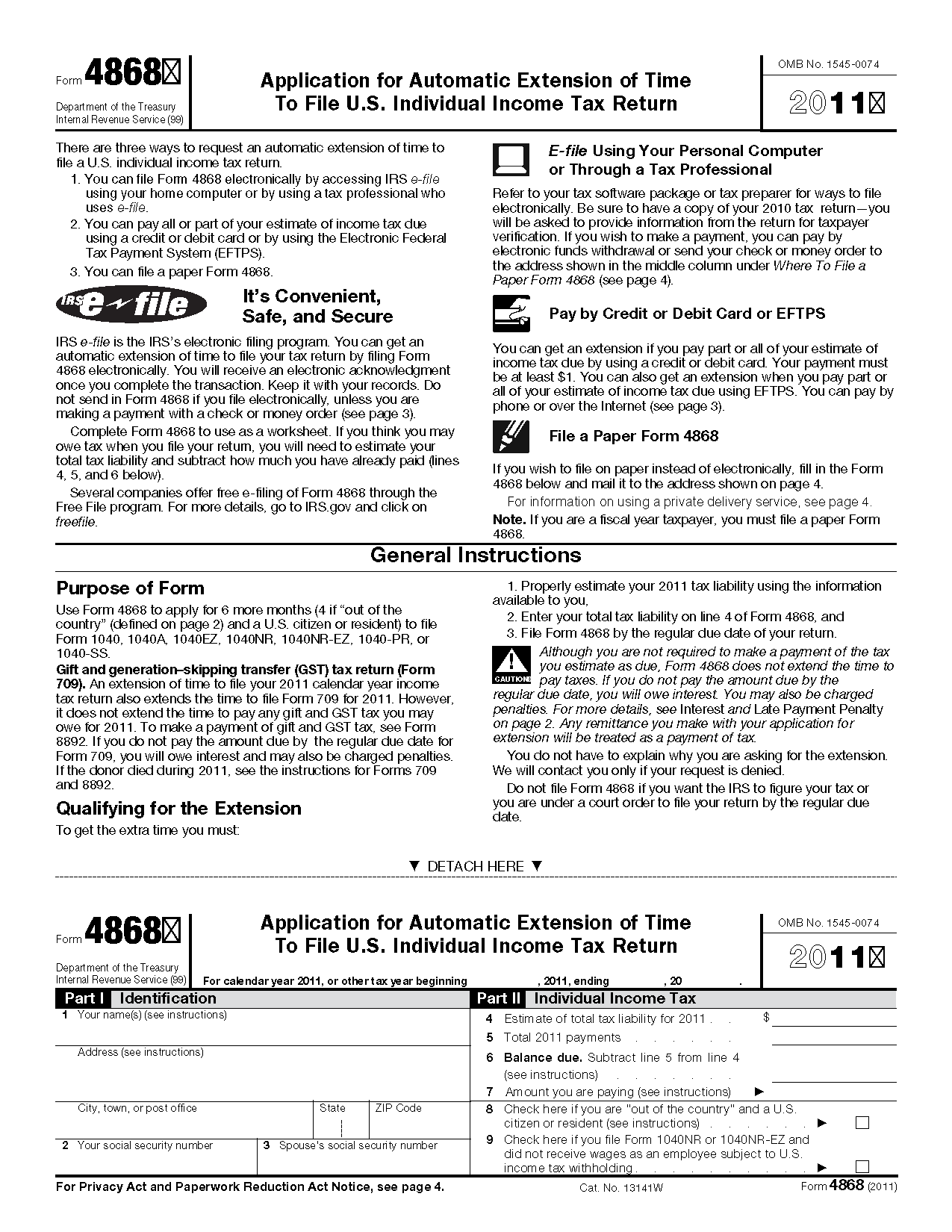

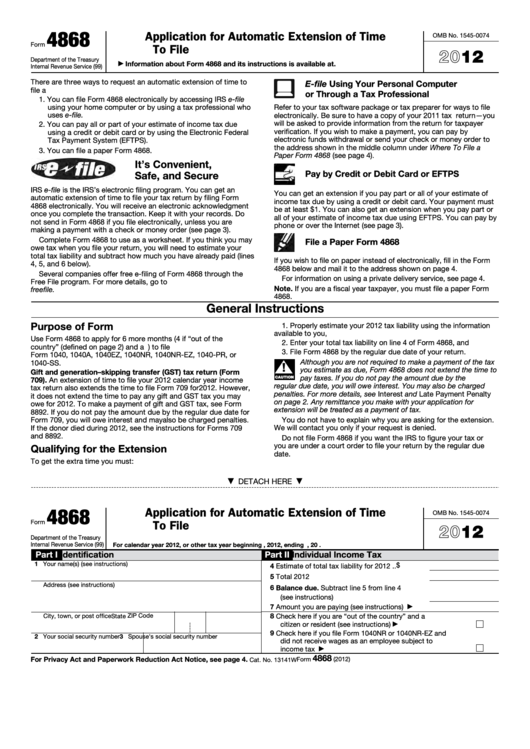

Form 4868 Example

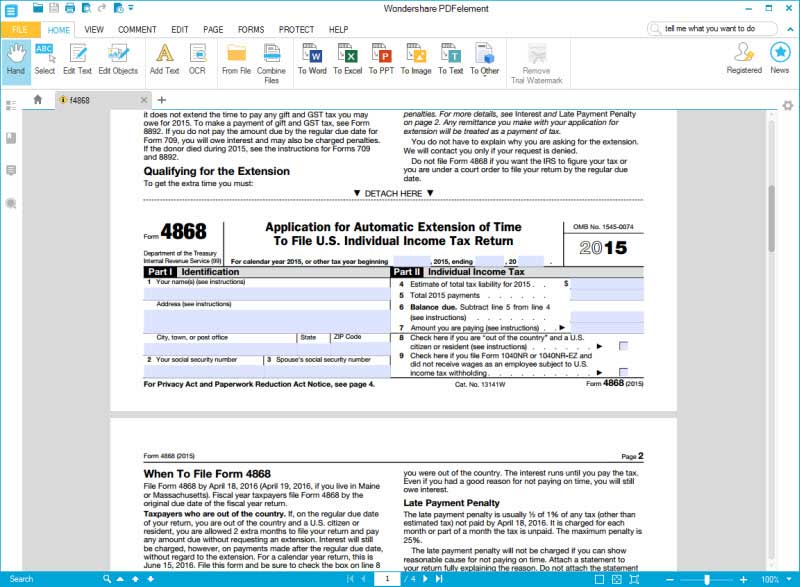

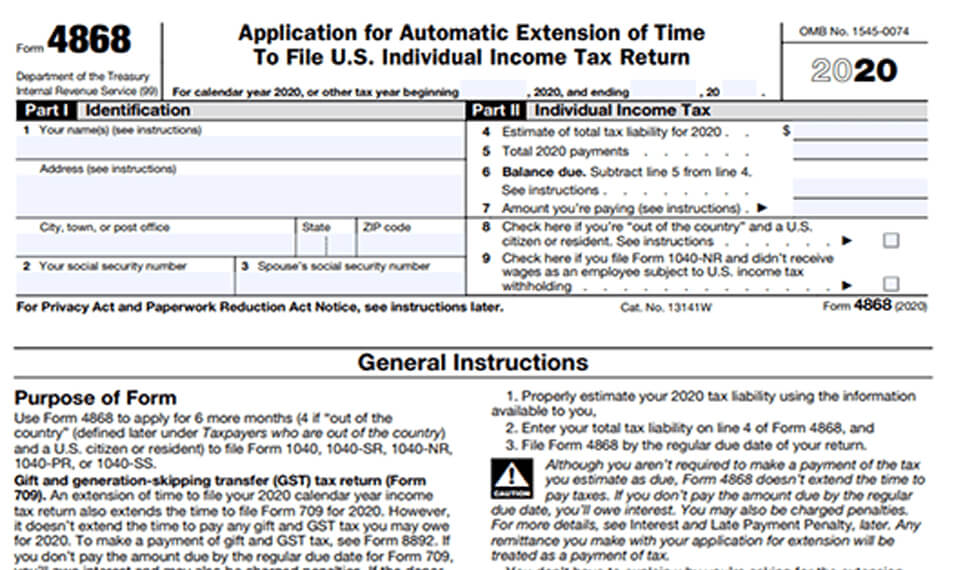

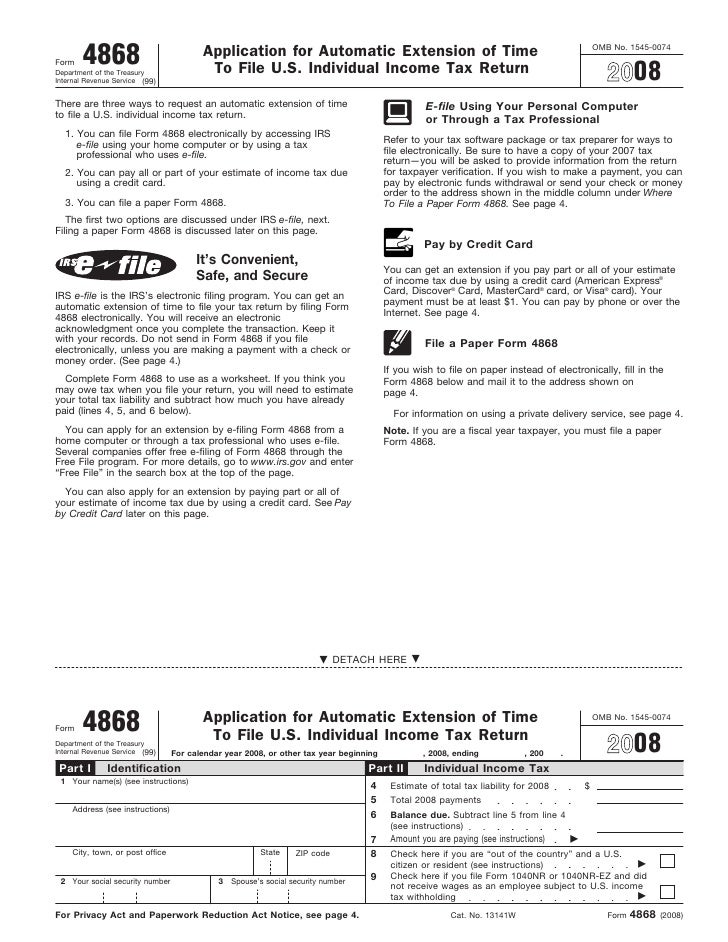

Form 4868 Example - Fiscal year taxpayers, file form 4868 by the regular due date of the. For more details, go to irs.gov and click on Web efile an irs tax extension extend your tax filing deadline by 3 months. For more details, go to www.irs.gov/freefile. It also provides instructions on what information must be included in the copy. The form will ask you to estimate how much you think you'll owe and to enter your total tax liability. Irs tax form 4868 for 2022 allows taxpayers an additional six months to file their federal income tax returns, changing the deadline from april 15th to october 15th. This form is better known as an application for automatic extension of time to file us individual income tax. Web learn how to fill the form 4868 application for extension of time to file u.s. Web form 4868 examples & solutions.

Individual income tax return in december 2022, so this is the latest version of form 4868, fully updated for tax year 2022. Applying for time extension to file taxes for 2022 this is a document individuals and businesses use to request an extension on their tax return filing deadline. Web this video assists in understanding how to file a tax extension in 2020 and how to fill out a form 4868. You should file for at tax extension anytime you are unable to complete your return by april 15th. Web definition and example of form 4868 form 4868 requests an extension of time to file your federal tax return. Citizen or resident files this form to request an automatic extension of time to file a u.s. Web complete form 4868 to use as a worksheet. Is the extension form allows you not to pay taxes? The form will ask you to estimate how much you think you'll owe and to enter your total tax liability. Form 4868 is a tax form used by a taxpayer who is seeking an automatic extention of time to file their federal income taxes.

