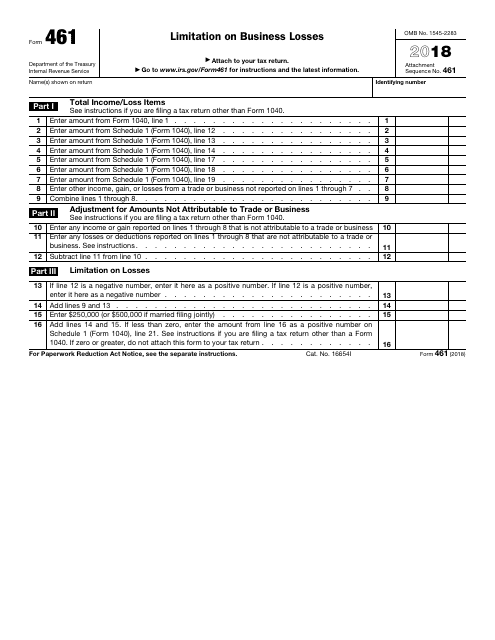

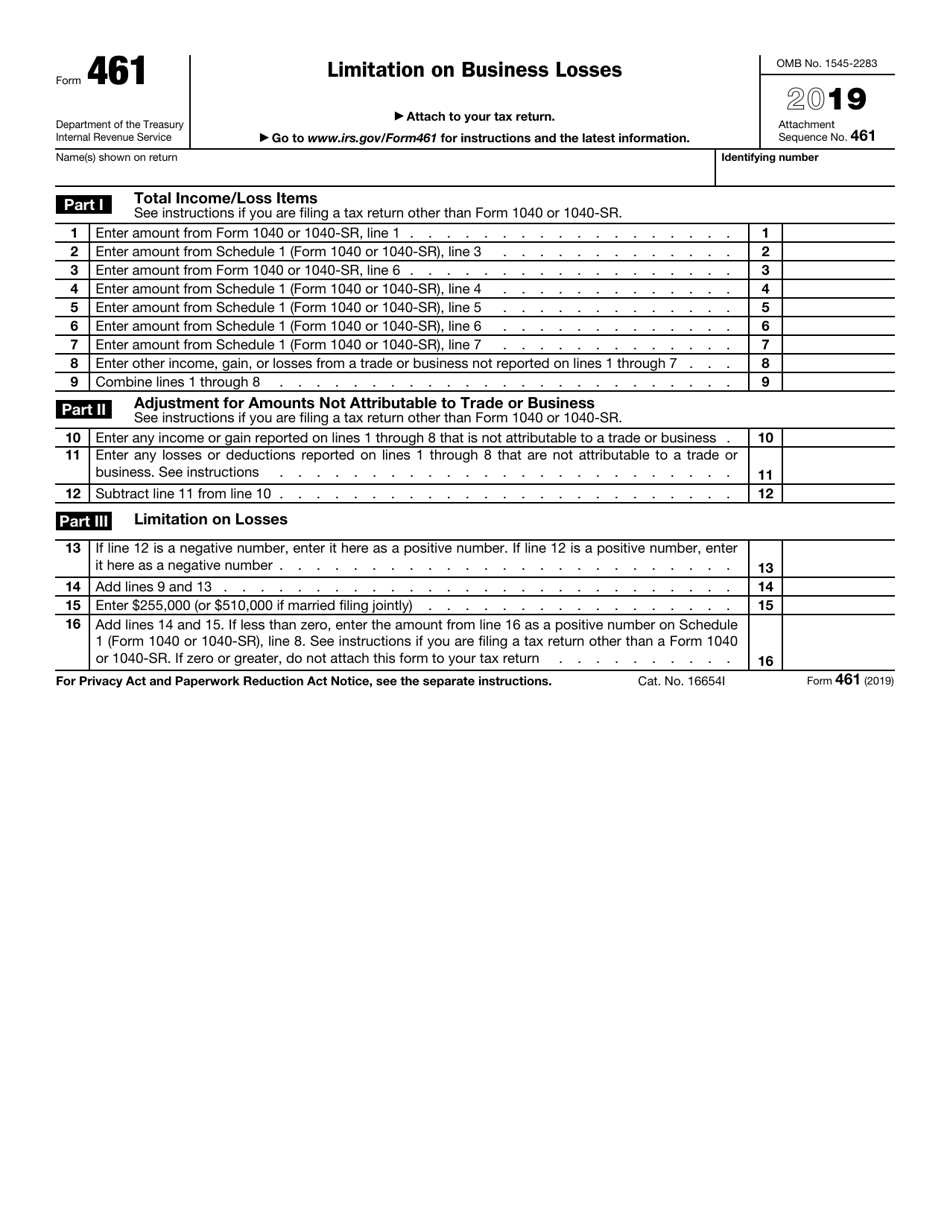

Form 461 Excess Business Loss

Form 461 Excess Business Loss - Taxpayers can not deduct an excess business loss in the current year. However, for california purposes, the. Web the excess business loss regime—which takes effect again for tax years beginning in 2021—may disallow losses for individuals, trusts, and estates. 10 enter any income or gain reported on lines 1 through 8 that is not attributable to a trade or business. Web an excess business loss is the amount by which the total deductions attributable to all of your trades or businesses exceed your total gross income and gains. Web the origins of excess business loss. Web the tcja amended sec. Use form ftb 3461 to compute the excess business loss. The tax cuts and jobs act of 2017 (tcja) added the excess business loss (ebl) limitation under sec 461 (l) applicable to. Web the excess business loss (ebl) limitation, codified in internal revenue code section 461(l), was originally created by the tax cuts and jobs act of 2017 (tcja).

Taxpayers cannot deduct an excess business loss in the current year. Web the tcja amended sec. Who must file file form 461 if you’re a noncorporate taxpayer and your net losses from all of your trades or. Web the excess business loss regime—which takes effect again for tax years beginning in 2021—may disallow losses for individuals, trusts, and estates. Web use form ftb 3461 to compute the excess business loss. Part ii adjustment for amounts. Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades. The tax cuts and jobs act of 2017 (tcja) added the excess business loss (ebl) limitation under sec 461 (l) applicable to. Web form 461 will be used to determine if there is an excess business loss.the taxpayers cannot deduct an excess business loss in the current year, however, according to the. 461 (l), should recognize that all of the taxpayer's trades or businesses (of both spouses, in the case of a joint.

