Form 4952 Instructions Pdf

Form 4952 Instructions Pdf - Try it for free now! How you can identify investment interest expense as one of your tax. The form must be filed. The taxpayer has $60,000 in. Upload, modify or create forms. Instructions for form 4952 created date: Enter a term in the find box. Web must file form 4952 to claim a deduction for your investment interest expense. Complete, edit or print tax forms instantly. Application for enrollment to practice before the internal revenue service.

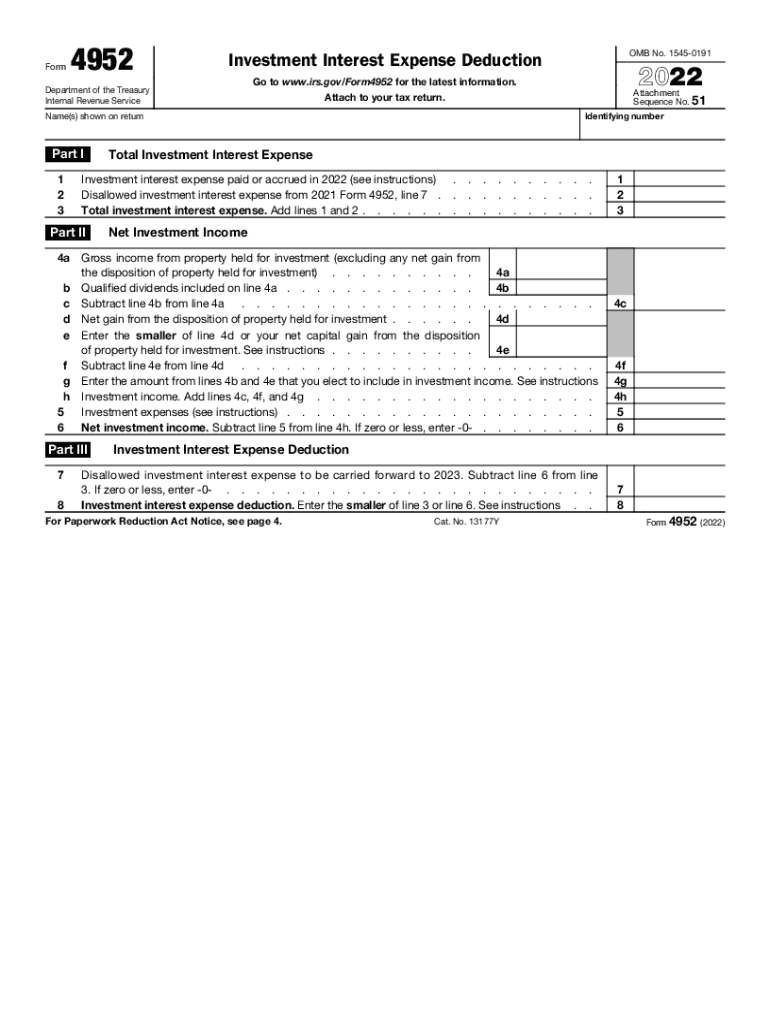

Web forms and instructions (pdf) instructions: 1 investment interest expense paid or accrued in 2020 (see instructions). Try it for free now! You do not have to file form 4952 if all of the following apply. The form must be filed. Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. Application for enrollment to practice before the internal revenue service. Instructions for form 4952 created date: Web this article will walk you through irs form 4952 so you can better understand: More about the federal form 4952 we last updated.

Web irs form 4952 determines the amount of deductible investment interest expense as well as interest expense that can be carried forward. Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. Web forms and instructions (pdf) occupational tax and registration return for wagering. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future years. Complete, edit or print tax forms instantly. Web form 4952 investment interest expense deduction department of the treasury internal revenue service. Select a category (column heading) in the drop down. Upload, modify or create forms. Try it for free now! Web must file form 4952 to claim a deduction for your investment interest expense.

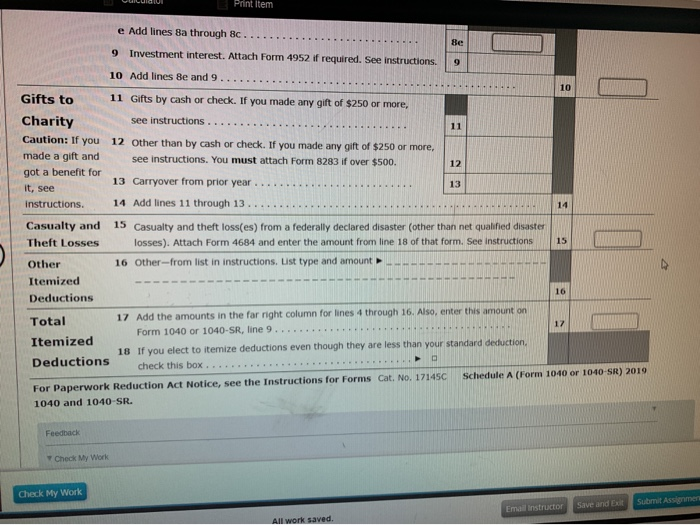

Instructions Form 1040 Schedule 1 Schedule A Form

Web must file form 4952 to claim a deduction for your investment interest expense. Web irs form 4952 determines the amount of deductible investment interest expense as well as interest expense that can be carried forward. Instructions for form 4952 created date: Web form 4952 department of the treasury internal revenue service (99). Web if you filled out form 4952,.

