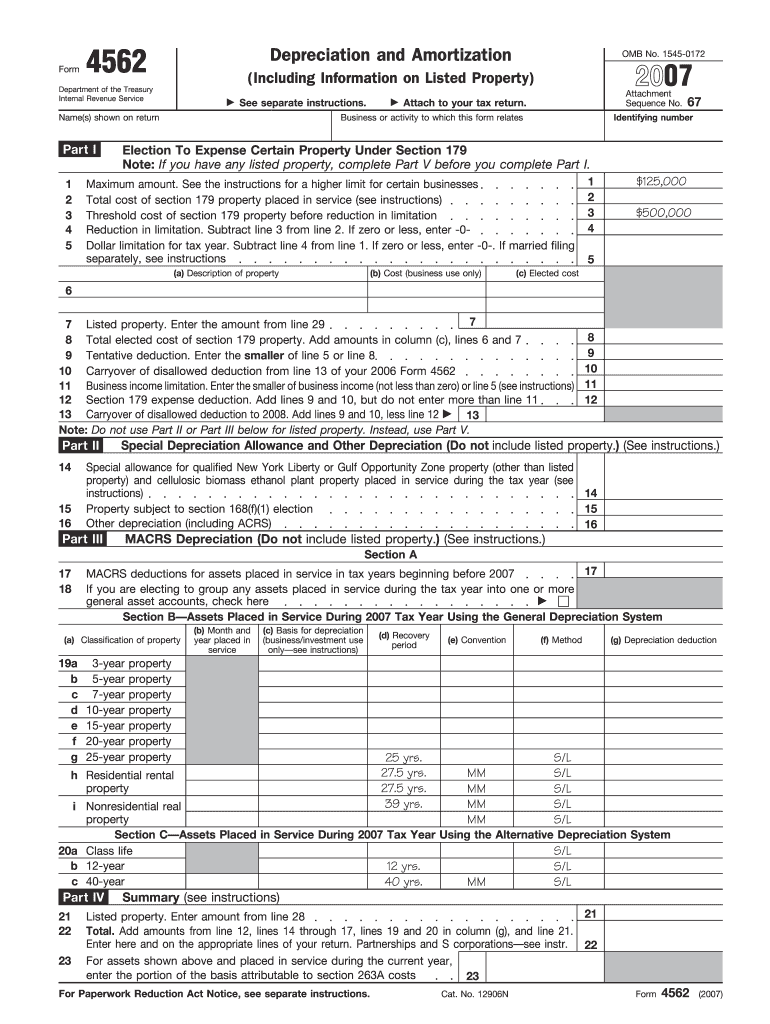

Form 4562 Depreciation And Amortization Worksheet

Form 4562 Depreciation And Amortization Worksheet - Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. Upload the form 4562 depreciation and amortization worksheet. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain property, and •provide information on the. Edit & sign form 4562 depreciation and amortization from anywhere. Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. 03/05/18) georgia depreciationand amortization (includinginformationon listed property) assets placed in service during tax years. Web print worksheet for irs 4562 depreciation and amortization (tffam1411m000) use this session to provide federal tax book data in irs form 4562 format. Complete, edit or print tax forms instantly. Form 4562, depreciation and amortization (including information on listed property), is generally completed in taxslayer pro via. Web department of the treasury 2009 internal revenue service instructions for form 4562 depreciation and amortization (including information on listed property) section.

Web federal income tax brackets income tax forms form 4562 federal — depreciation and amortization (including information on listed property) download this form print this. Web print worksheet for irs 4562 depreciation and amortization (tffam1411m000) use this session to provide federal tax book data in irs form 4562 format. Edit & sign form 4562 depreciation and amortization from anywhere. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain property, and •provide information on the. Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. Get ready for tax season deadlines by completing any required tax forms today. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • june 2, 2023 08:54 am overview if. Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. Depreciation and amortization (including information on listed property). Web use form 4562 to:

Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • june 2, 2023 08:54 am overview if. Web what is the irs form 4562? Complete, edit or print tax forms instantly. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain property, and •provide information on the. Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. 03/05/18) georgia depreciationand amortization (includinginformationon listed property) assets placed in service during tax years. Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. Get ready for tax season deadlines by completing any required tax forms today. Web department of the treasury 2009 internal revenue service instructions for form 4562 depreciation and amortization (including information on listed property) section. Edit & sign form 4562 depreciation and amortization from anywhere.