Web is there an example form 4868? If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve already paid (lines 4, 5, and 6 below). When to file the form: Get started tax extension form 4868 is quite simple to complete. Web this video assists in understanding how to file a tax extension in 2020 and how to fill out a form 4868. Filing a tax extension is important to avoid penalties and interest for failure to file a. Web definition and example of form 4868 form 4868 requests an extension of time to file your federal tax return. Is the extension form allows you not to pay taxes? The form will ask you to estimate how much you think you'll owe and to enter your total tax liability. Web form 4868 examples & solutions.

IRS Form 4868 Fill it Right In Case You Failed to File Tax Form

Get started tax extension form 4868 is quite simple to complete. Individual income tax return, to obtain this relief. Fiscal year taxpayers, file form 4868 by the regular due date of the. Use form 4868 to apply for 6 more months (4 if “out of the country” (defined on page 2) and a u.s. It also provides instructions on what.

Free Printable Tax Form 4868 Printable Templates

Web complete form 4868 to use as a worksheet. Filing form 4868 with the irs means that your taxes will be due on oct. Web the most crucial reasons to file a tax extension. Web this video shows an example to create form 4868, an application to extend federal income filing due date. Individual income tax return, to obtain this.

Learn How to Fill the Form 4868 Application for Extension of Time To

Web form 4868 is known as the application for automatic extension of time to file u.s. It is important to estimate tax responsibility and. Filing a tax extension is important to avoid penalties and interest for failure to file a. The form will ask you to estimate how much you think you'll owe and to enter your total tax liability..

