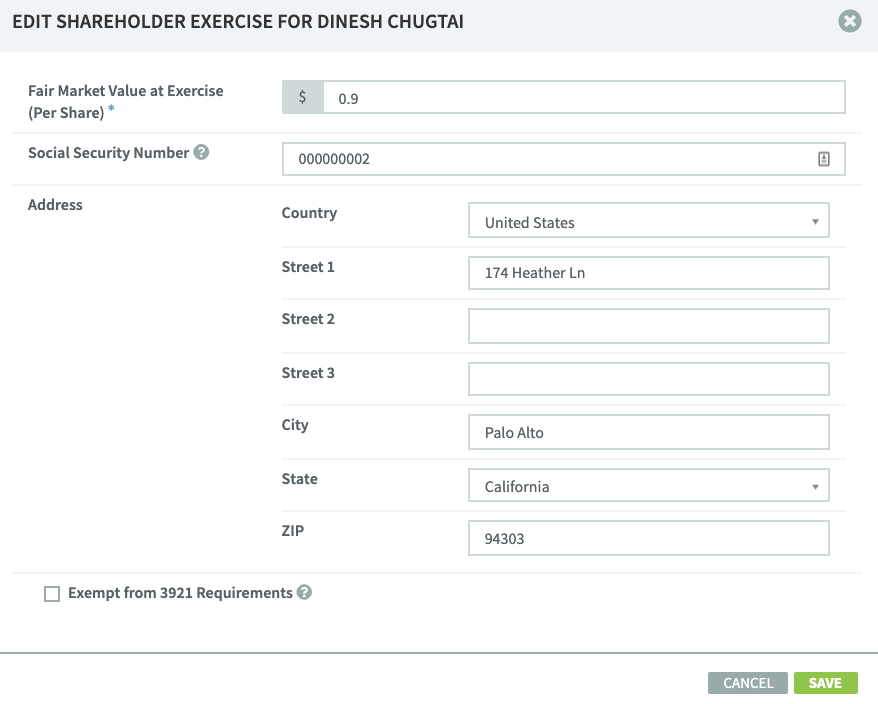

Web february 28, 2023. Carta makes it easy to generate and file form 3921. You must file one form per iso exercise. Although this information is not taxable unless disposed of, you may have to include the information for alternative minimum tax purposes (if required). Form 3921 informs the irs which shareholders received iso compensation.

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section 422 (b) must, for that calendar year, file form 3921 for each transfer made during that year. Companies also need to provide each applicable shareholder with a copy of this form..

What is Form 3921? Instructions on When & How to File Form 3921 Carta

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section 422(b) must, for that calendar year, file form 3921 for each. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an.

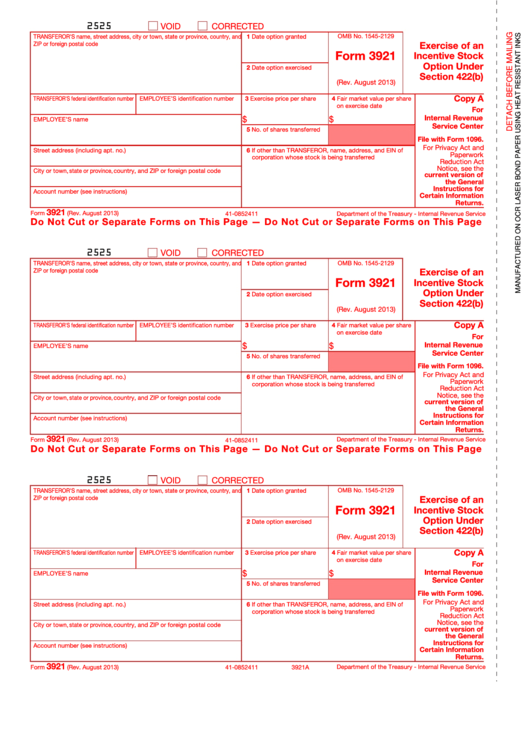

3921 IRS Tax Form Copy A Free Shipping

Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Web you have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive stock option (iso). Web form 3921 is a form that companies have to file with the.

