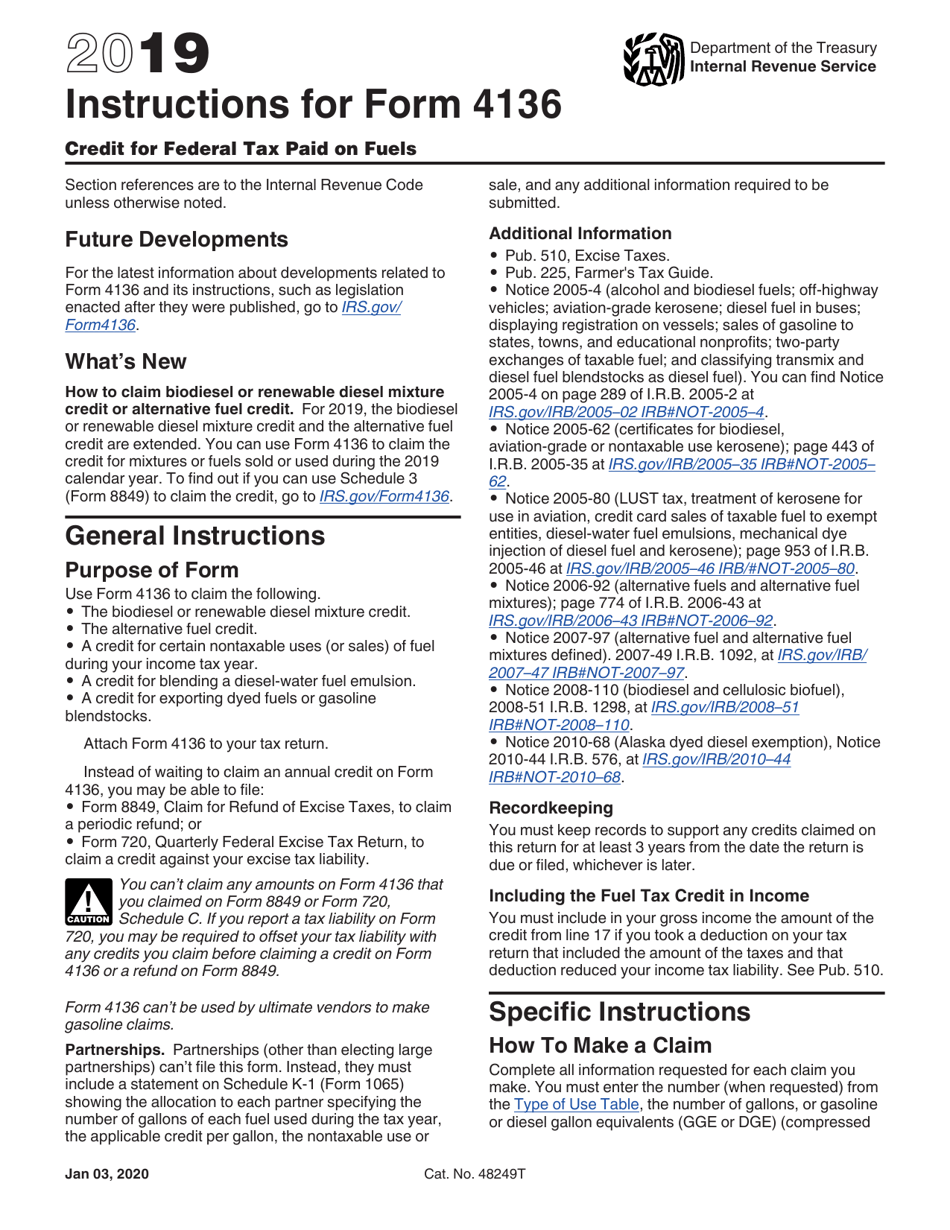

Form 4136 Instructions 2022

Form 4136 Instructions 2022 - Instructions for form 4136, credit for federal tax paid on fuels 2022 01/31/2023 Ad access irs tax forms. Web follow the simple instructions below: When individuals aren?t associated with document management and lawful processes, submitting irs forms can be extremely stressful. Territories will file form 941, or, if you prefer your. Web general instructions purpose of form use form 4136 to claim the following. Credit for federal tax paid on fuels 2022 01/13/2023 inst 4136: Department of the treasury internal revenue service. Use form 4136 to claim a credit. Web taxslayer support what do i report on form 4136?