EFile IRS Form 4868 File Personal Tax Extension Online

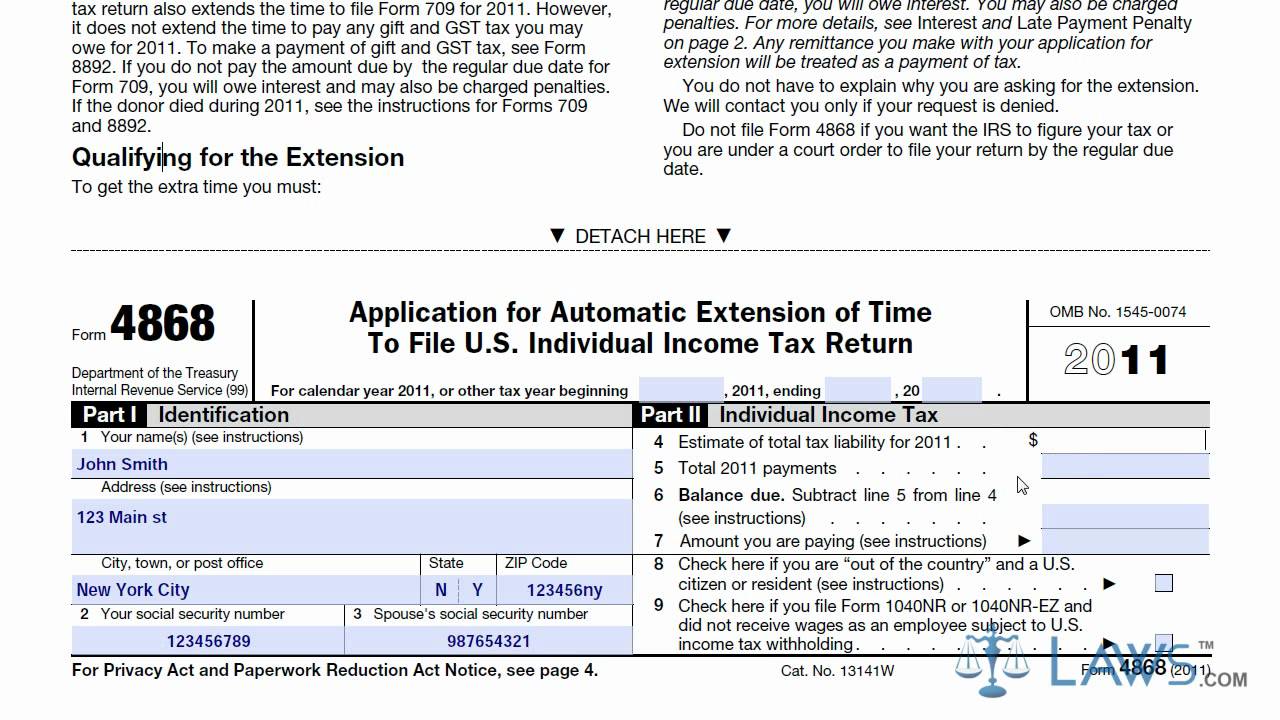

If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve already paid (lines 4, 5, and 6 below). A correctly completed form 4868 example in 2023 is as follows: Web (for example, $1.35 would become $1, and $2.50 would become $3). Web get now form.

Form 4868Application for Automatic Extension of Time

There could be a variety of reasons you are unable to complete your return by the deadline.the following are examples of good reasons to file a tax extension: Luckily, you’re in the right place to learn how to file an extension application without being penalized by the irs. Web form 4868 examples & solutions. Web form 4868, also known as.

SimpleTax Form 4868 YouTube

Web definition and example of form 4868 form 4868 requests an extension of time to file your federal tax return. If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve already paid (lines 4, 5, and 6 below). Web this video shows an example to.

Form 4868 Application For Automatic Extension Of Time To 2021 Tax

Web purpose of the form: Web we last updated the application for automatic extension of time to file u.s. Web the most crucial reasons to file a tax extension. Applying for time extension to file taxes for 2022 this is a document individuals and businesses use to request an extension on their tax return filing deadline. For more details, go.

Fillable Form 4868 Application For Automatic Extension Of Time To

When to file the form: Web this video assists in understanding how to file a tax extension in 2020 and how to fill out a form 4868. Filing form 4868 with the irs means that your taxes will be due on oct. Applying for time extension to file taxes for 2022 this is a document individuals and businesses use to.

Form 4868 IRS Tax Extension Fill Out Online PDF FormSwift

Is the extension form allows you not to pay taxes? Quick & easy process that takes 5 minutes to complete. This relief includes the filing of all schedules, returns, and other forms that are filed as attachments to the form 1040 series or are required to be filed by Web form 4868 examples & solutions. Individual income tax return, to.

