Form 4797 Instructions 2021

Form 4797 Instructions 2021 - Web sale of a portion of a macrs asset. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of. Web 4797 form sales of business property omb no. Web 2021 michigan adjustments of gains and losses type or print in blue or black ink. Web for instructions and the latest information. Web what is form 4797? Form 4797 is used to report the details of gains. Select take to my tax return, search for 4797, sale of business property (use this exact phrase). Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file. Complete and file form 4797:

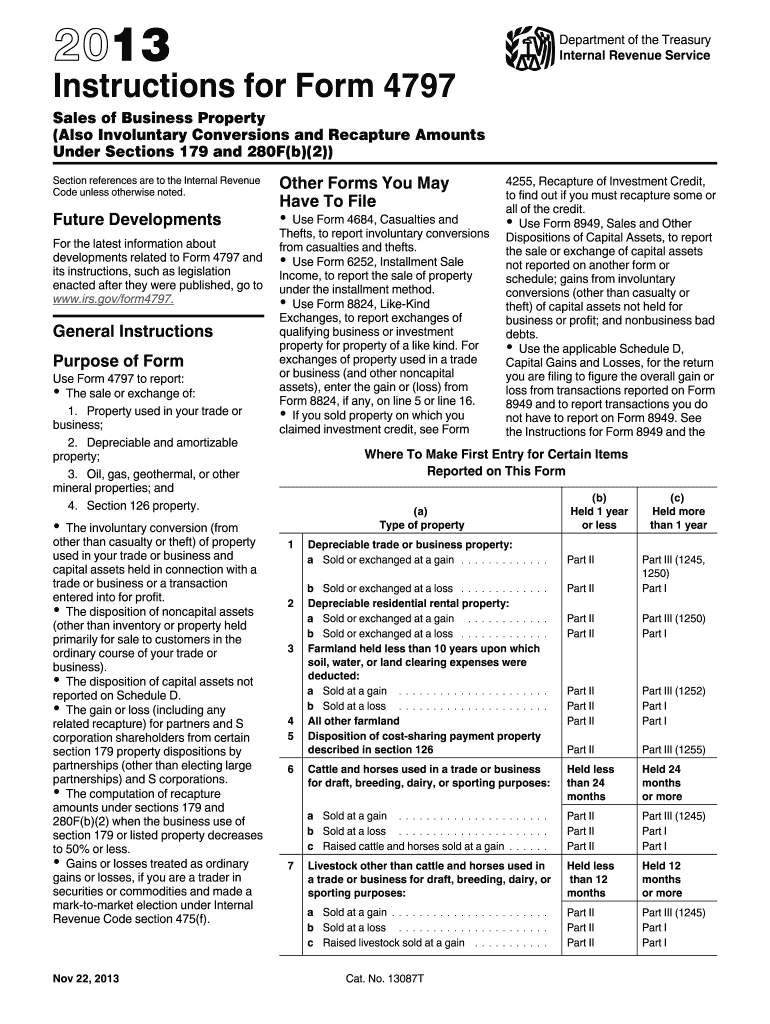

Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. Select take to my tax return, search for 4797, sale of business property (use this exact phrase). Web for instructions and the latest information. Web who should use an irs 4797 form? Involuntary conversion of a portion of a macrs asset other than from a casualty or theft. If you a) own a business, and b) own property in that business, you’ll eventually need to use a 4797 form. Complete and file form 4797: Web to oversimplify, schedule d is for reporting capital gains and losses on investment property, such as stocks, bonds, and mutual funds. Name on form 1040n or form 1041n social security number. Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture do not report on form 4797 sale.