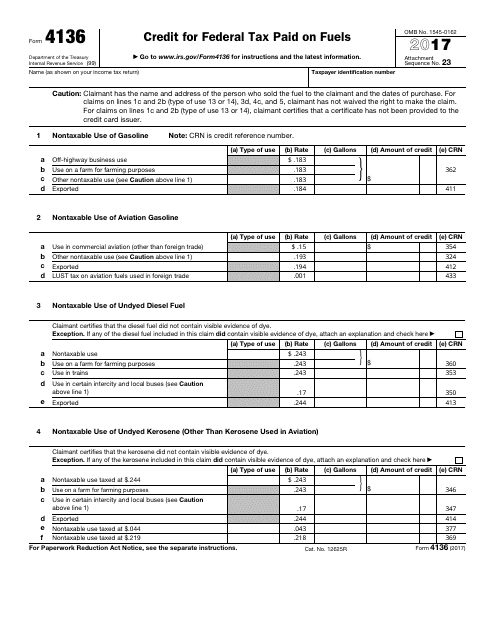

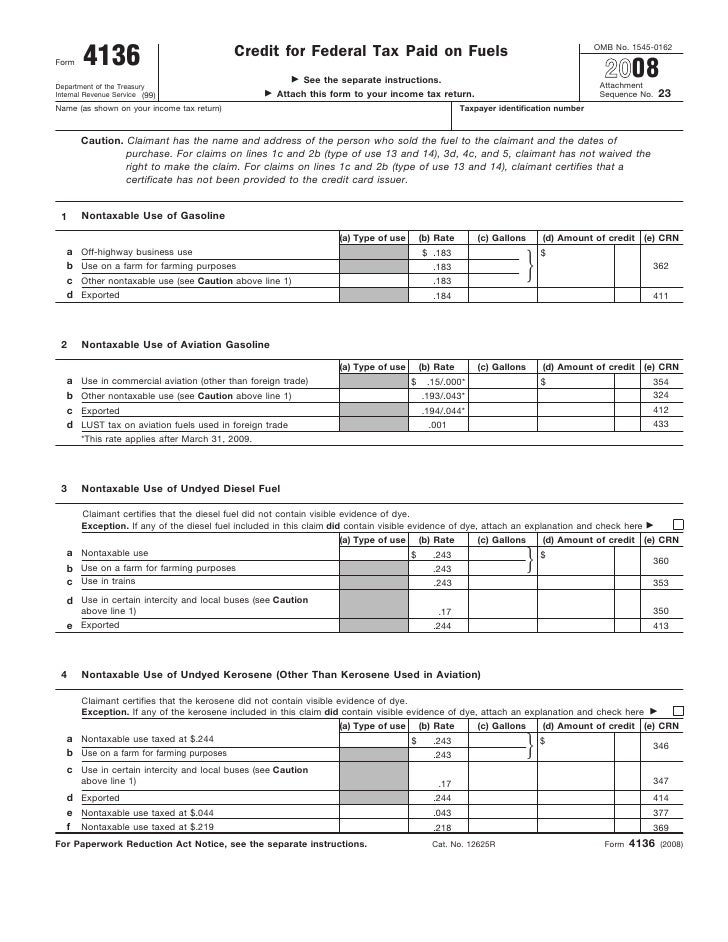

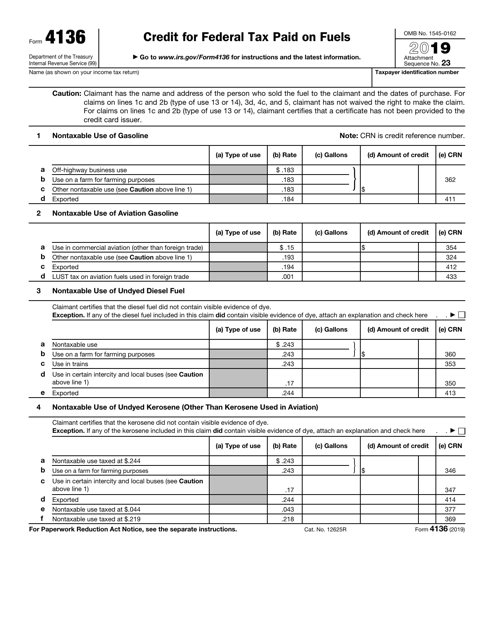

If you downloaded or printed the 2022 form 4136 between january 12, 2023, and january 13, 2023, please note that line. Complete, edit or print tax forms instantly. Use form 4136 to claim a credit for federal taxes paid on certain fuels. Complete, edit or print tax forms instantly. Territories will file form 941, or, if you prefer your. Use form 4136 to claim a credit. Credit for certain nontaxable uses (or sales) of fuel during your income tax year. Get ready for tax season deadlines by completing any required tax forms today. When individuals aren?t associated with document management and lawful processes, submitting irs forms can be extremely stressful. Web claimant certifies that the diesel fuel did not contain visible evidence of dye.

Credit for federal tax paid on fuels. Instead, employers in the u.s. When individuals aren?t associated with document management and lawful processes, submitting irs forms can be extremely stressful. Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel. Web show sources > form 4136 is a federal other form. Territories will file form 941, or, if you prefer your. Department of the treasury internal revenue service. Web taxslayer support what do i report on form 4136? Web claimant certifies that the diesel fuel did not contain visible evidence of dye. 23 name (as shown on your income tax return).

Fill Free fillable Form 4136 Credit for Federal Tax Paid on Fuels

The biodiesel or renewable diesel mixture credit. Use form 4136 to claim a credit for federal taxes paid on certain fuels. Web general instructions purpose of form use form 4136 to claim the following. Web to claim this credit, complete form 4136: Instead, employers in the u.s.

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