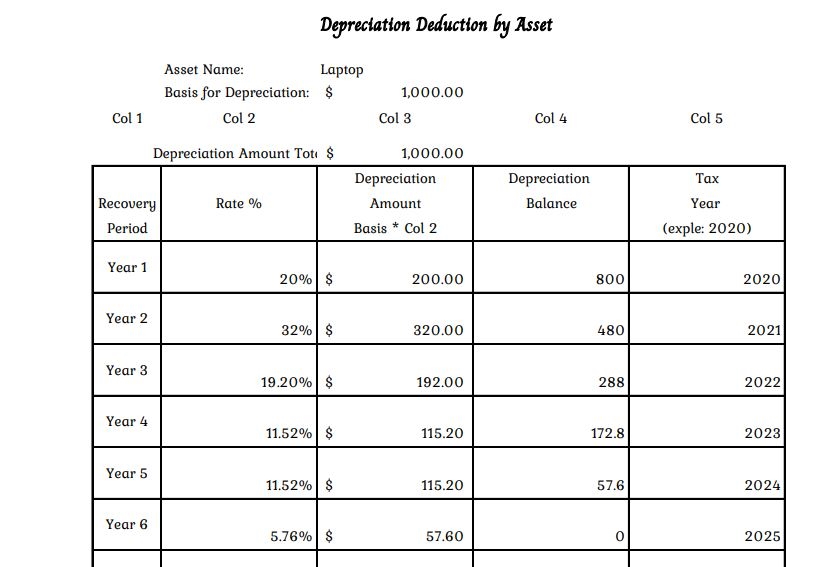

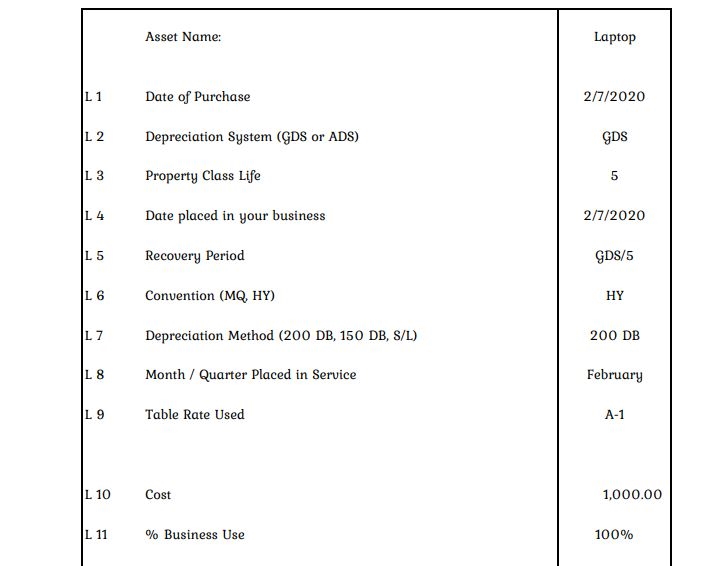

2020 Form 4562 Depreciation and Amortization16 Nina's Soap

Form 4562, depreciation and amortization (including information on listed property), is generally completed in taxslayer pro via. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • june 2, 2023 08:54 am overview if. Depreciation and amortization (including information on listed property). Web print worksheet for irs 4562 depreciation and amortization (tffam1411m000) use.

business tax worksheet

Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. Web download or print the 2022 federal form 4562 (depreciation and amortization (including information on listed property)) for free from the federal internal revenue. Written by a turbotax expert • reviewed by a turbotax cpa.