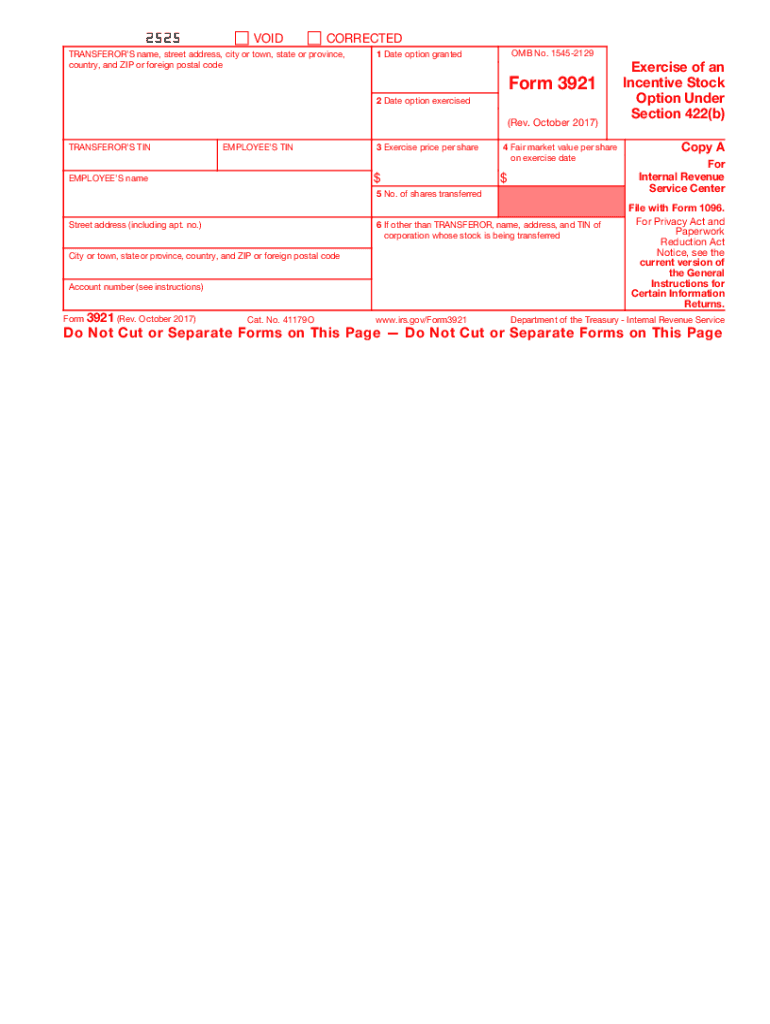

20172022 Form IRS 3921 Fill Online, Printable, Fillable, Blank pdfFiller

Form 3921 informs the irs which shareholders received iso compensation. Web form 3921 is a form that companies have to file with the irs when a shareholder exercises their incentive stock option (iso). Carta makes it easy to generate and file form 3921. The information on form 3921 will help in determining your cost or other basis as well as.

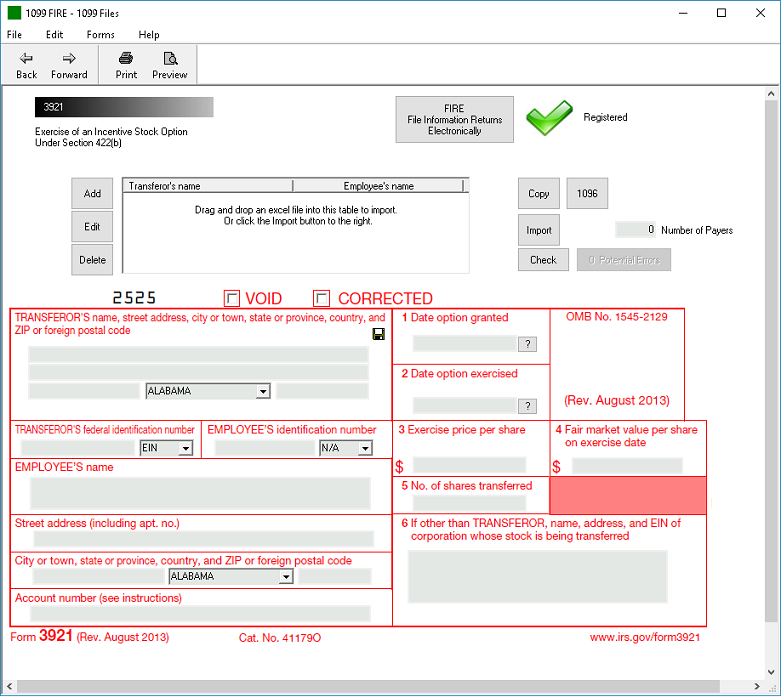

IRS Form 3921 Software 289 eFile 3921 Software

Web form 3921 is a form that companies have to file with the irs when a shareholder exercises their incentive stock option (iso). Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Web every corporation which in any calendar year transfers to.

IRS Form 3921

You must recognize (report) gain or loss on your tax return for the year in which you sell or otherwise dispose of the stock. Form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in the last tax year, and informs the irs which shareholders received iso compensation. Web form.

· IRS Form 3921 Toolbx

Form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in the last tax year, and informs the irs which shareholders received iso compensation. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Form 3921 is an irs form that.

What is Form 3921? Instructions on When & How to File Form 3921 Carta

You must recognize (report) gain or loss on your tax return for the year in which you sell or otherwise dispose of the stock. Form 3921 informs the irs which shareholders received iso compensation. About form 3921, exercise of an incentive stock option under section 422(b) |. The form has to be filed in the year in which the iso.

Web You Have Received This Form Because Your Employer (Or Transfer Agent) Transferred Your Employer’s Stock To You Pursuant To Your Exercise Of An Incentive Stock Option (Iso).

The information on form 3921 will help in determining your cost or other basis as well as your holding period. The form has to be filed in the year in which the iso is exercised , and before the deadline mentioned for that calendar year. Companies also need to provide each applicable shareholder with a copy of this form. Carta makes it easy to generate and file form 3921.

About Form 3921, Exercise Of An Incentive Stock Option Under Section 422(B) |.

Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Web february 28, 2023. Web may 22, 2023. Although this information is not taxable unless disposed of, you may have to include the information for alternative minimum tax purposes (if required).

Web Form 3921 Is Generally Informational Unless Stock Acquired Through An Incentive Stock Option Is Sold Or Otherwise Disposed.

Form 3921 informs the irs which shareholders received iso compensation. You must file one form per iso exercise. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section 422 (b) must, for that calendar year, file form 3921 for each transfer made during that year. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section 422(b) must, for that calendar year, file form 3921 for each.

Web Form 3921 Is A Form That Companies Have To File With The Irs When An Existing Or Former Employee Exercises An Iso.

Form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in the last tax year, and informs the irs which shareholders received iso compensation. Web form 3921 is a form that companies have to file with the irs when a shareholder exercises their incentive stock option (iso). You must recognize (report) gain or loss on your tax return for the year in which you sell or otherwise dispose of the stock. Form 3921 is an irs form that must be filed by a company when an employee has exercised an incentive stock option (iso) in the last tax year.