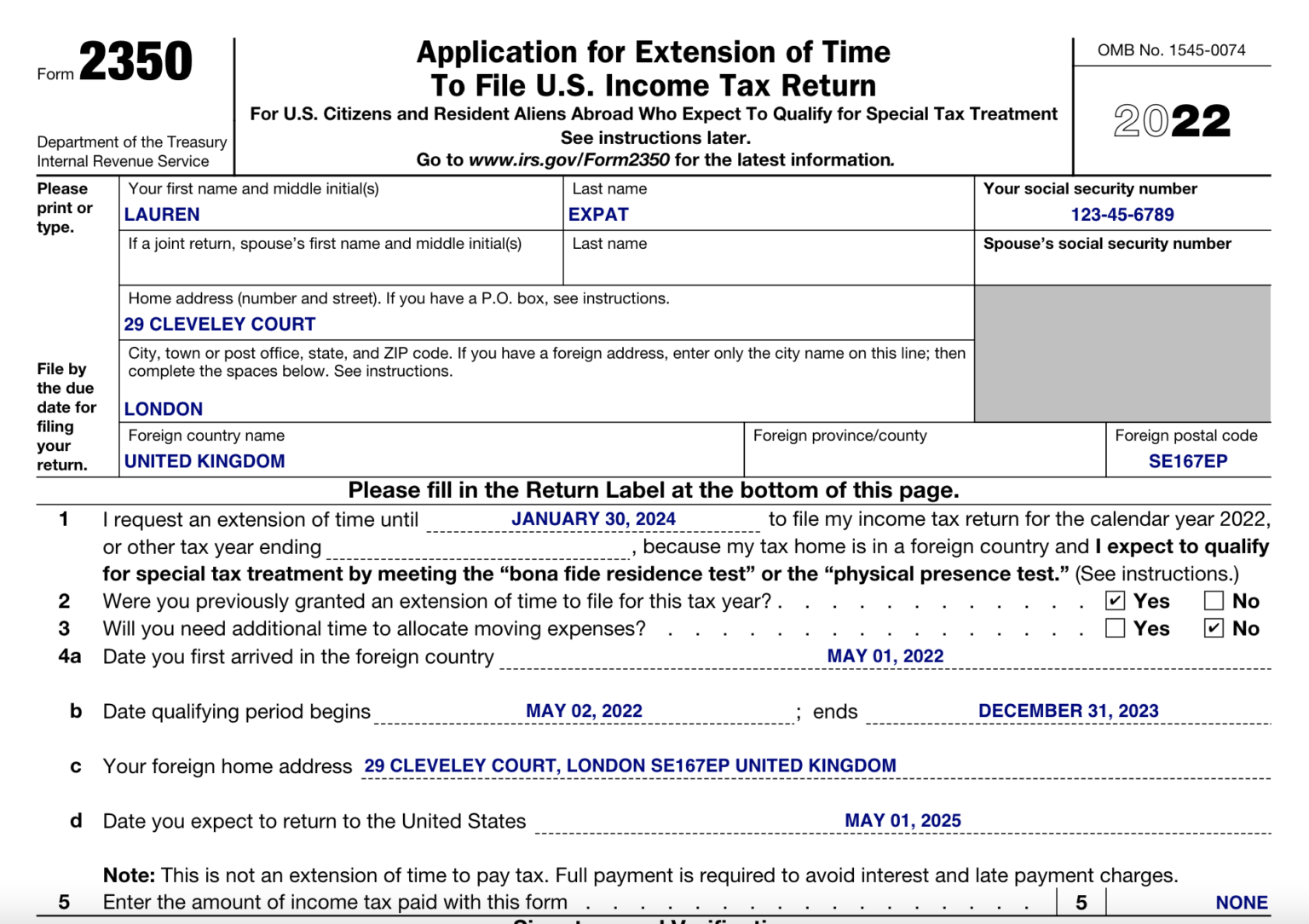

Form 2350 vs. Form 4868 What Is the Difference?

Web is there an example form 4868? Individual income tax return,” is a form that taxpayers can file with the irs if they need more time to finish. Get started tax extension form 4868 is quite simple to complete. Yes, there is a sample available on the irs website. If you think you may owe tax when you file your.

Web This Video Shows An Example To Create Form 4868, An Application To Extend Federal Income Filing Due Date.

Here are a few examples: Applying for time extension to file taxes for 2022 this is a document individuals and businesses use to request an extension on their tax return filing deadline. Web learn how to fill the form 4868 application for extension of time to file u.s. If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve already paid (lines 4, 5, and 6 below).

For More Details, Go To Www.irs.gov/Freefile.

There could be a variety of reasons you are unable to complete your return by the deadline.the following are examples of good reasons to file a tax extension: Filing a tax extension is important to avoid penalties and interest for failure to file a. You should file for at tax extension anytime you are unable to complete your return by april 15th. Web definition and example of form 4868 form 4868 requests an extension of time to file your federal tax return.

Web Complete Form 4868 To Use As A Worksheet.

This relief includes the filing of all schedules, returns, and other forms that are filed as attachments to the form 1040 series or are required to be filed by A correctly completed form 4868 example in 2023 is as follows: And tax form 4868 is the way to do it! Luckily, you’re in the right place to learn how to file an extension application without being penalized by the irs.

Web Complete Form 4868 To Use As A Worksheet.

Quick & easy process that takes 5 minutes to complete. Individual income tax return, to obtain this relief. Web we last updated the application for automatic extension of time to file u.s. Web (for example, $1.35 would become $1, and $2.50 would become $3).