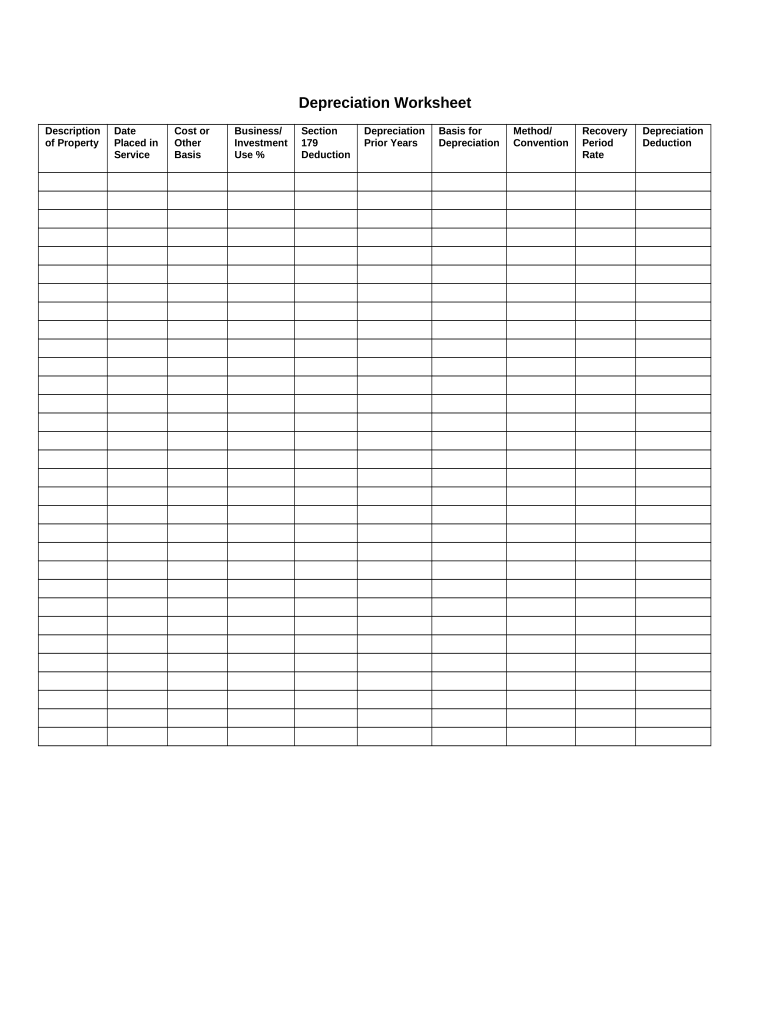

Depreciation Worksheet Irs Master of Documents

Web instructions for form 4562. Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. Web federal income tax brackets income tax forms form 4562 federal — depreciation and amortization (including information on listed property) download this form print this. Web department of the treasury.

depreciation worksheet Fill out & sign online DocHub

Form 4562, depreciation and amortization (including information on listed property), is generally completed in taxslayer pro via. Web use form ftb 3885a, depreciation and amortization adjustments, only if there is a difference between the amount of depreciation and amortization allowed as a. Web use form 4562 to: Edit & sign form 4562 depreciation and amortization from anywhere. Web print worksheet.

Form 4562 Depreciation and Amortization YouTube

Web what is the irs form 4562? Edit & sign form 4562 depreciation and amortization from anywhere. Web use form ftb 3885a, depreciation and amortization adjustments, only if there is a difference between the amount of depreciation and amortization allowed as a. Get ready for tax season deadlines by completing any required tax forms today. Depreciation and amortization (including information.

Form 4562, Depreciation and Amortization IRS.gov Fill out & sign

Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. Edit & sign form 4562 depreciation and amortization from anywhere. Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of..

2020 Form 4562 Depreciation and Amortization16 Nina's Soap

Upload the form 4562 depreciation and amortization worksheet. Form 4562, depreciation and amortization (including information on listed property), is generally completed in taxslayer pro via. Get ready for tax season deadlines by completing any required tax forms today. Web department of the treasury 2009 internal revenue service instructions for form 4562 depreciation and amortization (including information on listed property) section..

Form 4562 Depreciation and Amortization Definition

Complete, edit or print tax forms instantly. Web what is the irs form 4562? Form 4562, depreciation and amortization (including information on listed property), is generally completed in taxslayer pro via. To complete form 4562, you'll need to know the cost. Upload the form 4562 depreciation and amortization worksheet.

Tax Forms Depreciation Guru

Web print worksheet for irs 4562 depreciation and amortization (tffam1411m000) use this session to provide federal tax book data in irs form 4562 format. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain property, and •provide information on the. Form 4562, depreciation and amortization (including information on listed property), is generally completed in.

Understanding Form 4562 How To Account For Depreciation And

Form 4562, depreciation and amortization (including information on listed property), is generally completed in taxslayer pro via. Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. Web federal income tax brackets income tax forms form 4562 federal — depreciation and amortization (including information on.

Web Use Form 4562 To:

Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web federal income tax brackets income tax forms form 4562 federal — depreciation and amortization (including information on listed property) download this form print this. Web print worksheet for irs 4562 depreciation and amortization (tffam1411m000) use this session to provide federal tax book data in irs form 4562 format. Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of.

To Complete Form 4562, You'll Need To Know The Cost.

Web download or print the 2022 federal form 4562 (depreciation and amortization (including information on listed property)) for free from the federal internal revenue. Web use form ftb 3885l, depreciation and amortization, to compute depreciation and amortization allowed as a deduction on form 568, limited liability company return of. Form 4562, depreciation and amortization (including information on listed property), is generally completed in taxslayer pro via. Web instructions for form 4562.

Upload The Form 4562 Depreciation And Amortization Worksheet.

•claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain property, and •provide information on the. He records information on his depreciable property in a book that he can use to figure his depreciation allowance for several years. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Web What Is The Irs Form 4562?

03/05/18) georgia depreciationand amortization (includinginformationon listed property) assets placed in service during tax years. Edit & sign form 4562 depreciation and amortization from anywhere. Web department of the treasury 2009 internal revenue service instructions for form 4562 depreciation and amortization (including information on listed property) section. Depreciation and amortization (including information on listed property).

/GettyImages-88305470-c029ed42a1a24f8797984f42ddff3c84.jpg)