Web the tcja amended sec. Use form 461 to figure the excess business loss that is reported on your noncorporate tax return. An excess business loss is the amount by which the total deductions from your trades or businesses are more than your total gross income or. 461 (l), should recognize that all of the taxpayer's trades or businesses (of both spouses, in the case of a joint. Taxpayers cannot deduct an excess business loss in the current year. Who must file file form 461 if you’re a noncorporate taxpayer and your net losses from all of your trades or. The ebl limitation under irs code section 461(l) is a fairly new concept created by the tax law commonly known as the tax cuts and jobs. Web an excess business loss is the amount by which the total deductions attributable to all of your trades or businesses exceed your total gross income and gains. Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades. Web the irs and treasury, in drafting guidance for sec.

Excess business loss limitation developments Baker Tilly

Web once gone, but now back, form 461 per irc section 461(l) disallows excess business losses for noncorporate taxpayers. Web the excess business loss (ebl) limitation, codified in internal revenue code section 461(l), was originally created by the tax cuts and jobs act of 2017 (tcja). Part ii adjustment for amounts. Use form 461 to figure the excess business loss.

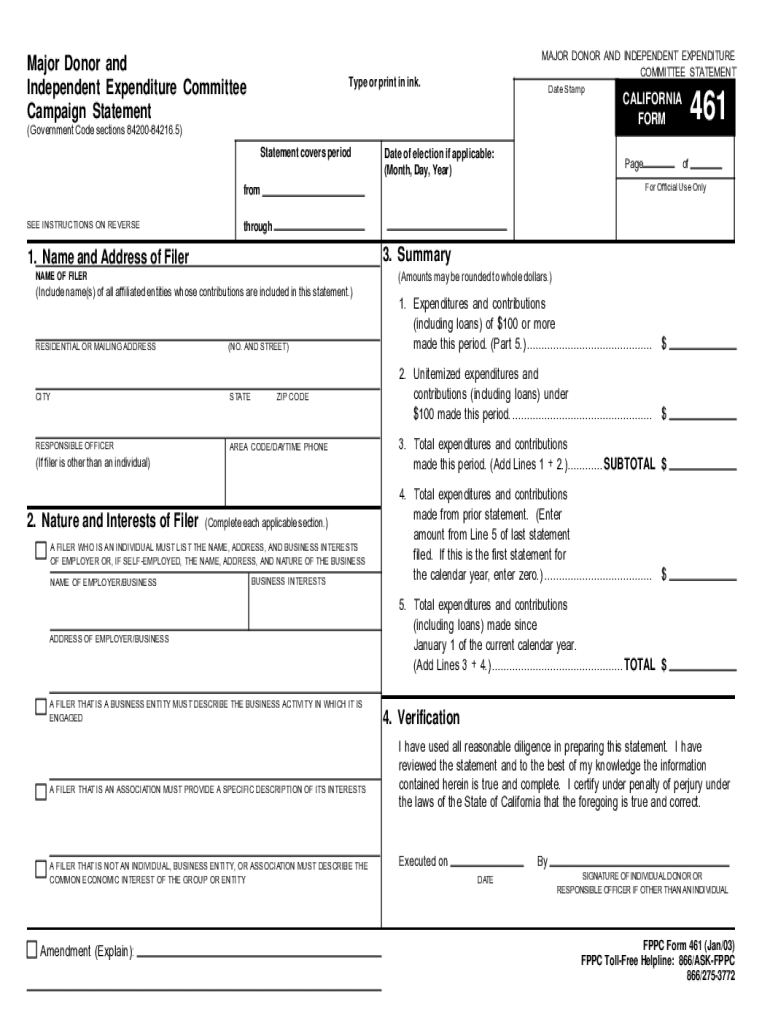

PJI Form 461 Stamped

461 to include a subsection (l), which disallows excess business losses of noncorporate taxpayers if the amount of the loss is in. Web the excess business loss (ebl) limitation, codified in internal revenue code section 461(l), was originally created by the tax cuts and jobs act of 2017 (tcja). 10 enter any income or gain reported on lines 1 through.