Perpendicular Slope Calculator

Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. Upload, modify or create forms. Web form 4952 investment interest expense deduction department of the treasury internal revenue service. Web irs form 4952 determines the amount of deductible investment interest expense as well.

Form 4952 Fill Out and Sign Printable PDF Template signNow

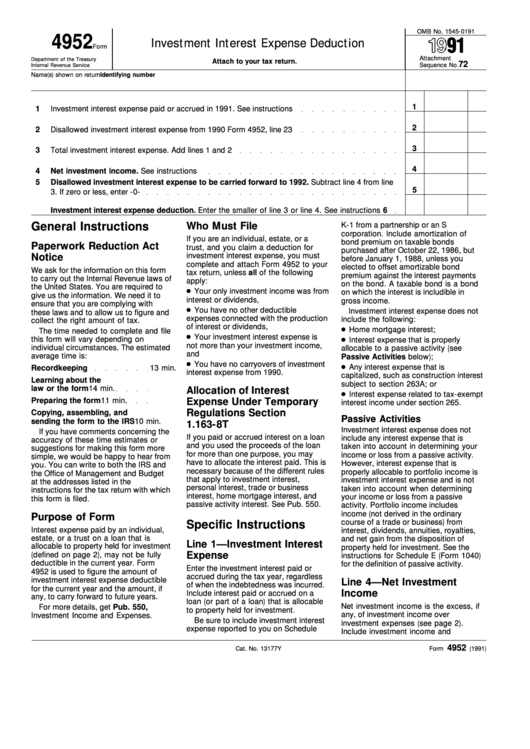

1 investment interest expense paid or accrued in 2020 (see instructions). Instructions for form 4952 created date: The taxpayer has $60,000 in. Try it for free now! Complete, edit or print tax forms instantly.

Form 4952 Investment Interest Expense Deduction printable pdf download

Instructions for form 4952 created date: You do not have to file form 4952 if all of the following apply. Web form 4952 investment interest expense deduction department of the treasury internal revenue service (99) a go to www.irs.gov/form4952 for the latest information. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2014.

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Web deduction on schedule a (form 1040), line 23, the 2% adjusted gross income limitation on schedule a (form 1040), line 26, may reduce the amount you must include on form. Enter a term in the find box. Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully.

U.S. TREAS Form treasirs49521992

Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. example: The form must be filed. Select a category (column heading) in the drop down. Web forms and instructions (pdf) occupational tax and registration return for wagering. Enter a term in the find box.

Fill Free fillable F4952 2019 Form 4952 PDF form

Web this article will walk you through irs form 4952 so you can better understand: 1 investment interest expense paid or accrued in 2020 (see instructions). Web form 4952 investment interest expense deduction department of the treasury internal revenue service. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in.

Form 4952Investment Interest Expense Deduction

Complete, edit or print tax forms instantly. Web form 4952 department of the treasury internal revenue service (99). The taxpayer has $60,000 in. Complete, edit or print tax forms instantly. Web irs form 4952 determines the amount of deductible investment interest expense as well as interest expense that can be carried forward.

Form 4952 Investment Interest Expense Deduction Overview

Web if you filled out form 4952, investment interest expense deduction, for your regular tax, you will need to fill out a second form 4952 for the amt as follows. 1 investment interest expense paid or accrued in 2020 (see instructions). Web irs form 4952 determines the amount of deductible investment interest expense as well as interest expense that can.

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. Web this article will walk you through irs form 4952 so you can better understand: Web forms and instructions (pdf) instructions: Web form 4952 department of the treasury internal revenue service (99) investment.

How You Can Identify Investment Interest Expense As One Of Your Tax.

Web must file form 4952 to claim a deduction for your investment interest expense. Try it for free now! 1 investment interest expense paid or accrued in 2020 (see instructions). Web irs form 4952 determines the amount of deductible investment interest expense as well as interest expense that can be carried forward.

Try It For Free Now!

Web forms and instructions (pdf) occupational tax and registration return for wagering. Web form 4952 investment interest expense deduction department of the treasury internal revenue service. The form must be filed. Web deduction on schedule a (form 1040), line 23, the 2% adjusted gross income limitation on schedule a (form 1040), line 26, may reduce the amount you must include on form.

More About The Federal Form 4952 We Last Updated.

Web general instructions purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2020 and the amount you can carry forward to future. Web this article will walk you through irs form 4952 so you can better understand: The taxpayer has $60,000 in. Application for enrollment to practice before the internal revenue service.

You Do Not Have To File Form 4952 If All Of The Following Apply.

Upload, modify or create forms. Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. example: Select a category (column heading) in the drop down.

:max_bytes(150000):strip_icc()/4592-f64c21a16a3847538c094ee48dee34fe.jpg)