Web general instructions purpose of form use form 4136 to claim the following. Web follow the simple instructions below: Form 941 and schedule r were revised for the first quarter of 2022 due to. Use form 4136 to claim a credit for federal taxes paid on certain fuels. Web for form 1120 filers:

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

Credit for federal tax paid on fuels. Ad access irs tax forms. If you downloaded or printed the 2022 form 4136 between january 12, 2023, and january 13, 2023, please note that line. When individuals aren?t associated with document management and lawful processes, submitting irs forms can be extremely stressful. Territories will file form 941, or, if you prefer your.

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

Web follow the simple instructions below: Web for form 1120 filers: Get ready for tax season deadlines by completing any required tax forms today. Credit for federal tax paid on fuels at www.irs.gov. Use form 4136 to claim a credit for federal taxes paid on certain fuels.

Form 4136Credit for Federal Tax Paid on Fuel

Web show sources > form 4136 is a federal other form. Form 941 and schedule r were revised for the first quarter of 2022 due to. For paperwork reduction act notice, see the separate instructions. Web for form 1120 filers: The credits available on form 4136 are:

Form 4136Credit for Federal Tax Paid on Fuel

Ad access irs tax forms. For paperwork reduction act notice, see the separate instructions. Web general instructions purpose of form use form 4136 to claim the following. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Territories will file form 941, or, if you prefer your.

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

Ad access irs tax forms. Use form 4136 to claim a credit. If you downloaded or printed the 2022 form 4136 between january 12, 2023, and january 13, 2023, please note that line. Complete, edit or print tax forms instantly. Web go to www.irs.gov/form4136 for instructions and the latest information.