Excess BusinessLoss Rules Suspended

However, for california purposes, the. Taxpayers can not deduct an excess business loss in the current year. Use form 461 to figure the excess business loss that is reported on your noncorporate tax return. Web use form ftb 3461 to compute the excess business loss. The ebl limitation under irs code section 461(l) is a fairly new concept created by.

IRS Form 461 Download Fillable PDF or Fill Online Limitation on

Use form 461 to figure the excess business loss that is reported on your noncorporate tax return. An excess business loss is the amount by which the total deductions from your trades or businesses are more than your total gross income or. Web taxpayers can’t deduct an excess business loss (see definitions, later) in the current year. However, for california.

461 Limitation on Business Losses

Who must file file form 461 if you’re a noncorporate taxpayer and your net losses from all of your trades or. Web the origins of excess business loss. The ebl limitation under irs code section 461(l) is a fairly new concept created by the tax law commonly known as the tax cuts and jobs. Web the irs and treasury, in.

Excess Business Loss Limits Change with CARES Act Landmark

Web an excess business loss is the amount by which the total deductions attributable to all of your trades or businesses exceed your total gross income and gains. Web about form 461, limitation on business losses. Web the tcja amended sec. However, for california purposes, the. Web the irs and treasury, in drafting guidance for sec.

IRS Form 461 Download Fillable PDF or Fill Online Limitation on

Web once gone, but now back, form 461 per irc section 461(l) disallows excess business losses for noncorporate taxpayers. Web an excess business loss is the amount by which the total deductions attributable to all of your trades or businesses exceed your total gross income and gains. Use form ftb 3461 to compute the excess business loss. Web form 461.

Form 461 Instructions Fill Out and Sign Printable PDF Template signNow

461 (l), should recognize that all of the taxpayer's trades or businesses (of both spouses, in the case of a joint. Web where to report the excess business loss on your return. Web the excess business loss regime—which takes effect again for tax years beginning in 2021—may disallow losses for individuals, trusts, and estates. Who must file file form 461.

Instructions for IRS Form 461 Limitation on Business Losses Download

Taxpayers cannot deduct an excess business loss in the current year. The tax cuts and jobs act of 2017 (tcja) added the excess business loss (ebl) limitation under sec 461 (l) applicable to. Web taxpayers can’t deduct an excess business loss (see definitions, later) in the current year. Who must file file form 461 if you’re a noncorporate taxpayer and.

Form 461 2022 2023 IRS Forms Zrivo

Who must file file form 461 if you’re a noncorporate taxpayer and your net losses from all of your trades or. Web an excess business loss is the amount by which the total deductions attributable to all of your trades or businesses exceed your total gross income and gains. Web about form 461, limitation on business losses. Web the excess.

Taxpayers Cannot Deduct An Excess Business Loss In The Current Year.

Web the origins of excess business loss. Who must file file form 461 if you’re a noncorporate taxpayer and your net losses from all of your trades or. Web the excess business loss (ebl) limitation, codified in internal revenue code section 461(l), was originally created by the tax cuts and jobs act of 2017 (tcja). Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades.

461 (L), Should Recognize That All Of The Taxpayer's Trades Or Businesses (Of Both Spouses, In The Case Of A Joint.

461 to include a subsection (l), which disallows excess business losses of noncorporate taxpayers if the amount of the loss is in. The ebl limitation under irs code section 461(l) is a fairly new concept created by the tax law commonly known as the tax cuts and jobs. Web where to report the excess business loss on your return. Taxpayers can not deduct an excess business loss in the current year.

Web Form 461 Will Be Used To Determine If There Is An Excess Business Loss.the Taxpayers Cannot Deduct An Excess Business Loss In The Current Year, However, According To The.

Use form ftb 3461 to compute the excess business loss. Use form 461 to figure the excess business loss that is reported on your noncorporate tax return. 10 enter any income or gain reported on lines 1 through 8 that is not attributable to a trade or business. Web the tcja amended sec.

However, For California Purposes, The.

The tax cuts and jobs act of 2017 (tcja) added the excess business loss (ebl) limitation under sec 461 (l) applicable to. Web the excess business loss regime—which takes effect again for tax years beginning in 2021—may disallow losses for individuals, trusts, and estates. However, for california purposes, the. Part ii adjustment for amounts.