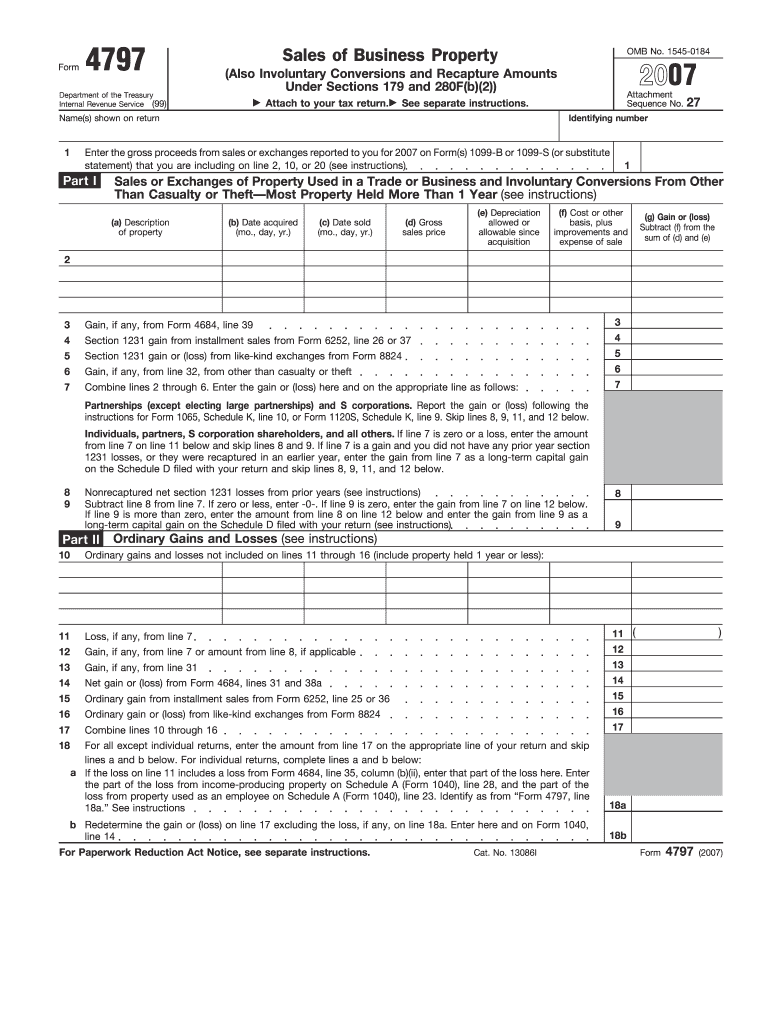

Complete and file form 4797: Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of. Web what is form 4797? Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Web for instructions and the latest information. Web 1 best answer michellet level 2 to add form 4797 to your return: Web sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. Web to oversimplify, schedule d is for reporting capital gains and losses on investment property, such as stocks, bonds, and mutual funds. Form 4797 is for reporting the sale of capital. Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797.

2021 Printable Irs 1040Ez Forms Example Calendar Printable

Select take to my tax return, search for 4797, sale of business property (use this exact phrase). Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. Involuntary conversion of a portion of a macrs asset other than from a casualty or theft. Web sale.

4797 Instructions 2021 2022 IRS Forms Zrivo

Web what is form 4797? Name on form 1040n or form 1041n social security number. Web to oversimplify, schedule d is for reporting capital gains and losses on investment property, such as stocks, bonds, and mutual funds. Web 4797 form sales of business property omb no. Involuntary conversion of a portion of a macrs asset other than from a casualty.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Involuntary conversion of a portion of a macrs asset other than from a casualty or theft. Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture do not report on form 4797 sale. Web 4797 form sales of business property omb no. Web form 4797 department of the.

IRS Form 8949 Instructions

Web 4797 form sales of business property omb no. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture do not report on form.

Irs Form 4797 Instructions 2022 Fill online, Printable, Fillable Blank

Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of. Name on form 1040n or form 1041n social security.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Complete and file form 4797: Web sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Web 4797 form sales of business property omb no. Web.

Instructions for Form 4797 Internal Revenue Service Fill Out and Sign

Web what is form 4797? Web who should use an irs 4797 form? Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture.

Publication 225 Farmer's Tax Guide; Farmer's Tax Guide

Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture do not report on form 4797 sale. Web who should use an irs 4797 form? Web what is form 4797? Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and.

Form 4797 Instructions Fill Out and Sign Printable PDF Template signNow

Form 4797 is used to report the details of gains. Web sale of a portion of a macrs asset. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of. Web what is form 4797? Web 2021 michigan adjustments of gains and losses type or.

IRS Form 8949 Instructions

Web 4797 form sales of business property omb no. Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file. If you a) own a business, and b) own property in that business, you’ll eventually need to use a 4797 form. Web 1 best answer michellet level 2 to add form.

Involuntary Conversion Of A Portion Of A Macrs Asset Other Than From A Casualty Or Theft.

Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4797. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Web for instructions and the latest information. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and.

Complete And File Form 4797:

Web sale of a portion of a macrs asset. If you a) own a business, and b) own property in that business, you’ll eventually need to use a 4797 form. Web to oversimplify, schedule d is for reporting capital gains and losses on investment property, such as stocks, bonds, and mutual funds. Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file.

Web Sale Of Business Assets Taking The Mystery Out Of Form 4797 Recapture = Ordinary Income Ordinary Income 1245 1250 Other Recapture Do Not Report On Form 4797 Sale.

Web who should use an irs 4797 form? Web 4797 form sales of business property omb no. Web what is form 4797? Form 4797 is used to report the details of gains.

Select Take To My Tax Return, Search For 4797, Sale Of Business Property (Use This Exact Phrase).

Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of. Web 2021 michigan adjustments of gains and losses type or print in blue or black ink. Web sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. Web 1 best answer michellet level 2 to add form 4797 to your return:

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://images.wondershare.com/pdfelement/pdfelement/guide/irs-form-4797-part2.png)

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://image.slidesharecdn.com/1273290/95/form-4797sales-of-business-property-2-728.jpg?cb=1239371111)