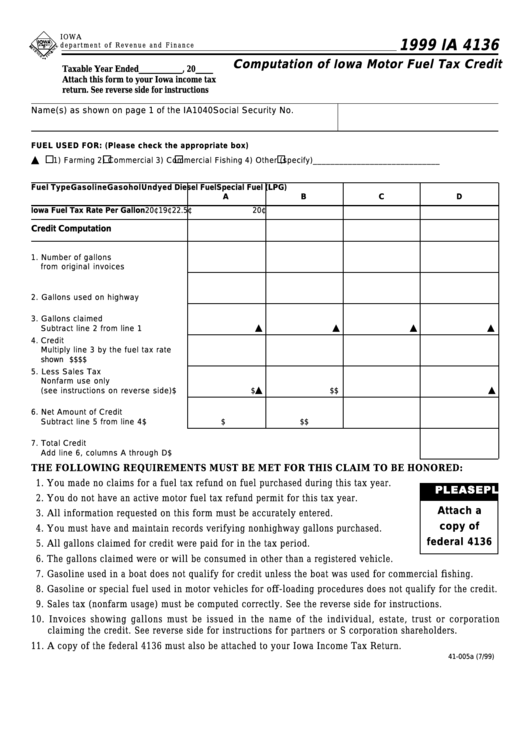

Form Ia 4136 Computation Of Iowa Motor Fuel Tax Credit 1999

If you downloaded or printed the 2022 form 4136 between january 12, 2023, and january 13, 2023, please note that line. Get ready for tax season deadlines by completing any required tax forms today. For paperwork reduction act notice, see the separate instructions. Instructions for form 4136, credit for federal tax paid on fuels 2022 01/31/2023 Credit for certain nontaxable.

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

Web show sources > form 4136 is a federal other form. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Web correction to form 4136 for tax year 2022. 23 name (as shown on your income tax return). Department of the treasury internal revenue service.

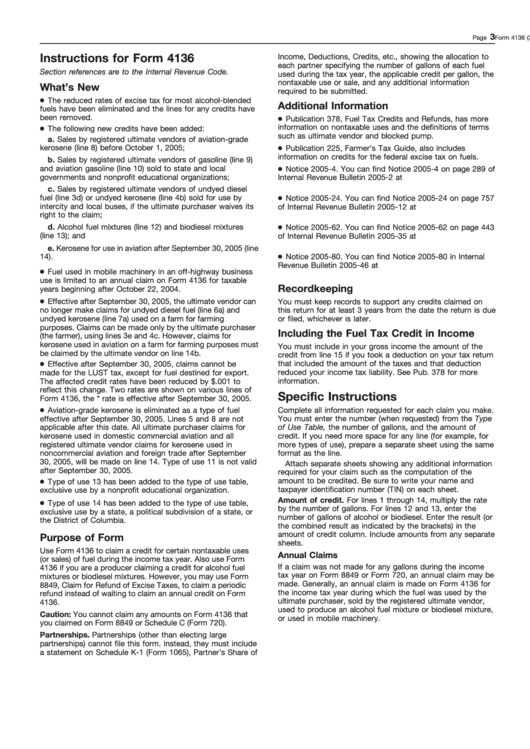

Instructions For Form 4136 2005 printable pdf download

Credit for federal tax paid on fuels at www.irs.gov. Web to claim this credit, complete form 4136: Web go to www.irs.gov/form4136 for instructions and the latest information. You can make this adjustment on screen. Get ready for tax season deadlines by completing any required tax forms today.

Use Form 4136 To Claim A Credit For Federal Taxes Paid On Certain Fuels.

Credit for federal tax paid on fuels 2022 01/13/2023 inst 4136: Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. (a) type of use (b) rate (c) gallons, or gasoline or diesel gallon equivalents (d) amount of credit (e) crn a liquefied petroleum gas (lpg) (see.

Form 941 And Schedule R Were Revised For The First Quarter Of 2022 Due To.

Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Web for form 1120 filers: Instructions for form 4136, credit for federal tax paid on fuels 2022 01/31/2023 Web to claim this credit, complete form 4136:

When Individuals Aren?T Associated With Document Management And Lawful Processes, Submitting Irs Forms Can Be Extremely Stressful.

Ad access irs tax forms. Web show sources > form 4136 is a federal other form. Web general instructions purpose of form use form 4136 to claim the following. The credits available on form 4136 are:

Web Credit For Federal Tax Paid On Fuels (Form 4136) The Government Taxes Gasoline, Diesel Fuel, Kerosene, Alternative Fuels And Some Other Types Of Fuel.

Web claimant certifies that the diesel fuel did not contain visible evidence of dye. Web go to www.irs.gov/form4136 for instructions and the latest information. Credit for certain nontaxable uses (or sales) of fuel during your income tax year. Web follow the simple instructions below: